Health Care Sector Outlook

Over the last month and a half, we’ve been asking ourselves, “Are these failed moves just false starts, or are they the start of something bigger?”

It looks like we’ve got our answer: the bull market lives on.

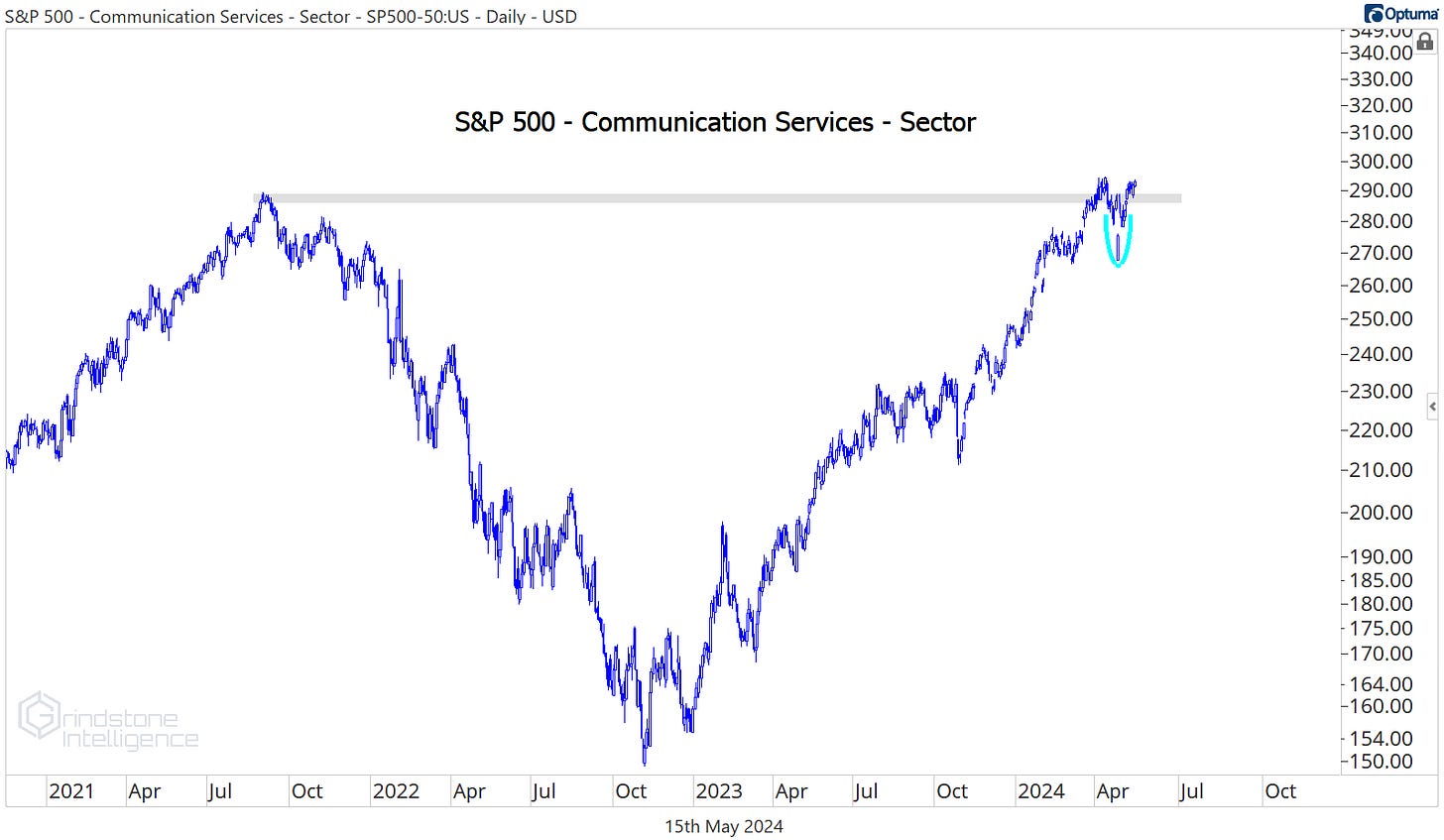

Communication Services, the worst sector during the bear market of 2022 but the best so far this year, is back above its prior cycle highs.

So are the Financials.

And the Materials.

The same goes for the Health Care sector, despite its status as one of the year’s laggards. After surging to new all-time highs in February, Health Care has been the single worst performing sector over the last three months. In other words, even the worst areas of the market are doing pretty well - that tells you a lot about the type of environment we’re in.

