Health Care Sector Outlook

Top charts and trade ideas

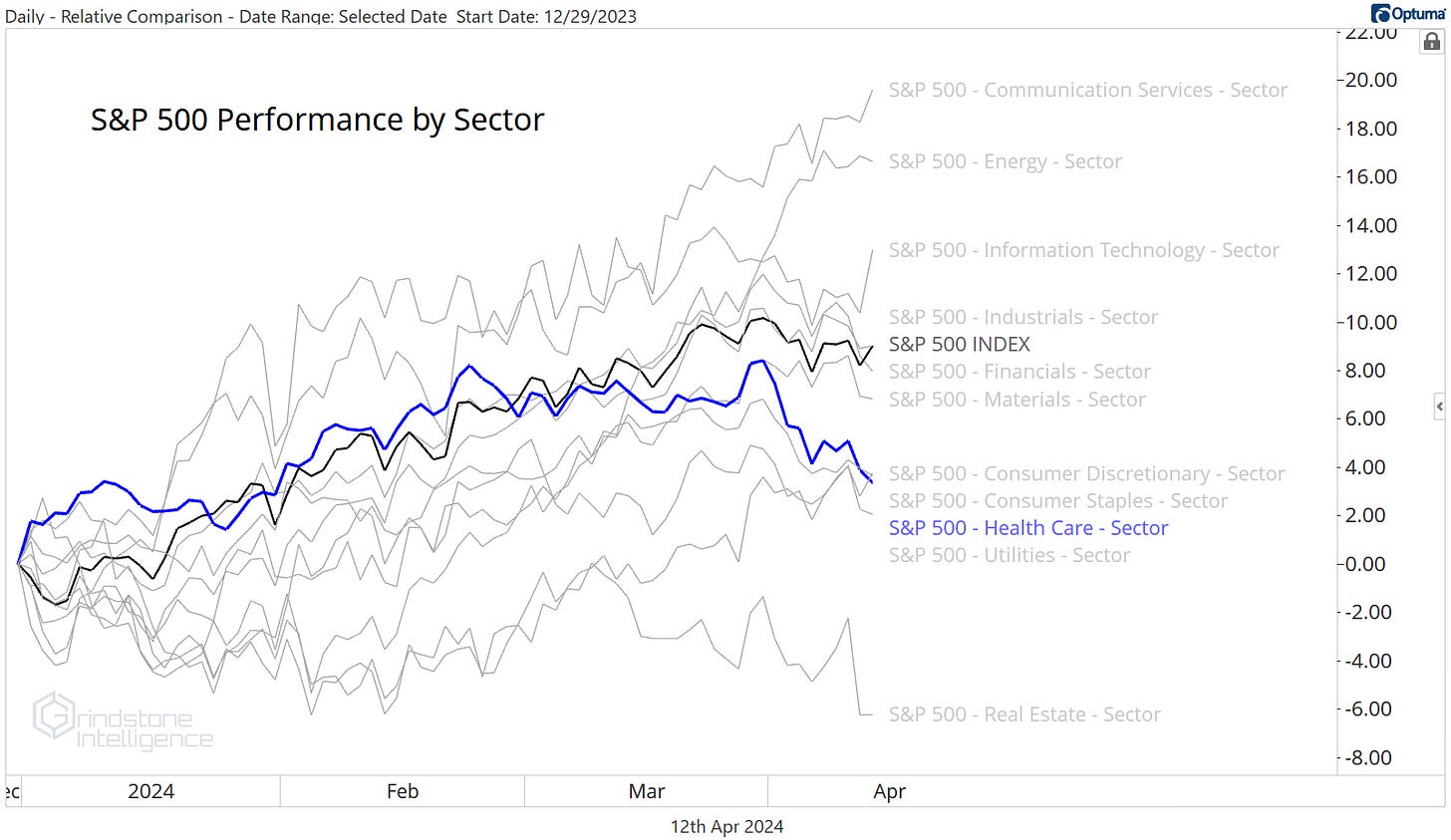

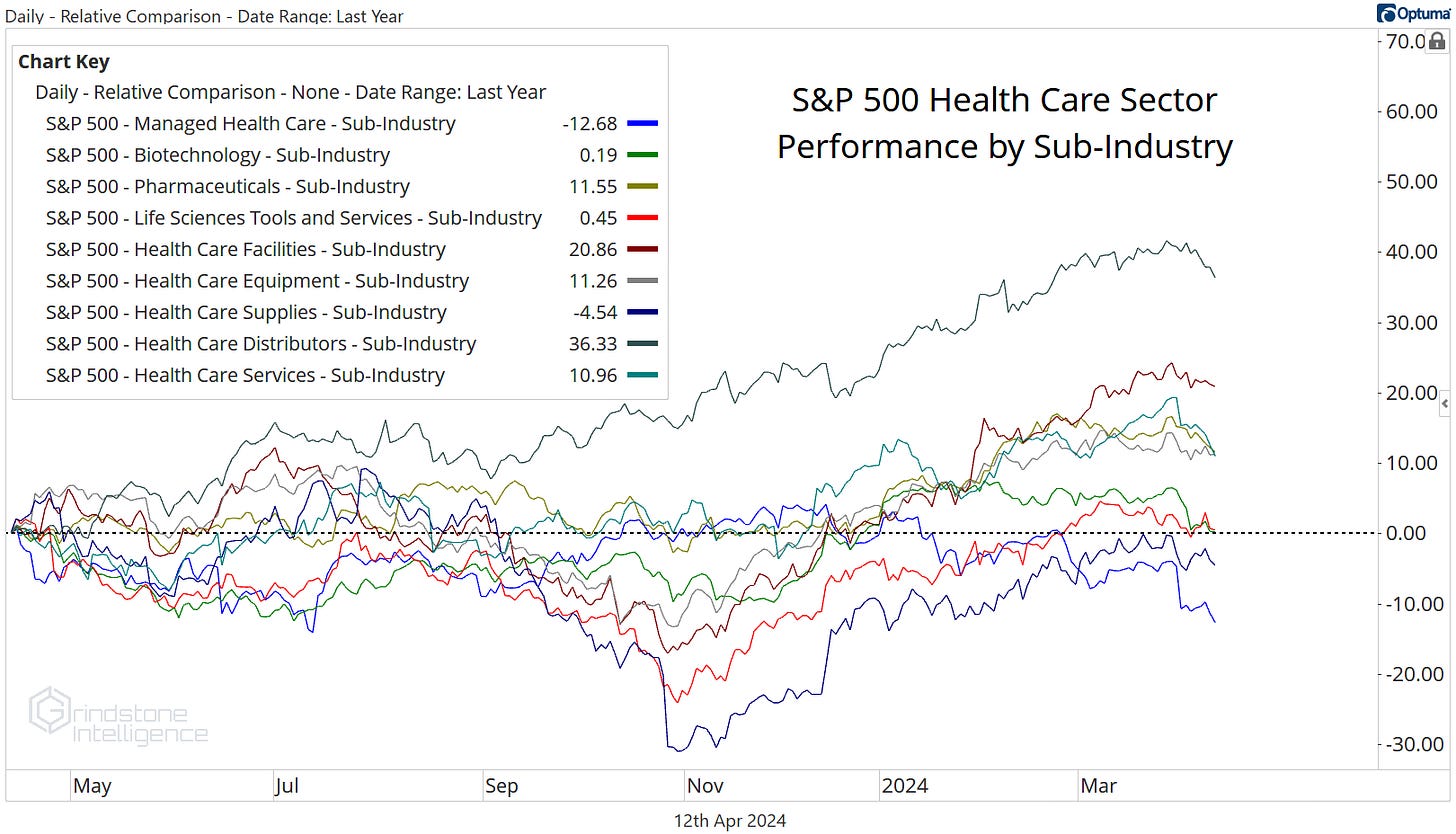

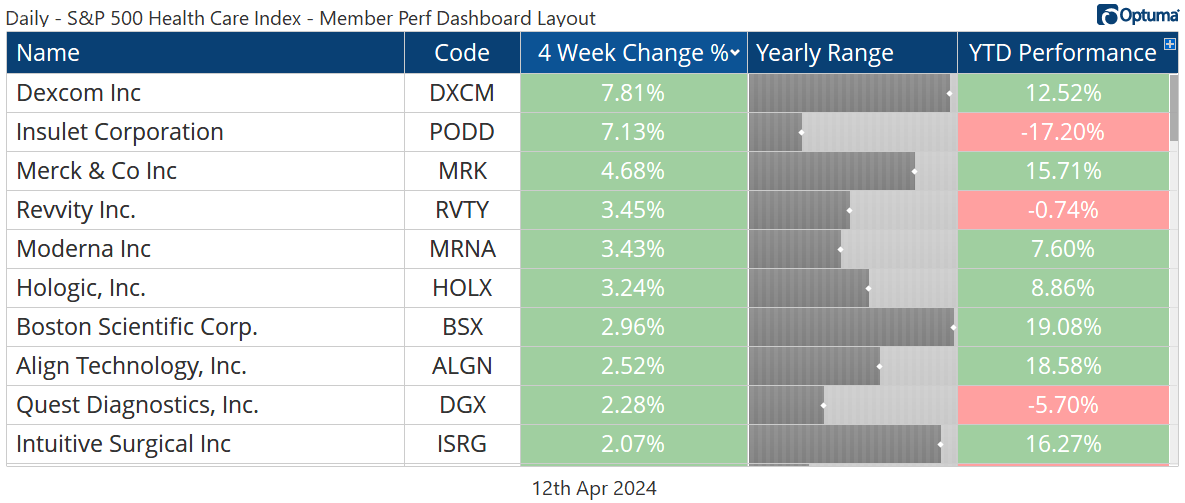

We’re living in a different world than we were a year ago, one where leadership and participation in the bull market has broadened out. One thing hasn’t changed, though: risk-off sectors are still lagging. The Real Estate, Utilities, and Consumer Staples sectors are each trailing the overall S&P 500 by half in 2024, and despite being a leader through the first two months of the year, Health Care has slipped behind, too.

