Healthy Rotation

More and more sectors are breaking out. That’s not bearish.

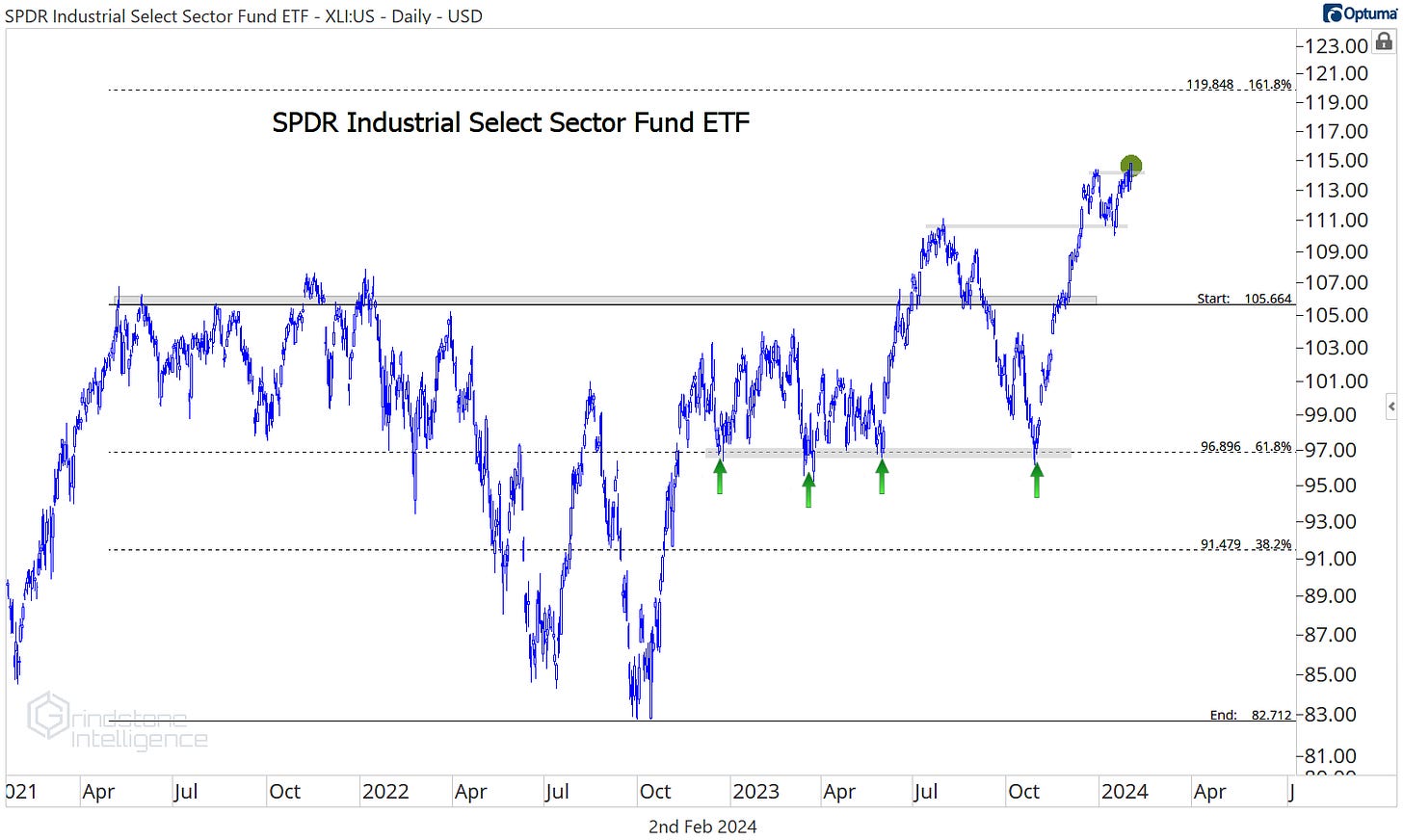

We’ve all heard about the dominance of mega cap growth stocks, and with the Meta and Amazon earnings impressing last night, that strength is set to continue. It’s not just the high-flyers that are performing well, though. Yesterday, the S&P 500 Industrials sector closed at a new all-time high.

Perhaps that doesn’t impress you. After all, the Industrials were the first sector to set new highs last year, and they’re now 7% above the bull market peak set back in 2021. this latest breakout is just a continuation of that strength.

It’s not just the Industrials.

Health Care just closed at its highest level in almost 2 years.

This is an area that was completely out of favor for most of the last year. During 2023, the Health Care sector underperformed the benchmark S&P 500 index by 20%, falling from 7-year relative highs to near multi-year relative lows. What better place for Health Care to bottom?

Health Care has found support here at the exact same place it did back in 2021. What we really like is the bullish momentum divergence at these lows. After getting severely oversold on the initial test of those lows last November, RSI hasn’t dropped below 30 on subsequent declines. We saw the same types of momentum divergences at the 2020 and 2023 peaks and the 2021 bottom.

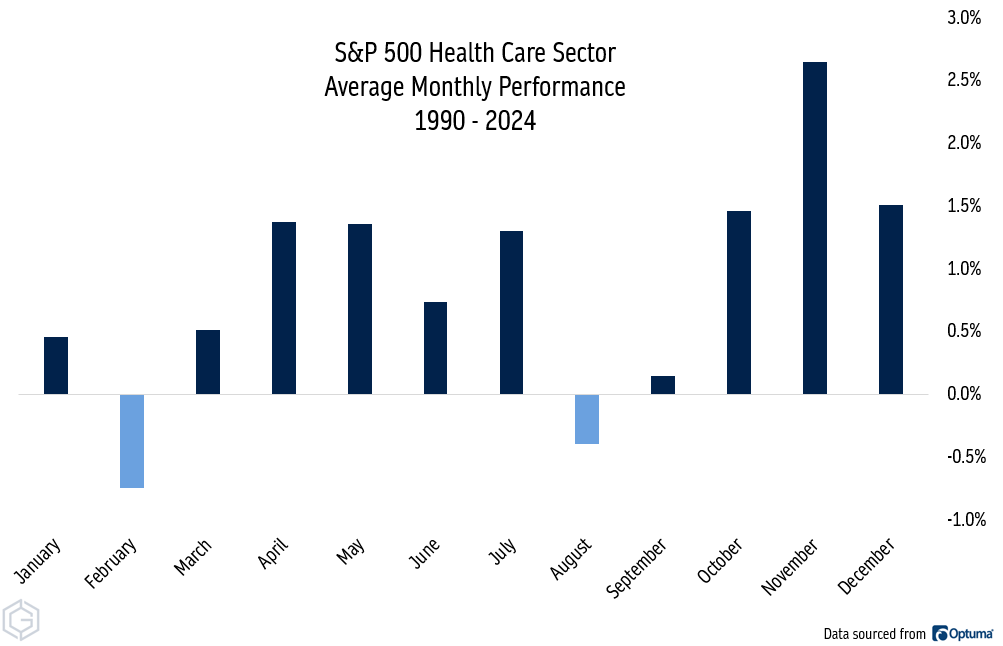

It’s not all good news. Seasonality could present a problem over the next month, since February is the single toughest month for Health Care. The sector has declined by an average of 0.75% in all Februarys since 1990.

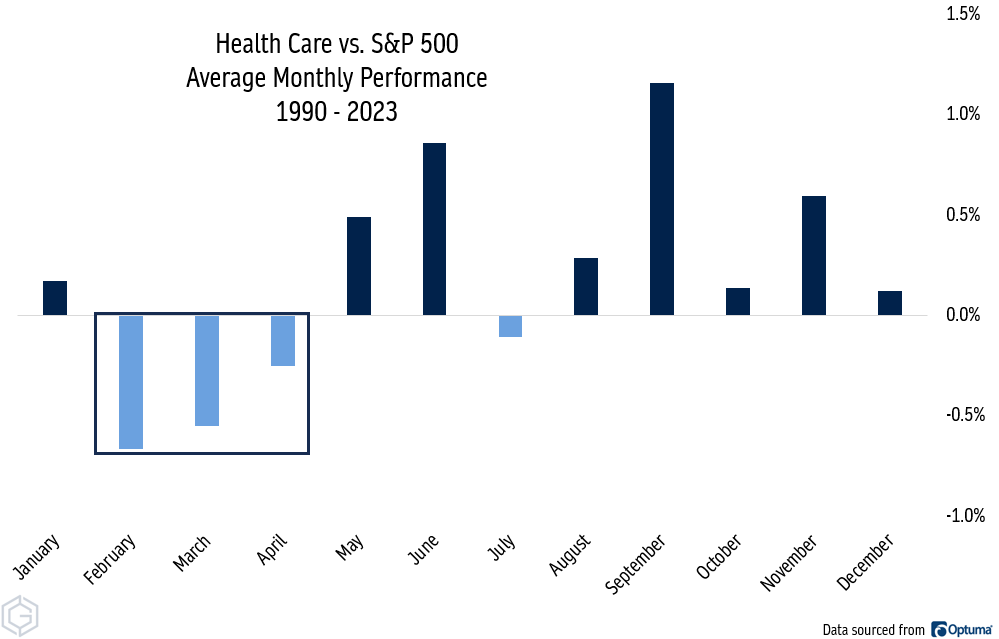

And on a relative basis, the weakness extends throughout the next quarter. Health Care has lagged the rest of the S&P 500 by 0.67% on average in the month of February since 1990, and by 0.55% in March.

