January Market Outlook: The Bear Case for Stocks

Dow theory, bearish divergences, and the return of the US Dollar

At the outset of every month, we take a top-down look at the US equity markets and ask ourselves: Do we want to own more stocks or fewer? Should we be erring toward buying or selling?

That question sets the stage for everything else we're doing. If our big picture view says that stocks are trending higher, we're going to be focusing our attention on favorable setups in the sectors that are most apt to lead us higher. We won't waste time looking for short ideas - those are less likely to work when markets are trending higher. We still monitor the risks and conditions that would invalidate our thesis, but in clear uptrends, the market is innocent until proven guilty. One or two bearish signals can't keep us on the sidelines.

Similarly, when stocks are trending down, we aren't looking to buy every upside breakout we see. We can look for those short opportunities instead, or look for setups in other asset classes.

So which is it today? Are we looking for stocks to buy or stocks to sell?

One thing is clear: stocks are not in a downtrend. We just put the finishing touches on a banner year by closing higher for nine consecutive weeks. For the S&P 500, that matches the longest streak since 1985. That’s just the tip of the iceberg. Three quarters of S&P 500 stocks are above their 200-day moving average. Risk-on sectors are leading, and risk-off sectors are lagging. Credit spreads are at multi-year lows. Central bank policy is loosening and interest rates have fallen sharply from last year’s highs. And the S&P 500 just had its best monthly close EVER in December.

The bull case isn’t hard to see, and we continue to lean towards further gains for stocks.

Unfortunately, our crystal ball is hazy as ever. We have no idea what the future holds. That’s why, whether we’re bullish or bearish, we always take the time to understand both the bull and bear cases. By understanding where the risks to our thesis are, we’re more likely to know when our thesis is wrong - how to take corrective action.

So let’s dig into the bear case for stocks.

First, Mr. Dow would like a word.

Much of modern technical analysis can trace its roots to Charles Dow, a founder of the Wall Street Journal. Dow created indexes to track the market’s broader moves, defined trends and their phases, and even pushed an early form of the efficient market hypothesis (sixty years before Fama’s research was published). Dow’s most famous tenet, though, was his belief that the averages must confirm each other for a trend to be established.

The Dow Jones Industrial Average broke out to new highs in late December, but the Transportation Average did not. Per Dow Theory, that’s a problem.

Is it just that the Transports haven’t broken out yet? Maybe. We can’t expect the indexes to break out at the exact same time every time. But if the Transports roll over and the Industrials fall back below those January 2022 highs? That’s a different story.

For that matter, the S&P 500 hasn’t confirmed the DJIA’s breakout yet, either. The January 2022 highs are still the high water mark, and that area should act as overhead supply.

Can the SPX blow right past 4800? Of course. But it would make sense to see prices respond to that level with some backing and filling.

Especially if the leaders stop leading.

All throughout 2023, it was the growth sectors that drove the indexes higher, none more important the Information Technology. Comprising more than a quarter of the S&P 500, Tech’s unrelenting rise seemed to be the only thing that mattered. Momentum just put in a bearish divergence for Tech though, as RSI failed to reach overbought territory on the most recent leg higher. Yesterday’s sharp decline acted as confirmation.

That will most likely put a ceiling on Tech sector prices for the next several weeks.

We also saw a negative divergence in the number of new 52-week highs on the S&P 500. The SPX set its high last week on December 28, but the number of new highs within the index peaked 2 weeks before that. That’s a sign that things aren’t quite as healthy below the surface.

The risk-off areas of the market are to blame. We shouldn’t expect risk-off areas to lead in a bull market, but a rising tide should lift all boats. Instead, only a quarter of Consumer Staples and Utilities stocks have managed to reach new 52-week highs, and less than 20% are setting new 6-month highs. Stocks in the Health Care sector are similarly weak.

Everything is corrected if the weak stocks catch up to the strong ones. That’s what should happen in bull markets. But since we’re explicitly looking for bearish evidence today, let’s consider the alternative. What if the strong stocks catch down to the weak ones?

Much like it did near the end of 2021 and 2022, the Growth/Value ratio reversed course at the end of 2023. Value stocks have moved back into favor since mid-November. It happened at a logical level, too. Value began to outperform at exactly the same place it did in September 2020 and December 2021.

On the one hand, sector rotation is the lifeblood of bull markets. Value stocks rising faster than growth stocks - like we saw from September 2020 to May 2021 - is healthy. The alternative outcome is more akin to 2022, when Value outperformed not by rising more, but by falling less.

Take a look at the Russell 2000, which is heavily tilted towards value stocks. If IWM hangs above support at $200, there’s no reason to be bearish the broader market. But if the breakout fails to hold when value stocks are supposed to be leading? Then the bull market is on hold.

Lack of confirmation from the Transports, the S&P 500 stuck below resistance, a bearish momentum divergence in the Tech sector and a lack of new highs. Most of this evidence points to a bull in need of a rest, rather than the start of a major decline. So what would it take for us to turn more bearish?

How about the return of Dollar strength? All throughout 2022 and 2023, it seemed the US Dollar was driving the boat. Every time the Dollar rallied, stocks were under pressure. And when the Dollar relented, equities moved higher.