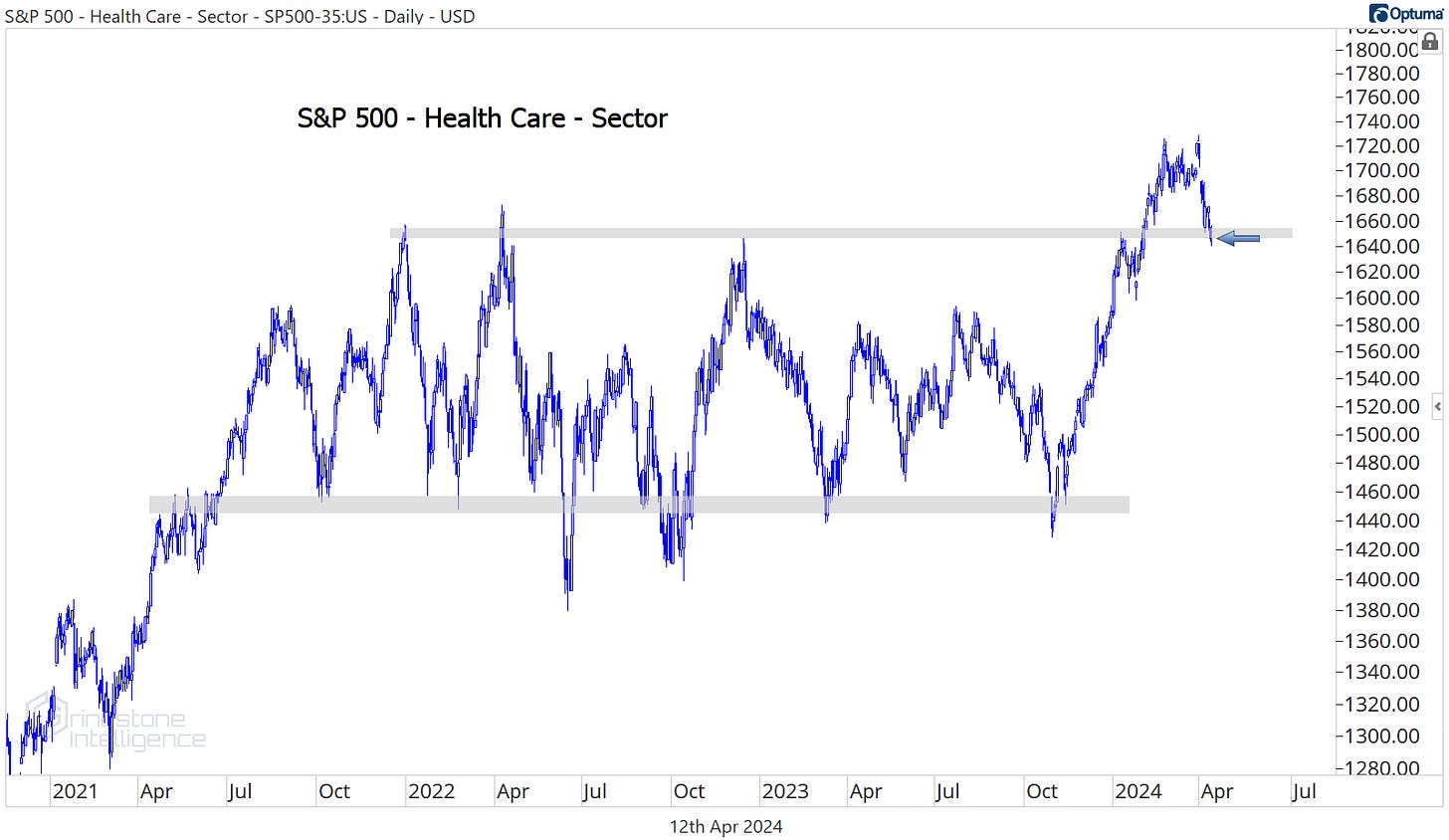

We don’t believe Health Care is always a risk-off sector (it outperformed during the early stages of the dotcom bubble and again out of the 2011 lows), but it’s certainly acting like one right now. We’d been eying that bullish momentum divergence forming at the 2021 lows and believed that was a perfect time for the bulls to step in on Health Care. But instead of working off that divergence with a rally higher, we worked it off through time. Now, the Health Care/SPX ratio is at decade-plus lows.

