Leaders and Losers: Industry Trends - 1/11/2024

We put a lot of emphasis on a top-down approach here at Grindstone. Yes, there’s tremendous value to be had in a bottom-up technical approach, too, which is why we sift through thousands of charts of individual stocks each month. When we’re just checking the charts of individual stocks, though, we can miss out on big themes in the market – especially if we aren’t in tune with the fundamental factors that drive each of those individual stocks.

Zooming out helps.

If you’re a regular reader of our work, you’ve probably noticed that our equity research process centers around the 11 GICS sectors. When we take groups of similar companies together, we can better identify the types of companies that are working best, and that can help us identify the most sustainable trends. And once we’re in the right zip-code, then we can spend our time deciding which companies within that zip-code we want to own.

Today, we’re going a step deeper than those sector-level trends and moving to the “Industry” level of the GICS classification system. We’re looking at which groups have performed the best over the last few weeks and months, which ones are showing bullish momentum characteristics, and which ones are setting higher highs. Here’s the rundown:

Let’s take a look at some of the most interesting industry setups.

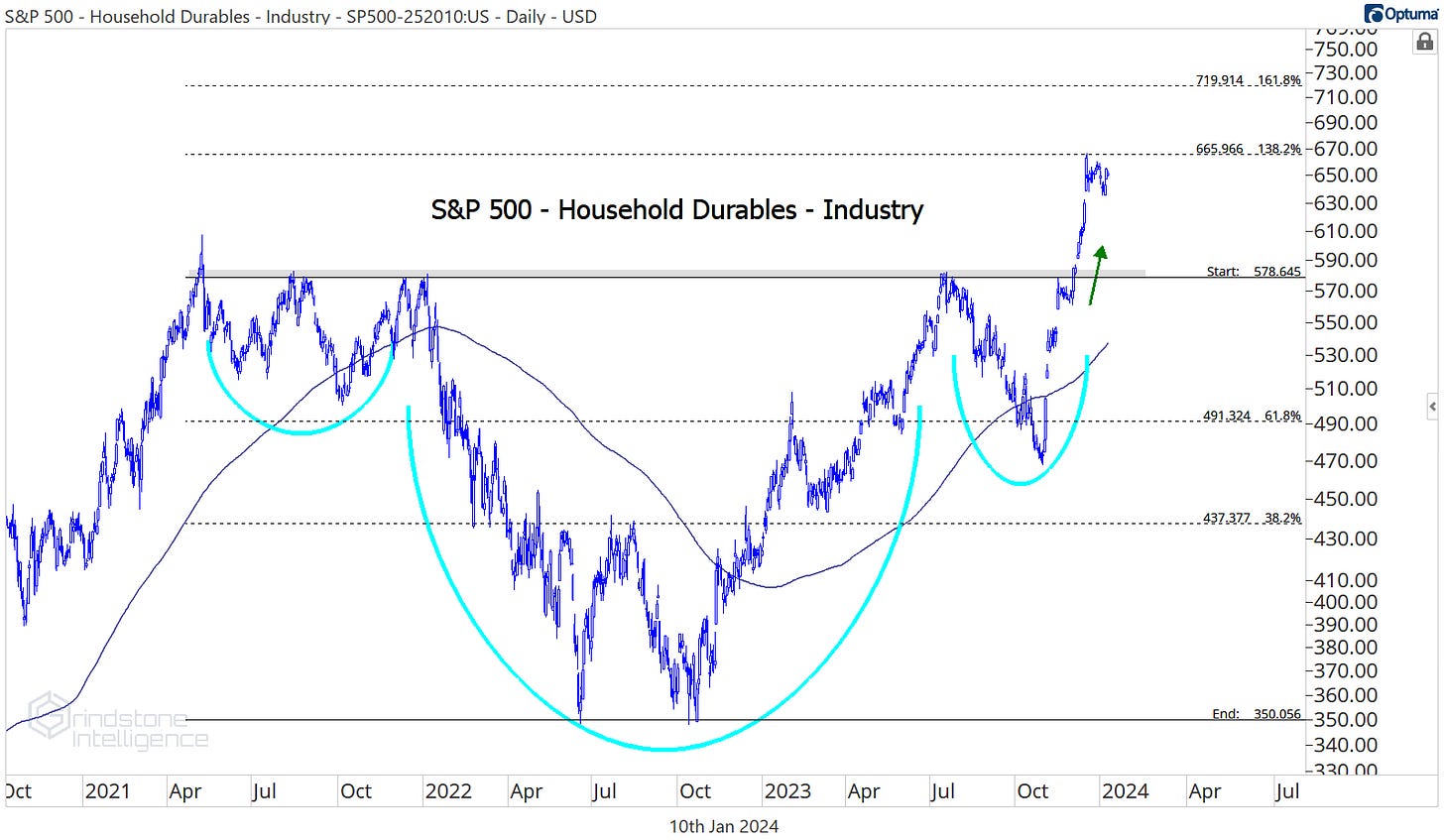

First up is Household Durables, which resides in the Consumer Discretionary sector and topped the leaderboard over the last month. After breaking out from a big, 2-year, inverse head-and-shoulders pattern, the Durables found some resistance at the 138.2% retracement from the 2021-2022 decline. We only want to be long this group if it’s above 670, and from there we’re targeting a move to the next key Fibonacci retracement level at 720.