But remember that seasonality is a general guideline, not a prescription. Even in those two months, where the sector has underperformed the S&P 500 most consistently, Health Care has still won out a third of the time. This year could easily be the ‘one’ in the one-in-three.

Our target here on the XLV is $155, which is both the 261.8% retracement from the 2020 decline and the 161.8% retracement from the 2021-2023 range.

But we only want to be betting on the Health Care sector if we’re above the former highs of $141. Otherwise, it’s a rangebound mess that we want no part of.

Whichever way the large cap sector resolves, we expect the small caps will follow. Small cap health care has been significantly worse than the large cap space, having declined as much as 47% from the 2021 highs and spending most of the time since then stuck below a declining 200-day moving average:

Right now, though, PSCH is above its 200DMA, threatening to break a 2-year downtrend line, challenging overhead resistance from the 2022 lows, and just saw momentum reach its highest level in 3 years. A sustained break above $43 would be confirmation that Health Care stocks are an area of strength.

We think that’s the higher likelihood outcome, and we’re betting on outperformance from the Health Care sector in the months ahead.

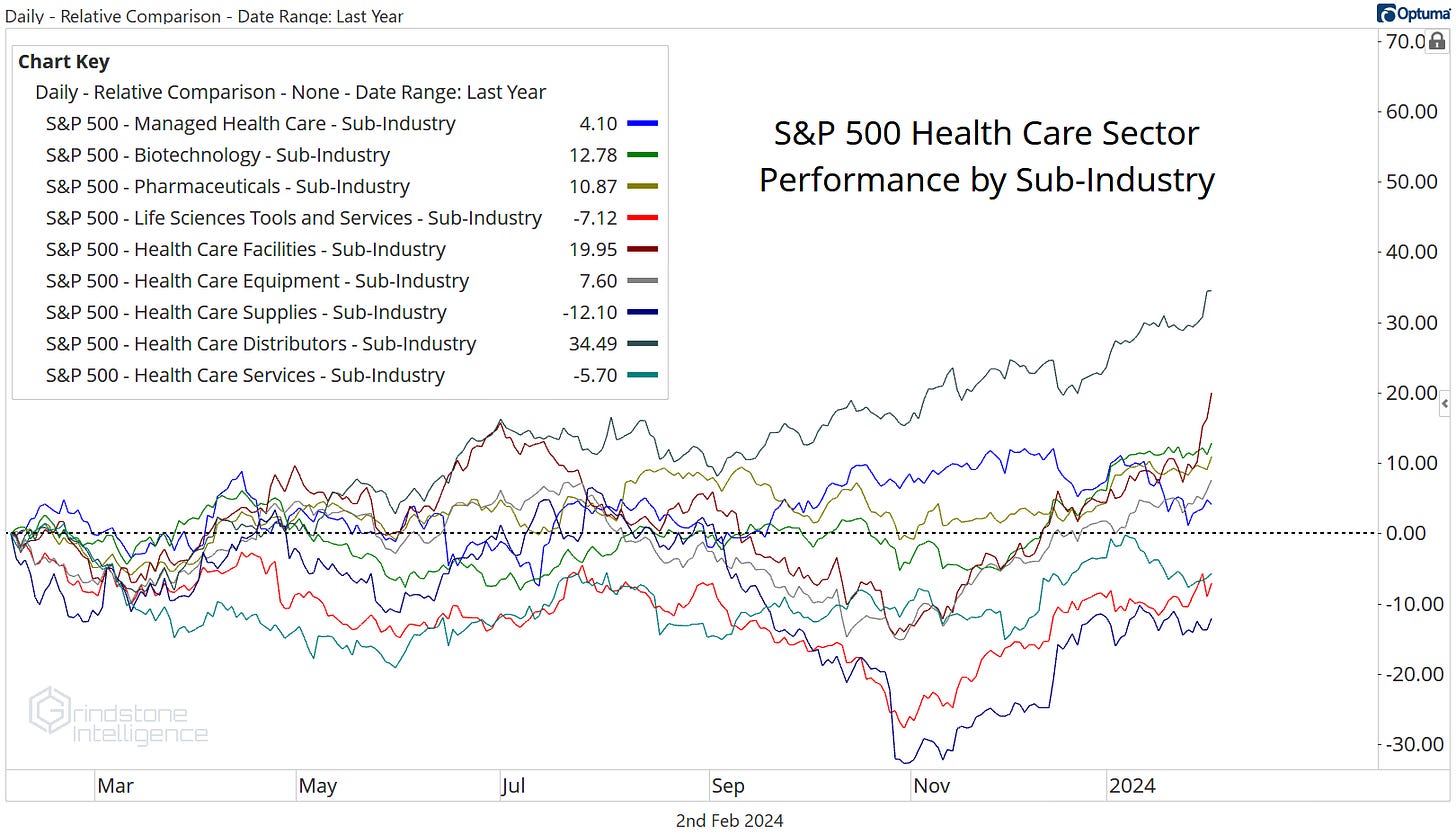

Digging Deeper

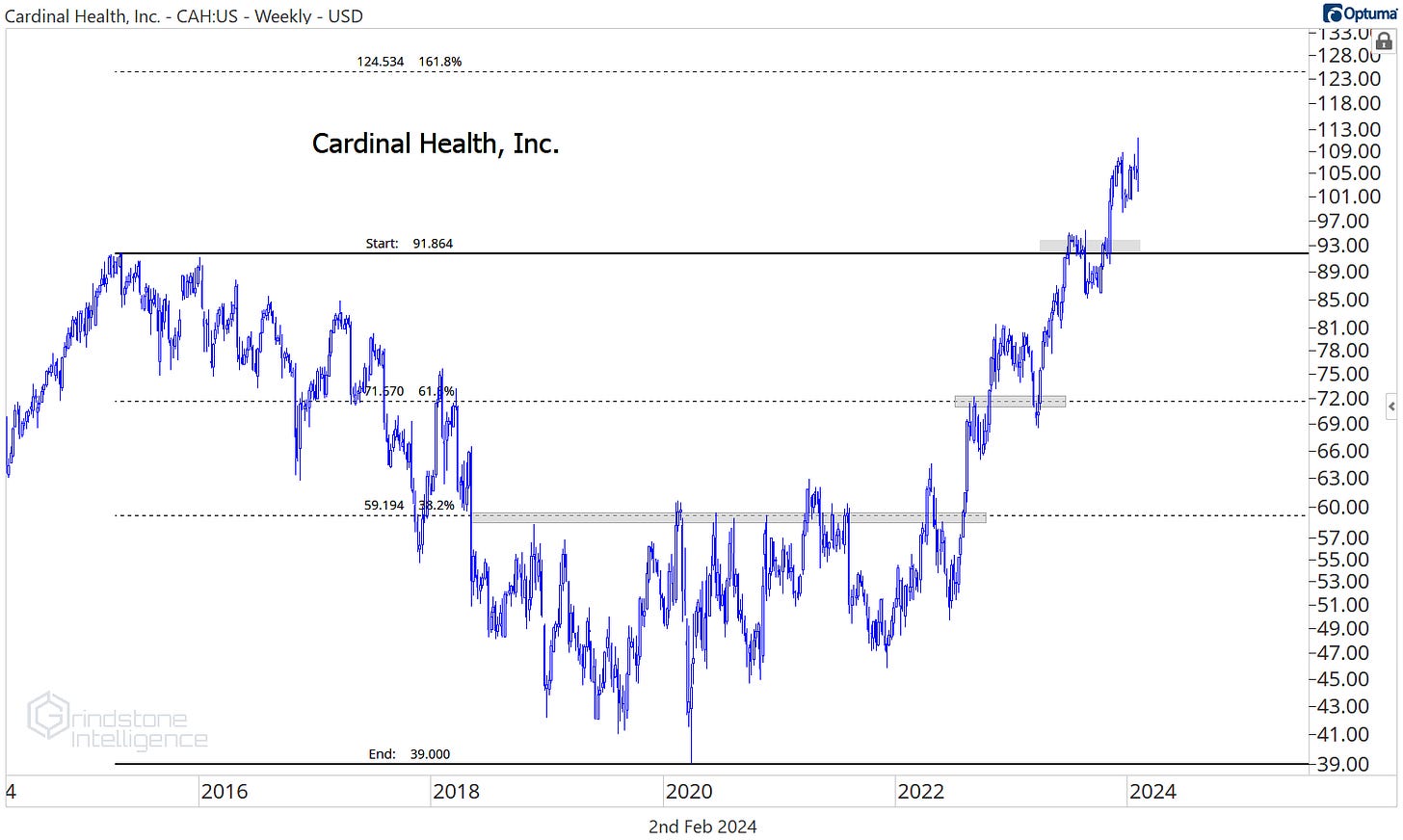

The Health Care Distributors are the best-performing sub-industry over the last year, and the relative strength hasn’t slowed. Cardinal Health is halfway to our target of $125.

