Finding the Growth in… Value?

The ‘value trade’ has long been the laughingstock of U.S. equity markets. Value has lagged Growth for the better part of 15 years, but could it be time for a regime change?

Value companies are loosely defined as those whose current stock price is below that of their true worth. Their alternative, Growth companies, are marked by high future expectations and high current prices. Standard & Poors uses a handful of criteria – sales growth, earnings growth, momentum, and the ratios of price to sales, earnings, and book value – to create the S&P 500 Value (SVX) and Growth (SGX) Indexes.

Twenty years ago, the world witnessed the bursting of a bubble fueled by foolhardy growth expectations for internet companies. The S&P 500 Growth Index dropped nearly 60% and proceeded to underperform Value for the next 7 years. But the collapse of the global financial system marked a changing of the guard. Since 2007, Growth has outperformed to the tune of more than 100%.

But that trend could finally be weakening. Over the last 4 weeks, Value has led by 7.5%, the best such stretch since 2001. The move confirmed a 6-month bearish momentum divergence in the SGX/SVX ratio, and it occurred near a key extension from the entire 2000-2007 decline. It’s usually better to assume that long-term trends will continue in their existing direction, but were Value stocks ever going to turn the tide, this is how you’d expect it to begin.

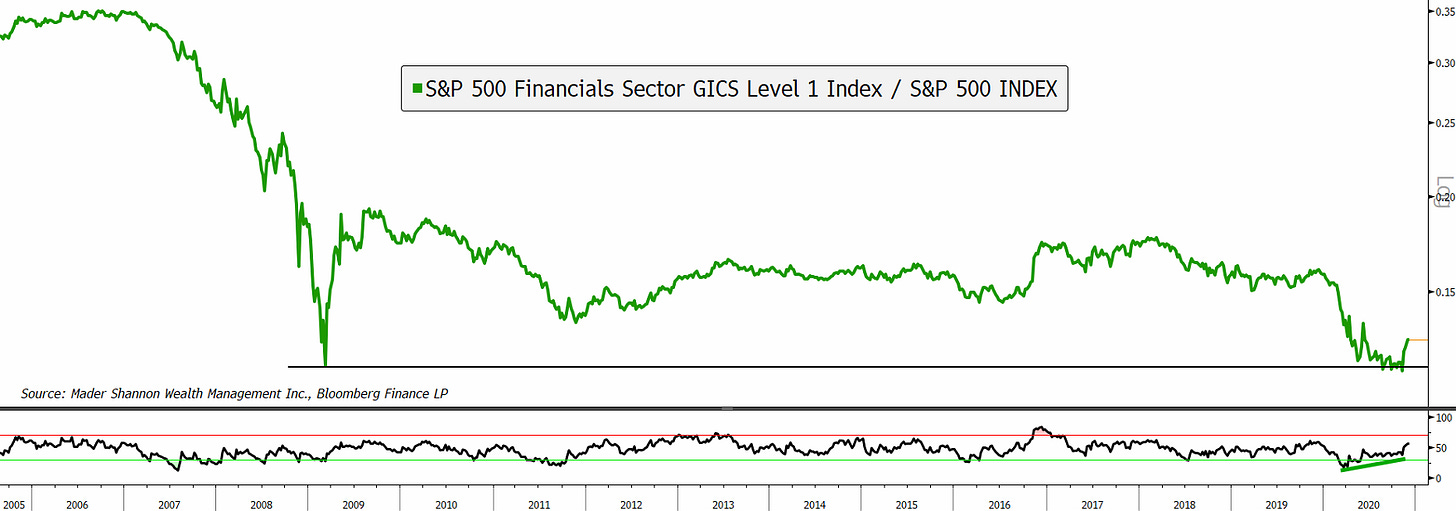

If Value is going to outperform, it’ll need some help from its largest sector component: Financials.