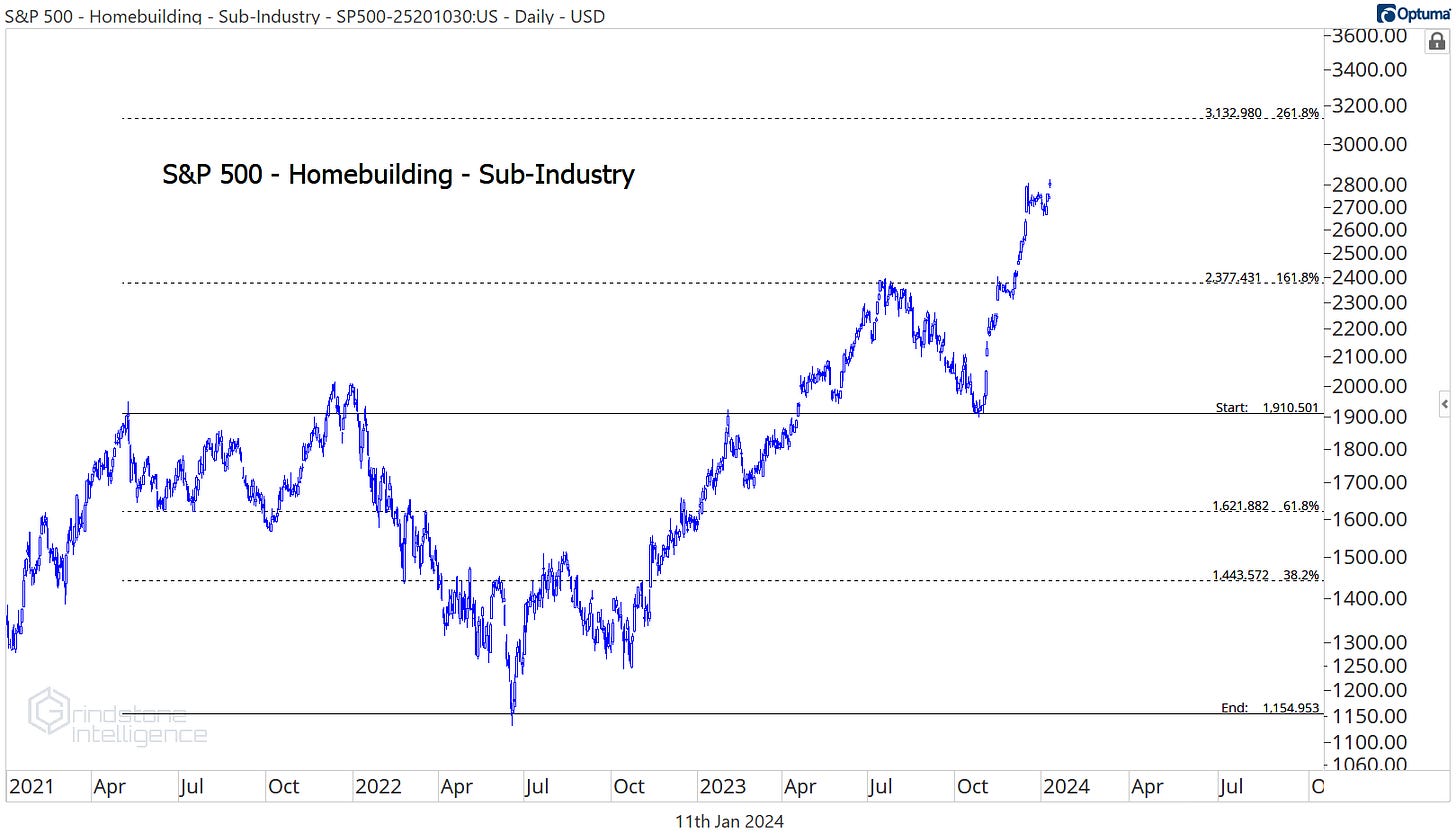

The homebuilders are the ones driving the boat within the Household Durables, and they’ve still got room to run. The Homebuilding sub-industry hit a new high yesterday on its way to the 261.8% retracement from the 2021-2022 decline.

