Inside the Inflation Debate

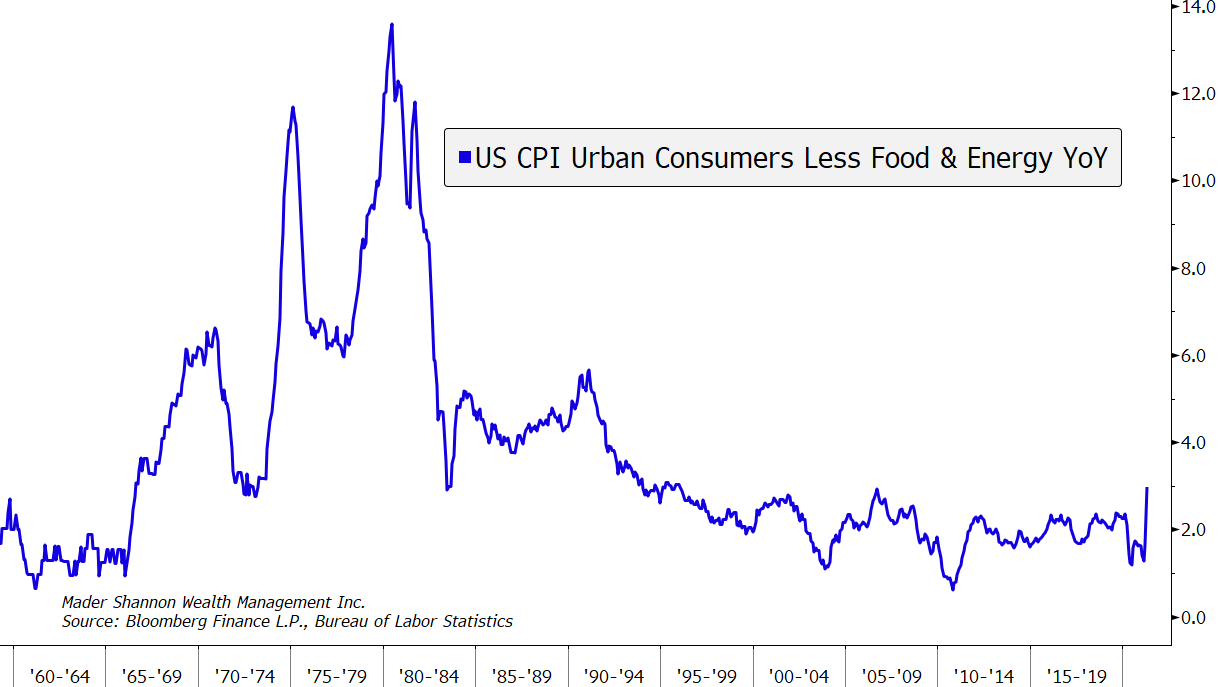

Inflation. It’s been dead in America since the 90s, yet a recent surge in prices has brought it back into focus. You’ve heard the word, seen the headlines, perhaps even lived through the domestic edition in the 1970s, but what exactly is it? There seems to be some disagreement.

The first recorded use of the word ‘inflation’ with respect to economics was in 1838, by American politician Daniel D. Barnard in a speech to the Assembly of New York. In it, Barnard requested two amendments to the General Banking Law under debate, each aimed at guarding against the depreciation of paper notes. The first was that banks be required to limit outstanding currency issues to five times the amount of specie on hand, and the second, that all currency notes be redeemable at par in the city of New York. The key provision in the bill that concerned him stipulated that redeemable notes issued by banks would be backed by property in the event that specie (e.g. gold or silver) could not be provided by the bank within 24 hours. Barnard, familiar with the sad history of property-backed currencies, said bluntly,

“In the first place, the property pledge can have no tendency whatever to prevent an inflation of the currency, which is always a point of danger”

Daniel D. Barnard, Speeches and Reports in the Assembly of New York at the Annual Session of 1838

Barnard’s use of the word may have been new, but the concept wasn’t. Adam Smith, the father of modern economics, was familiar enough with the idea that he took care to differentiate between “real” and “nominal” prices in his 1776 book Wealth of Nations. Hundreds of years later, though, academics still don’t fully understand it. They’ve even struggled to settle on a definition. In a piece titled “On the Origin and Evolution of the Word Inflation” published by the Federal Reserve Bank of Cleveland in 1997, the confusion was summarized this way:

“Today, we commonly hear about different kinds of inflation. Indeed, the word inflation is often used synonymously with “price increase.” But there is also a different, more specific, definition of inflation – a rise in the general price level caused by an imbalance between the quantity of money and trade needs… It is the latter definition… that more closely conforms with the word’s original meaning.”