Just because a sector is underperforming doesn’t mean we should be shorting it. In bull markets, even the weakest sectors tend to rise, so betting on falling prices is a losing game . That’s what makes the action in Health Care right now so interesting. This recent weakness has Health Care threatening to fall back into the 2022-2023 trading range. Failed breakouts - even ones in lagging areas of the market - aren’t something we’d expect to see during a healthy bull market.

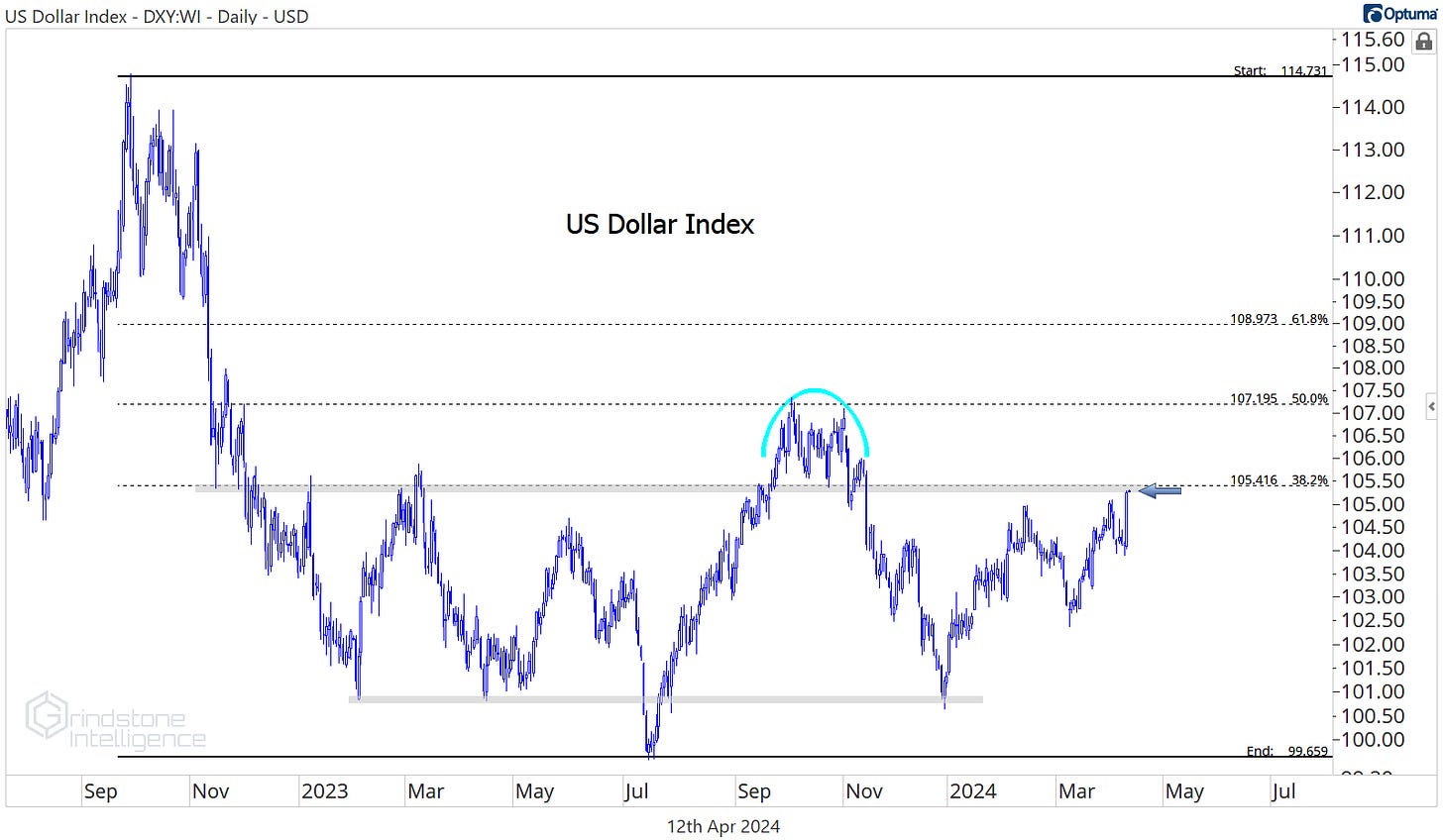

A breakdown would be just one more warning sign to go along with higher interest rates and strengthening US Dollar - two key risks we’ve been talking about all year. The Dollar index is at year-to-date highs and knocking on the door of the 38.2% retracement from the 2022-2023 decline.

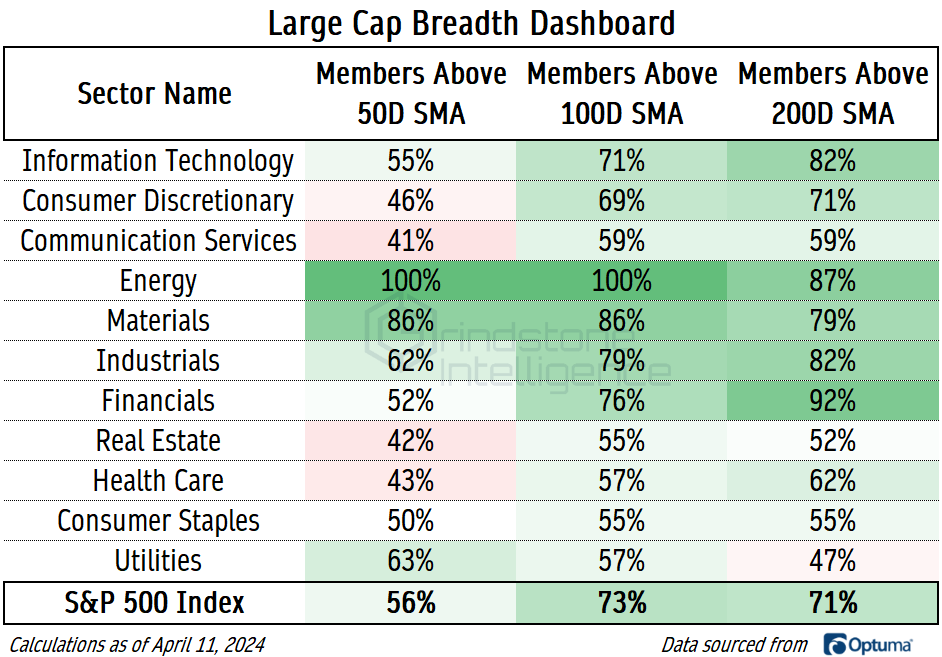

For now, most S&P 500 stocks are in well-established intermediate and long term uptrends.