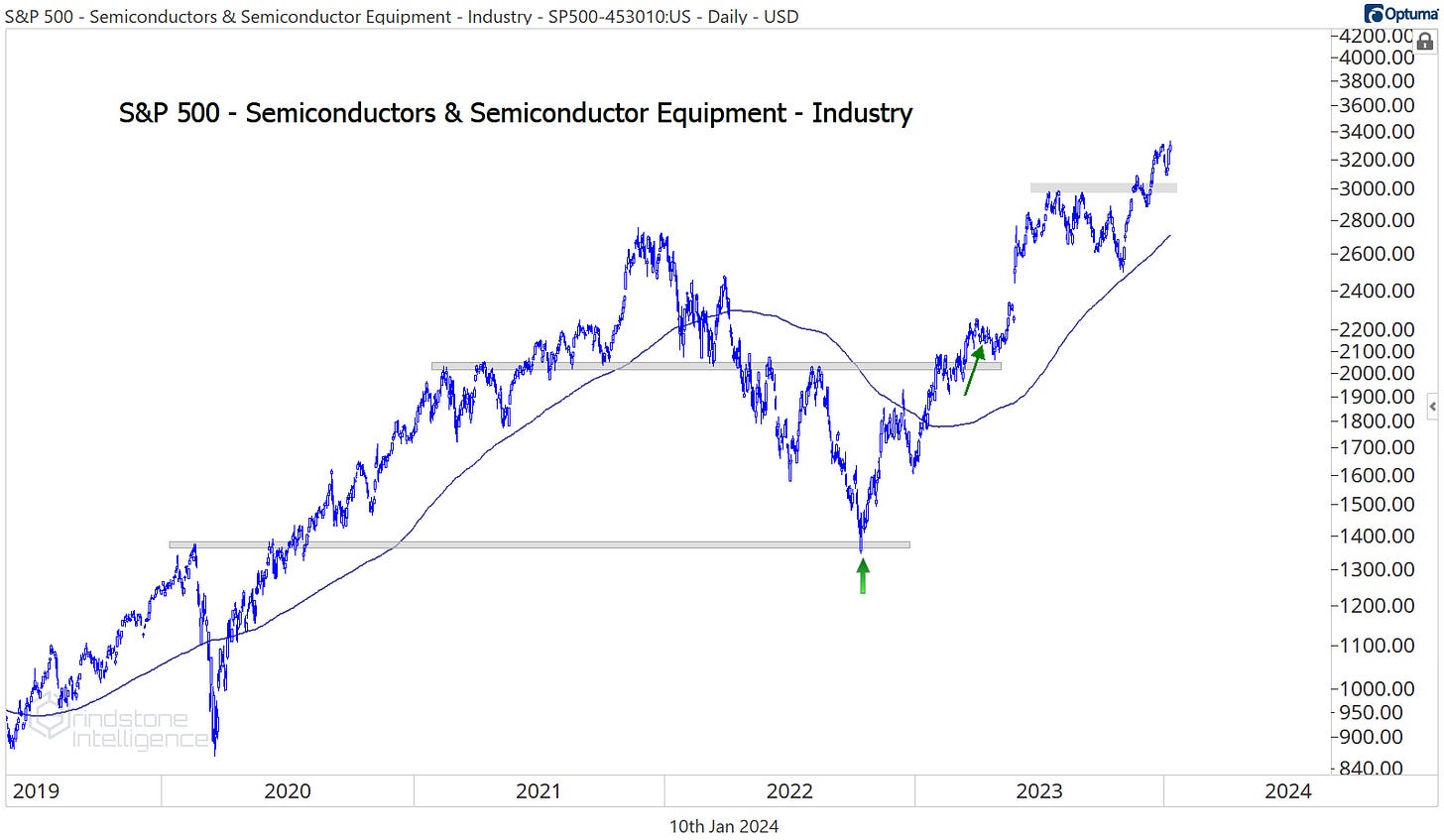

Within the Information Technology sector, semiconductors continue to trek higher. They were among the top-performing groups in 2023, and they’re off to a strong start in ‘24, too.

