What Recession? Homebuilders Hit New Highs as the Housing Market Remains Tight

The recession has done little to slow a red-hot housing market. In fact, it may have strengthened it. The S&P 500 Homebuilding index just hit a new all-time high this week – its first since 2005.

It’s unusual to see such strength in residential real estate during an economic downturn, but consider the following:

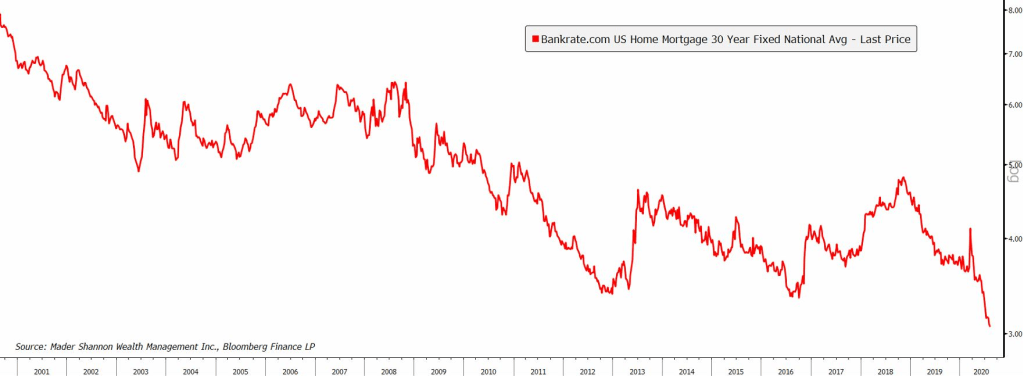

Mortgage rates just dropped to new lows. This year’s edition of quantitative easing from the Federal Reserve has pushed Treasury yields to near-zero, while term and default premiums have remained subdued. A prime borrower can now pay just over 3% for a 30-year home mortgage.

Millennials have notoriously postponed marriage and children until later in life compared to previous generations. But in recent years, household formation has picked up in the nation’s most populous demographic cohort. Growth in owner-occupier households outpaced that of renter households over the last few years and showed signs of acceleration in Q2.

The coronavirus, and the work-from-home movement that accompanied it, has served to strengthen the demand environment. Homebuilders are wary of predicting a long-term behavioral changes, but some inhabitants of densely populated urban areas are interested in escaping crowds during the pandemic. Here’s Ryan Marshall, CEO of PulteGroup, Inc.:

“As far as the markets that we highlighted where we are seeing an increase in our local business as a result of an urban exodus, if you will, I’ll use that term loosely, San Antonio, North Florida, Southwest Florida which for us would be the Naples, Fort Myers, Sarasota, kind of West Coast of Florida, and then we’re also seeing a bit of it in the Northeast corridor which is middle and Southern Jersey, and in to Pennsylvania. So there, I think we are seeing some folks that maybe were living closer to the city, New York City that is, looking for an opportunity to be a little bit more suburban in New Jersey and Pennsylvania.“

Of similar mind was Bill Wheat, CFO of DR Horton, Inc. Here are his thoughts on the aforementioned urban exodus:

I think what you’re referring to is a longer-term trend I think is continuing. And I think certainly the pandemic’s had an effect on it. We would generally agree that that is a trend that probably is accelerating right now, but it’s still too early to know the depth of that and the sustainability of it.

And being forced to quarantine or work from home for extended periods has people longing for improved living areas. Michael Murray, COO of DR Horton, Inc, had this to say:

We are seeing more consideration given to a setting that accommodates a better work from home environment; whether it’s an extra bedroom to be used for a classroom, an office, a playroom that provides a little more space.

Simultaneously, the supply of existing homes remains low. Baby boomers are largely aging in place, staying in single-family housing at an age when prior generations might have downsized or moved to retirement communities. And given the havoc that COVID-19 has wreaked on senior housing, it’s hard to see a change in behavior anytime soon.

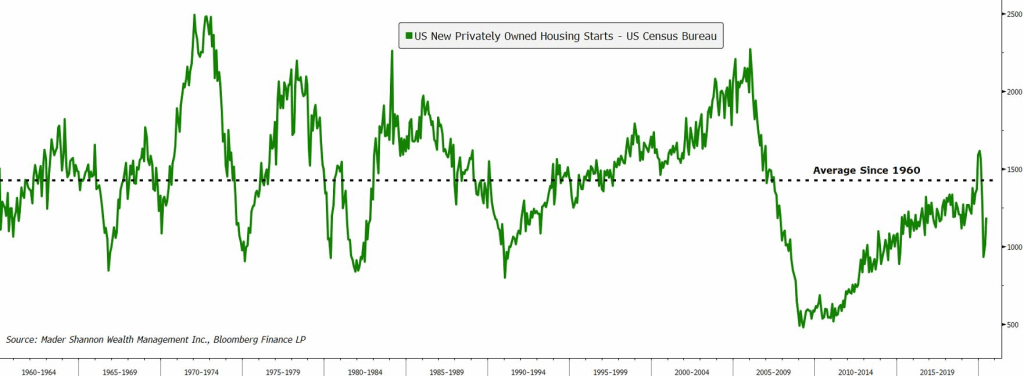

The supply of newly-built homes is similarly tight. The number of new housing starts just spent more than a decade below the 60 year average and is still far below the levels seen just before the Great Financial Crisis. A strong opening to 2020 pushed starts back above average for the first time since 2007, but progress stalled thanks to nationwide stay-at-home orders in the spring.

With supply and demand clearly out of balance, you might expect an upward bias in home prices. And for existing home prices, that expectation would be right. But price trends for new homes are a little more nuanced.

The median price for new homes has actually fallen over the last two years, despite the supply-demand imbalance. Here’s Mr. Marshall to offer one explanation.

Go back to fall of 2016. We talked as a company that we felt that we had an opportunity to reposition our business to be a bit more balanced in the consumers that we target, and we laid out that ideally we wanted our first time buyer business to be about 35% of our business… So what you’ve seen is it’s gone from our business being 26%, 27% first time to we’re now in the 31%, 32% and we’re moving much closer to that ideal target of 35%.

The recent surge in demand has overwhelmingly come from first-time home buyers, so homebuilders have largely shifted some focus away from building high-end, high priced homes, in favor of smaller, less-expensive ones, that accommodate their new customers.

So far it’s paid off for them.

Nothing in this post or on this site is intended as a recommendation or an offer to buy or sell securities. Posts on Means to a Trend are meant for informational and entertainment purposes only. I or my affiliates may hold positions in securities mentioned in posts. Please see my Disclosure page for more information.

The post What Recession? Homebuilders Hit New Highs as the Housing Market Remains Tight first appeared on Grindstone Intelligence.