On a short-term basis, though, things are closer to a coin flip. Just 51% of stocks are above a rising 50-day moving average, while 30% are below a falling 50-day. We’re watching closely to see whether that short-term weakness starts to infect the longer-term trends.

Digging Deeper: Health Care Sector Trade Ideas

Unlike the Utilities sector we covered earlier this week, there have been some consistent bright spots in Health Care, despite the sector’s relative weakness.

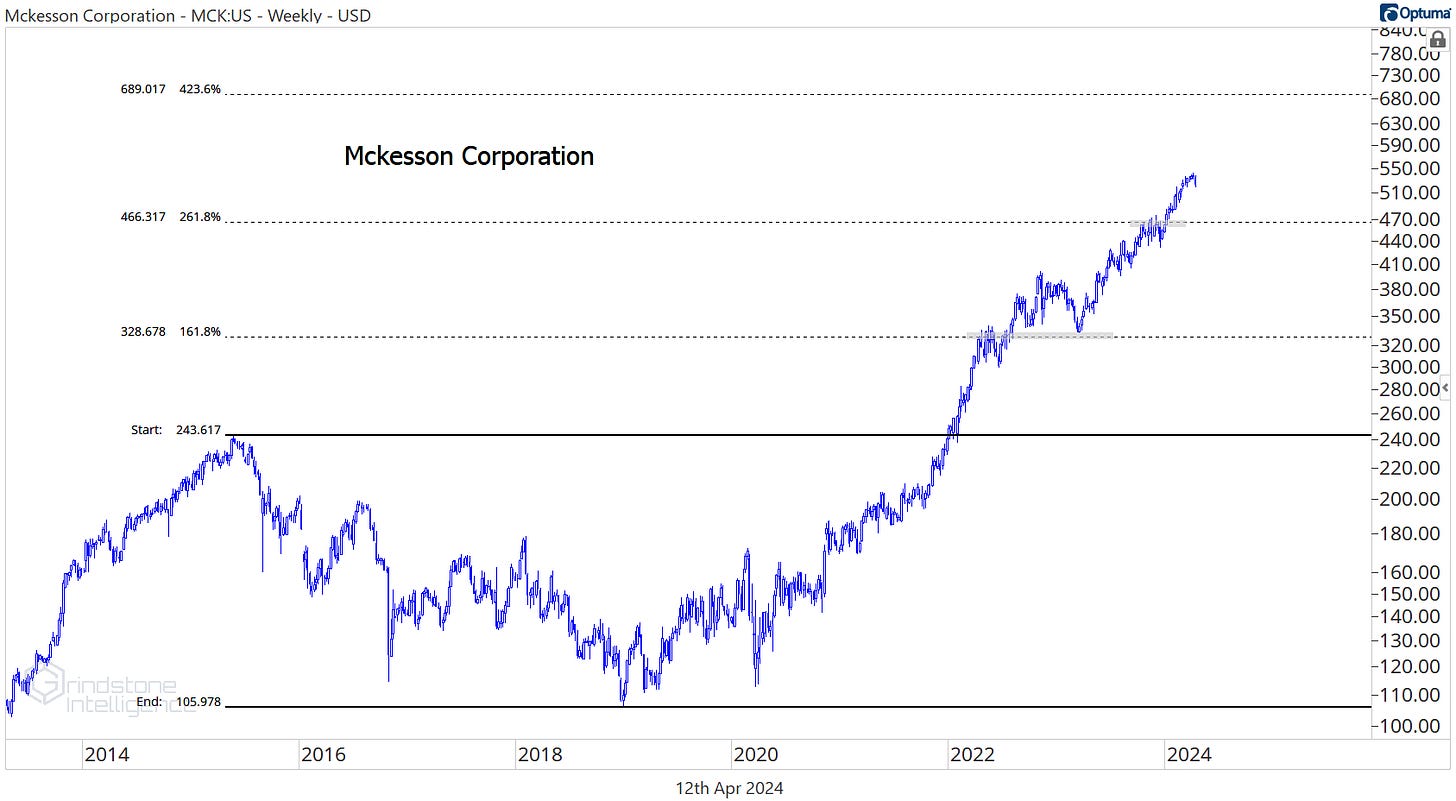

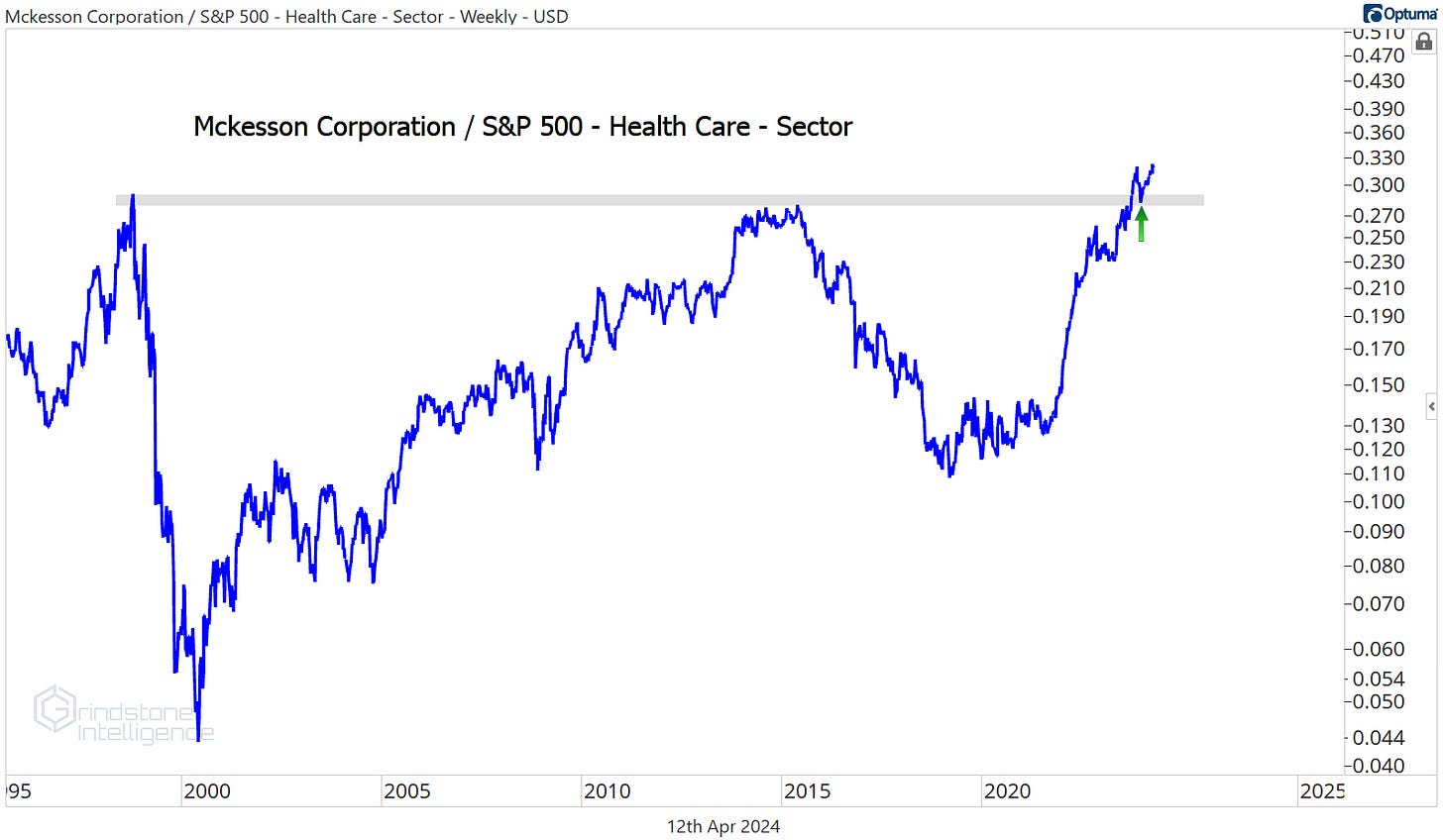

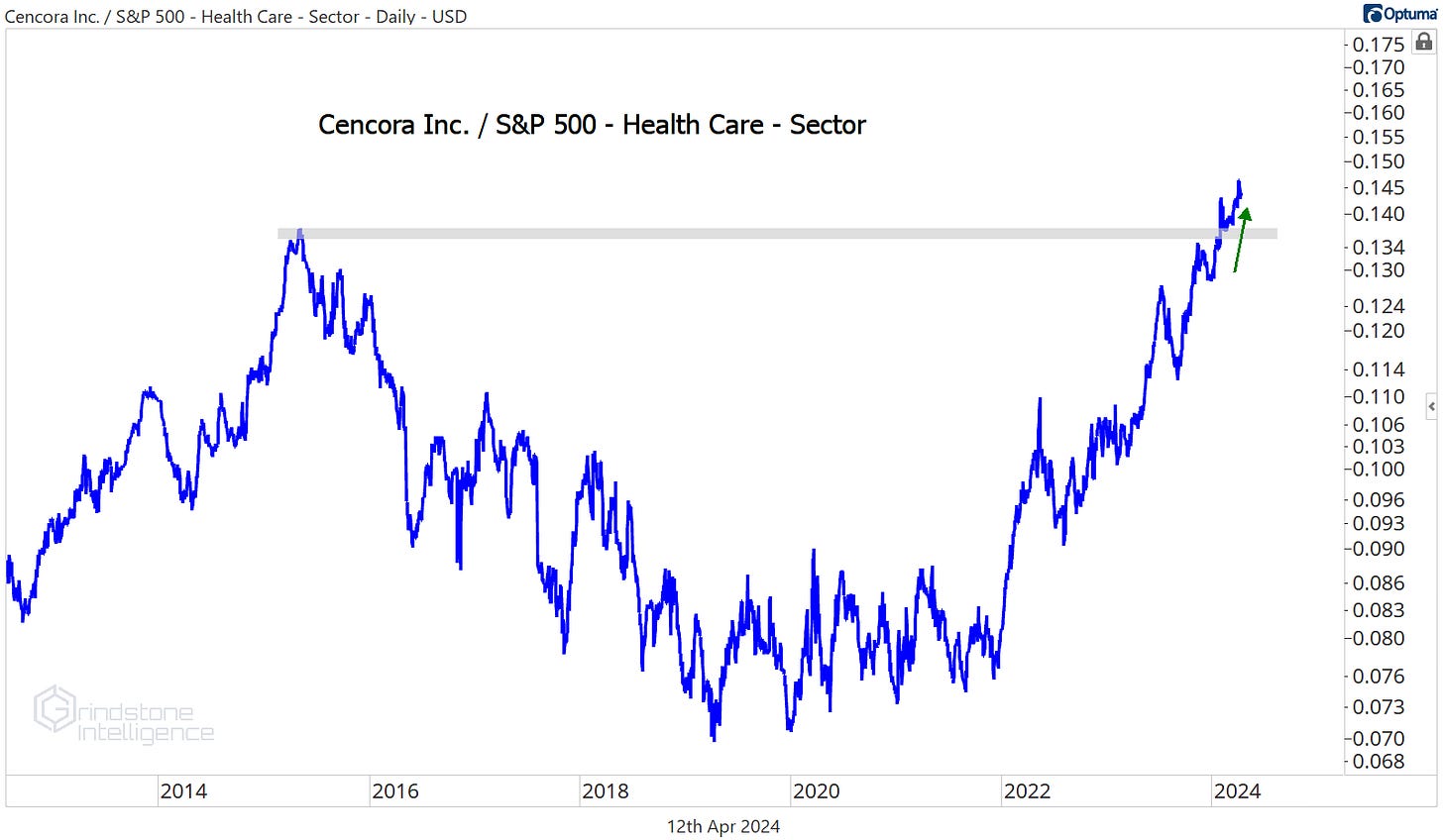

The Health Care Distributors have gained 36% over the past year, led by Mckesson and Cencora. We’re still targeting $690 on MCK, which is the 423.6% retracement from the 2015-2018 decline. A break below our risk management level of $470 would put us on the sidelines.

As long as COR is above $225, we can be long with a target of $320, which is the 685.4% retracement from the 2018-2020 range.

We don’t just like MCK and COR because they’re trading near all-time highs. It’s the relative strength that impresses us most. Check out McKesson breaking out of a 25 year base versus the rest of Health Care:

For Cencora, it’s ‘only’ a 10 year relative base.