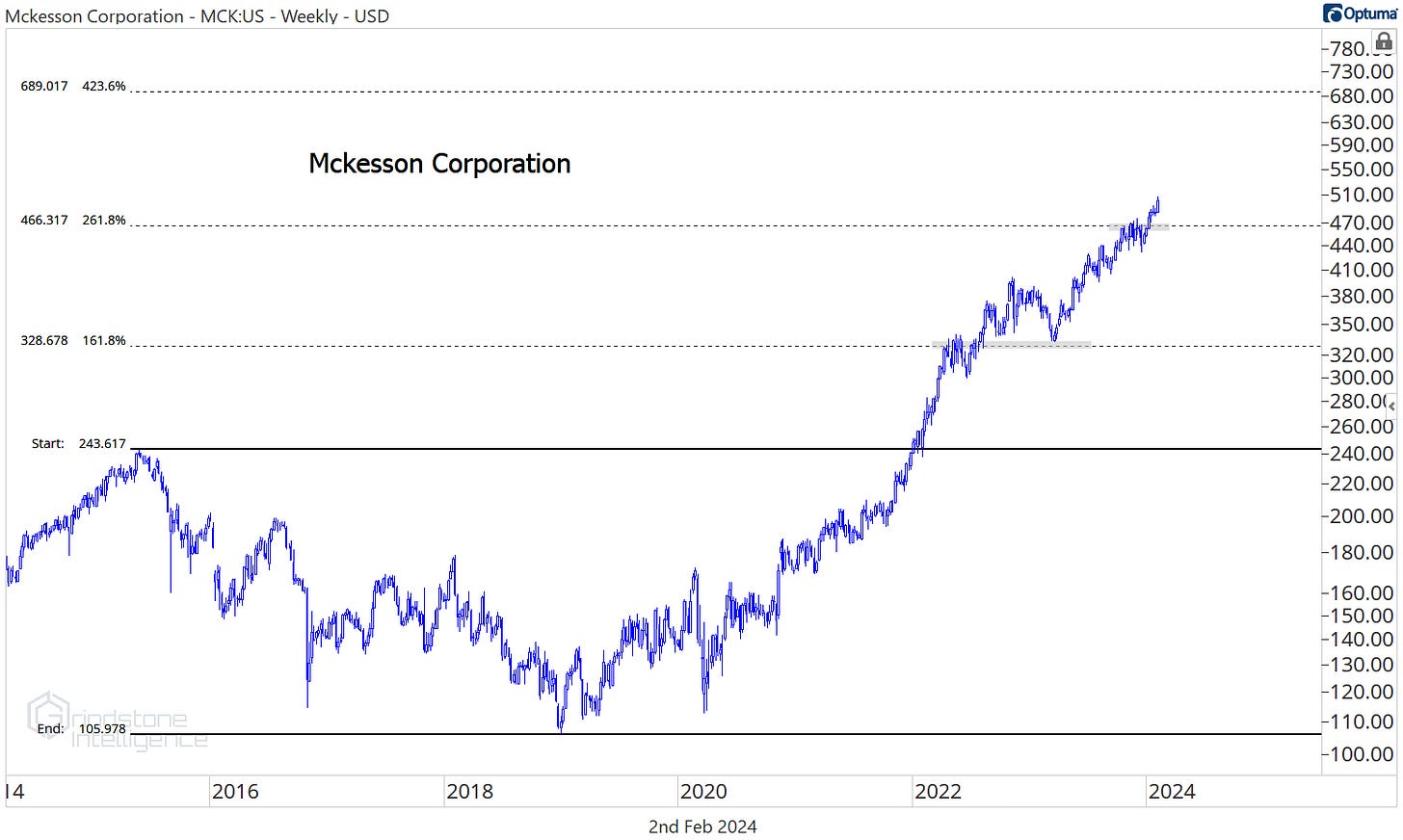

We’re still targeting $690 on MCK, with $470 as our risk management level.

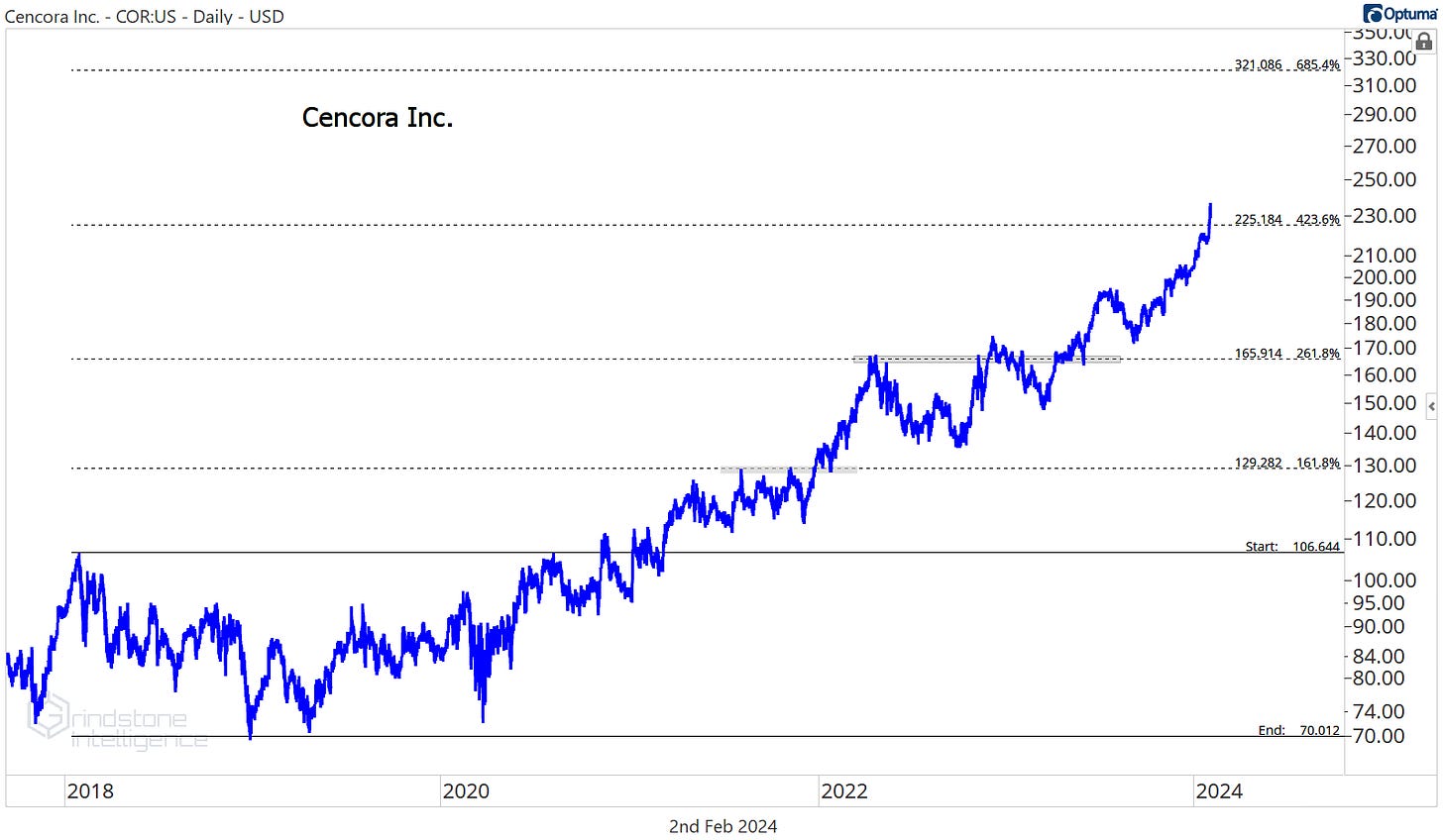

Cencora was the one we were more cautious on as it approached our target of $225, but it blew past that target earlier this week, and now we want to use that former target to manage downside risk. As long as COR is above $225, we can be long with a new target of $320, which is the 685.4% retracement from the 2018-2020 range.

