Information Technology Sector Deep Dive - October

What is it that drives prices in the markets? Is it intrinsic value? The present value of future cash flows, the pace of earnings acceleration, dividend and buyback policies? Is it economic growth, interest rates, or manufacturing activity?

Each of these plays an important role in building an investment outlook, but the truth is, they don’t make prices move. Not directly. The reality is more simple than that. Prices move based on changes in supply and demand, or put another way, on peoples’ decisions to buy or sell securities.

People do their best to incorporate all those important, fundamental components into their buy/sell decisions, but human behavior is a funny thing. We’re susceptible to psychological flaws, and even when we know those flaws exist, we’re not good at correcting them.

Over long enough time horizons, asset prices do tend reflect their intrinsic values. If you overlay the S&P 500 index with its annual earnings per share over the long term, you’d be hard pressed to tell which was which. The logical thing, then, would be for humans to make buy or sell decisions solely upon the intrinsic value of an asset. And people know that’s what they’re supposed to do – there are a million books written about the subject. But people don’t do what they’re supposed to do. Emotions get in the way. There are plenty of books written about that, too.

Technical analysis, at its core, is really a study of human behavior. And human behavior reacts to prices it remembers by buying or selling. That’s the foundation of what technicians call ‘support’ and ‘resistance’.

So what does that mean for the market today?

The US stock market peaked back in early 2022, then embarked on the most extended decline since the 2008 financial crisis. Undoubtedly, many investors looked at their dwindling account values and thought, "If only I had sold back in January. If I could just get back to where I was..."

Those are the types of emotions often drive investment decisions, and we see the result when prices react to former highs and lows. When prices approach a level that once marked a significant bottom, investors that missed out the first time around are inclined to buy so they don't miss out again. This demand for shares is called support. And when the opportunity comes again for those who wish they'd sold at a former peak, they're inclined to take advantage by supplying shares, something we refer to as resistance.

Of course, the emotions that investors experience are more complex than that and there are millions of other factors at play. But we still see the importance that former turning points have on market action.

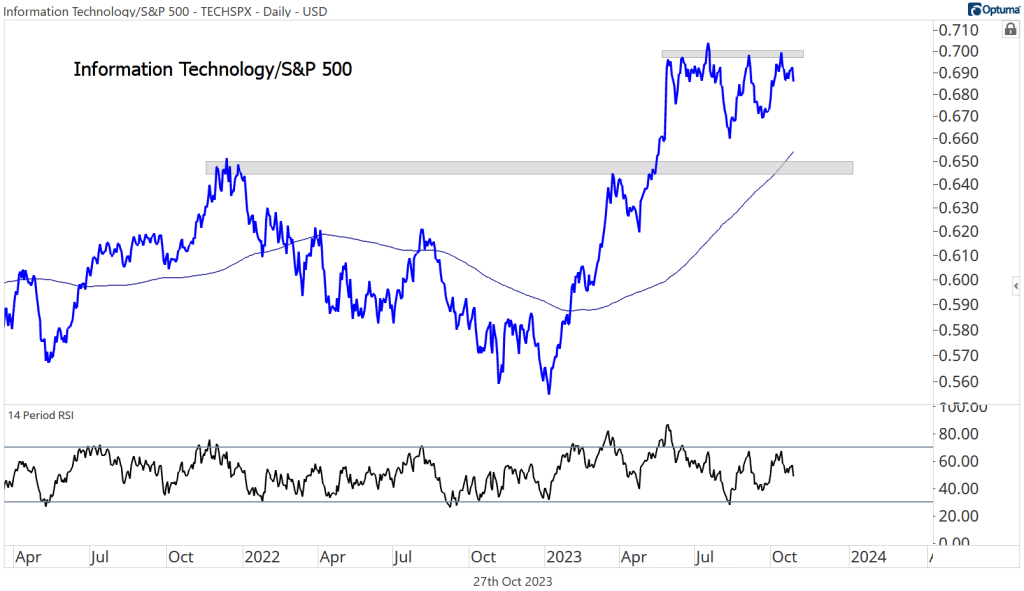

And Information Technology is still trying to absorb overhead supply.

Let's be clear about where the sector stands. Prices are above their long-term moving average, RSI momentum is in a bullish range, and we're much closer to 52-week highs than 52-week lows. This is absolutely not a downtrend. If this decline extends further and momentum drops into oversold territory, that's a different story. But that's not the story today.