Leaders

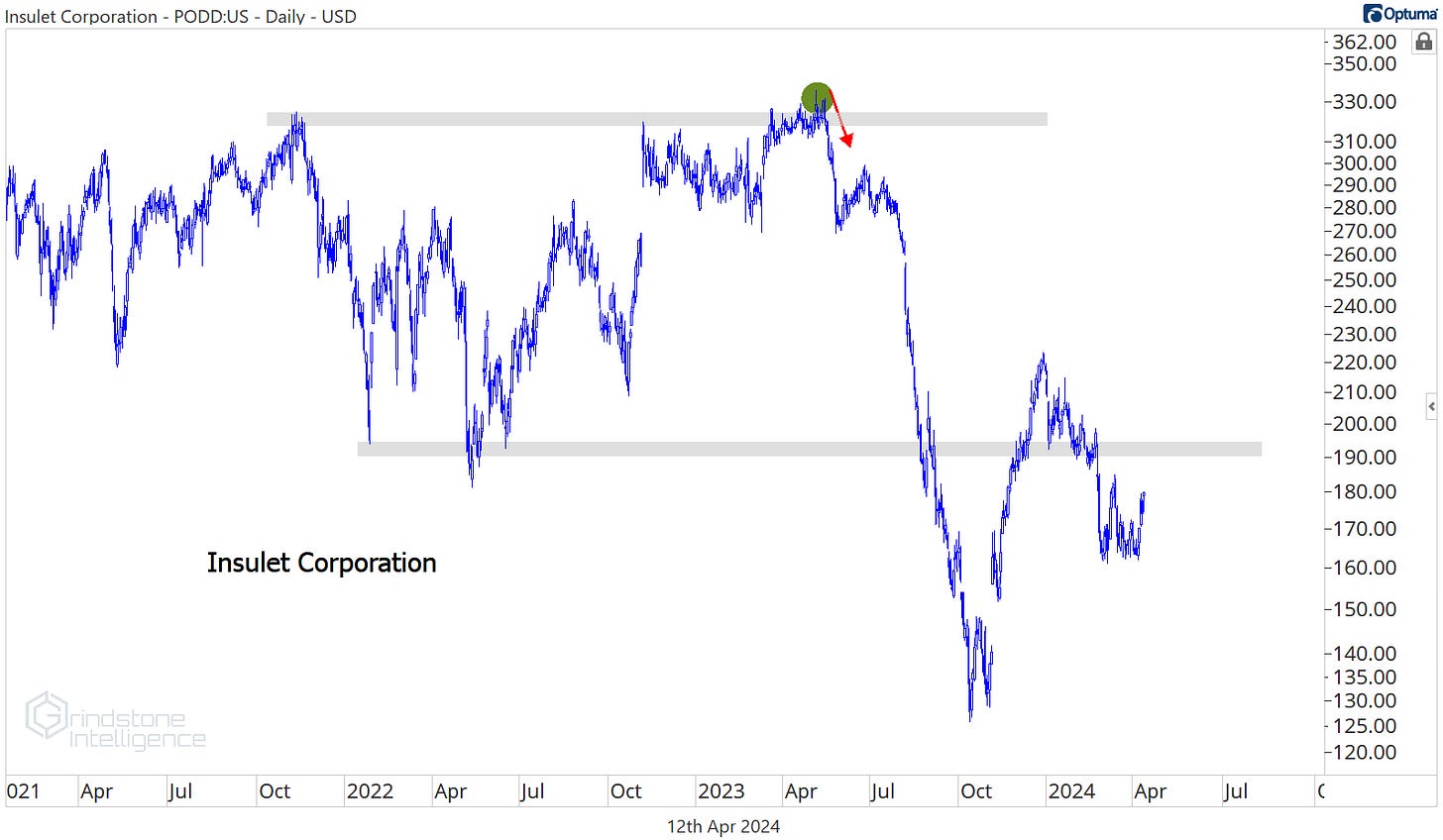

Don’t be fooled by Insulet popping up on the biggest winners list from the last 4 weeks. It’s still one of the sector’s worst performers for 2024, down 17%. During bull markets, we want to be looking to buy pullbacks in uptrends, not rallies in downtrends. PODD still has more work to do before we can say this downtrend has reversed.

And compared to other things we could own, the stock is much closer to setting new multi-year lows than it is to setting higher highs. There’s just no reason to be involved with charts that look like this one.

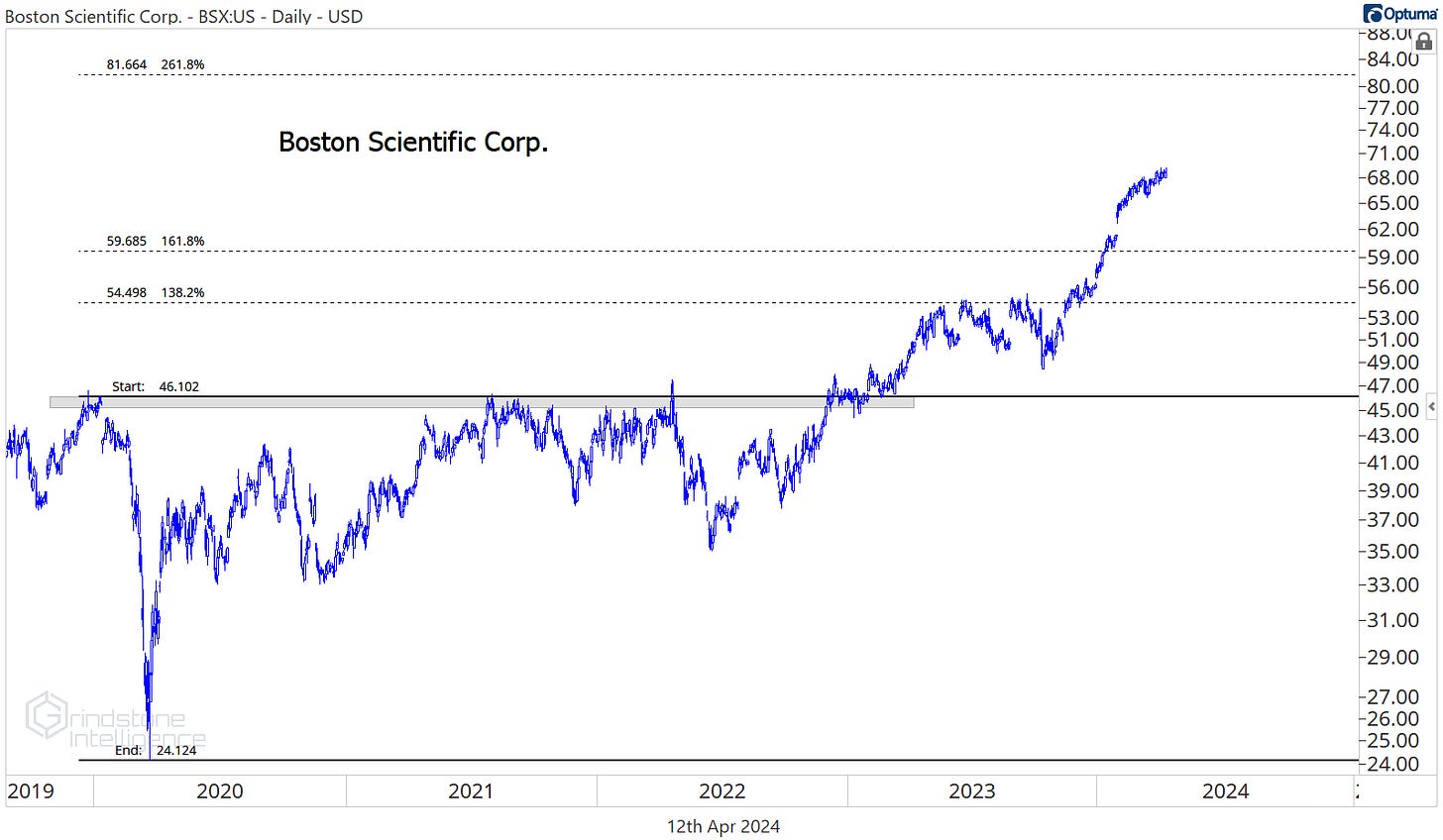

Boston Scientific, on the other hand, continues to be among our favorites. After breaking out relative to the rest of the market last month, it’s been consolidating above the former highs. That’s not bearish.