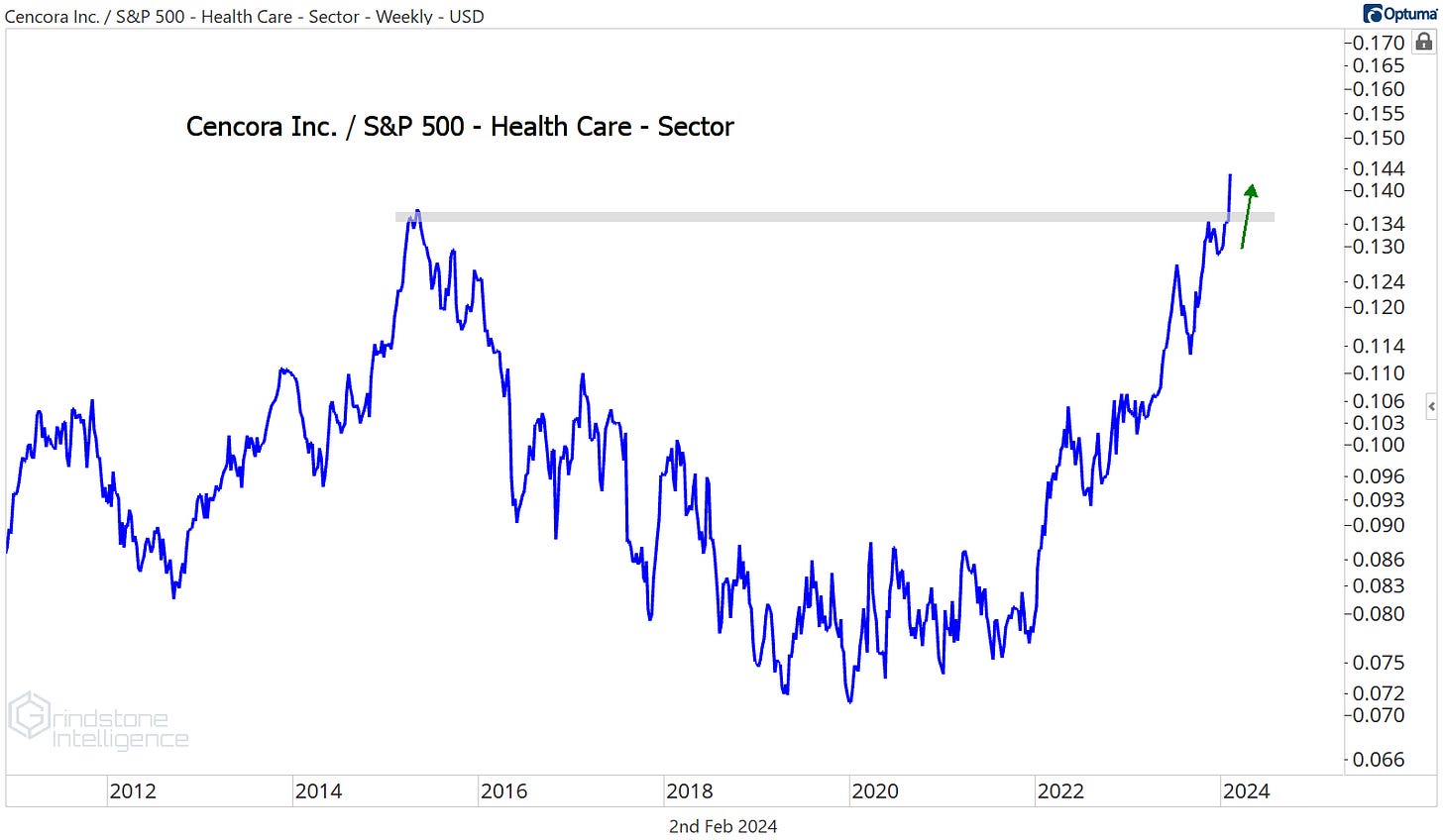

As if the gains COR has made weren’t impressive enough, the latest surge pushed the stock to new highs vs. the rest of the Health Care sector, too, putting the cap on a 9-year base.

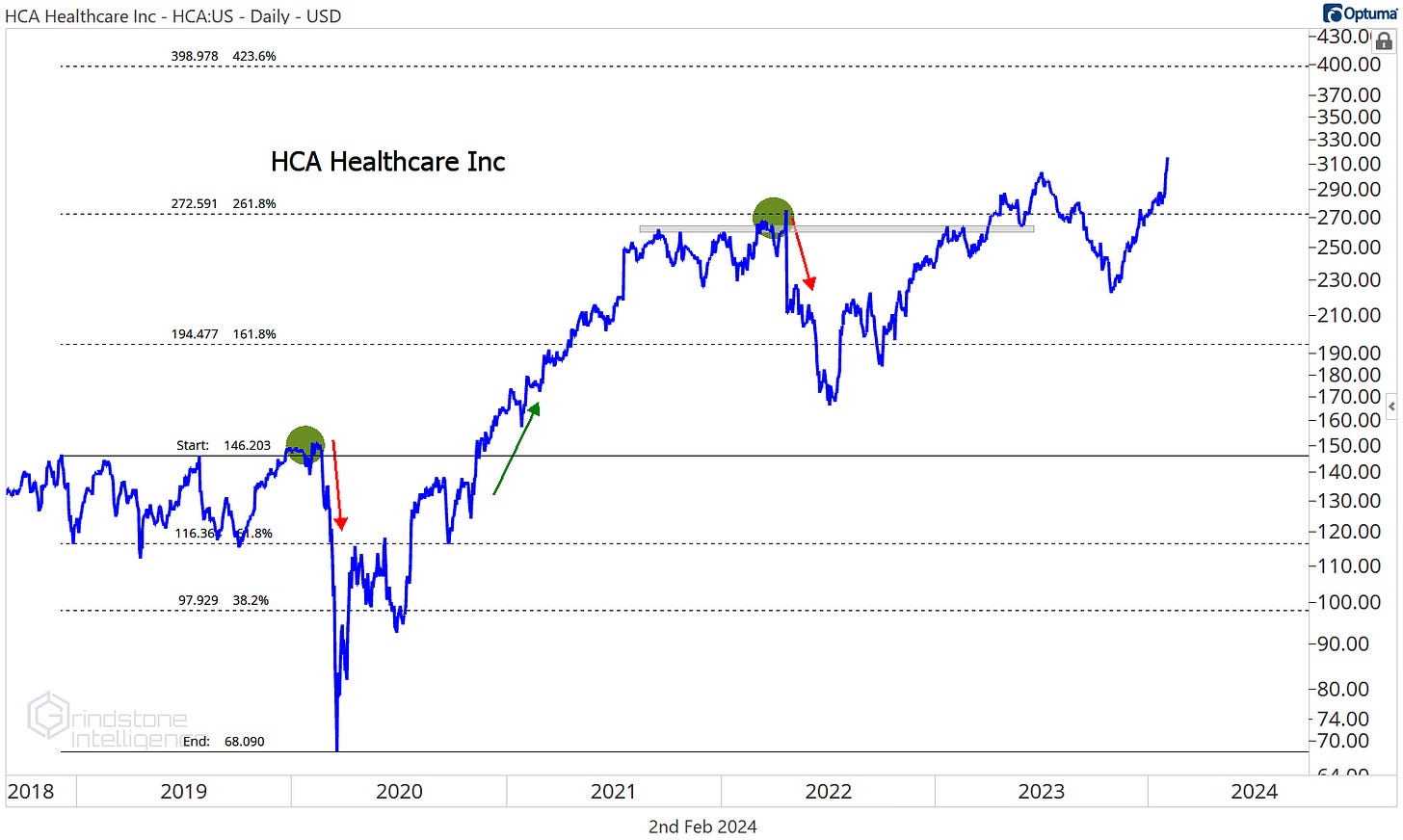

As good as the Distributors have been over the last month, though, the Health Care Facilities sub-industry has been better. HCA just hit new all-time highs, and we think it goes all the way to $400.

The risk/reward setup is even better in UHS. Universal Health Services has gone nowhere for nearly a decade. From big bases come big resolutions. We need to be a little careful with big, messy consolidations like this - sometimes the breakouts can be just as messy - but if UHS stays above $160, we like it long with a target of $225.