And let’s be clear. Health Care is one of the worst places to be right now. Relative to the S&P 500, the group failed to find support at the 2021 trough. We’d been eying that bullish momentum divergence forming at those former lows and believed that was a perfect time for the bulls to step in on Health Care. But instead of working off that divergence with a rally higher, we worked it off through time. Now, the Health Care/SPX ratio is at decade-plus lows.

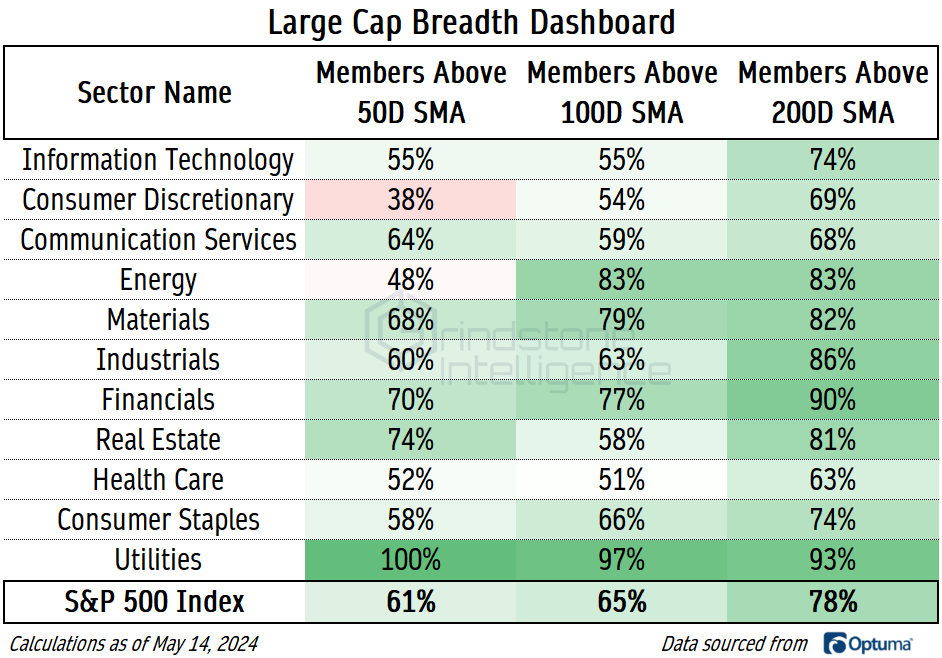

Breadth readings support the negative bias towards Health Care. More than half of the sector’s constituents are above the 50, 100, and 200-day moving averages, so it’s not as if we want to be shorting the group - this is a bull market, after all. But no sector has fewer stocks trading above their long-term average than Health Care does. There are simply better uses of our time and resources than to be buying a bunch of Health Care stocks right now.

What could change our mind? A breakout for the SmallCap Health Care ETF would be a good start. Someone forgot to tell these guys that the stock market bottomed all the way back in October 2022 - PSCH was hitting new lows in October 2023.

A break above $44 would put an end to the downtrend that’s been in place for the 40 months, and that might be enough to shift the narrative around Health Care going forward.

Digging Deeper - Top charts and trade ideas

Over the last year, only one Health Care sub-industry has managed to outperform the 27% gain of the S&P 500. The Distributors have narrowly edged the index, gaining just over 28%.

Similarly, only one sub-industry has failed to move higher over the last year: Health Care Supplies has fallen 7%.

