Health Care Sector Deep Dive – 11/9/2023

It’s historically the best month of the year for Health Care stocks, and so far, November is living up to its reputation. The sector is already up nearly 3% in just over a week, outpacing its 2.5% average November gain since 1990.

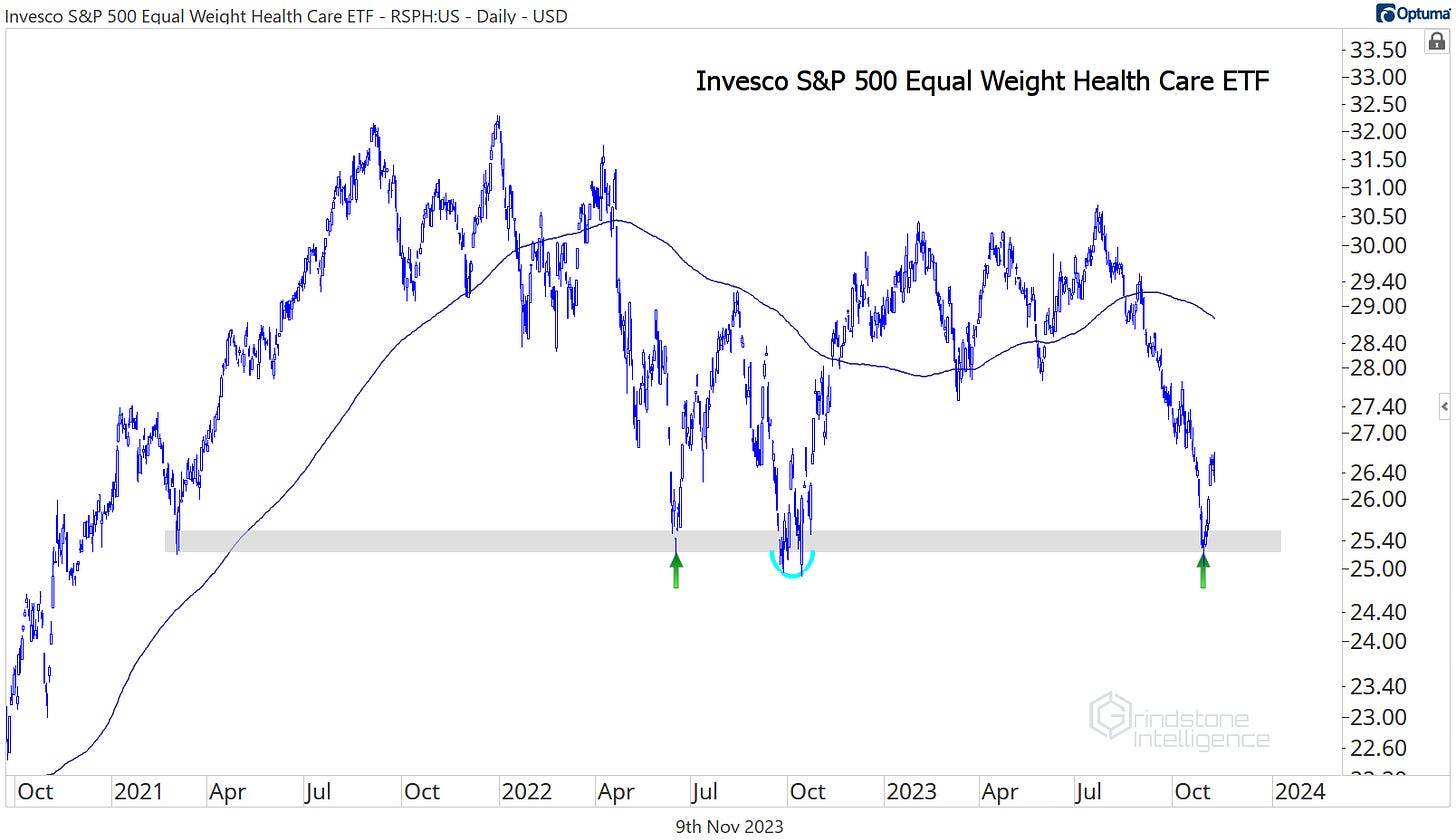

That rally came at just the right time, keeping intact a level of support that’s been in place for more than 2 years now. It’s still tough to get excited about a group that’s stuck within a huge trading range and can’t sustain rallies, but at least they aren’t breaking down.

Even the equally weighted sector managed to maintain those prior lows, despite having lagged the market cap weighted sector for most of the year.