So if Tech isn't in a downtrend, it's either in an uptrend or a sideways range.

Those highs from almost two years ago are our line in the sand. If Tech is above that line, there's absolutely no reason to be bearish the sector, and, given Tech's weight in the benchmark S&P 500 index, not much reason to be bearish on stocks overall.

Since we're below that line, though, it's best to take a more cautious and selective approach to the group.

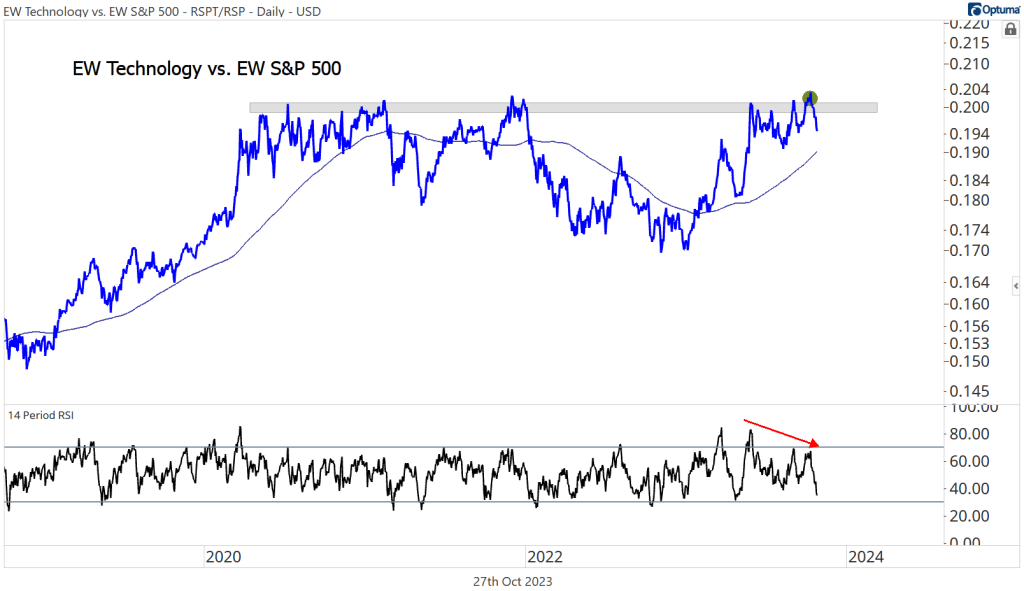

Especially since breadth in the sector isn't as strong as the index-level price chart appears. The equal weight Tech sector has fallen below support and is now stuck back within the trading range that endured from April 2022-May 2023.

A rapid recovery in the EW sector above that area of support-turned-resistance would turn us incrementally bullish on Tech.

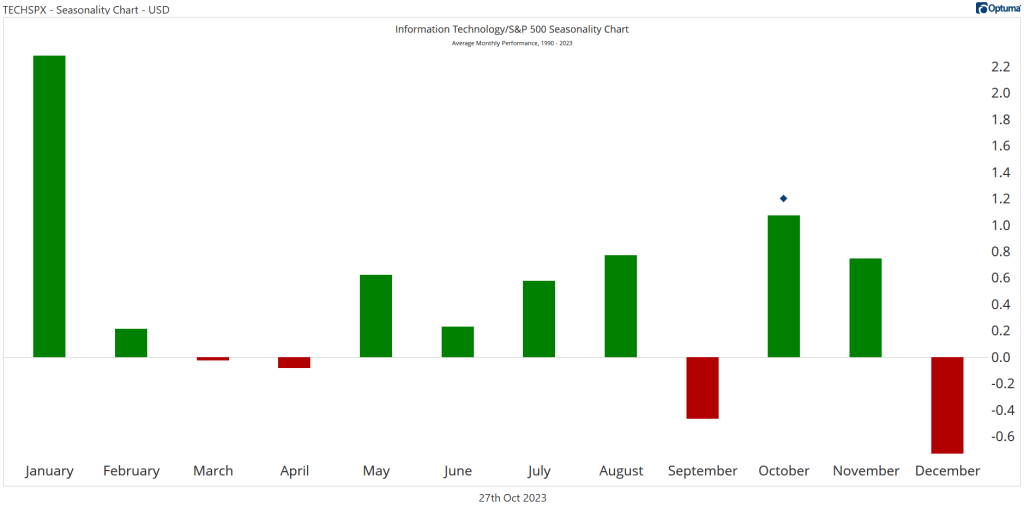

Seasonality is a tailwind, but that hasn't mattered much lately. Historically, October is among the best months for Tech, yet the sector has dropped about 2.4% this month. Often, seasonality offers the best information in hindsight. If stocks are weak during a seasonally strong period, that tells us how weak things really are.