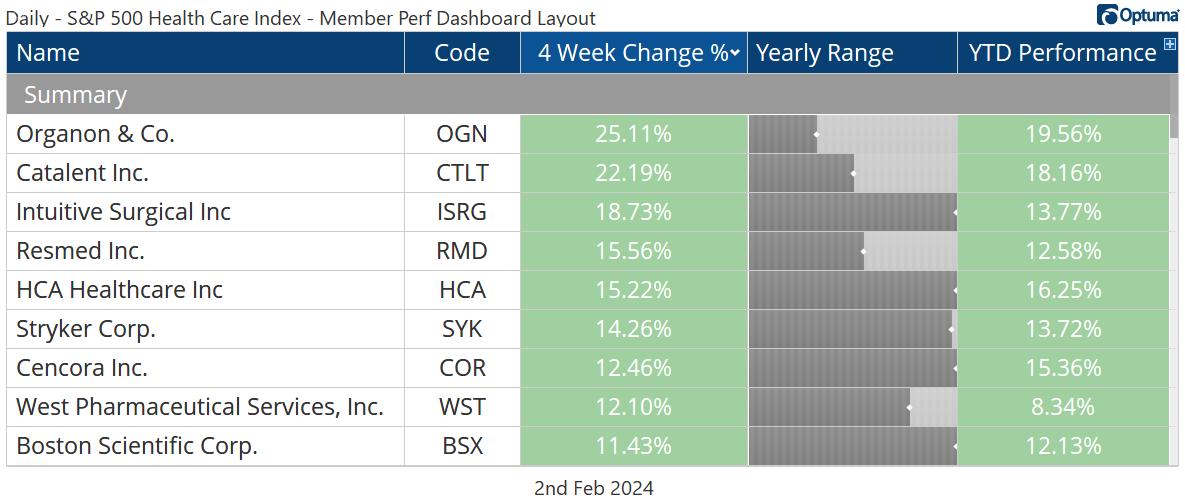

Leaders

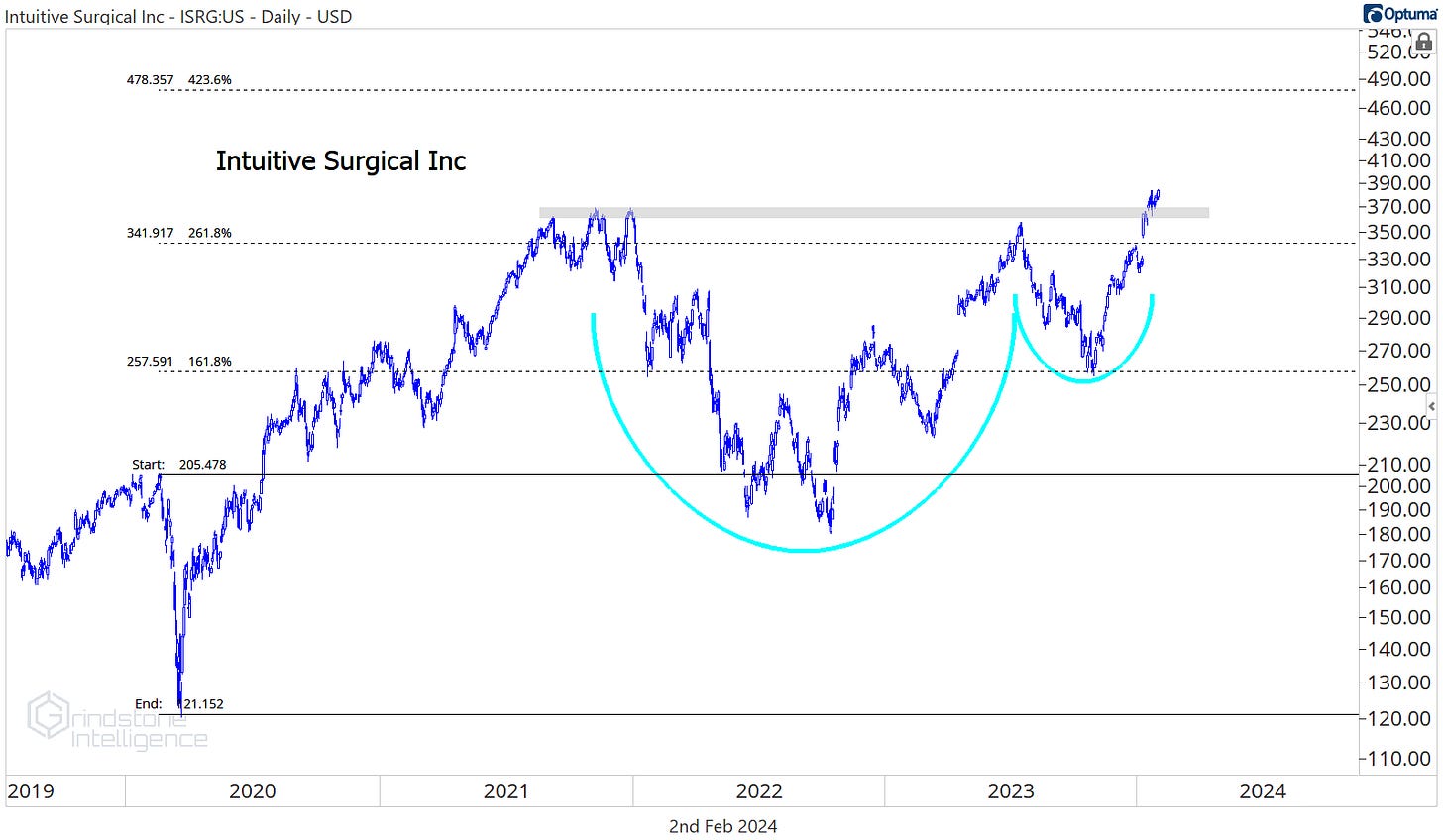

Intuitive Surgical has risen nearly 20% over the last 4-weeks, completing a 2-year cup and handle continuation pattern.

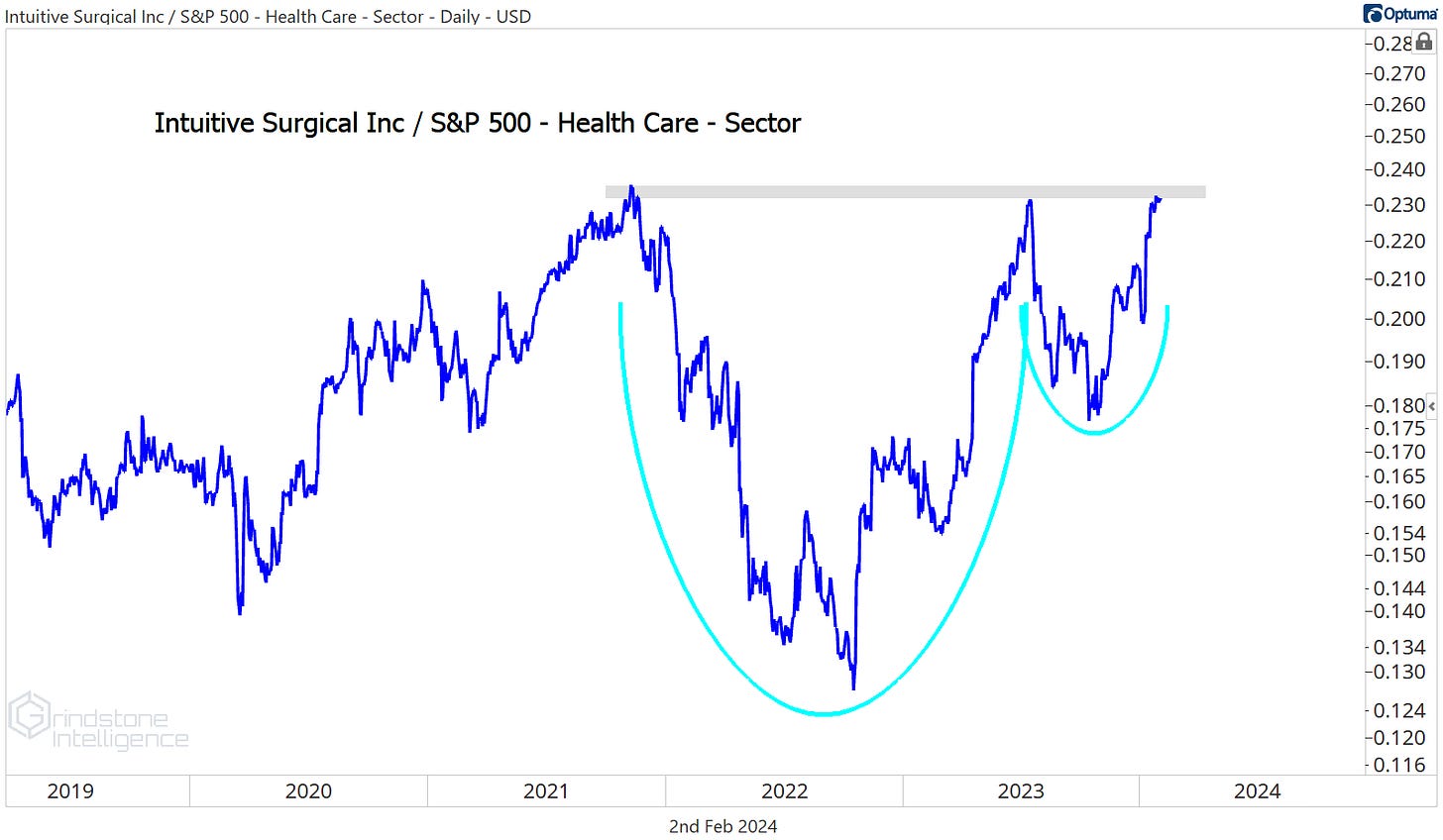

We like ISRG above $375 with a target of $480. Especially if it can complete the same cup and handle pattern relative to the rest of the Health Care sector.