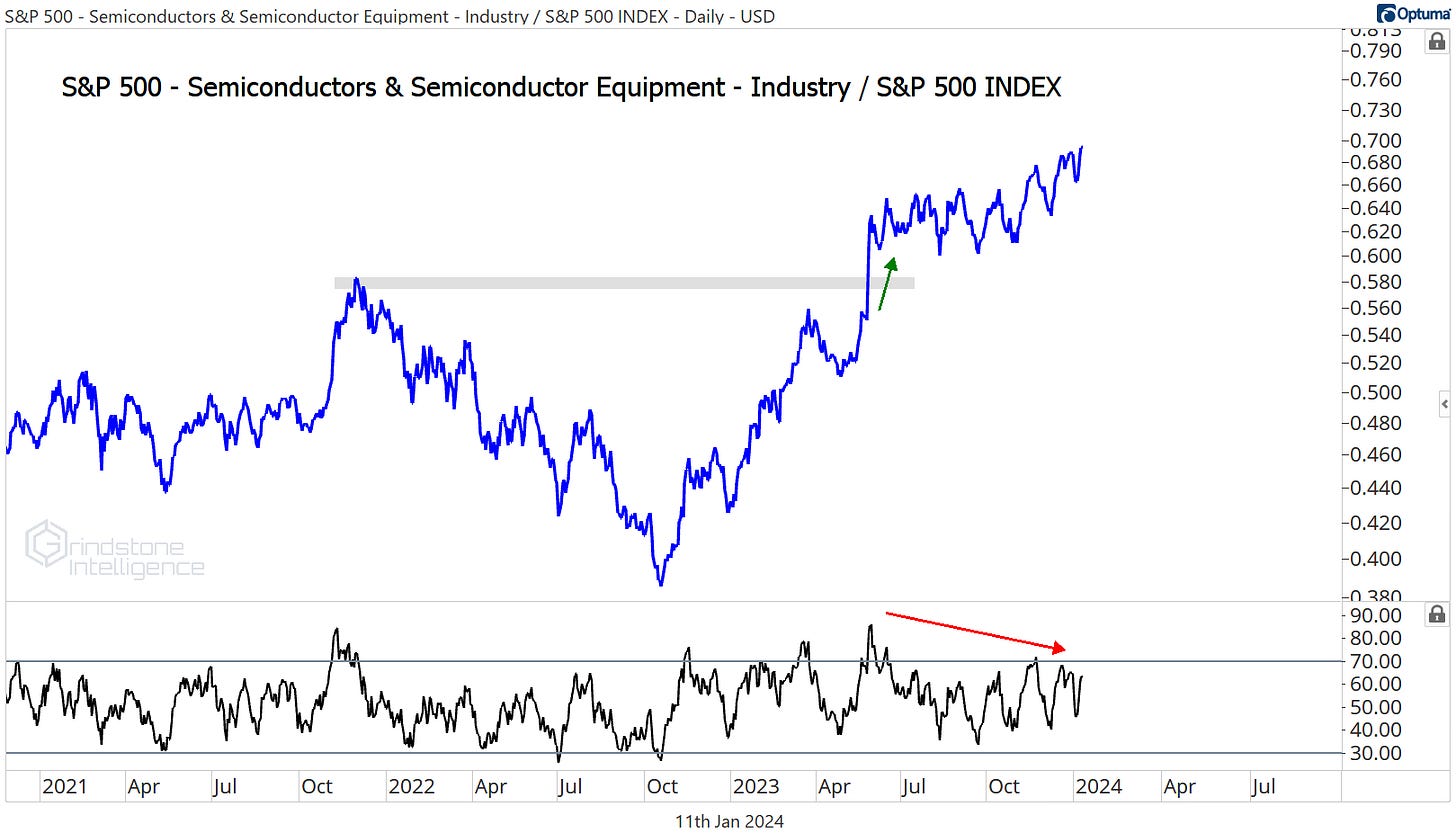

The biggest point of concern for the semiconductors is the bearish momentum divergence that’s shaping up relative to the rest of the market. Momentum for the Semis/SPX ratio has stayed out of overbought territory this year despite the new highs, indicating that the move is starting to weaken.

