Inflation Matters to Mr. Market

Whether we like it or not, economic data matters to the markets. Not every report will move prices, but each one has its place in building the macroeconomic puzzle. This week’s inflation update could be particularly important. Equity prices for the last year have mirrored changes in interest rates and foreign exchange rates. Rates and currencies are being impacted by central bank policy. And central banks are being forced to act in response to high inflation. Let’s break it all down.

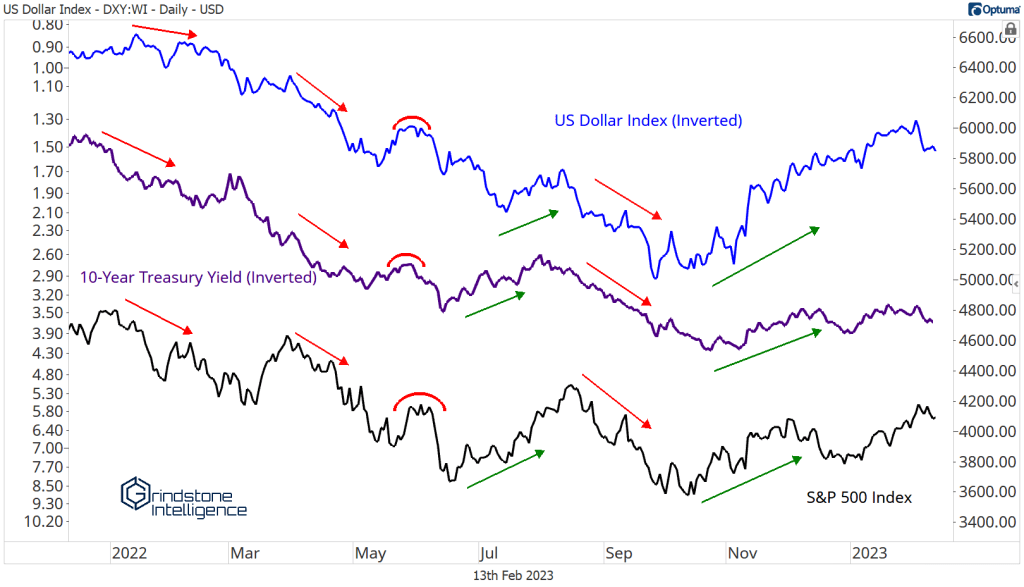

Those who’ve followed this blog know that interest rates and currencies were the big drivers of equity price action in 2022. Check out how closely the three moved together:

Those relationships seem natural – a stronger dollar negatively impacts corporate earnings, and higher interest rates increase the cost of capital and decrease the present value of future cash flows. Still, the correlations typically aren’t that strong. Last year was nearly unprecedented.

So if interest rates and currencies are what’s driving the stock market, what’s driving interest rates and currencies? The most obvious answer is central bank policy. The US Federal Reserve began using forward guidance to tighten financial conditions in the summer of 2021, and then began hiking short-term rates last March.

Since then, their policy rate has increased at the fastest pace in almost 50 years and now stands at the highest level since the Fed first took borrowing costs to zero in response to the 2008 financial crisis. In addition, the Fed’s balance sheet is shrinking at a pace of $95B per month – twice as fast as the pace of quantitative tightening in 2018.

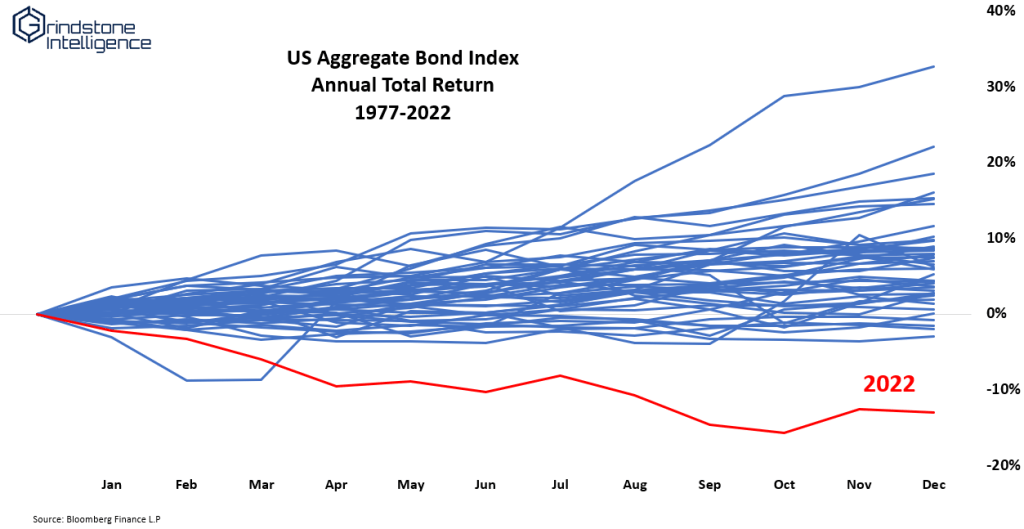

That pushed interest rates higher across the yield curve and drove fixed income returns to their worst year in memory. The US Aggregate Bond index dropped 13% in 2022.

