I Can’t Stop Talking About Energy

It seems I can’t stop talking about Energy stocks. But honestly, why should I? Energy has been the place to be since the latter half of 2020. It’s the best sector on just about every time frame since then. And if you wanted positive returns this year – a year where virtually every asset has disappointed – then investing in the Energy space has been the way to do it.

It wasn’t so long ago that Energy was a dumpster fire. There was no worse place to invest. Not only did it lag the performance of other sectors, it fell while other stocks were enjoying a bull market.

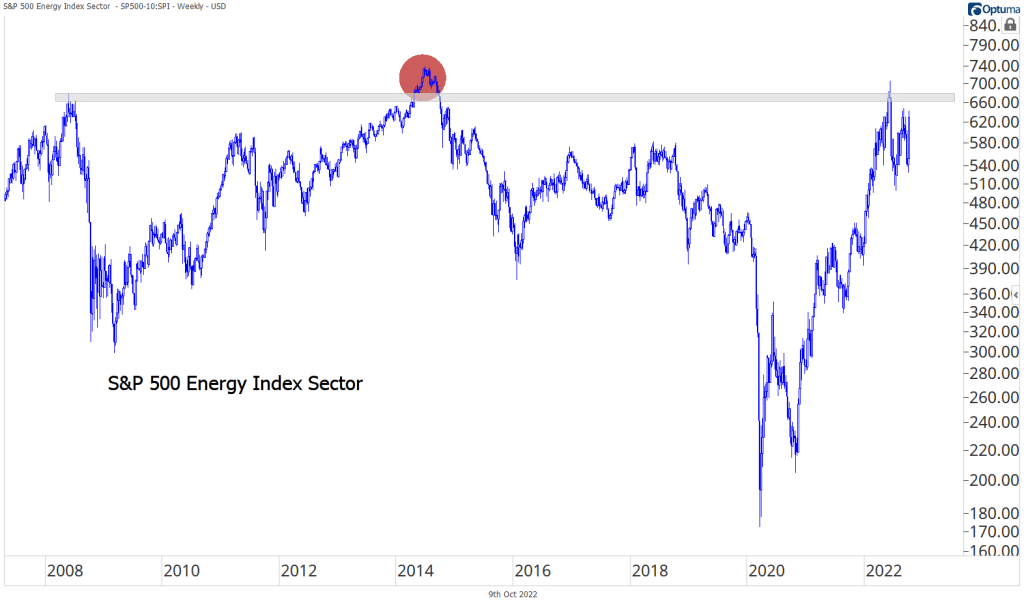

The trouble started in 2014. Energy was finally surpassing its 2008 highs after doubling from the bear market bottom. But then the price of oil collapsed, dropping from over $100 to near $30. As oil company profits dwindled, so did the price of their shares. Then, just when it seemed things couldn’t get much worse, a once-in-a-generation pandemic crushed the global economy.

Oil prices went negative. Most of us didn’t even know that was possible – I mean who pays to get rid of oil?

No one could have foreseen the ride we’ve experienced since. Just two and a half years later, we’re right back to those 2008 highs.

