King Dollar

The U.S. Dollar is the largest reserve currency in the world. The U.S. economy represents about a quarter of the globe’s GDP, yet the Dollar’s share of official foreign reserves is more than double that amount. Strength and weakness in the USD has both obvious and more obscure impacts on economic activity, no matter where you reside.

The DXY, a basket of currencies measured relative to the USD, has largely gone nowhere since a marked rally in 2014. The 38.2% and 61.8% retracements from the 2001 – 2008 decline have acted as support and resistance, and now prices are approaching the upper end of the channel once again. With a flat 200-week moving average, there’s not much of a long-term trend here, but another break above $100 could be enough Dollar strength to start looking at the 2001 highs near $121.

The Euro cross comprises nearly half of the DXY, so it’s no big surprise that the two look so similar over the shorter term (with one of the two charts inverted, of course). The EUR has been rangebound vs. the USD for 5 years. The 38.2% retracement from the 2008-2016 decline has been a key rotational area for a decade, and held as resistance again last year. Though the EUR is approaching multi-year lows and the short-term trend is down, the trend hasn’t been all that strong – daily momentum hasn’t even gotten oversold in the last 12 months. This exchange rate is stuck in the range until it isn’t.

Amid the political turmoil surrounding Brexit, the British Pound has been relatively weaker. The mid-2016 vote to leave the European Union pushed the cross below the 2010 swing low, a level that held as resistance in early 2018. Now, the exchange rate is threatening to set fresh lows.

The Japanese Yen, on the other hand, is trying to set fresh highs against the USD. The Asian currency rallied from 2007-2011, before weakening back to 124 Yen per Dollar in 2015. The 61.8% retracement at from those major moves (near 105) has acted as chart support for the last 3 years, but any further weakness from the Dollar would push the cross through that level and towards rotational support near 100.

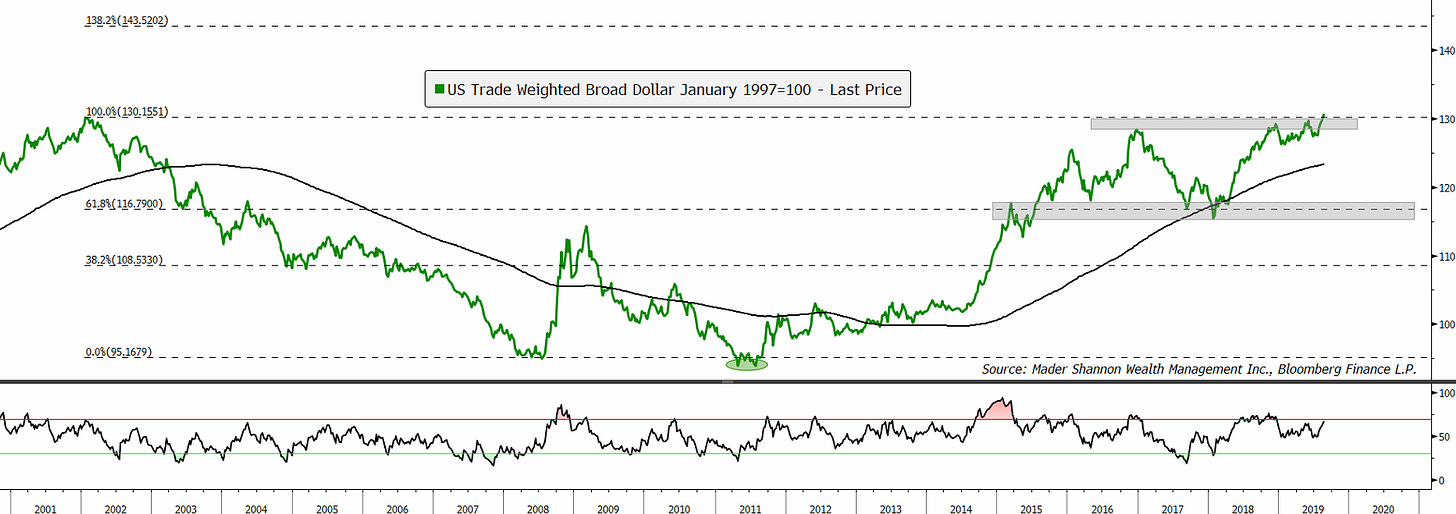

Once we get past the major crosses, though, things get a little more interesting. The Trade Weighted Dollar Index, with its reduced Euro exposure, is setting 20-year highs. The strength is most apparent against emerging markets

The Chinese Remninbi has broken through the former resistance area at 7.0, and is now at the weakest level since 2008. The 138.2% extension from the 2017-2018 move is a logical stopping point over the near-term, but anything is possible in a currency controlled by the state.