Michael F. Bryan, current Vice President and Senior Economist at Federal Reserve Bank of Atlanta

Bryan’s words, already more than 20 years old, ring ever true today. Inflation measures are on the rise, and a debate rages. One side argues that readings this year are a result of one-time and temporary price increases related to the pandemic, and therefore aren’t indicative of true inflation. The opposing side points to the extraordinary amount of fiscal and monetary stimulus unleashed in the last year as the primary cause of rising prices. This latter form of inflation, the one Barnard feared, tends to end in disaster.

In 18th century France, an over-issuance of paper assignats (in an effort to stimulate a debt-laden economy) caused their value to plummet and helped spur a bloody revolution. In the 1920s, Germany’s Weimar Republic dealt with perhaps the most famous hyperinflationary period in history as it tried to repay war debts. Hungary, too, tried extreme fiscal stimulus to spur the post-WWII recovery, but capacity was slow to return, and the effort resulted in the worst hyperinflation in recorded history. The last 100 years are riddled with similar bouts of rapidly rising prices – in the Soviet Union, Argentina, Yugoslavia, Zaire, Zimbabwe, Russia, Venezuela, and elsewhere – with varying degrees of disastrous outcomes.

So if inflation so regularly ends in disaster, it would seem that rising prices in any form should be anathema to central banks. But that oversimplifies the issue. Some inflation actually works to stimulate growth. Indebted asset owners benefit from higher prices, while cash is guaranteed to lose value. Thus, inflation stimulates borrowing (you get to pay back loans with cheaper dollars in the future) and incentivizes spending (you should buy something now instead of when the nominal price is higher next year). Increased spending is what makes the proverbial economic world turn round. Those incentives start to disappear when inflation rises too quickly and becomes unpredictable. What person wants to take on debt or spend aggressively when their future cost of living is uncertain? Likewise, businesses are apt to take a more cautious approach to capital expenditure decisions, or pull back altogether. Consequently the world’s most powerful monetary authorities want inflation that’s predictable and low.

Just not too low.

In the same way that inflation incentivizes spending and credit creation, deflation incentivizes saving over spending. While generally advisable for an individual’s financial health, reduced spending and excess saving on a macro level weighs on economic growth. To both foster full employment and maintain price stability, the Federal Reserve works to thread the needle between inflation that is too high and too low.

Unfortunately for them, many drivers of inflation are outside their control. Inflation may be a monetary phenomenon, but it’s not solely a monetary phenomenon – just ask the Bank of Japan, who’s (rather unsuccessfully) fought deflation for the last 25 years and has used unprecedented policy tools like negative interest rates and direct equity purchases to try stimulating growth. Economist Ed Yardeni details four D’s in this excerpt from his book, Fed Watching for Fun & Profit, to explain global deflationary forces in place since the turn of the century. Here’s a quick summary:

Détente (Globalization) – War is inflationary. Peace is deflationary. Since the end of the Cold War (and with the addition of China to the WTO) global trade barriers have fallen. Inflation has been pushed lower by worldwide competitive forces.

Demographics – The world is aging. Older people tend to spend less than their younger counterparts, and younger people today tend to spend less than previous generations. Relatively lower demand, coupled with the rising labor market share of more experienced and productive workers, has exerted downward pressure on prices.

Disruption – Rapid technological innovation over the last 25 years has enabled businesses to cut costs and boost productivity across a wide range of industries.

Debt – A generation of low interest rates has resulted in elevated levels of debt. Consumers are effectively ‘maxed-out’, limiting new spending. Additionally, easy money conditions are supportive to production capacity, boosting supply and driving prices lower.

Enter a global pandemic. Governments around the world shuttered economic activity in an effort to limit the spread of COVID-19, then unleashed never before seen levels of fiscal and monetary stimulus. In the United States alone, fiscal measures enacted since last February sum to more than $5 trillion dollars – almost a quarter of pre-pandemic GDP. There’s roughly $4 trillion more on deck if Congress agrees to the proposed American Jobs and American Families plans. The Federal Reserve was not to be outdone. They cut short-term interest rates to 0%, doubled the size of their balance sheet to almost $8 trillion, and continue to buy $120 billion of Treasuries and mortgage-backed securities every month.

By and large, the stimulus worked as intended. Thousands of businesses were able to access cheap credit and stay afloat. Millions of workers lost their jobs, but direct checks and enhanced unemployment benefits were so substantial that aggregate U.S. personal income jumped a record amount to reach new highs. As a result, consumer balance sheets are abnormally healthy.

