Is it Time to Buy Some Gold?

Stocks are selling off for the third straight month, and with interest rates on the rise, bonds aren’t offering the safe haven that we’ve grown accustomed to over the last 30 years. Maybe it’s time to find somewhere else to hide.

Maybe that place is gold.

Writing about gold tends to spark some pretty strong opinions among readers. Often enough, we’ve heard or read the arguments of the naysayers: “Only old people and conspiracy theorists hold gold. Why would you hold a non-productive asset when you could own a piece of this high-flying growth stock or this new, disruptive technology?”

And given the performance of gold vs. stocks over the last decade, who can blame them? Gold has gone absolutely nowhere since its 2011 peak. The S&P 500, meanwhile, has risen some 250%.

Ironically, one could have made many of the same arguments 25 years ago. From 1990 to 1999, gold prices dropped by 40%. Over that same period, stock prices quadrupled. If Twitter was around back then, I bet the sentiment back then would look pretty similar to the kind of things we see and hear today. “Why hold gold when there are all these companies harnessing the power of the internet?”

But there’s a time and a place for everything.

Gold rose from roughly $250/oz in 1999 to $1,900/oz in 2011, outpacing the S&P 500 by 800% for that 11 year period. Those non-productive shiny rocks don’t look quite so bad now, do they?

We think gold could be headed for another run like that.

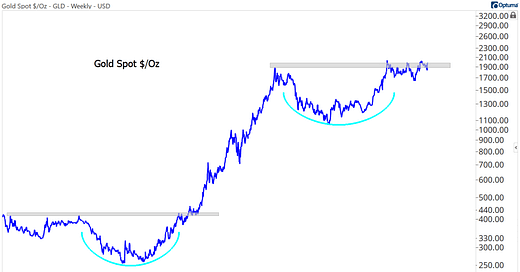

Mark Twain said history doesn’t repeat itself, but it does often rhyme. Look at what gold has done over the last decade, then compare that to the 1990s. See how similar they are?

Both saw 40% declines and bases that lasted for more than 10 years. Both periods were marked by the dominance of growth stocks and rising equity valuations. Why can’t both be followed by huge gains for gold?

First, we’d like to see silver step up and take a leadership role.

Prices for silver and gold tend to be highly correlated, but silver tends to move in greater magnitudes. As such, when precious metals are rising, we expect silver to outperform. That’s what we’ve typically seen during gold’s best runs. These days, silver refuses to lead. If we see the silver/gold ratio back above the 2019 highs, that will be a big feather in the cap for precious metal bulls.

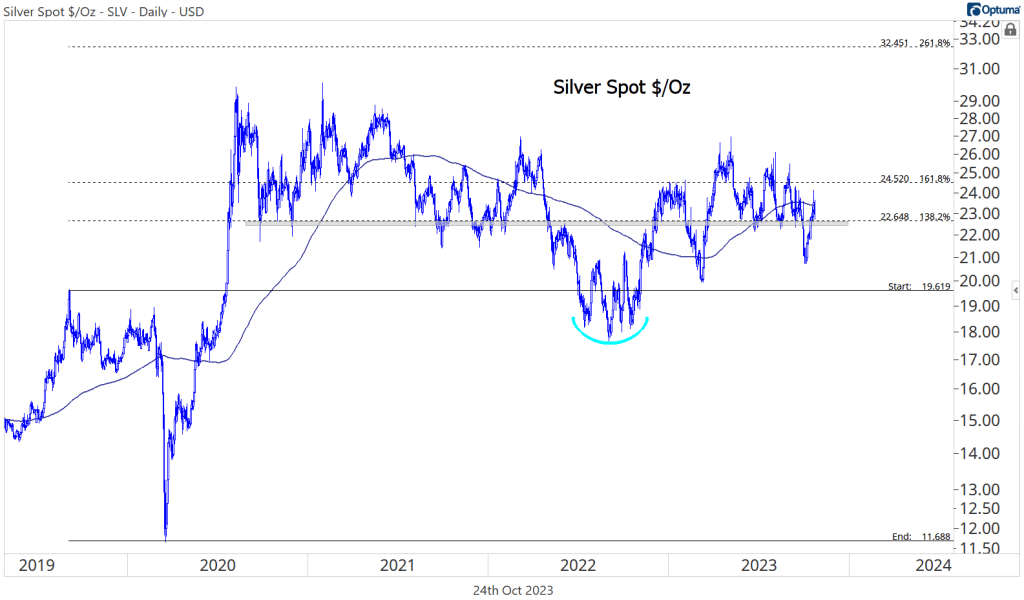

On an absolute basis, silver has improved sharply over the past month. It’s already risen 10% from the early-October lows, and it’s back above a key, 3-year rotational level at $22.50. That level is the 138.2% Fibonacci retracement from the 2019-2020 decline.

We’d be more optimistic about silver’s future prospects if it can surpass $24.50, which is the 161.8% retracement. From there, we’d be targeting a move to $32.

