(Premium) January Information Technology Outlook

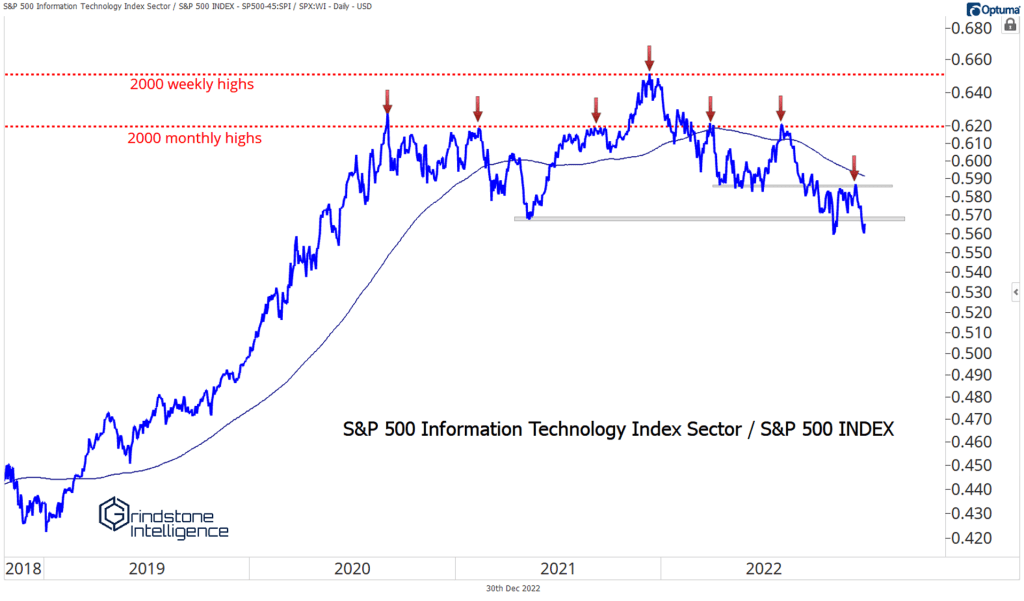

The chart below is one of our favorites, and if you’ve followed our work you’ve probably seen it before. It’s the ratio of the S&P 500 Information Technology sector vs. the S&P 500 index. We laid out the reason we like it so much in our December note:

“Growth stocks were in control for more than a decade after the financial crisis. Being a ‘Value’ investor was synonymous with underperforming. That changed in September 2020, when Information Technology ran into the relative highs it set at the peak of the internet bubble. Lots of people will argue that technical analysis is a farce. Price moves are random, and historical moves have no bearing on the future. Even more folks will balk at the importance of prices from more than 20 years ago – let alone the ratio of two price indexes. Allow us to ask: Does that chart look random? Do you really think it’s just coincidence that after a decade-long bull market, Tech just happened to peak at exactly the 2000 highs – the height of the biggest Tech bull market of our lifetimes? We don’t.”

The only thing that’s changed since our last note is that Tech has shown more relative weakness – it’s back under the 2021 lows. That gives us increased confidence in the underweight rating we’ve had since October.