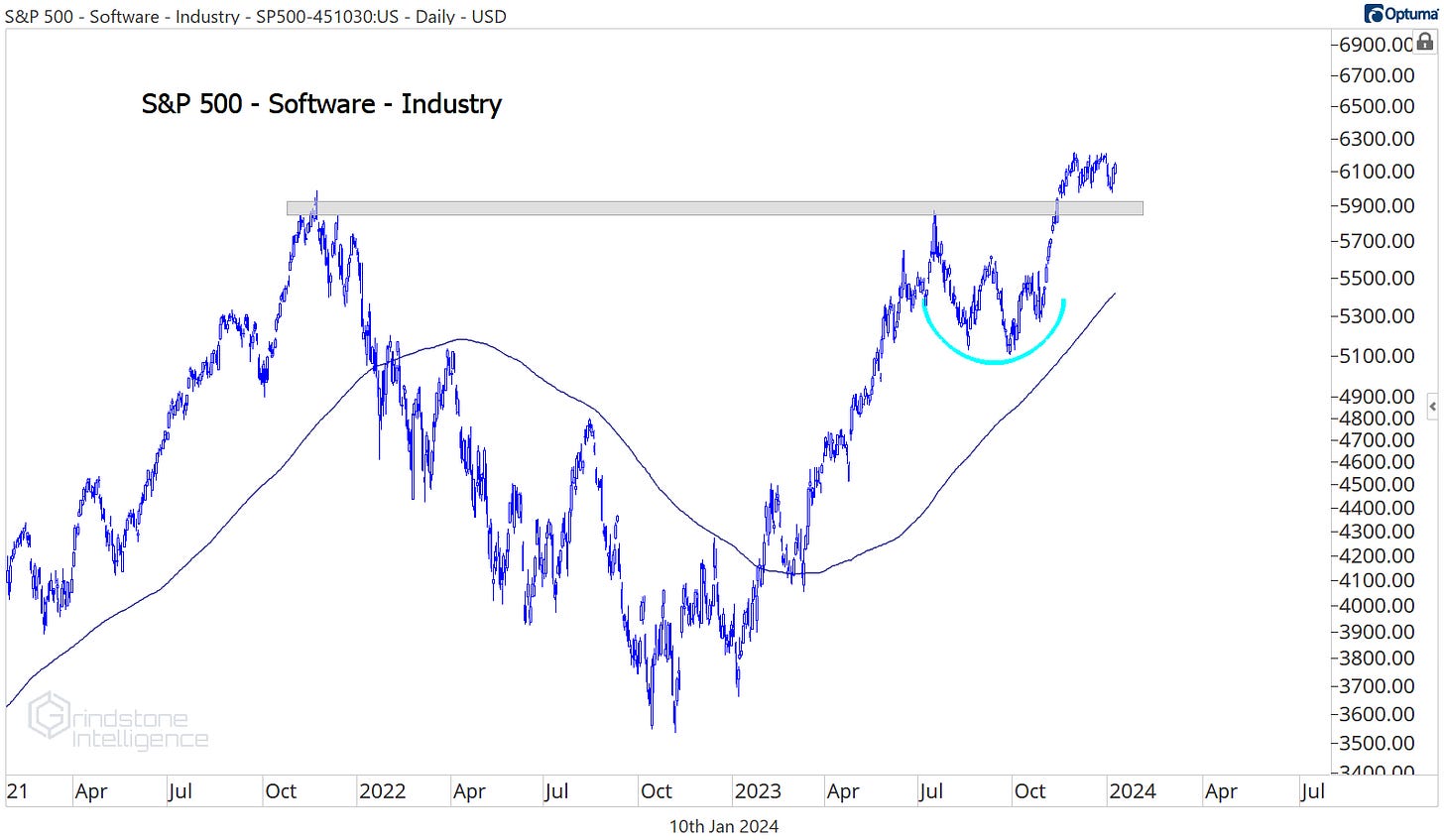

The Software industry offers a better risk/reward proposition. The group is consolidating above its 2021 highs after breaking out above them in November.