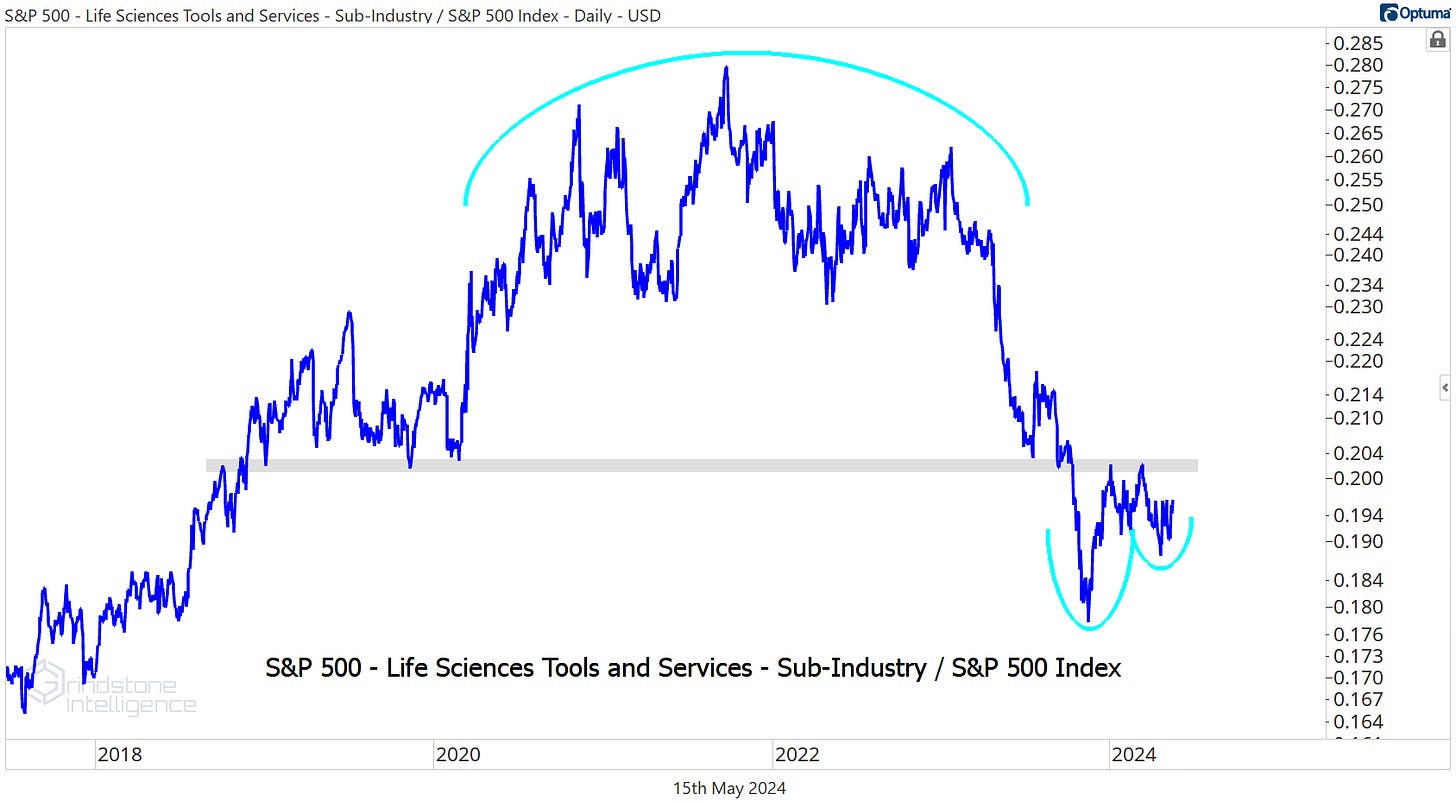

Near the middle of the pack is the Life Sciences Tools & Services sub-industry, where we’ve got a potential reversal shaping up. Here’s the group relative to the rest of the market.

Trends are always more likely to continue than reverse, so we can’t discount the likelihood that this cup and handle pattern doesn’t pan out, but it’s an intriguing setup. Especially as the sub-industry’s largest component threatens to break out of a big, multi-year trading range.

Thermo Fisher Scientific is knocking on the door of new highs. We like TMO above $610 with a target of $900, which is the 685.4% retracement from the 2020 decline.

Leaders

Moderna is another stock working on a major reversal, and this recent break above $120 was confirmation that the downtrend has run its course. That $120 level, which is also the 38.2% retracement of the 2023 decline, is a good level to manage risk against. We like it long from there with an initial target of $155, and a longer-term target back to last year’s peak of $215.

It’s not enough to just own stocks that are rising in bull markets. We want to own the stocks that are rising the most. United Health Services was among the sector’s best performers of the last month, and it’s hitting new multi-year highs relative to the rest of the sector, too. That’s the type of relative strength we like to see.

The risk/reward setup is pretty clean here, as well. Universal Health Services just went nowhere for nearly a decade. From big bases come big resolutions. We continue to like UHS from the long side as long as it stays above $160, with a target of $225.

Losers

The opposite of relative strength is CVS. We didn’t bother to adjust the y-axis on our chart for a reason. This is a bull market. Why on earth would we waste our time on stuff like this?