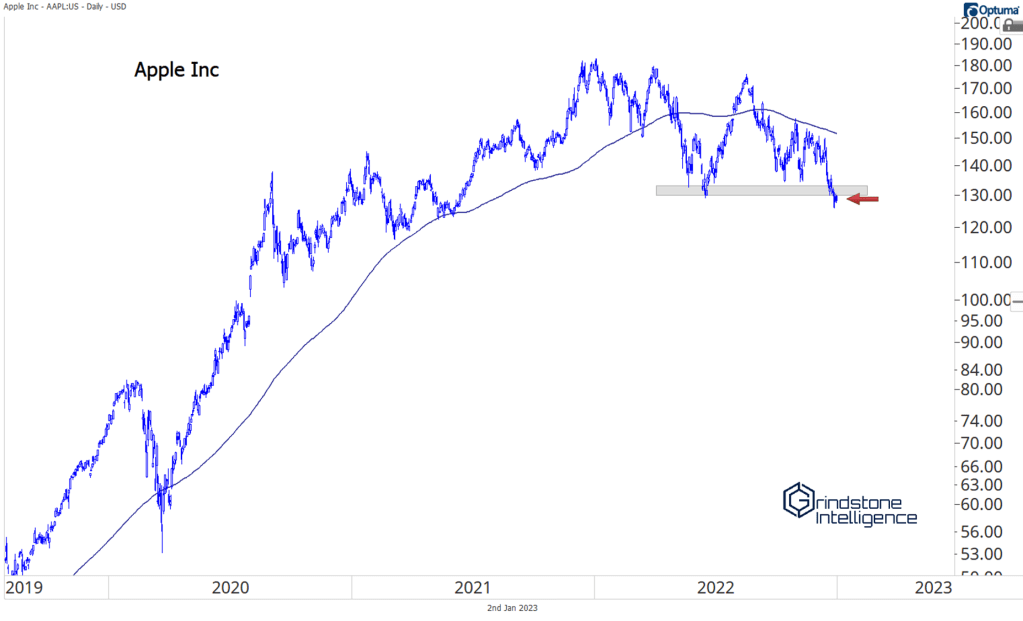

Apple has the biggest weighting in the group, and it spent most of 2022 holding the sector up. Now it’s breaking down to new 52-week lows. If there’s one thing we know about new lows, it’s that they aren’t bullish.

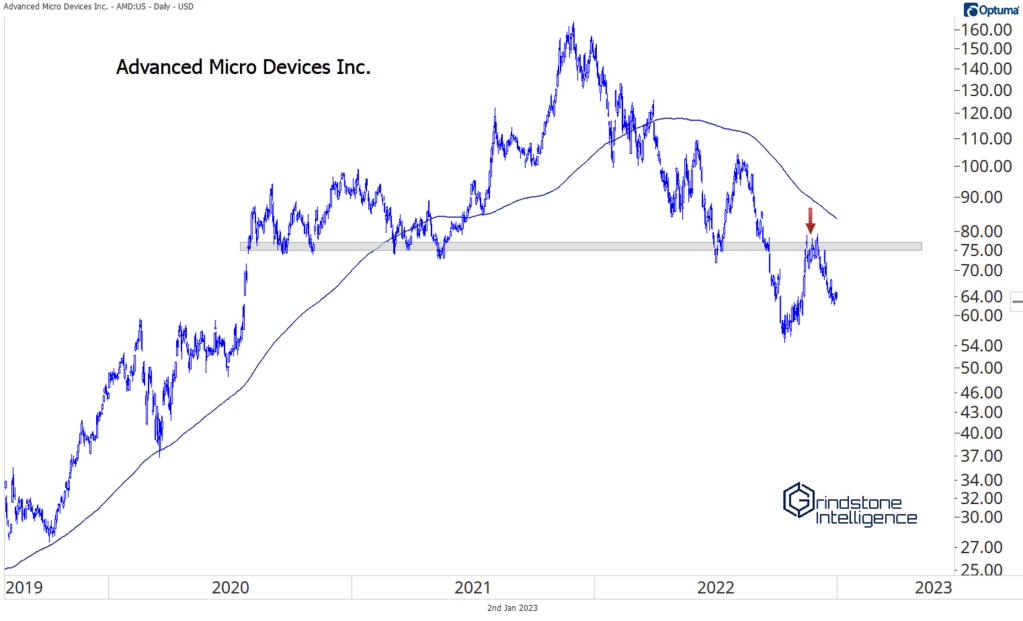

Semiconductors had rallied in November, making us think that maybe this Tech selloff had run its course. But semis broadly got rejected by their prior year lows, and they’re still stuck solidly below resistance. AMD is a great example:

Stocks in uptrends don’t fail at overhead supply, so that failure doesn’t make us want to buy semis.