Yields rose relative to global alternatives, too, and combined with geopolitical turmoil and the ongoing COVID crisis in China, drove inflows to the USD. That pushed the US Dollar index up as much 28% from its 2021 trough.

Investing is quite easy then, right? Each time the Fed raises rates at a regularly scheduled meeting, we can simply bet on a stronger Dollar and short equities. Piece of cake.

Except the Dollar peaked in September, equities bottomed in October, and rates stopped rising a few weeks later, all while the Fed has continued to tighten their policy rate. Why? Because investing is never that easy. Markets don’t reflect they world as it is today. They discount the future – or at least the future as market participants believe it to be.

And thanks to former Fed Chair Ben Bernanke, the godfather of forward guidance, we have a pretty good idea of what the Fed intends to do.

In the days of Arthur Burns, Paul Volcker, and Alan Greenspan, the Federal Reserve largely operated in silence. Monetary policy decisions weren’t known until they were implemented. That often made policy changes difficult to interpret, and policy changes could take months or years to affect actual conditions. Bernanke, though, believed that by increasing transparency into deliberations and the decision-making process, the Fed would have better control of the effects of policy changes.

During his tenure as the world’s foremost monetary authority, press conferences were added to the end of FOMC meetings, and the Fed began releasing its quarterly Summary of Economic Projections, including the infamous dot plot.

Just 30 years ago, we might not even know that a policy change had been made on the day of the decision. Now, thanks to the dots, we know the Feds own forecasts of rate changes years in advance.

Of course, those forecasts change from month to month and quarter to quarter. But even those changes are well telegraphed by an unending cycle of ‘Fed speak’. Members of the Federal Open Market Committee (dubbed by some the Federal Open Mouth Committee) take every opportunity available to appear on business news networks, speak at conferences, or post on social media to update the public on their current views.

The point is, it’s not really about what the Fed is doing or even what they’re going to do. That’s all old news. The things that matter are those that can change what the Fed says they’re going to do.

Which brings us to tomorrow’s CPI report. Year-over-year measures of consumer prices have declined for 6 consecutive months, leading many to believe the Fed’s terminal policy rate will be lower than previously forecast. The change from last December is still elevated at 6.7%, but annualizing the last 3 months of price changes indicates a more modest 3.3% change. That’s not far from the Fed’s 2% price stability target.

The Fed believes stripping out volatile food and energy components gives a better indication of the future path of inflation. That measure, Core CPI, has been encouraging, too. It peaked in September, and the annualized 3-month change is at its lowest level in a year.

So does that mean it’s time for the Powell and Co. to declare victory?

Not so fast.

The improvement is encouraging, but the drop is partially due to transitory factors. December’s inflation reading was dragged down by new and used motor vehicles, which together comprise 8% of the Consumer Price Index. On a 3-month annualized basis, the decline in December was the sharpest in more than 15 years. In the first months of 2023, though, early reports say that wholesale prices for used cars are back on the rise.

Moreover, Chair Powell said in a November speech that headline and core measures of inflation were not the ones he’d be watching this year. He broke the inflation measure into 3 components: core goods, housing services, and core services less housing.

Core goods inflation peaked in early 2022 (though a reacceleration in auto prices could spoil that story), and leading indicators of rental rates imply that shelter costs will start to normalize in the middle of the year. Core services, though, has shown little signs of slowing. In the December report, the measure was still 6.3%, triple the Fed’s target.

A reacceleration in this measure – or even a stubborn lack of slowdown – could tip the scales and make monetary policy officials reassess how much more pressure they’ll need to apply to financial conditions. On the other hand, further confirmation of the disinflation we’ve seen already would add credence to a lower terminal rate and easier policy going forward.

A lot of eyes will be on Tuesday’s report, and rightfully so. Inflation is driving the Fed, the Fed is driving rates and the Dollar, and rates and the Dollar are driving equities.

Stay tuned.

The post Inflation Matters to Mr. Market first appeared on Grindstone Intelligence.