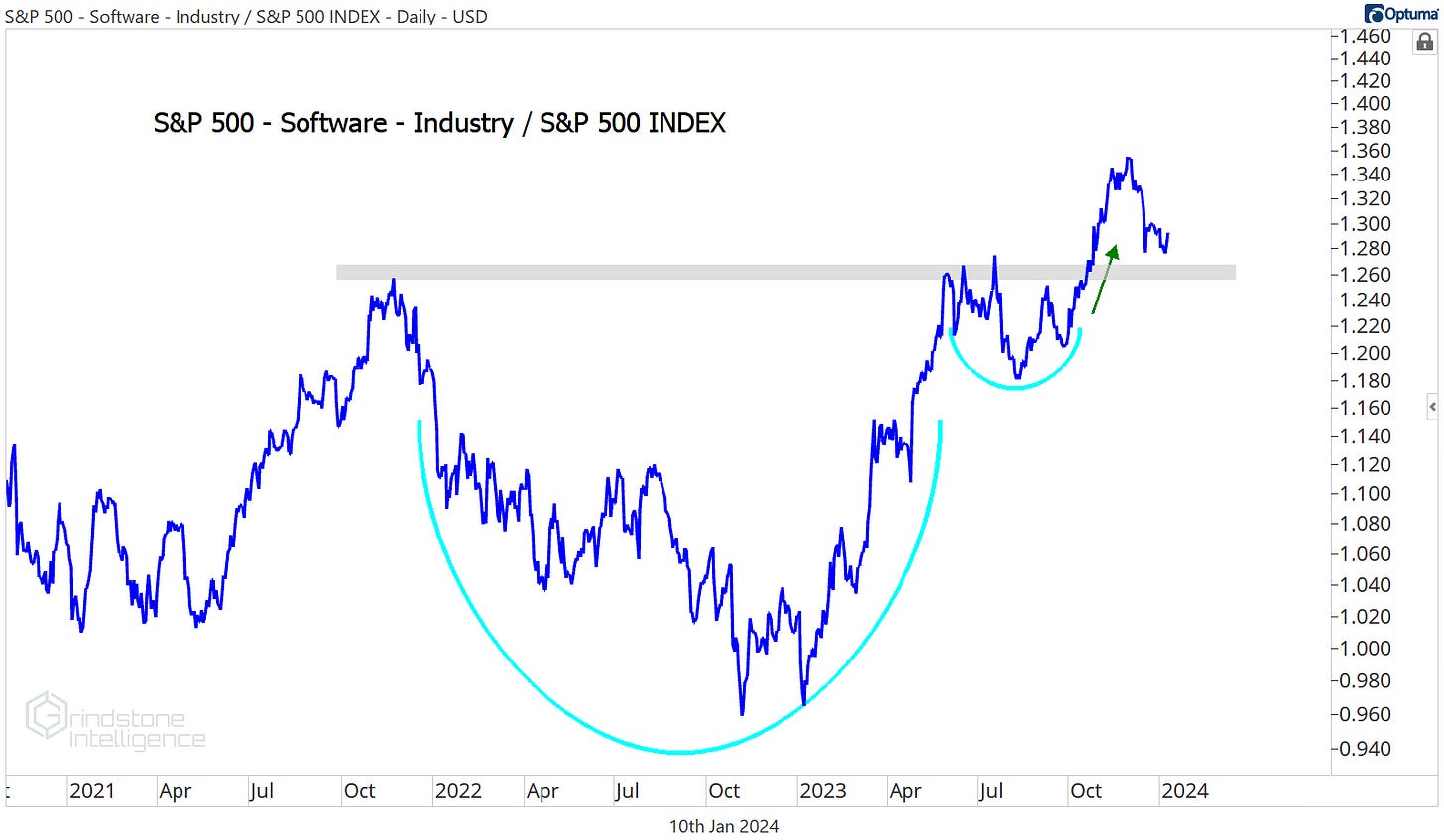

And we’ve got the exact same setup for the group when it’s compared to the S&P 500. We view the relative pullback over the last few weeks as a health consolidation for the software industry, and we want to be looking for software stocks to buy as long as the group is above its 2021 peak.

The Health Care Providers & Services Industry is threatening to break out to new highs after being stuck below the 261.8% retracement from the 2020 decline for the past 2 years. We want to be buying the group above 1725 with a target near 2400.

Within the Financials sector, we like the Capital Markets industry, which resolved higher out of an 18-month base in December. We want to be looking for Capital Markets stocks to buy as long as the group is above 300.

