(Premium) January Industrials Outlook

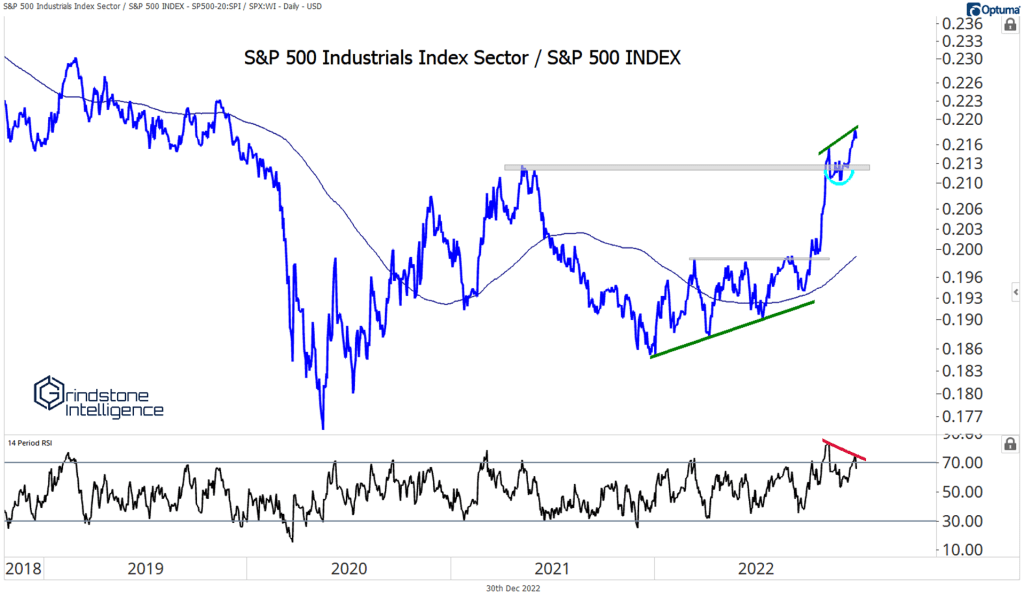

We lowered our overweight rating on Industrials after they reached our relative target in November. They’ve since absorbed that level of resistance and resumed their march higher. We’re wary given the lack of momentum confirmation we’ve seen so far but, this is not a group we want to be approaching from the short side.

Machinery stocks are still among our favorite names in the sector. If Caterpillar is above 250, we want to be long with a target of 340. That’s the 423.6% Fibonacci retracement from the COVID collapse, and those levels have worked well over the past two years.

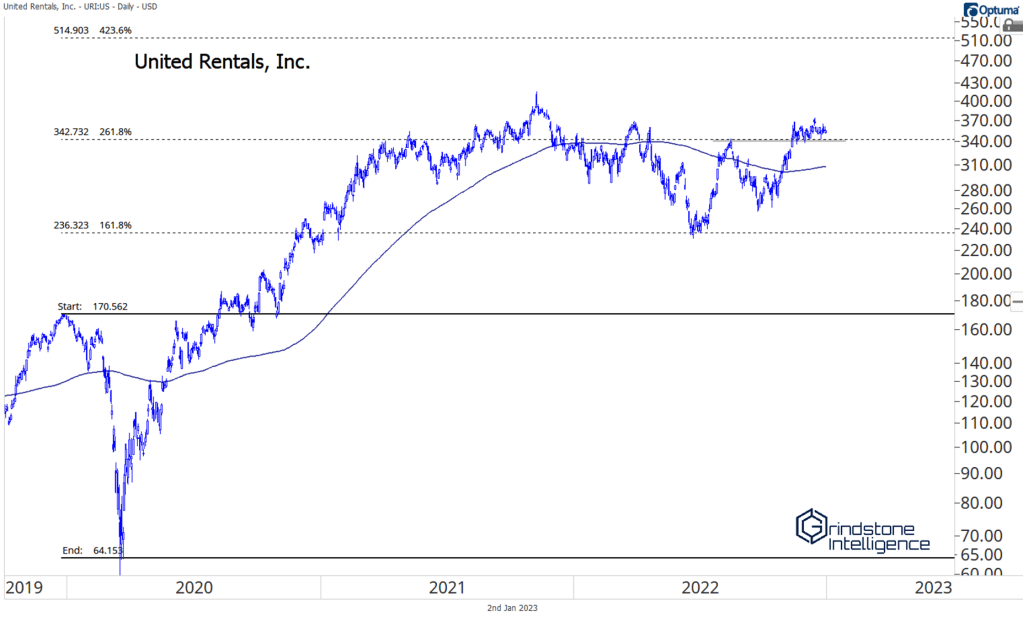

We also want to own United Rentals if it’s above 340 with a target of 500.

Wabtec is another one with a favorable setup – see how it’s consolidating above support and not below resistance? Those are the types of things that set the Industrials sector apart from groups like Information Technology and Communication Services.

Even the worst stocks within the sector – and it’s hard to find a stock that’s been much worse than Stanley Black & Decker – aren’t getting worse. SWK is still above the COVID lows after first testing them in October. Momentum has improved, too.

Generac is one that’s arguably been worse than SWK – it’s fallen from 500 all the way to 90. But check out that series of higher lows in momentum while prices have continued to fall.

I don’t include GNRC or SWK because I think they’re buys – they’re still in downtrends, and we don’t like fighting the trend. But if even the worst stocks can stop going down, that’s a bullish sign for the indexes.

The post (Premium) January Industrials Outlook first appeared on Grindstone Intelligence.