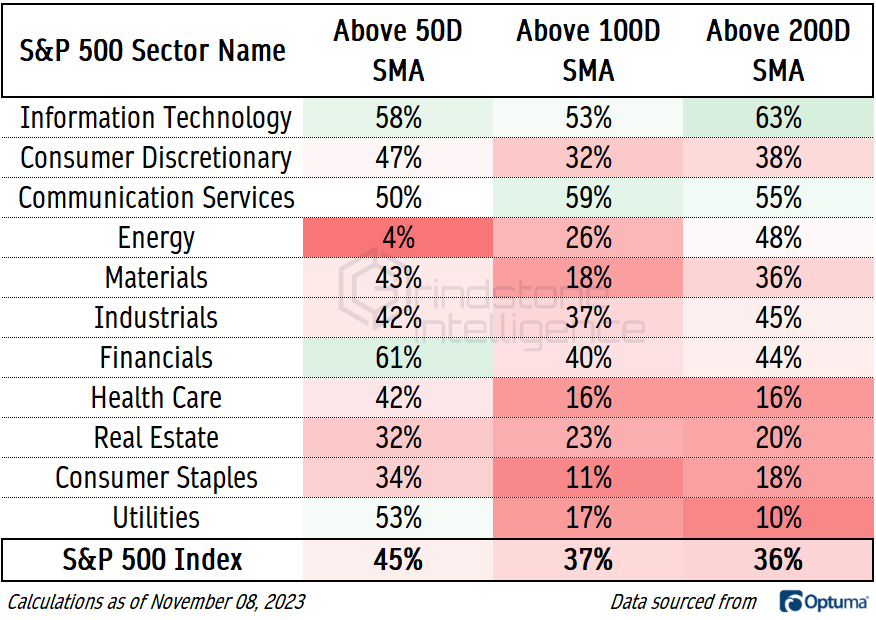

Unfortunately, trends beneath the surface don’t paint a rosy picture, even as support at the index level continues to hold. Just 16% of Health Care stocks are above their 100 and 200-day moving averages, a number on par with the weakest sectors in the index.

And even though the sector overall is still above last year’s lows, half of the sector’s membership has set new lows in 2023, and 40% are still beneath last year’s trough levels.

Digging Deeper

Every sub industry in the Health Care sector is down for the year, save one.

The Distributors are a force to be reckoned with, sporting a 19.4% gain for the year even while every other group has struggled to gain ground. This isn’t a new trend. That same group rose throughout 2022 as well, in spite of stocks being gripped by the most extended bear market since 2009.

Previous iterations of the distributors rally were led by McKesson and Cencora (formerly AmerisourceBergen), but Cardinal Health has recently moved to the forefront. The 11% surge over the last month helped CAH finally surpass the highs it set al the way back in 2015.

Out of this 8-year base, we’re targeting a move to $125 for Cardinal.

We especially like the relative strength. Here’s the stock breaking out from a cup and handle consolidation pattern when compared to the S&P 500 index. We see further outperformance ahead.

We’re also keeping an eye on the Managed Health Care sub-industry. While most of the sector (and most of the S&P 500) was trending lower from August through October, Managed Care was doing the opposite. This group troughed in July and is just off its highest levels of the year.

United Health is threatening to break out to new all-time highs. Just like the overall sector index, UNH is stuck in a 2-year trading range. Unlike the sector, UNH is near the top, not the bottom, of its range. That’s what we call relative strength. We also like that momentum is showing bullish characteristics by getting overbought on rallies and staying out of oversold territory on declines. We want to buy a breakout above $550 for a move to $610, and then $710 after that. Those are the first key Fibonacci retracement levels from the 2 year range.

For confirmation, we want to see UNH push through this key level relative to the SPX. This spot is where the UNH/SPX ratio troughed in the summer and fall of 2022, and where it peaked in April. We want to see this resistance turn back into support.

Leaders

Insulet was a top performer over the last 4 weeks, the recent rally following a bullish momentum divergence at the lows. Still one of the worst stocks for 2023, and this chart screams ‘dead cat bounce’. We definitely aren’t touching this one from the long side.

Losers

Losers keep on losing. The biggest losers of the last 4 weeks is littered with names that were under pressure for the first 9 months of the year, too. There’s no need to be a hero by catching a falling knife. The opportunity cost of owning garbage like this with the hope of catching a bottom is sky high.

Growth Outlook

Earnings for the Health Care sector are expected to decline nearly 20% this year, according to Wall Street analysts. That’s among the worst declines in the S&P 500 index, and far worse than the 3% EPS decline that’s expected for the index as a whole.

Over the next two years, though, sector earnings growth is expected to rebound to an above average rate, with 17% bottom-line growth in 2024, and another 10% growth in 2025. Unlike the earnings growth for several other sectors, Health Care’s projections don’t rely on profit margins expanding to new highs. In fact, implied 2025 margins are well below the 10-year average. That makes the sector’s earnings targets more achievable than estimates for some of its counterparts.