On the other hand, Tech is outperforming the S&P 500 index for the month, which is confirming historical seasonal patterns.

The relative strength over the past few weeks has pushed Tech back to the top of the year-to-date S&P 500 sector leaderboard, but it hasn't been enough to spur a relative breakout. The ratio of Tech to the SPX is rangebound as it digests the run-up from the first half of the year.

Similarly, rangebound is the ratio of Tech to the SPX on an equally weighted basis. This ratio isn't in a downtrend, but we shouldn't be betting aggressively on Tech outperformance as long as were below the highs of this 3-year range.

Digging Deeper

The good are getting less good and the bad are getting worse.

The Semiconductors sub-industry has been the leader for most of the year, and its 59% gain still outpaces any group within the Tech sector. But that 59% gain is down from nearly 90% over the summer, and we see a familiar them in the chart below.

The Semis weren't able to hold above the late-2021 highs, so bull case is on hold. It's best to approach the group cautiously, and we have to acknowledge the possibility that this failed breakout turns into a much more significant decline.

NVIDIA is the poster child for the semis. For them, the level is $420. If we're below that, we think they can drop all the way back to the former highs near $330. Longer-term, we still believe there's a path to $700 for the stock, but we only want to be betting on that if we're above the 161.8% Fib retracement from the 2021-2022 decline, which sits at $475.

Meanwhile, the weakest sub-industry of the year continues to fall. The Electronic Equipment & Instruments sub-industry fell through the 2022 lows and has kept on going. We don't see any reason to be involved in this space.