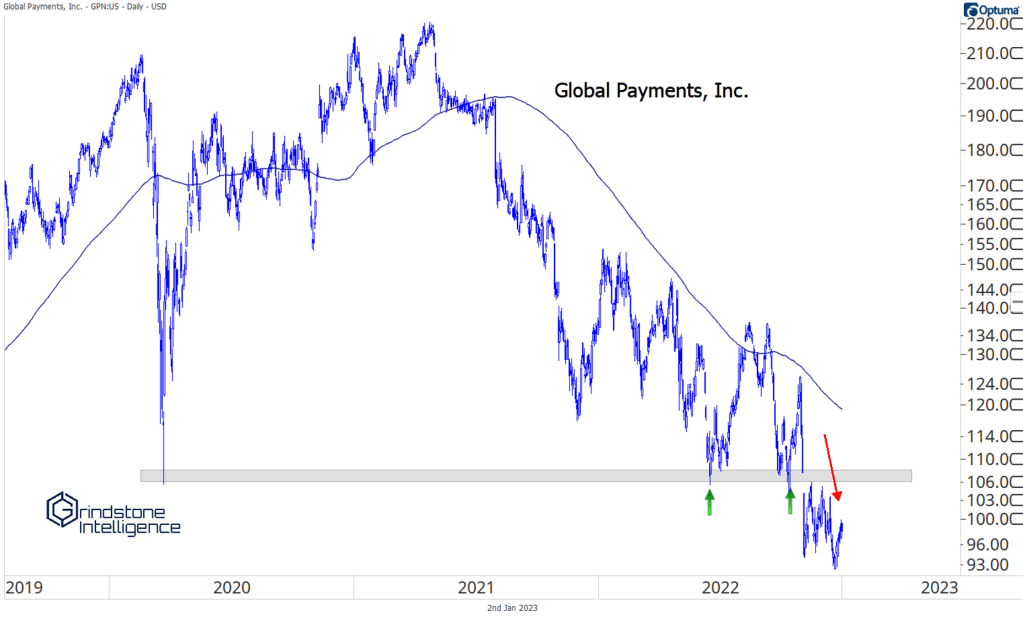

The other thing stocks in uptrends don’t do is break to new lows, like Global Payments did here.

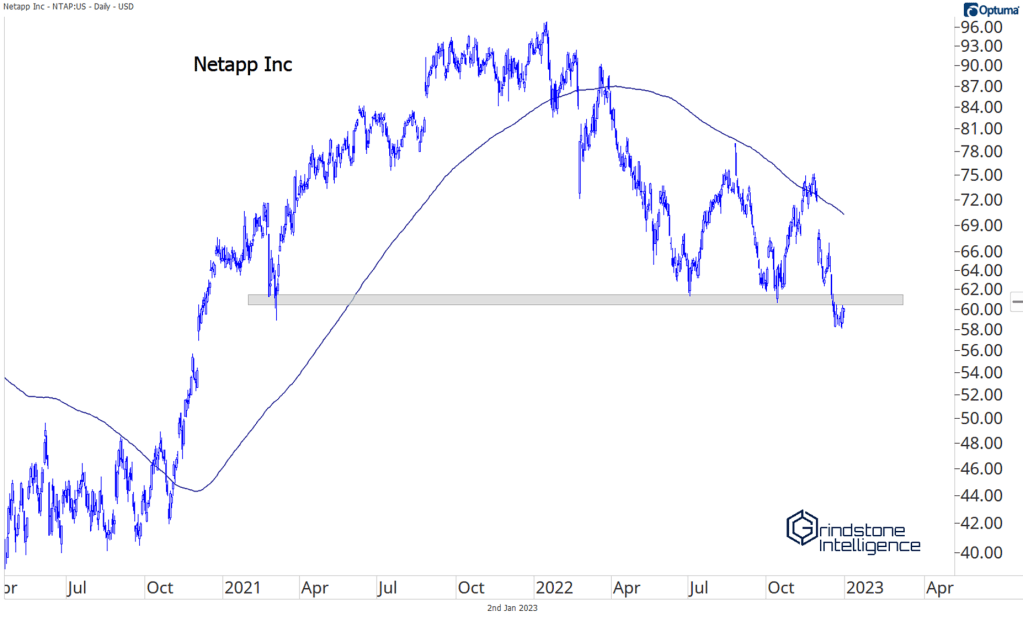

And Netapp here:

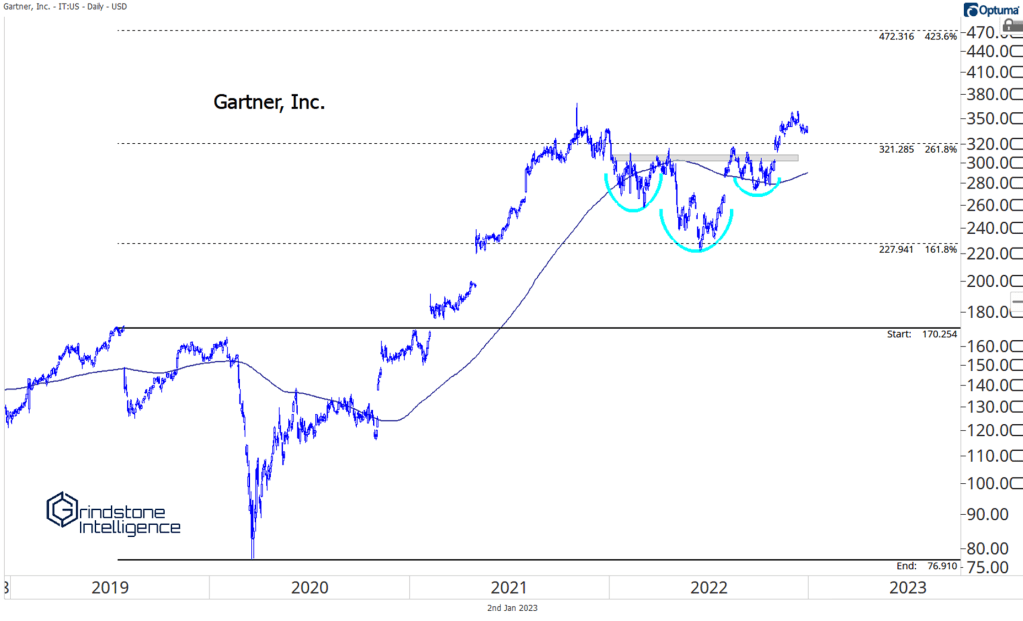

Not all of Tech is that dark, though. There are some bright spots. We called out Gartner last month, and it continues to be on our radar because of its relative strength. As long as this name is above 320, we like it with a target up near 470.

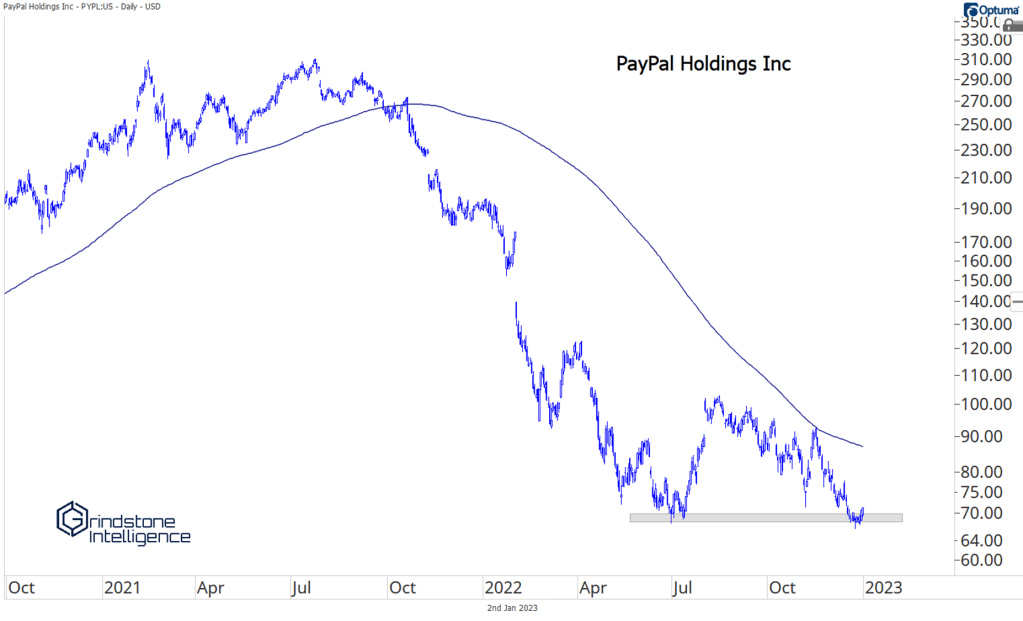

If there’s one stock that we’re watching for the Tech sector and for risk appetite over the next few weeks, it’s Paypal. Paypal peaked in late 2021, before the rest of the sector, but it hasn’t gotten any worse since the end of June, even though Tech as a whole continued to fall until mid-October. This multi-month consolidation for PYPL should resolve in the direction of the trend – that’s lower.

If it doesn’t, that tells us we should be approaching the sector and the market from a more bullish perspective.

The post (Premium) January Information Technology Outlook first appeared on Grindstone Intelligence.