The risk-reward here isn’t great today, but if we see a pullback in the broader market that keeps the relative strength profile intact, we want to be buying BSX above $60 with a target of $81.

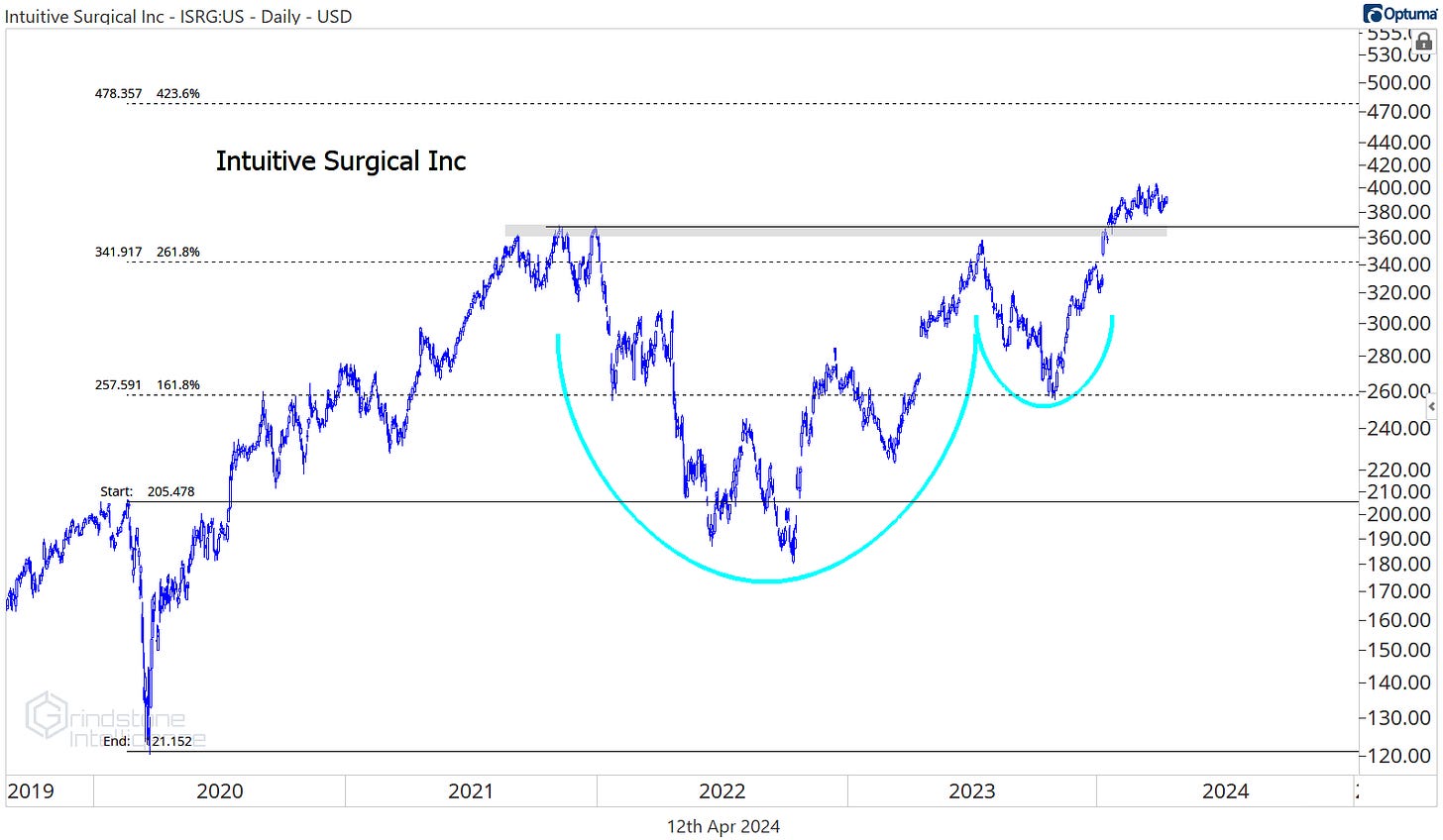

Intuitive Surgical just broke out of a 2-year cup and handle base and has been consolidating above the former highs.

We like ISRG above the former highs of $375 with a target of $480, which is the 423.6% retracement from the 2020 decline. Especially after it just completed the same cup and handle continuation pattern relative to the rest of the sector.

Losers

We want to be buying relative strength and avoiding relative weakness. The managed care space is where we’re seeing the relative weakness right now.

For UnitedHealth Group, it started with a failed breakout relative to the rest of Health Care, and that failed move was the start of more than just a mean reversion: this is an outright relative downtrend.