Leaders

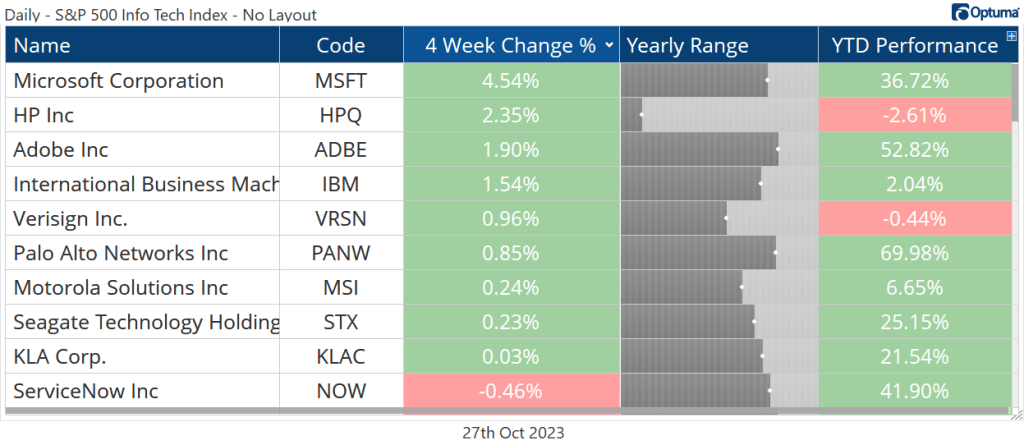

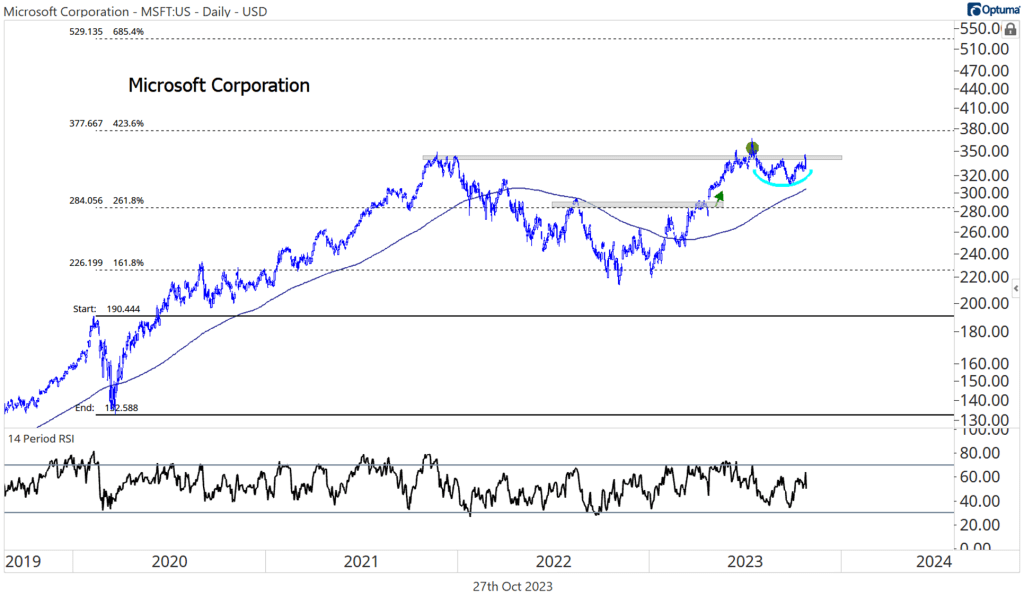

Microsoft has been doing some heavy lifting to hold the sector index up. It's risen 4.5% over the last 4 weeks and is knocking on the door of all time highs. The level here is $350. If we're above that, we want to be targeting an initial move to $380 and a longer-term move to $525, which is the 685.4% retracement from the COVID selloff. After going nowhere for almost 2 years, that sort of move wouldn't be surprising.

What makes MSFT most attractive, though, is the relative strength it's showing against the rest of Tech. We want to own stocks that are both rising and outperforming. If the ratio of MSFT vs. the Tech sector is breaking out, we want to be betting on continued leadership from the stock.

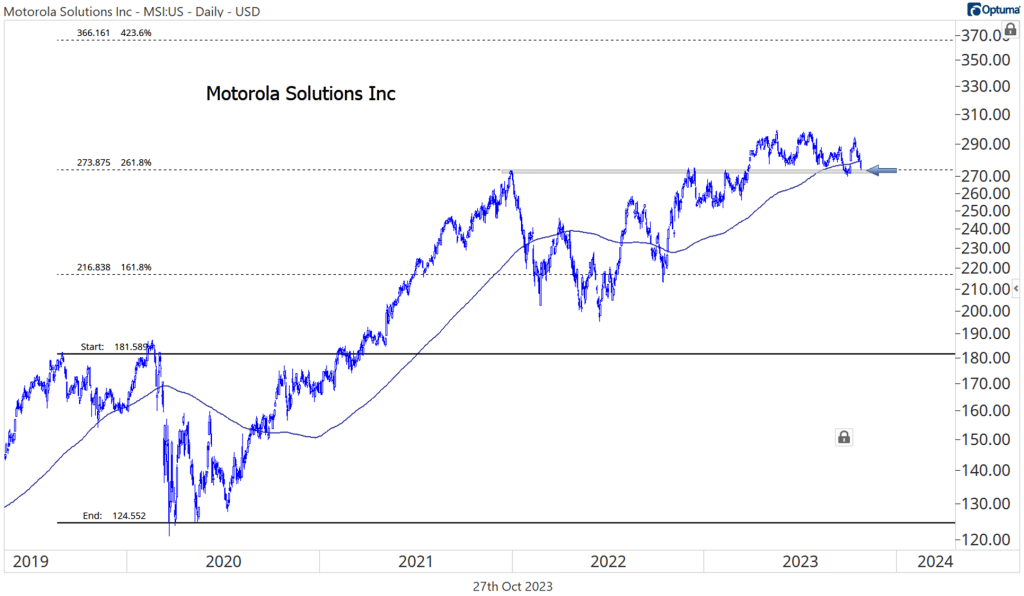

Motorola is another recent winner that catches our eye. We want to be long if it's above $270 - below that, it falls into the same camp as the rest of Tech - with a target of $366.