Financials are at a similar ‘now-or-never’ level relative to the total S&P 500 Index. They fell back to their 2009 lows early this year, but momentum improved on each subsequent test of that all-important level. Just like the ratio above, Financials have rallied over the last few weeks and could have further to go.

On an absolute basis, the S&P 500 Financials Sector Index is still stuck below its 2007 highs. In early 2020, the group briefly set a new record, but failed to hold the breakout when the global pandemic struck. If we see Financials outperforming for a sustained period again, it’s likely happening when they’re above that 13-year resistance level.

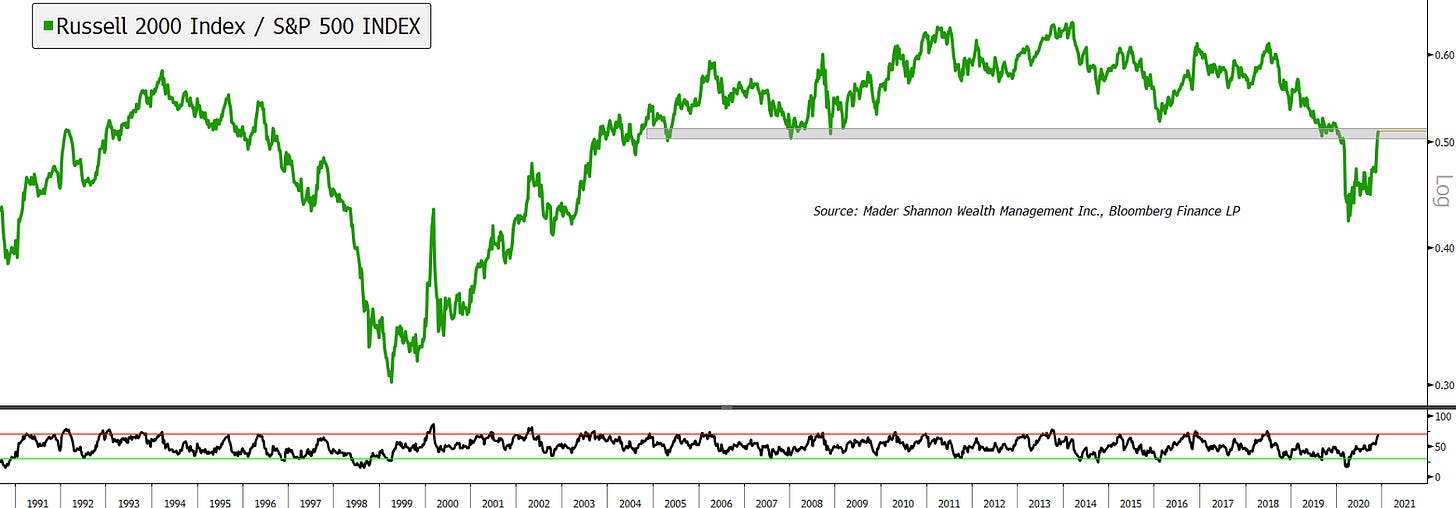

In that scenario, other indexes with heavy Financials exposure could be expected to perform well, too. Small cap stocks are one example. The Russell 2000 fell to 17 year lows against its large cap counterpart early this year, but quickly recovered. November was its best month in decades. Still, the ratio below needs to work its way through a potential area of resistance before we can have any confidence that the longer-term downtrend has run its course.

Trying to identify the moment when Value will make its long-awaited comeback is a bit of a fool’s errand. Trends tend to continue – and they often continue for longer than anyone expects. Plenty of investors have prematurely called for the turn in years past, to no avail. That said, several pieces have fallen into place. It’s now or never.

Nothing in this post or on this site is intended as a recommendation or an offer to buy or sell securities. Posts on Means to a Trend are meant for informational and entertainment purposes only. I or my affiliates may hold positions in securities mentioned in posts. Please see my Disclosure page for more information.

The post Finding the Growth in… Value? first appeared on Grindstone Intelligence.