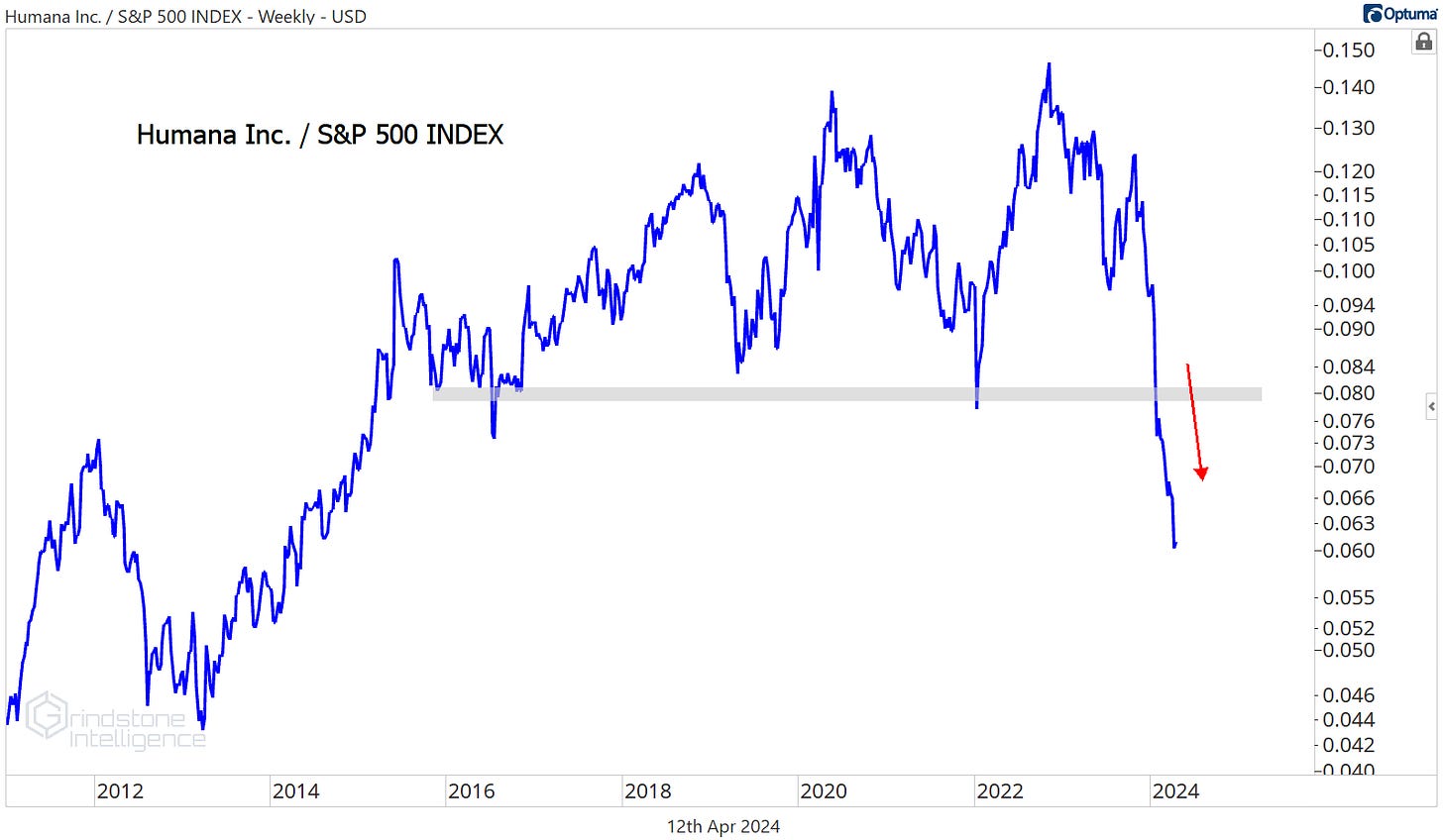

Humana is even worse. It’s at its lowest level in a decade relative to the overall market.

This space is best left alone until we at least see some stabilization.

More stocks to watch

The relative strength we’re seeing in Eli Lilly is the opposite of the weakness we’re seeing in those managed care stocks. Check out LLY vs. the S&P 500: it’s been above a rising 200-day moving average for almost all of the past 3 years.

As Lilly consolidates at the 685.4% retracement from the early 2023 selloff, we have a clean setup to work with. We like it long above $740 with a target of $1000.

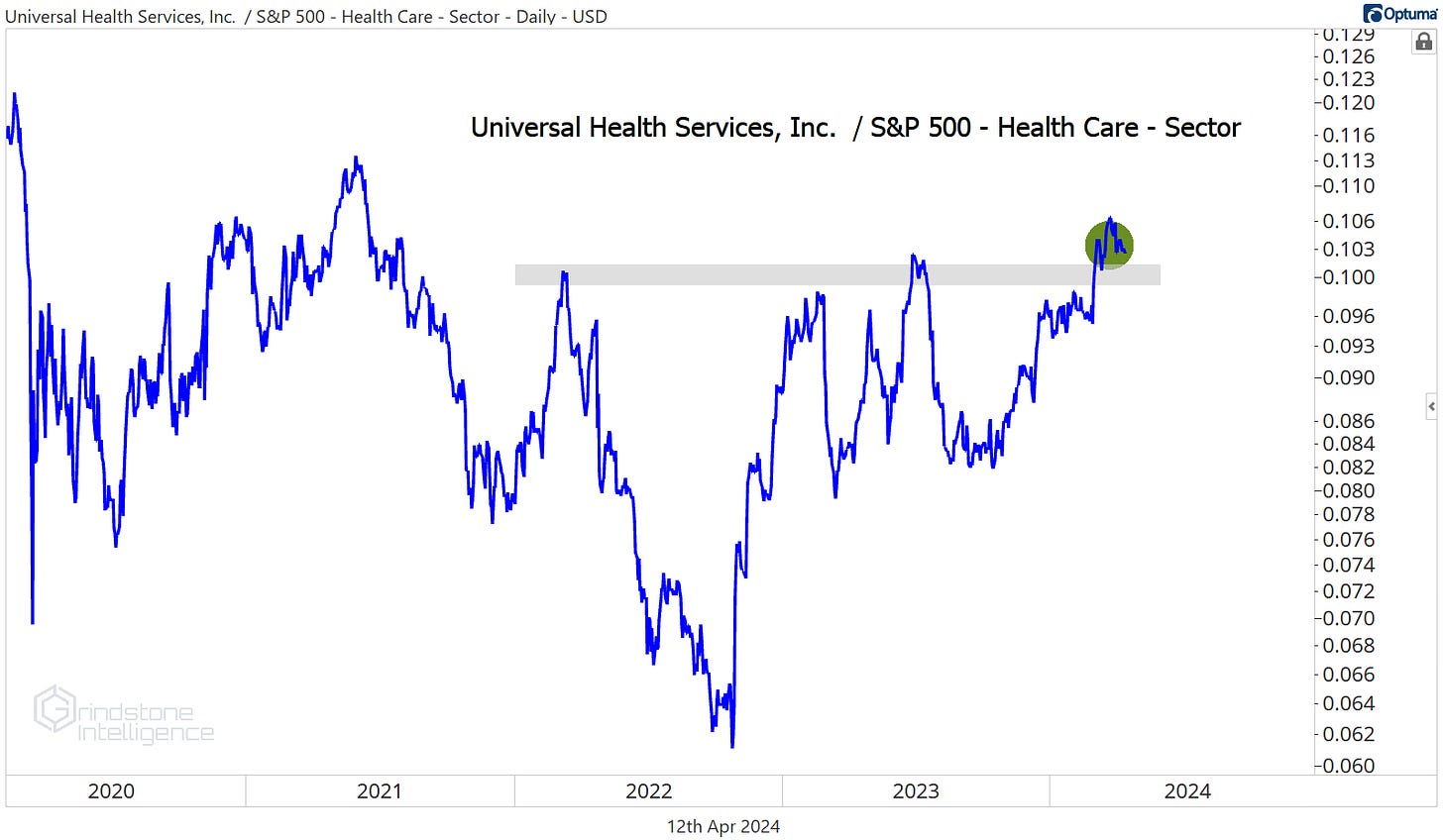

The recent strength in the Health Care Facilities space is really impressive, too. United Health Services is hitting new multi-year highs relative to the rest of the sector.

The risk/reward setup is pretty clean here. Universal Health Services just went nowhere for nearly a decade. From big bases come big resolutions. We continue to like UHS from the long side as long as it stays above $160, with a target of $225.

That’s all for today. Until next time.