(Premium) January Technical Market Outlook and Equity Playbook

We can finally put one of the worst years for investors in the rearview mirror. In 2022, both stocks and bonds came under pressure, something we’ve rarely seen since the 40-year bull market in bonds began in the early 1980s. Will 2023 be any different? January will set the tone, so let’s see how things are shaping up.

US Equities

We start our monthly technical outlooks at the top for a reason. In just a handful of charts, we can see exactly the type of investment environment we’re in. Are stock prices rising or are they falling? Should we be erring on the side of buying or selling stocks?

In that respect, nothing has changed since we wrote our December outlook: US stocks are NOT in an uptrend. The S&P 500, a market cap-weighted index comprised of 500 of the biggest companies in the United States, is stuck below a falling 200-day moving average. At best, prices are stuck in a sideways trend.

(Editor’s note: If you’re having trouble seeing any chart in this report, click on it to view a larger version)

The line in the sand for the SPX is 4100. That’s the 161.8% Fibonacci retracement from the entire COVID selloff, and that’s been overhead resistance since May. If we’re above that, we’ll be looking for stocks to buy. As long as we’re below it, we need to err towards caution. A break below 3500 would be even more evidence that bears are still in control.

The Dow Jones Industrial Average was the leader for all of 2022, and there’s no reason to expect that to change any time soon. The Dow is alone among the major indexes in that it’s above its long-term moving average. Still, the DJIA failed to stay above the August peak after rallying above it in November.

We’d turn incrementally more positive with prices back above those swing highs.

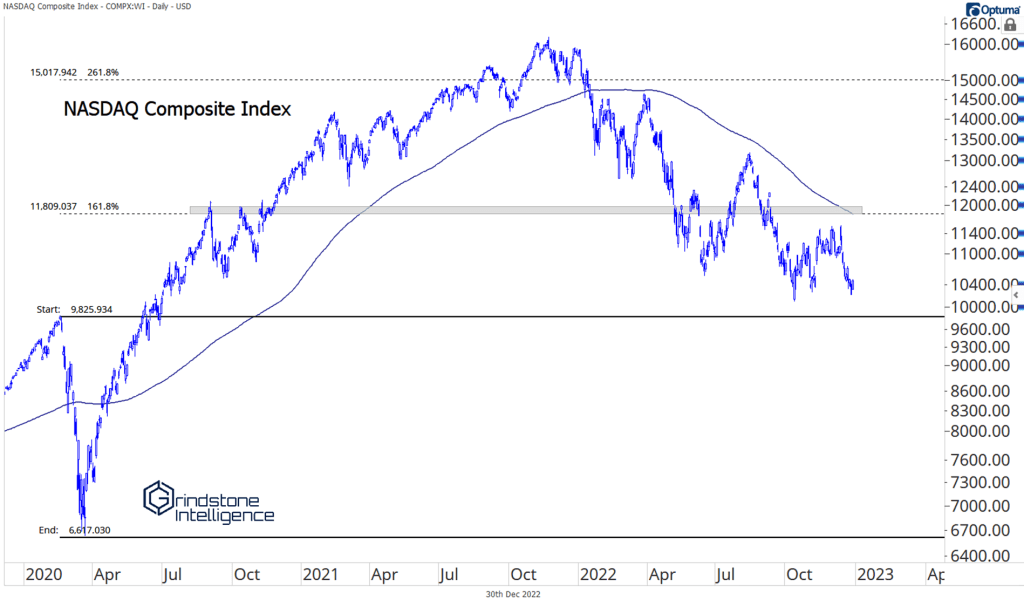

The Nasdaq Composite is the least constructive of the major indexes and showed relative weakness for all of 2022. Even if this bear market has run its course, there’s no good reason to be heavily involved from the long side until we get back above 12000. Near-term, a test of 10000 and the pre-COVID highs seems more likely, as December’s selloff nearly pushed prices to new 52-week lows.

Small cap stocks continue to maintain support from the January 2020 highs. The Russell 2000 hasn’t set a new low since the summer.

The 200-day moving average has acted as resistance on each rally since then, though. A neutral approach is best for now on small caps, at least until this range resolves in one direction or the other.

Click on each section below to see the rest of our January outlook:

Fixed Income, Currencies, and Commodities Communication Services Sector Consumer Discretionary Sector Consumer Staples Sector Energy Sector Financials Sector Health Care Sector Industrials Sector Information Technology Sector Materials Sector Real Estate Sector Utilities Sector

Premium members can log in to see our sector outlook and US Equity Model Portfolio below:

Playbook and Model Portfolio

Sector Outlook

The Grindstone Intelligence Sector Outlook is based on our top-down technical approach. These ratings are based on our views over the next month but are subject to change with incoming data. If we feel the need to adjust our ratings before the next scheduled newsletter, we will notify subscribers via email with updated views and our justification.

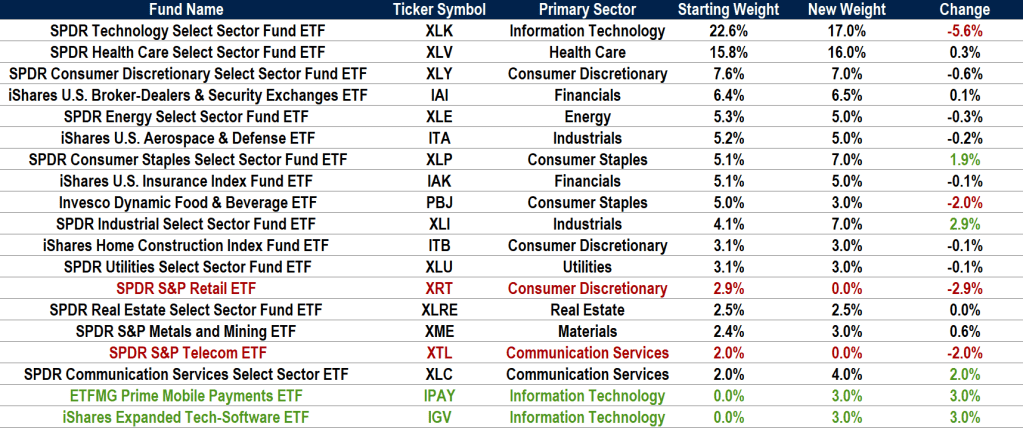

We’re lowering our view on Consumer Discretionary to equalweight and raising our ratings on Industrials after that sector successfully moved through its 2021 relative highs.

Grindstone Model Portfolio

The Grindstone US Equity Model Portfolio is a hypothetical allocation designed to align with our Sector Outlook and seeks to outperform the S&P 500 Index over the long-term. The Model will invest only in exchange-traded funds that track sectors, industries, or categories of stocks. No individual stocks or cash positions will be used in the Grindstone US Equity Model Portfolio. Changes to the model portfolio will be communicated via email to subscribers, and official ‘trades’ will be executed at the next closing price. Fund performance will cause portfolio weights to drift between updates.

We’re making several changes to the model portfolio to reflect our sector ratings changes. These will be effective at the close of day on January 3rd. The table below details the adjustments and the new positioning.

Please reach out with any questions. We’re happy to clarify any of our opinions, but the nature of our publication prevents us from providing personalized advice. For those questions, please contact your financial advisor.

The post (Premium) January Technical Market Outlook and Equity Playbook first appeared on Grindstone Intelligence.