As long as the US Dollar Index is stuck in this range between 100 and 105, we think this bull market in stocks can remain intact. Perhaps a rally in DXY toward the top end of this range occurs while the S&P 500 consolidates below 4800 and the Tech sector digests its momentum divergence. But if the Dollar is above 105, the story changes. We’d have to start taking the bearish evidence more seriously.

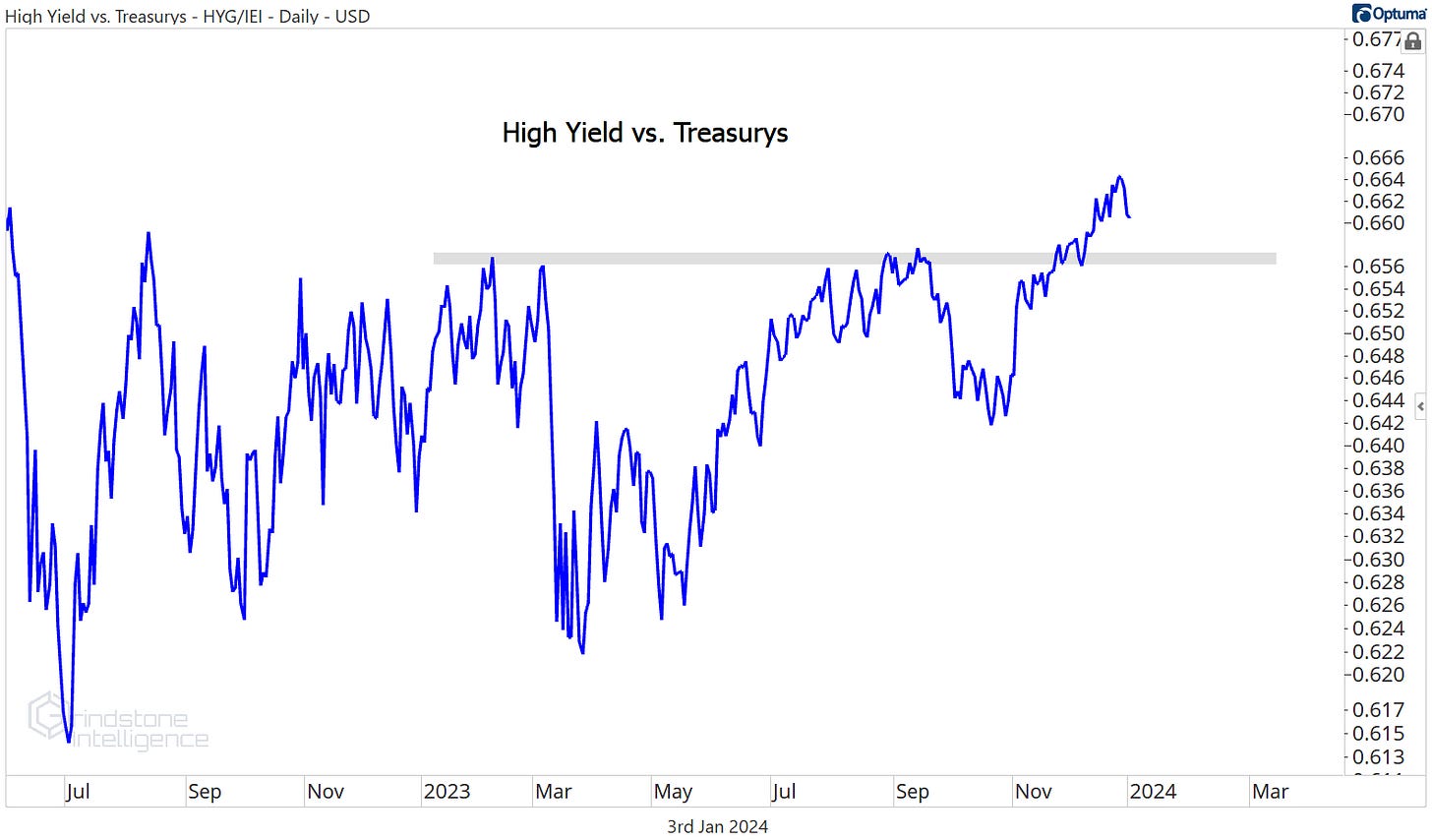

In that scenario, we’d expect to see more flight to safety, especially in the form of credit spreads. Check out the ratio of high yield bonds to Treasurys (HYG/IEI). High yield just touched its best level in almost 2 years, which is evidence of risk appetite.

If this ratio falls back below the November breakout level, that would be clear evidence of investors trading riskier assets for safer ones. And risk aversion is something we tend to see in bear markets.

Our bullish approach has worked out pretty well for over the last 7 months or so, and for now, there’s no reason to abandon that view. But we’ve also identified some key risks to this market to tell us when our thesis is wrong. We want to see the Dow Jones Transportation Average confirm the breakout in the Industrials, Tech stocks and small caps successfully hold their breakouts, an expansion of new highs, and a subdued Dollar index.

If those things aren’t happening, we’ll be reassessing our bullish outlook for stocks.

That’s all for today. Until next time.