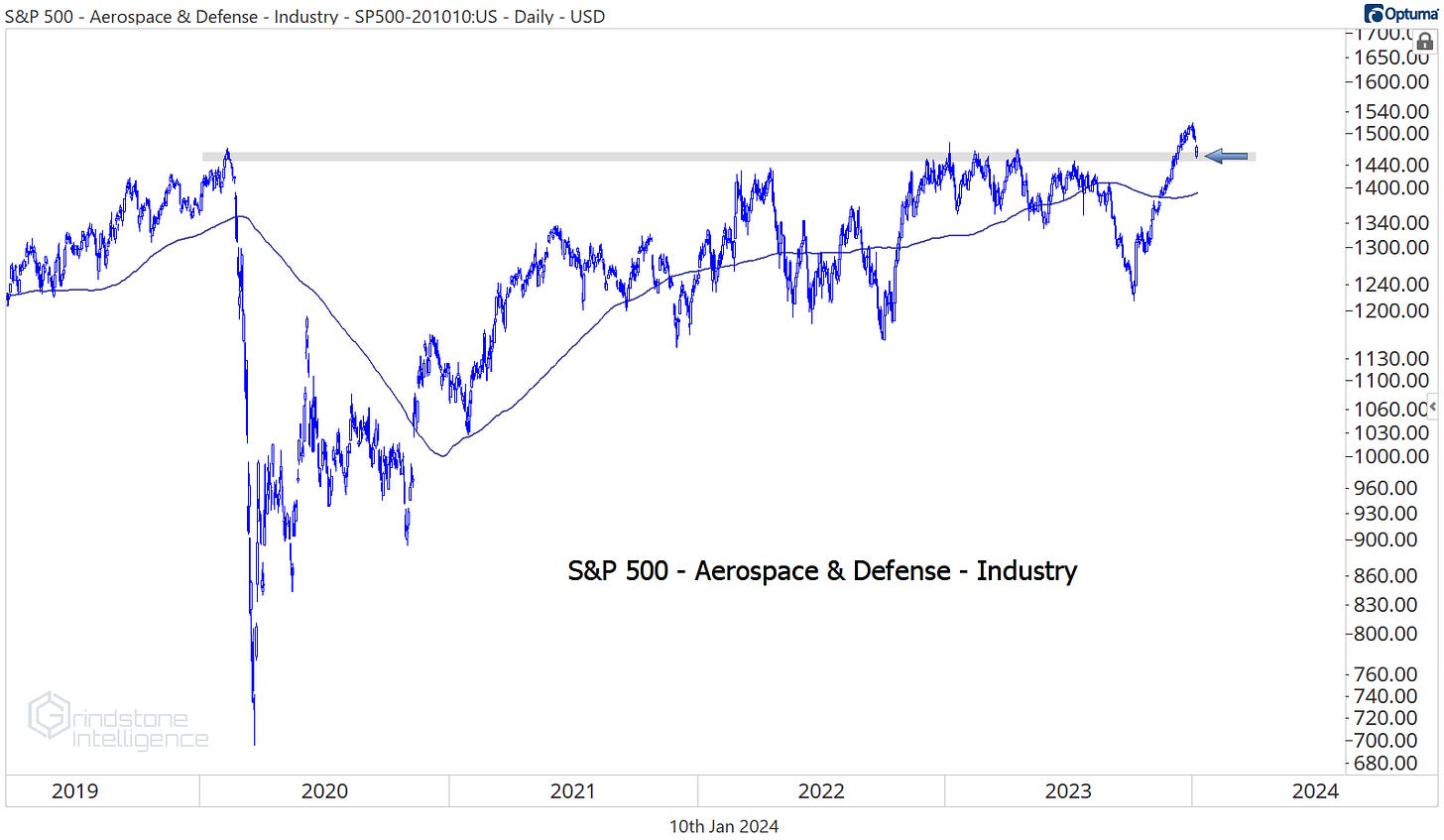

The Aerospace & Defense industry was looking great until a bunch of Boeing employees apparently forgot how to use a ratchet. Now we need to make sure that the group can hold the recent breakout above a 4-year resistance level. The setup here couldn’t be cleaner. We want to be aggressively long above 1450, but only if we’re above 1450. Otherwise, this could be a failed move that results in a big, fast move in the opposite direction.