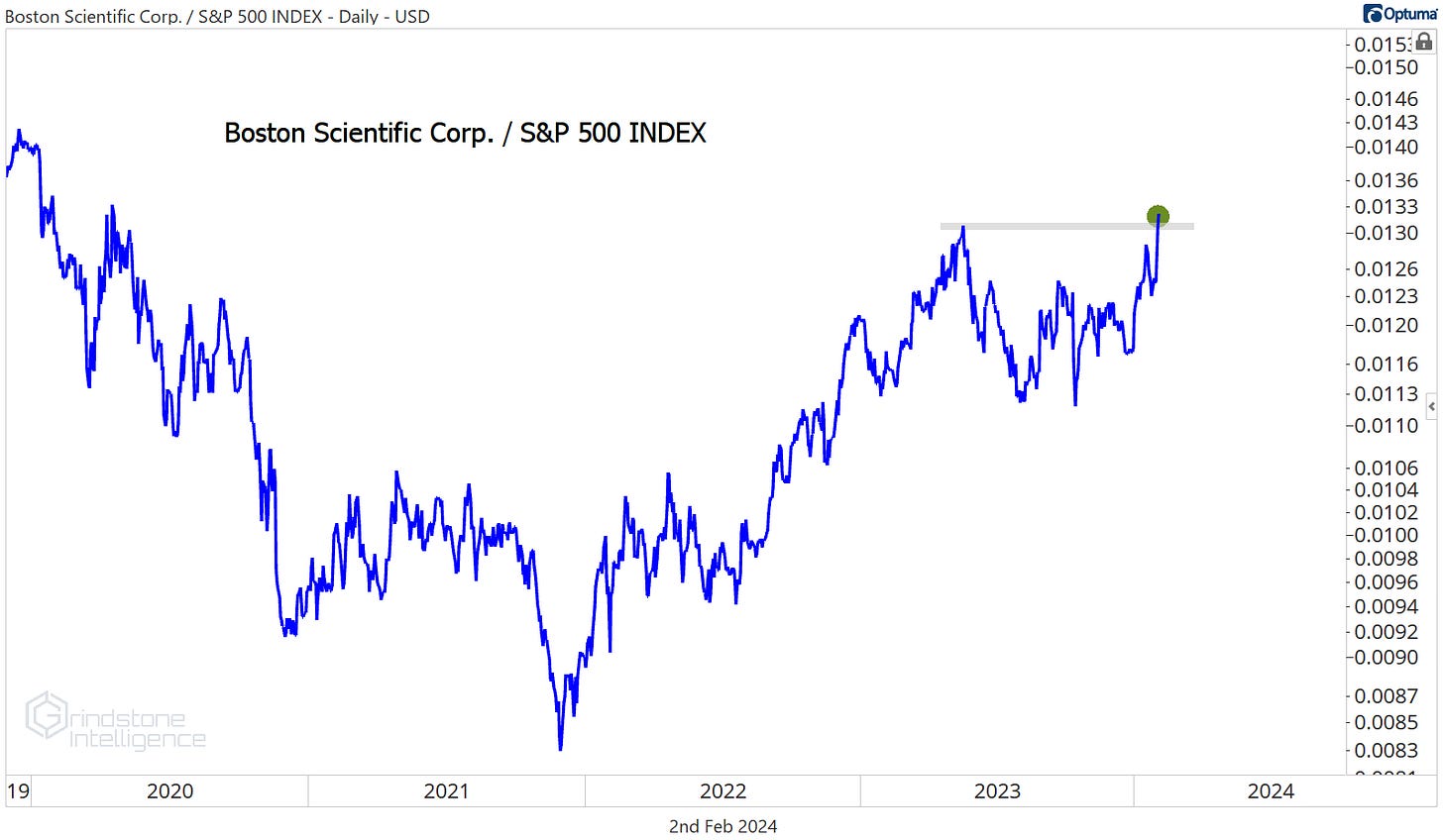

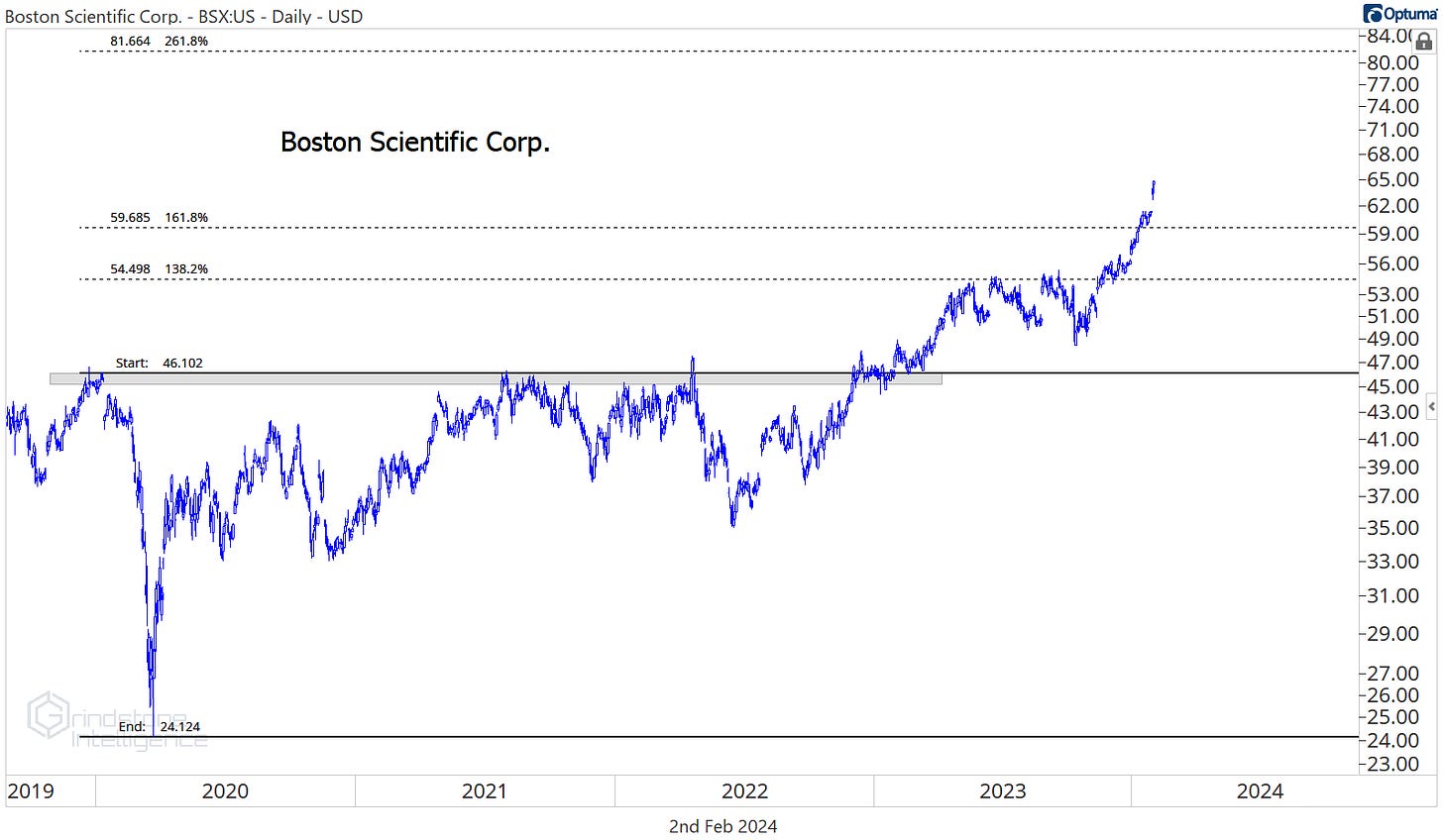

Boston Scientific isn’t just showing relative strength vs. rest of Health Care. It’s breaking out against the entire S&P 500 index.

We want to be aggressively buying any pullbacks in BSX toward $60 - though we might not get any. We think BSX is headed to $81.