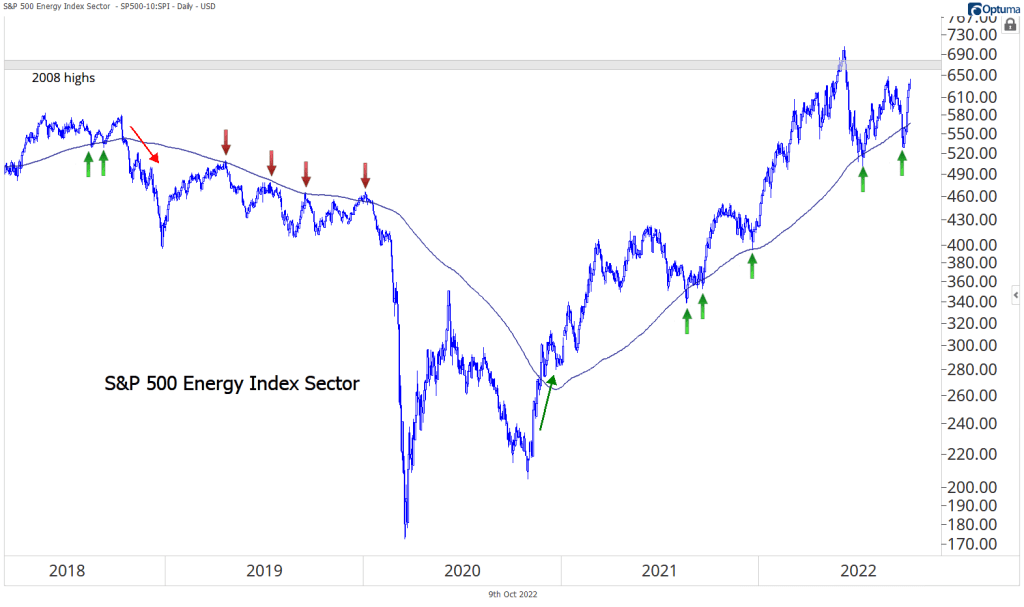

The long-term moving average has been a great indicator to watch for changes in trend. Though I don’t put much stock in simple moving averages as traditional support or resistance (they don’t represent historical buys or sells by market participants) it’s hard to ignore how much respect Energy’s price has shown for the 200-day over the last 5 years. Time and again, price has met the average and reversed course. And on the only two occasions where the average was materially breached – in late 2018 and late 2020 – the trend changed. Today, the uptrend is still clearly intact.

What’s most impressive about Energy’s strength, though, is how it’s continued in spite of a major bear market in stocks overall. Take a look.

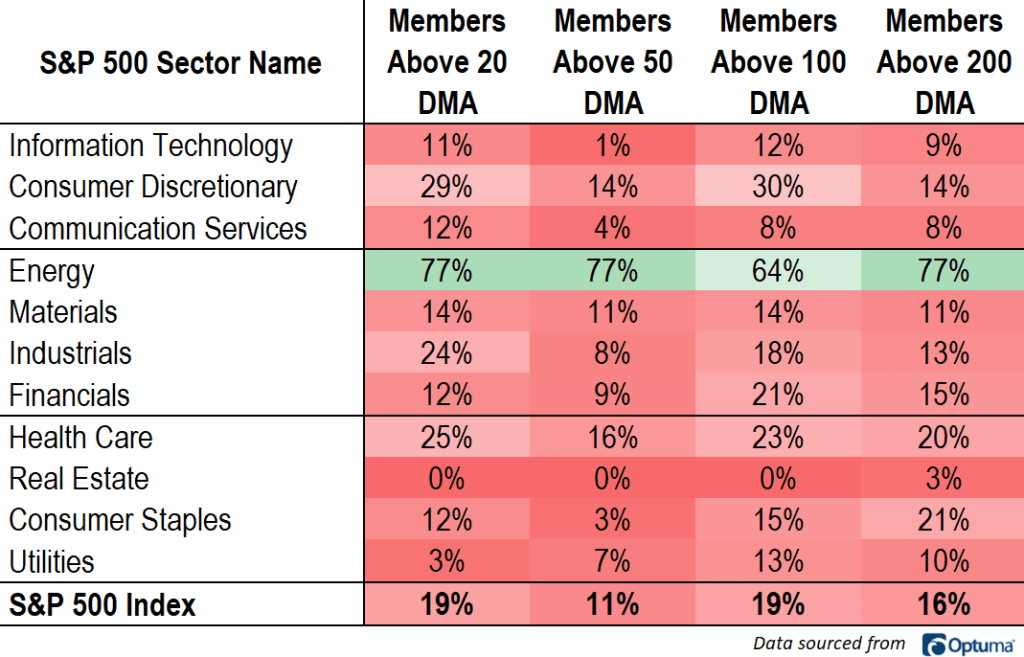

One of these things is not like the others. Only 16% of all S&P 500 stocks are above their 200-day moving average. More than three-quarters of Energy stocks are. The story is the same on virtually every timeframe.

That relative strength was all too apparent last week, as Energy broke out to new 52-week highs against the S&P 500.

If there’s one thing we know, it’s this: new highs are not something we see in downtrends. Avoid Energy at your own peril.

Nothing in this post or on this site is intended as a recommendation or an offer to buy or sell securities. Posts on Means to a Trend are meant for informational and entertainment purposes only. I or my affiliates may hold positions in securities mentioned in posts. Please see my Disclosure page for more information.

The post I Can’t Stop Talking About Energy first appeared on Grindstone Intelligence.