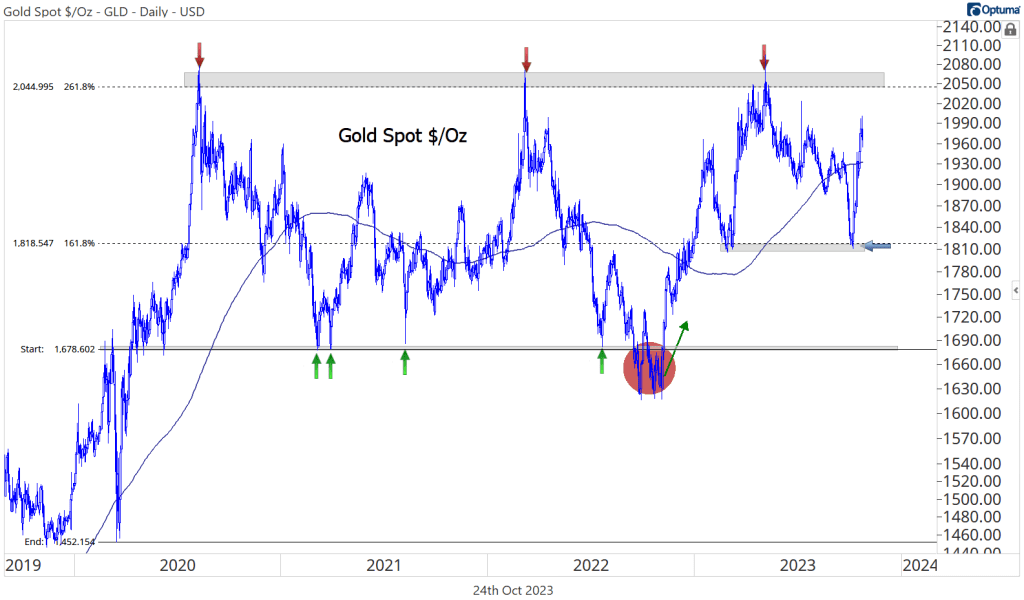

Perhaps if silver can get going, we’ll finally have the catalyst we need for gold to break out from this big, messy trading range. For now, gold prices are near a flat 200-day moving average and lacking an actionable trend. But ‘no trend’ is better than a ‘downtrend’. We found support earlier this month at the 161.8% retracement from the COVID selloff, and that’s a level that should continue to hold.

On a breakout to new highs, though, we want to be aggressively long.

And if that bullish resolution does come, how high could gold go then? We’re eying $3200. That’s the 1794% Fibonacci retracement from the 1990s decline. Prices have respected these retracement levels all the way up: The hiccups in 2006 and 2008 occurred near Fib levels, the ceiling from 2013-2019 was the 684.4% retracement, and right now, were stuck below the 1109% retracement. It would make a lot of sense to go up and touch the next one. $3200 might even be a conservative expectation – prices rallied a lot more after the 2004 breakout.

Of course, this consolidation near the former highs has lasted for several years at this point, frustrating any and all who’ve been waiting for the breakout. Fortunately for them, the opportunity cost of owning it has been fairly low. Gold has kept pace with the S&P 500 since the end of 2017, and it’s outperformed over the last 2 years. As long as the Gold/SPX ratio is above the summer 2023 lows, there’s no harm in owning gold if the only alternative is stocks.

For those more tactically focused, precious metals miners offer some interesting setups. The VanEck Gold Miners ETF is stuck below former support from 2021-2022 and momentum is in a bearish range. However, if it’s breaking out above $30, we can comfortably be buying with a target back at the spring highs near $37.

The downtrend in silver miners is even more apparent. But if we’re looking for places to get long exposure for a move higher in precious metals, the risk/reward setup here is pretty clean. We can be long the junior silver miners (SILJ) if – and only if – we’re above $8. A target just under $12 makes sense, since that’s the 38.2% retracement from the entire 2021-2022 selloff and the highs from the spring.

If you’d rather see the winds shift a bit before getting involved in this area, the Global X Silver Miners ETF (SIL) might be a better option. We want to see this one break the downtrend lines from the 2021 peak. That would be around $27.50. A break above that level would have us targeting the swing highs near $33.

But is gold obsolete?

Gold tends to perform well when people are uncertain and afraid, and when government deficits get out of control. Over the past few years, governments have borrowed and spent more than ever, and global geopolitical tensions are arguably higher than they’ve been at any point since the end of the Cold War. It’s safe to say that key fundamental tailwinds are in place for another historic rally.

Unless, of course, gold has been replaced.

Decentralized currencies, those that aren’t backed by any government and have limited supplies, are increasingly popular around the world. The crypto world has been knocked down a peg (or three) in the past two years, following sharp declines in prices, exchange meltdowns, and riveting scandals. Despite all that, crypto lives on.

Bitcoin, the OG crypto, is paving the way. It just broke out to its highest level in more than a year, following a length consolidation between 25,000 and 30,000.

Our initial target, which we laid out for premium subscribers last week, is 45,000. That’s the 261.8% retracement from the 2017-2018 decline.

The post Is it Time to Buy Some Gold? first appeared on Grindstone Intelligence.