It’s a Growth Problem

The NASDAQ just fell for the second consecutive week – the first time it’s done that all year.

Don’t be fooled by a couple of disappointing declines for the large cap stock indexes, though. This isn’t a market where demand has completely dried up and investors are rushing for the exits. If it were, we’d be seeing broad declines in stocks, and risk-off areas of the market would be outperforming.

That’s not what’s happening. Instead, the trouble is quite narrow: this market has a growth problem.

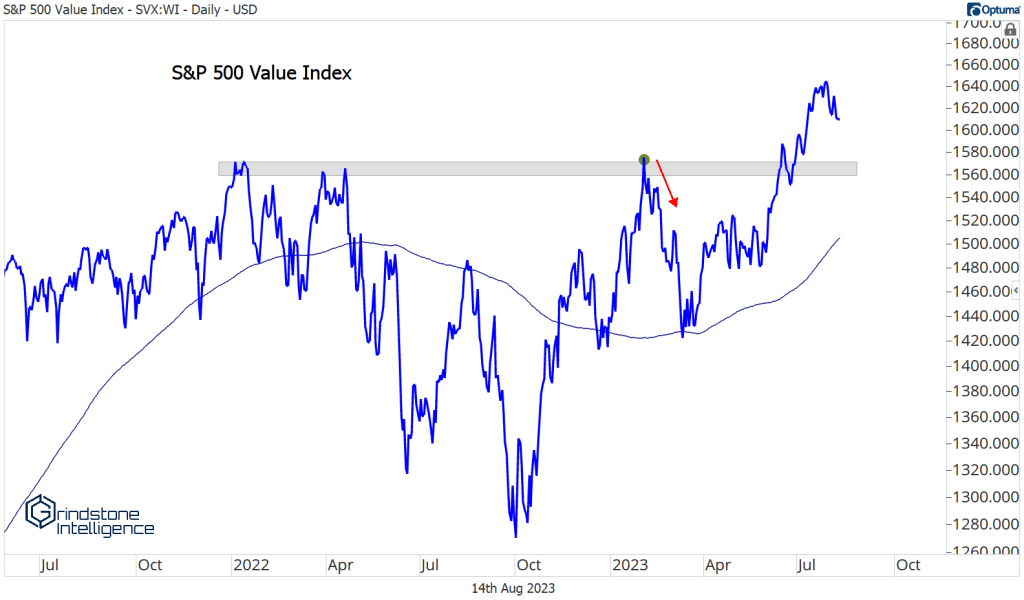

The S&P 500 Growth index just put in a failed breakout above the highs from last summer.

From failed moves tend to come fast moves in the opposite direction, and that sharp reversal has knocked the wind out of investors these past few weeks. Whether growth continues to retreat or simply digests the year-to-date rally with a sideways consolidation, we can only guess. In any case, we expect those highs from last August to act as stiff resistance on any rallies. Growth is better left alone for now.

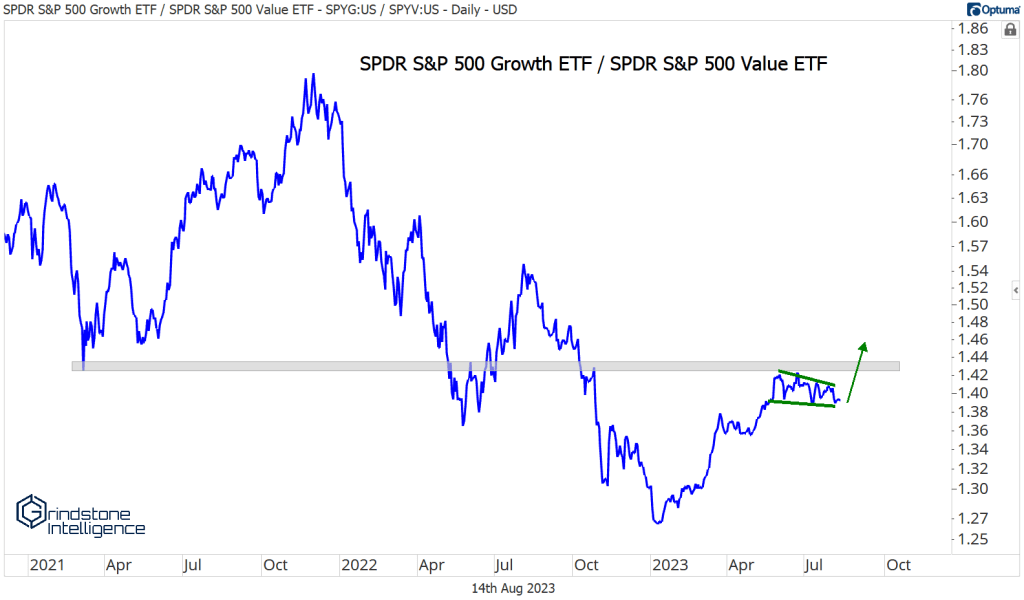

That doesn’t mean we have to take our ball and go home. Growth sectors have stalled out before, and that didn’t spell doom for the rest of the market. To the contrary, rotation is a good thing. Don’t forget, it wasn’t growth that led stock indexes off their lows last October – it was the value sectors: Industrials, Materials, and Financials. Those groups handed the baton to Information Technology, Communication Services, and Consumer Discretionary in the first week of January, and now the baton has been passed back. Check it out:

If market participants were truly scared, the relative safety offered by Utilities, Staples, and Health Care sectors would be catching a bid. Instead, we continue to see appetite for risk – it just looks a bit different than it did for the first half of the year.

Our biggest question is, how long will value’s leadership last this time? Did the start of the 2022 bear market mark a structural change in the Growth/Value ratio, where this year’s countertrend rally was always destined to reverse?

Or does it look like this, where Growth is just consolidating this year’s massive rally before resuming higher?

We’ll be watching carefully to see how things play out over the next few weeks.

In the meantime, the absolute trend in the S&P 500 Value Index hasn’t been damaged at all. After a failed breakout of its own earlier this year, the index broke out in June and has been setting all-time highs.

Even a pullback to last year’s highs wouldn’t change the fact that this group is in a structural uptrend. So why bother with things that are clearly stuck below overhead supply?

The market has a growth problem. It doesn’t have to be our problem.

The post It’s a Growth Problem first appeared on Grindstone Intelligence.