More Charts to Watch

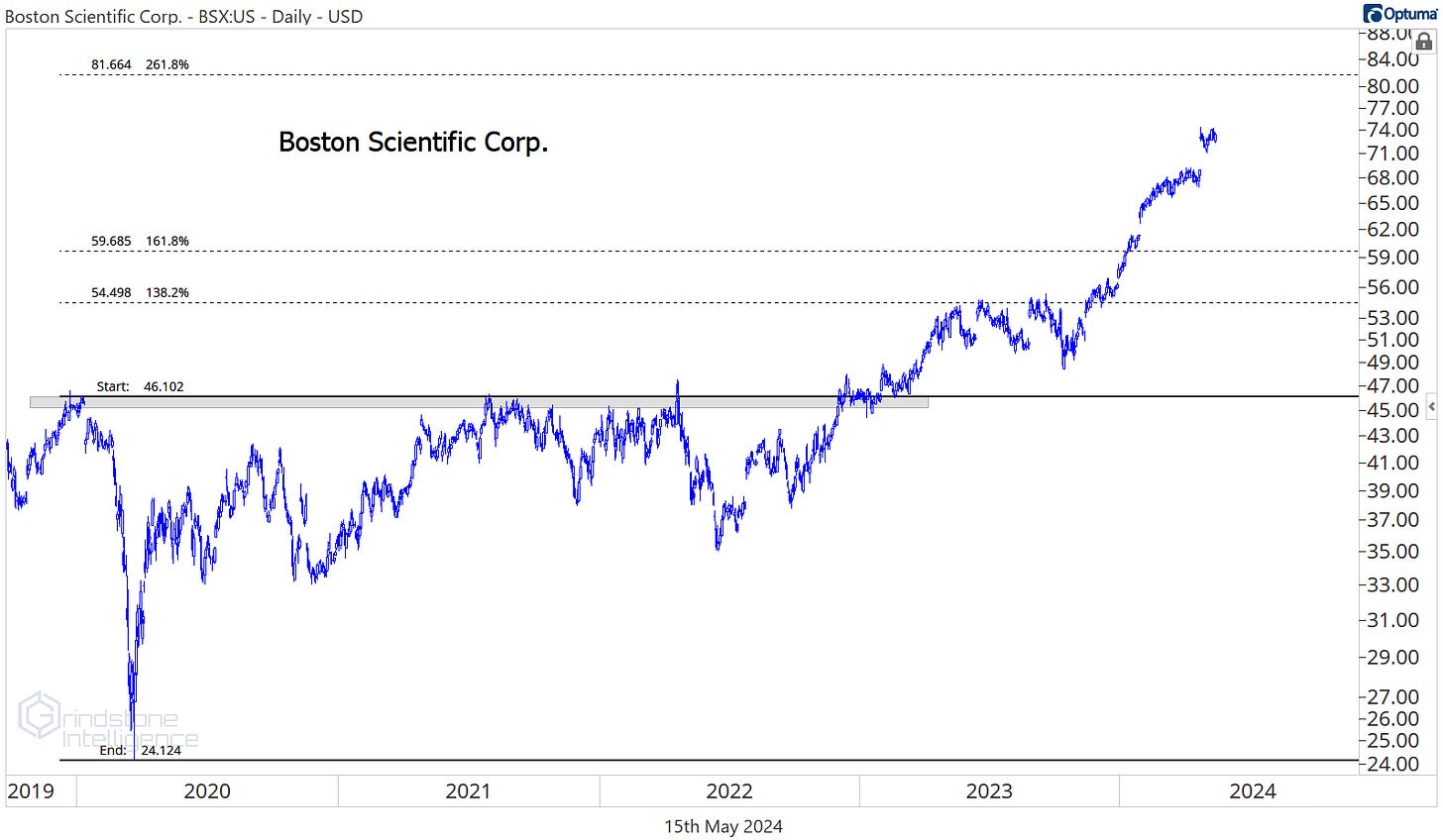

Boston Scientific, on the other hand, is anything but a waste of time. It’s not just showing strength versus the weak Health Care sector, it’s been setting new highs against the rest of the market as a whole. That’s not bearish.

The risk-reward here isn’t great today for new entries as it approaches our target of $81, but if we see a pullback that closes the gap from the end of last month, we can be buying BSX above $68 with a target of $81.

Eli Lilly has shown even more relative strength than BSX. Check out LLY vs. the S&P 500: it’s been above a rising 200-day moving average for almost all of the past 3 years.

As Lilly consolidates at the 685.4% retracement from the early 2023 selloff, we have a clean setup to work with. We like it long above $740 with a target of $1000.

We also continue to like this setup in Intuitive Surgical. ISRG just broke out of a 2-year cup and handle base and has been consolidating above the former highs.

We like ISRG above the former highs of $375 with a target of $480, which is the 423.6% retracement from the 2020 decline. Especially if it can complete this same cup and handle continuation pattern relative to the rest of the sector.

That’s all for today. Until next time.