Keeping up with Commodities

Lost amid a week of wild swings in the equity markets were some incredible rallies in a handful of commodities.

Commodities have been a safe haven of sorts in 2022, as both stocks and bonds are on pace for one of the worst years ever. Their relative strength faded as spring turned to summer and the US Dollar continued to soar, but since the Dollar Index peaked September, hard assets have regained some of their luster.

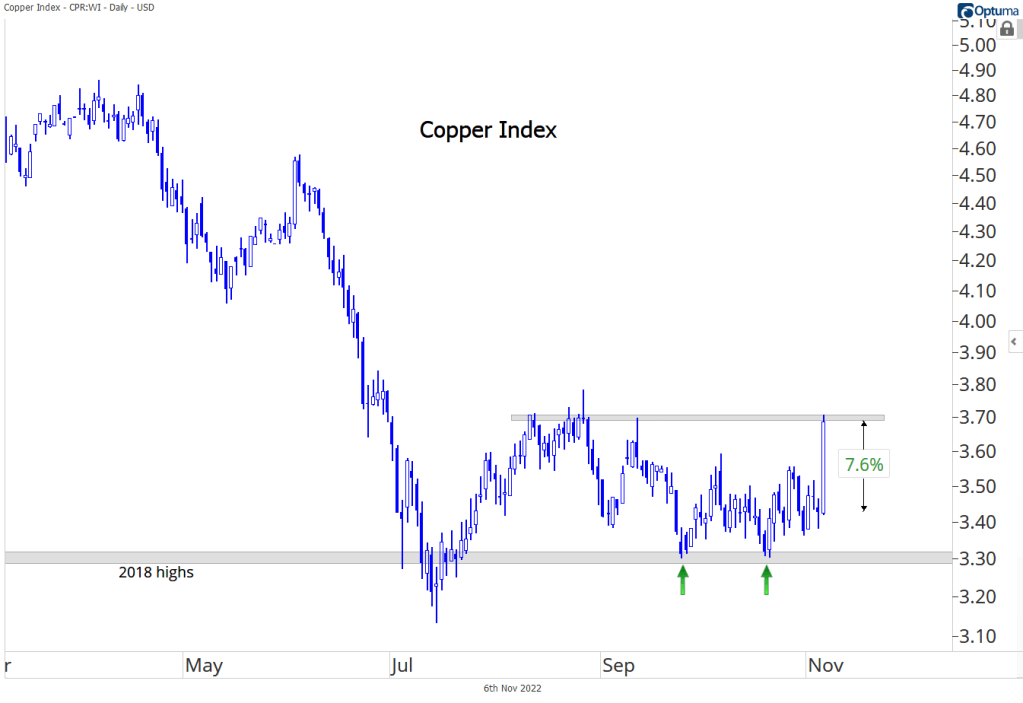

Copper had it’s largest one-day gain in over a decade on Friday.

After the early-summer selloff found support at the old 2018 highs, prices took 4 months to digest the action. Copper is still technically rangebound, but Friday’s 7.6% rally has it challenging the high end of the channel.

Gold had its best day since March 2020.

Gold has been in a well-defined intermediate term downtrend since peaking in March, but prices stopped going down in September. They’re still below the downtrend line from the peak and resistance at $1700, but any follow through after Friday’s gain would indicate the trend has changed – if not to a new uptrend, then at least to sideways instead of down.

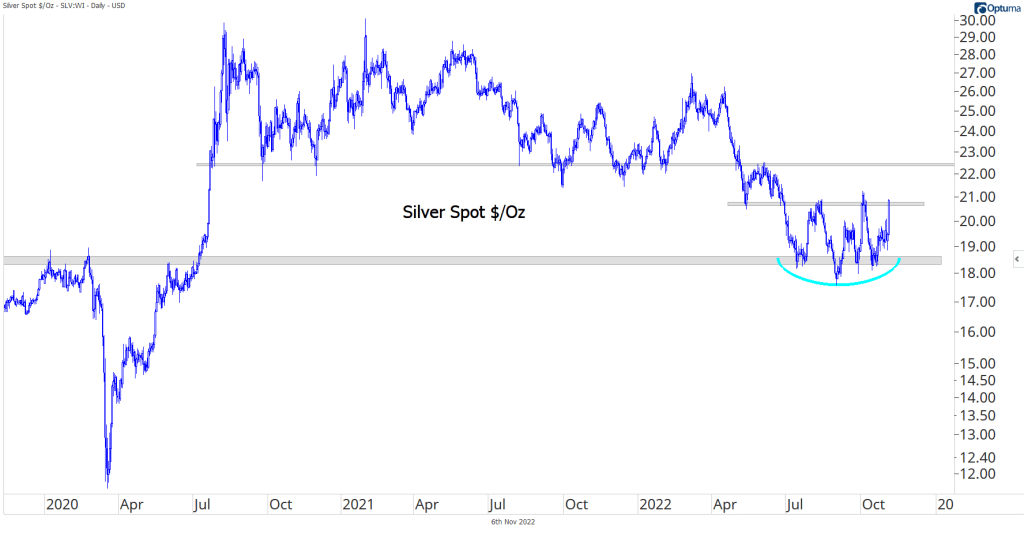

If Gold is set for a new uptrend, other precious metals will probably join in. In fact, they’ll most likely lead. Silver tends to trade like a more volatile version of Gold – when Gold prices fall, Silver prices tend to fall more, and vice versa. In recent months, though, Silver has failed to confirm the new lows we were seeing in Gold prices.

While Gold was setting lower lows, Silver was setting higher lows after finding support at the 2020 highs. Now, it’s trying to break to 4-month highs.

Crude oil joined in the rally, too, having it’s best one-day gain since May. It’s still below a key rotational level near $95,but one more day like the last would push prices back above an area that’s proven tough resistance over the last few months.

The future of commodities may well rest in the hands of the currency markets. Friday’s US Dollar Index drop was just as extreme as the aforementioned rallies – it was the largest one-day decline since 2015. The Dollar has now set 2 consecutive lower highs, and this week it could challenge support at 110.

Don’t lose track of the 200-day average, though. The Dollar is still in a well-established, long-term uptrend, and until that changes, it’ll be a risk for bulls in stocks, bonds, and commodities alike.

Nothing in this post or on this site is intended as a recommendation or an offer to buy or sell securities. Posts on Means to a Trend are meant for informational and entertainment purposes only. I or my affiliates may hold positions in securities mentioned in posts. Please see my Disclosure page for more information.

The post Keeping up with Commodities first appeared on Grindstone Intelligence.