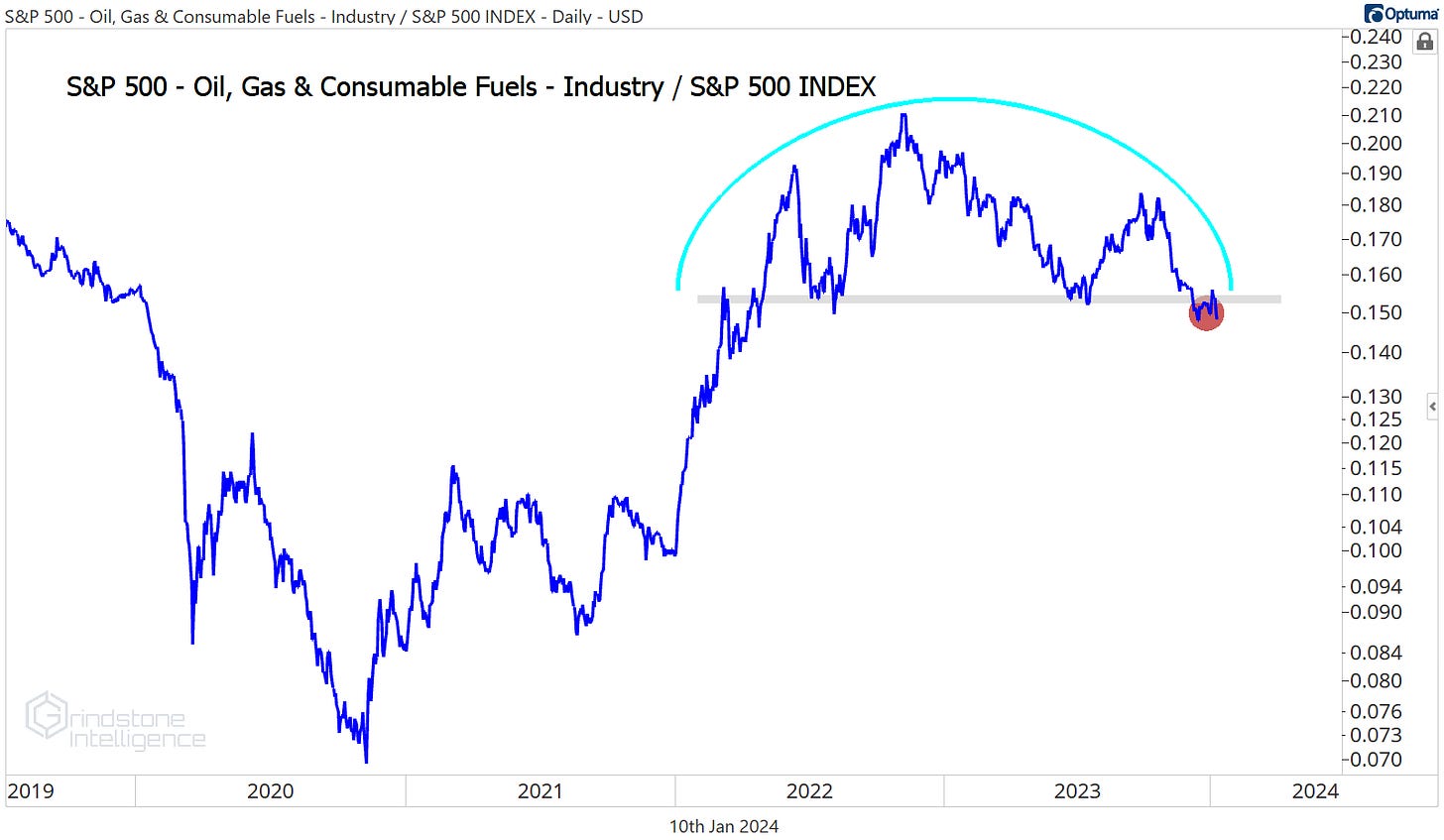

We want to be avoiding Energy stocks, especially those in the Oil, Gas, & Consumable Fuels industry. They just broke down to 18-month lows relative to the S&P 500, and that’s a recipe for a reversion back to the mid-point of the 2020-2022 range.

The Chemical industry - a major component of the Materials sector - is even worse. It just broke its 2022 lows when compared to the S&P 500.

If we see a the bulls step in right here and push this ratio back above support, then we could get behind a mean reversion rally for the Chems. But for now, we’d prefer to focus on the groups that are showing relative strength.

That’s all for today. Until next time.