All that extra cash helped spark a buying spree. Unable to spend on traditional services thanks to lockdowns, consumers turned their eyes to goods – furniture, vehicles, homes, toys, groceries. The only problem? Supply chains (some still even under lockdown) weren’t ready for so much demand. The price of construction materials has soared, with copper and lumber leading the way. A global shortage of semiconductors has forced automakers and other manufacturers to halt or slow production, sending new and used car prices through the roof. Median home values are rising at a double-digit pace. Grain prices reached the highest levels since 2013. All told, the April reading for the core Consumer Price Index rose at the fastest pace since 1996.

In normal times, that might have triggered concern for the Federal Reserve and their price stability mandate, but Chairman Powell has spent the better part of the last 6 months warning that any increase in CPI this year would be ‘transitory’. He’s blamed the base-effect – abnormally low measures from a year ago – and the temporary nature of supply chain disruptions for elevated price increases. Federal Reserve economists have taken a unified stance that inflation will fall back toward their 2% annual target by year-end, when global activity has more fully recovered.

A few economists disagree, perhaps none more vocal than former Treasury Secretary Larry Summers. Summers has warned that additional stimulus in 2021 was largely unnecessary, even irresponsible. He’s concerned – especially after the latest CPI data – that inflation could spin out of the Fed’s control, leading to stagflation or a monetary policy clampdown that results in recession. In rebuttal to those pointing to labor market slack, Summers notes that enhanced unemployment benefits could be decreasing labor supply, and the labor market is tighter than data suggests. If he’s right, it could send wages and prices into an upward spiral.

The future may well depend on businesses’ willingness to protect margins and raise prices – and consumers’ willingness to pay them. We’ve been carefully tracking inflation-linked commentary from company executives over the last three quarters, and it seems we’re not the only ones. According to FactSet, the term “inflation” has been used on more earnings calls this quarter than in any period since at least 2010.

More important than the number of mentions is the change in tone about pricing since the fall. As one extreme example, consider the homebuilding industry. Ryan Marshall, CEO of PulteGroup, said this about pricing in October:

“It is important that we not become overly aggressive and move prices too fast or too high, particularly within first-time communities. Given market competition and normal affordability constraints among entry level buyers, pushing prices a few thousand dollars too high can stall sales very quickly”

Ryan Marshall, President and CEO, PulteGroup Inc.

Afraid of stifling demand, affordability was cited 7 times on that conference call. During the most recent call in April, it wasn’t mentioned once. The focus shifted instead towards driving price increases and boosting (not just protecting, but boosting) margins. Here’s their Chief Financial Officer:

“While we now expect our house costs, excluding land, to be up 6% to 8% for the year, the strong demand environment is allowing us to pass through these costs in the form of both higher base sales prices and lower discounts. Given these cost/price dynamics, we expect gross margins to move higher throughout the remainder of 2021.

Robert O’Shaughnessy, CFO, PulteGroup Inc.

For the consumers’ part, such aggressive price increases haven’t been enough to crimp demand. PulteGroup, along with peers, has resorted instead to limiting lot releases to shorten backlog lead-times. The dynamic isn’t limited to homebuilders. From labor, to commodities, to packaging materials, to transportation, input costs are on the rise. And from personal care products, to water heaters, to frozen chicken, to new cars, consumer prices are rising. Nonetheless, consumers are still spending. The most recent retail sales report may have been below expectations, but the 17.9% increase from pre-COVID levels was still the fastest 14-month growth rate on record per available U.S. Census Bureau sales data.

The big question is, how long can the supply/demand imbalance last? Supply chains are still woefully behind, but how quickly can production capacity be brought online? Enhanced unemployment benefits expire in September – how might that impact incomes, spending, and labor costs? How long will it take to burn through the excess savings generated during the pandemic? Will the Fed take its foot off the gas? Will Congress further stimulate demand with fiscal measures? And even if they do, is that enough to offset Yardeni’s four D’s?

We’ll have some answers in the coming months. Until then, Powell, Summers, and their respective supporters are sure to have some lively debates.

Prices are definitely rising. Is it inflation? Or inflation?

Nothing in this post or on this site is intended as a recommendation or an offer to buy or sell securities. Posts on Means to a Trend are meant for informational and entertainment purposes only. I or my affiliates may hold positions in securities mentioned in posts. Please see my Disclosure page for more information.

The post Inside the Inflation Debate first appeared on Grindstone Intelligence.