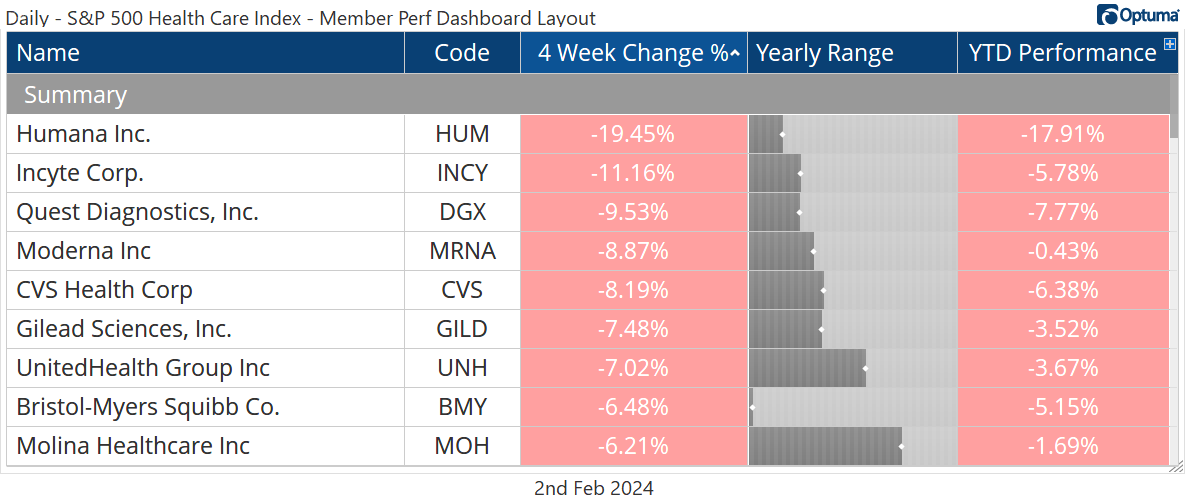

Losers

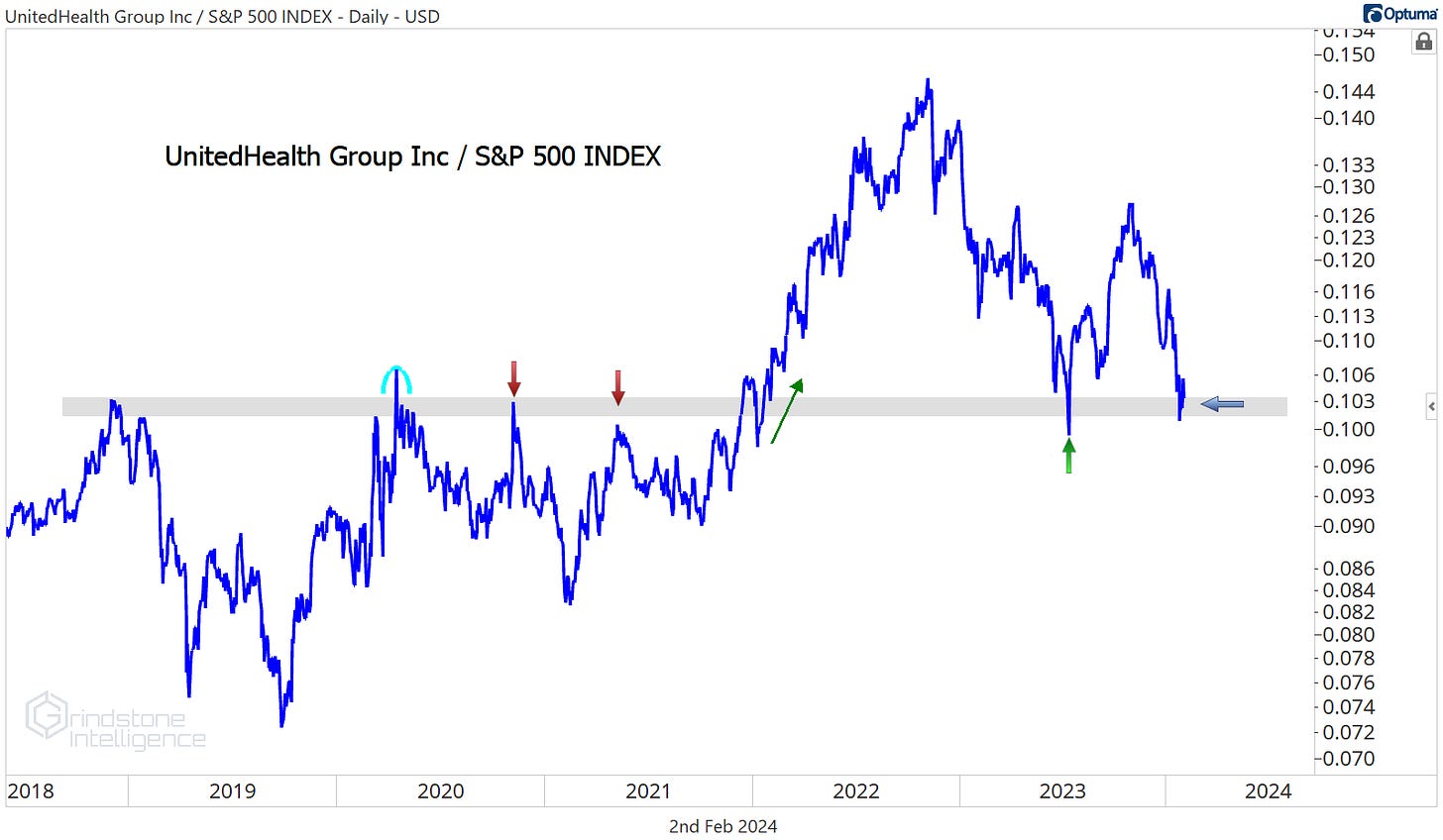

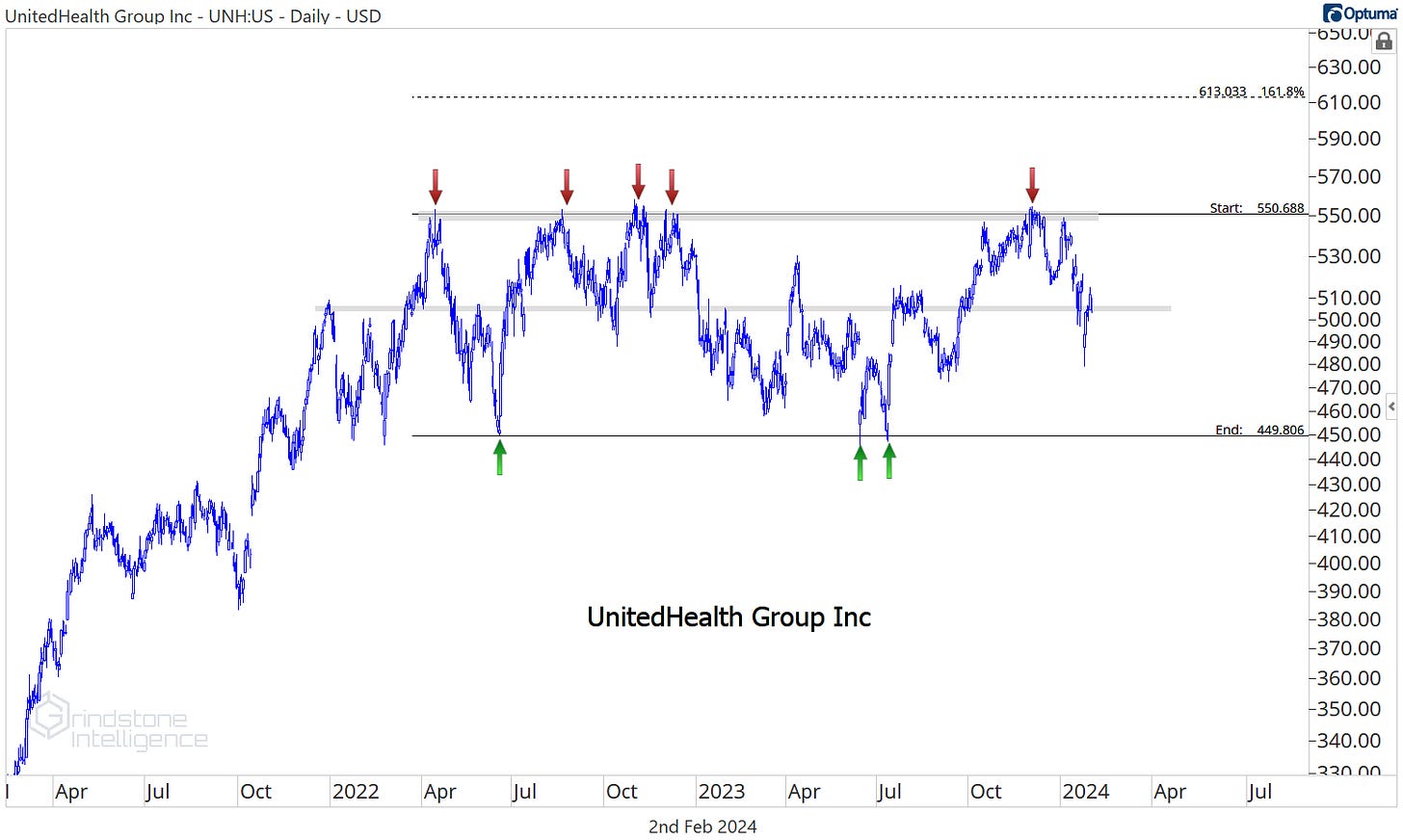

The managed care space ran into some trouble over the last month, led by a $20% decline in Humana after they guided 2024 EPS to be far below expectations. Peer UnitedHealth was dragged down with them, but the decline presents a compelling setup for UNH when compared to the S&P 500. The UNH/SPX ratio is right back to where it bottomed in mid-2023 - the same place it peaked from 2018-2021.

This is a rangebound stock to be sure, and one that we’d normally leave alone. But the relative strength profile intrigues us. We think the idea of owning UNH on a tight leash above $505 with a target of $613 makes sense here.

More Stocks to Watch

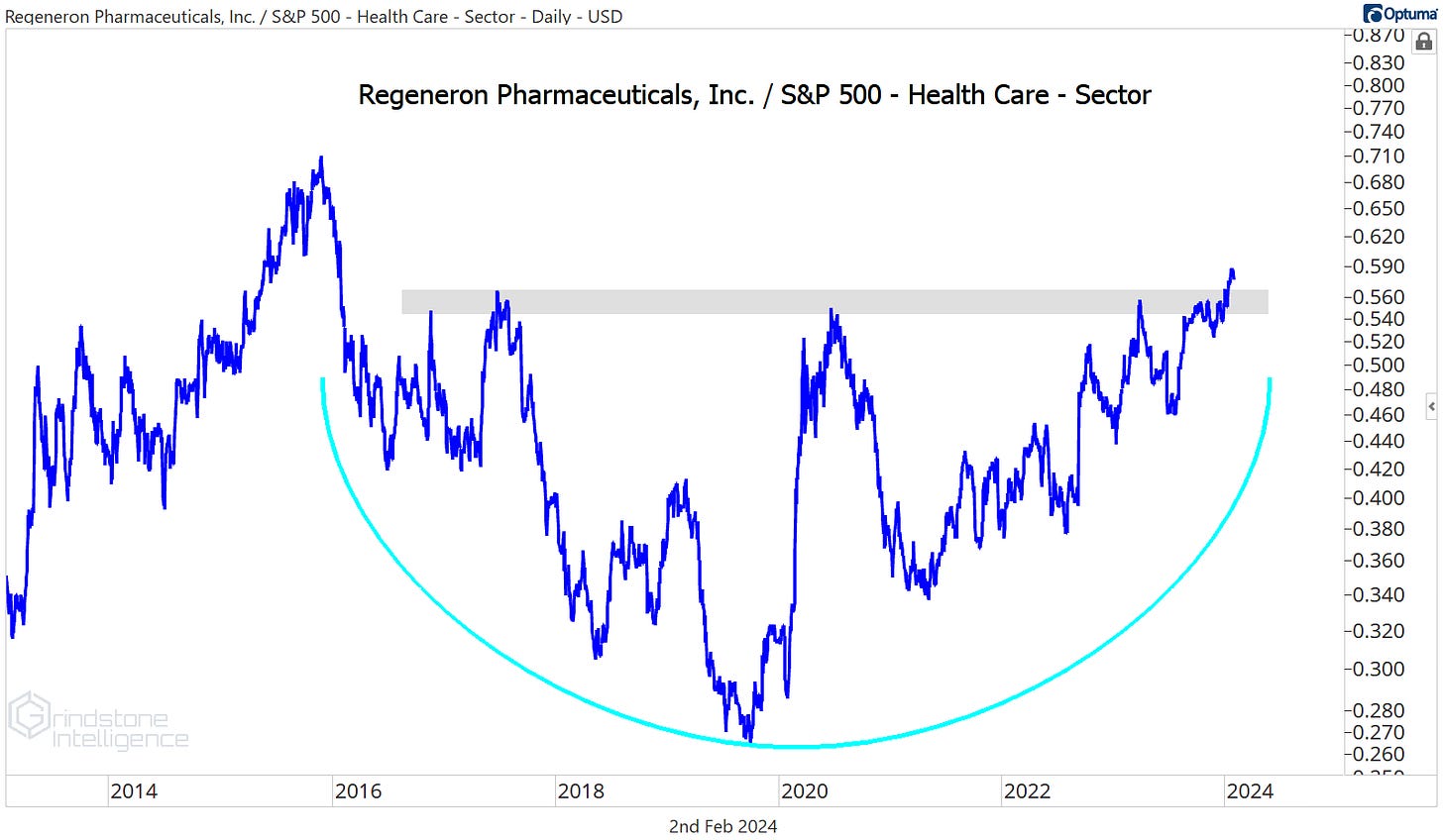

How can we ignore Regeneron? It’s breaking out of a 7-year base relative to the rest of Health Care.