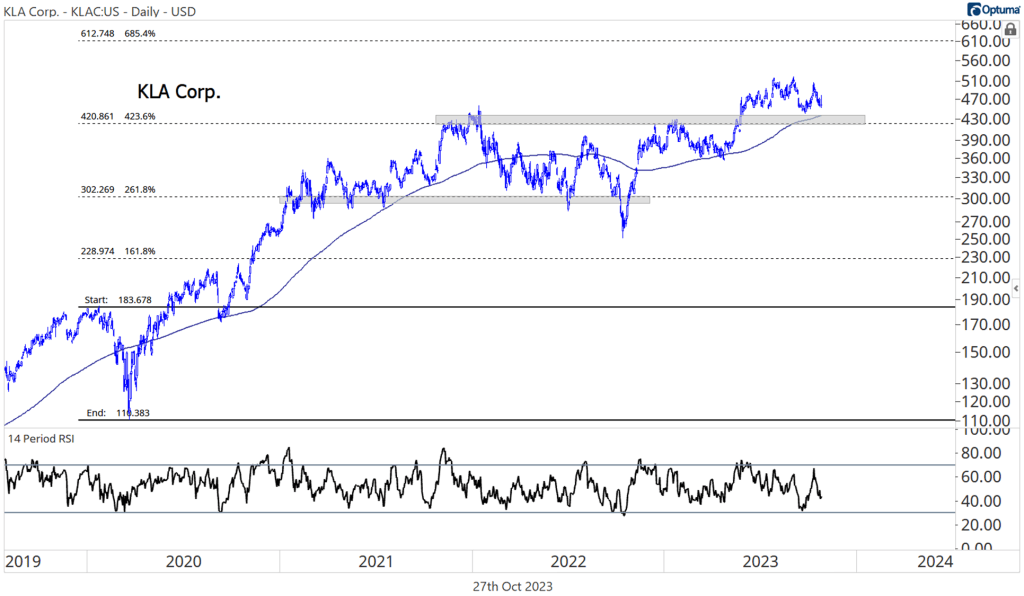

We want to continue owning KLAC above $420 with a target up above $600, which is the next key Fibonacci retracement level from the COVID selloff.

Losers

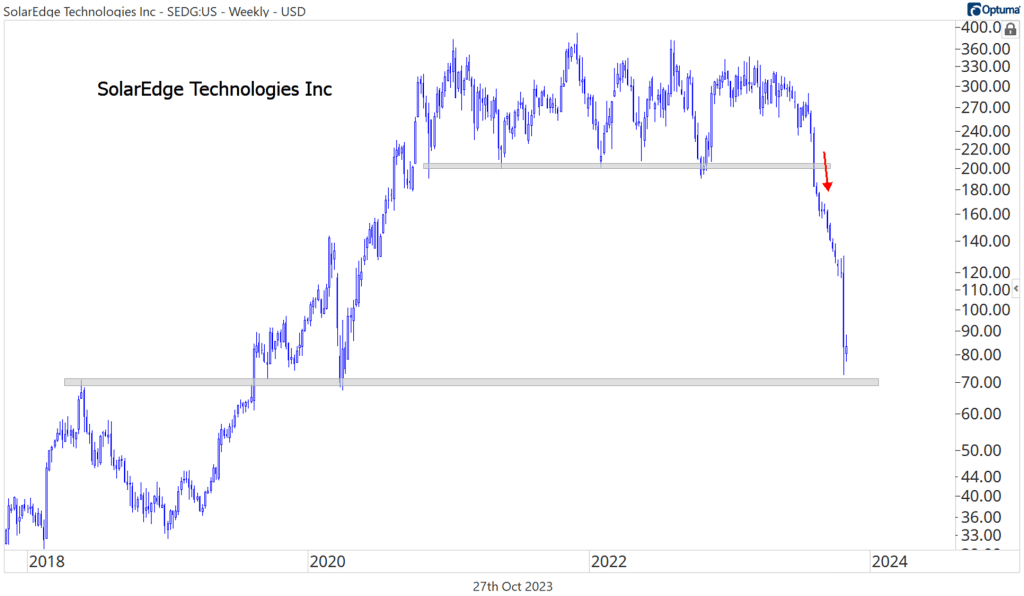

SolarEdge continues to give lessons in risk management. There's been no reason to own this one since it broke below support at $200. It could find support here near $70, which was a swing high back in 2018 and a swing low in 2020, but we'd much rather wait and see how prices respond than try to catch a falling knife.

Growth Outlook

Tech is expected to lead earnings and sales growth over the coming two years.

That comes after a relatively weak performance in 2023, where sales are set to grow less than 5%, and earnings are expected to fall. Sharp rebounds in 2024 and 2025 are what analysts are anticipating – but for the sector to actually meet those EPS projections, profit margins will have to reach new highs. We hate to be the pessimists in the room, but that type of margin expansion seems pretty unlikely.