The Brazilian Real is near its weakest level of the twenty-first century. The cross has consolidated for almost 5 years after the 2011-2015 rally, and with weekly momentum in a bullish range, could easily weaken further. The 138.2% extension from the entire 20-year range lies just under 5.0. That area could act as resistance if the chart weakens past the 2018 highs.

In countries like Argentina and Turkey, the relative strength of the Dollar is more pronounced and troublesome. Debt in these countries is often denominated in USD, and it becomes more difficult to pay back when revenues in the local currency are worth less and less over time.

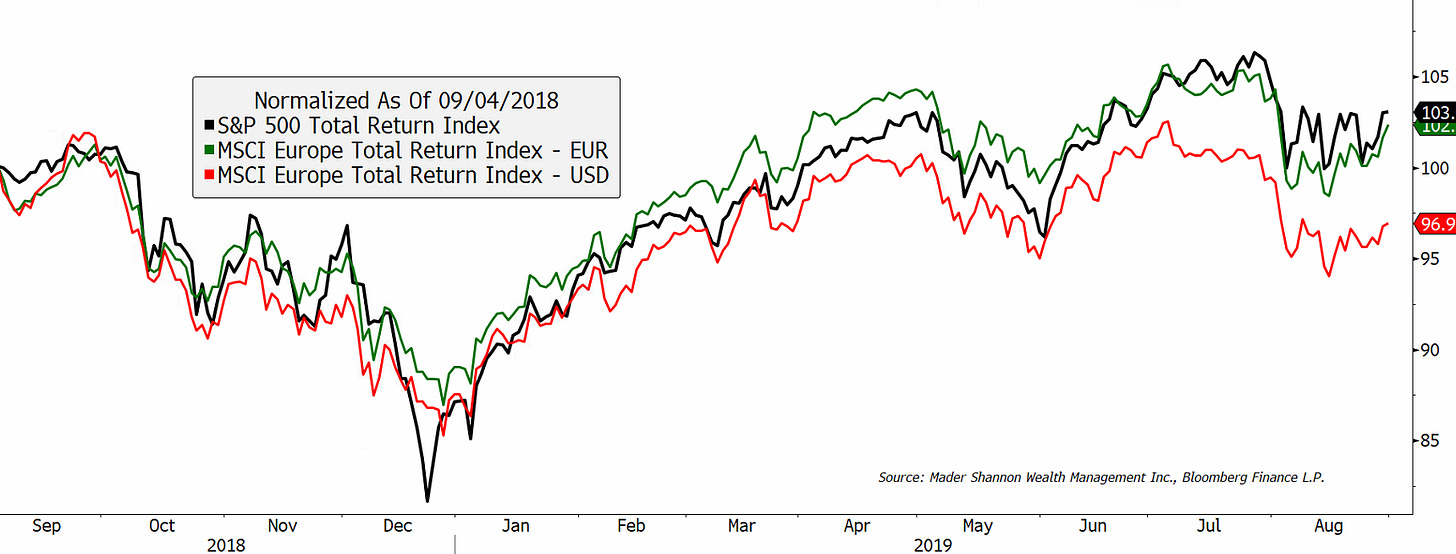

Strength in the U.S. Dollar has made it more difficult for U.S. investors to make money overseas, too. European indexes have, on balance, performed similarly to domestic equities over the past 12-months. As you can see below, however, the currency translation has negatively impacted performance by more than 5%. The problem is obviously worse in some of the emerging market currencies mentioned above, whose relative performance has been substantially worse than that of the rangebound Euro.

As the globe’s primary reserve currency approaches key levels in several key crosses, it will pay to keep in mind the potential effects on both emerging market credit and equity performance.

Nothing in this post or on this site is intended as a recommendation or an offer to buy or sell securities. Posts are meant for informational and entertainment purposes only. I or my affiliates may hold positions in securities mentioned in posts. Please see my Disclosure page for more information.

The post King Dollar first appeared on Grindstone Intelligence.