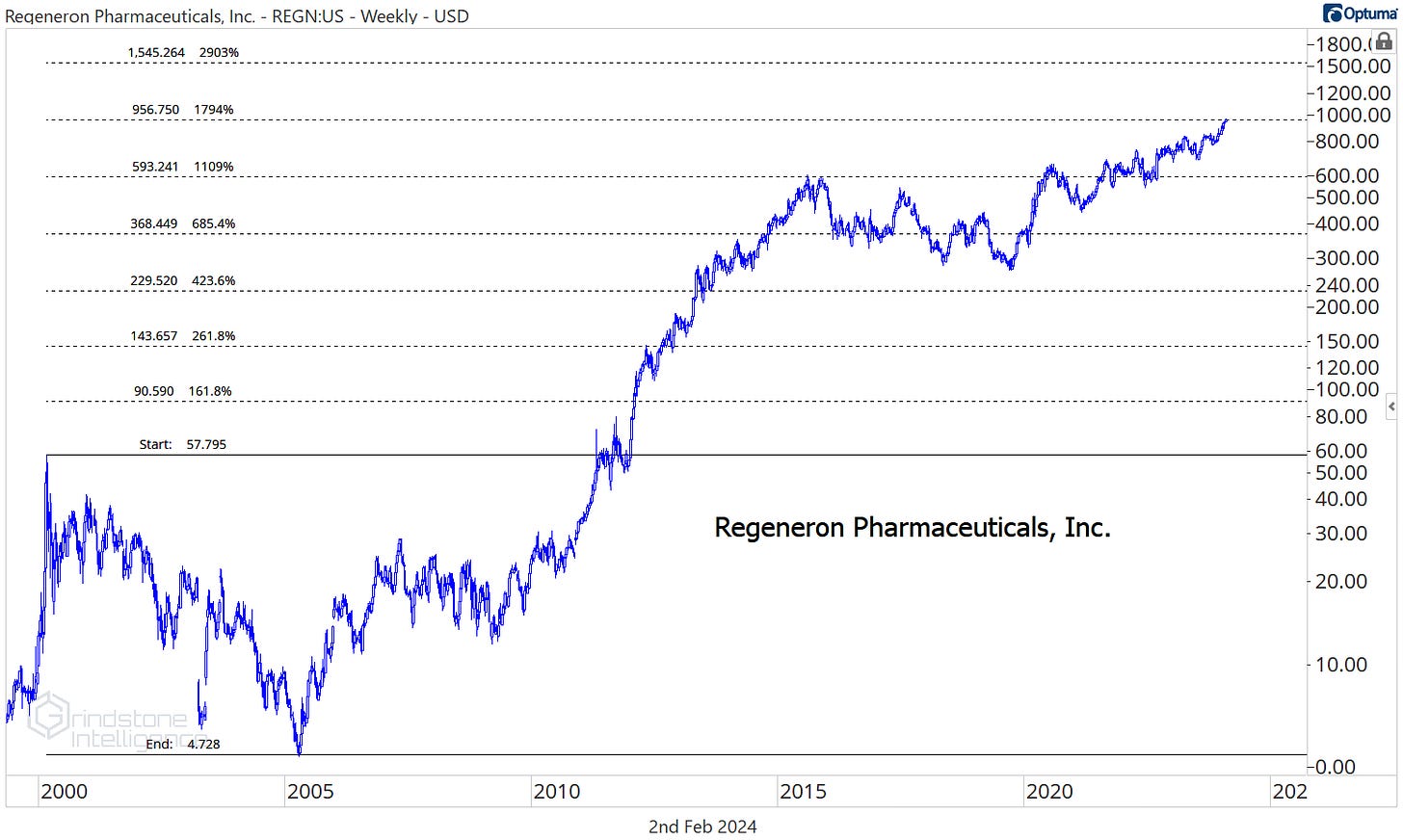

We’re zooming out a lot on this one, all the way back to 2000. The 1794% retracement from the 2000-2005 collapse is at $956, right where we’re trading today. This is not the place for new long positions, since we could easily see several weeks, months, or even years of consolidation here. After some consolidation, though, we’d like to own REGN above $956 with a target of $1500.

Eli Lilly’s 5-month consolidation resolved higher, and we’re maintaining our target of $830, with support down at $620.

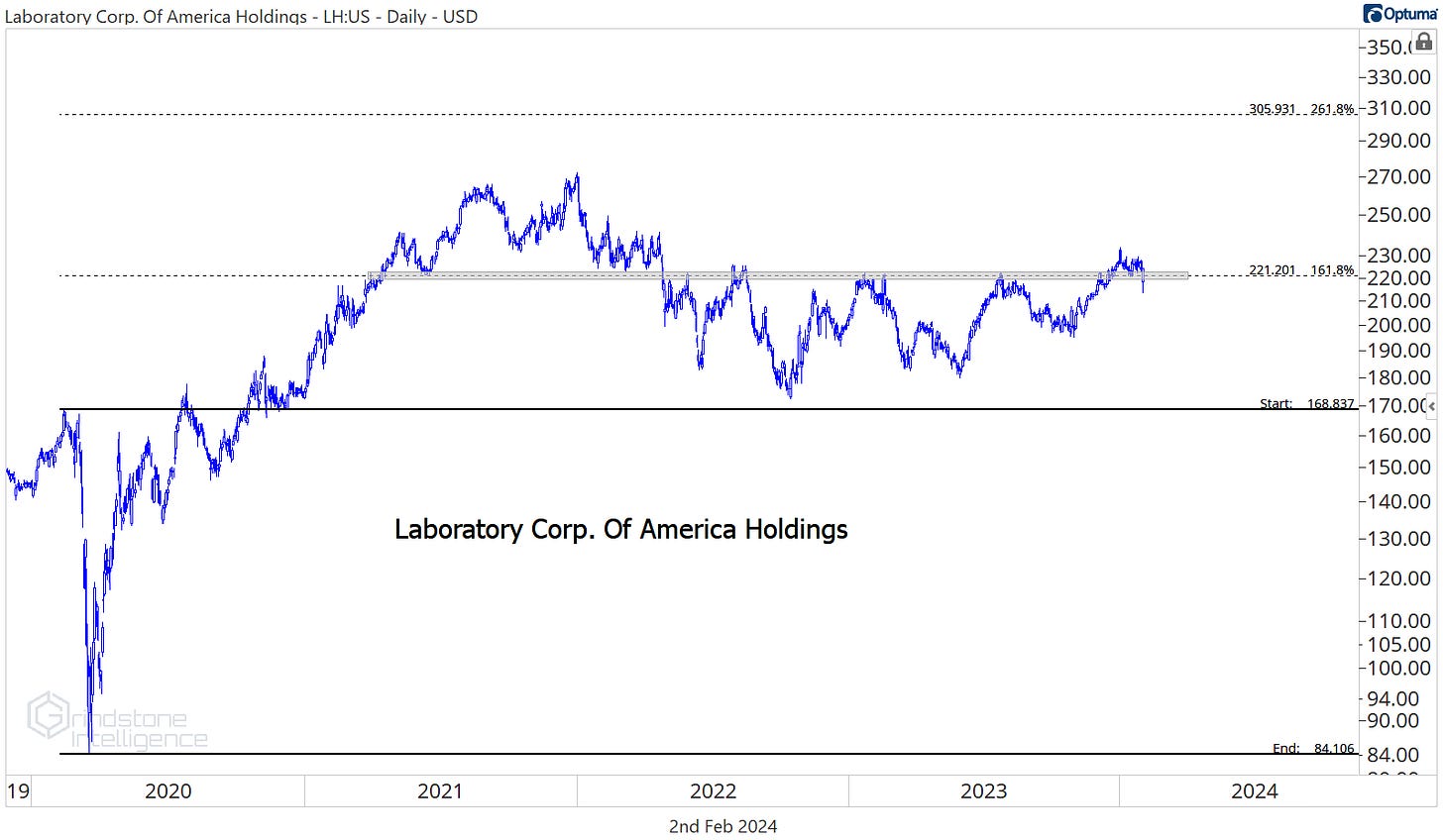

LabCorp is one of the cleanest risk-reward setups in the sector. We only want to be long LH if it’s above $220, which is the 161.8% retracement from the 2020 selloff. Our target is the next key Fibonacci retracement level at $305.

That’s all for today. Until next time.