Looking for Internal Weakness in Stocks? Don’t Hold Your Breadth

The S&P 500 set another intraday record last week. I started this blog 2 years ago with the intention of helping readers identify market trends, but when the foremost equity index keeps hitting new all-time highs, the readers don’t really need my help. The trend is higher. Clearly. And if market breadth is any indication, that trend is in healthy condition.

The concept of breadth is pretty simple: the more stocks that participate in a trend, the stronger that trend is. The cumulative advance-decline line might be the most well-known such indicator. Its calculation is easily understood (the difference between rising issues and falling issues at the close is added to the previous day’s value), and it has reliably diverged before several major market declines. Most recently, the NYSE Advance-Decline line failed to confirm new highs in February 2020, foreshadowing the March collapse in prices. Things are different today. The A/D line is setting new highs right along with the S&P 500.

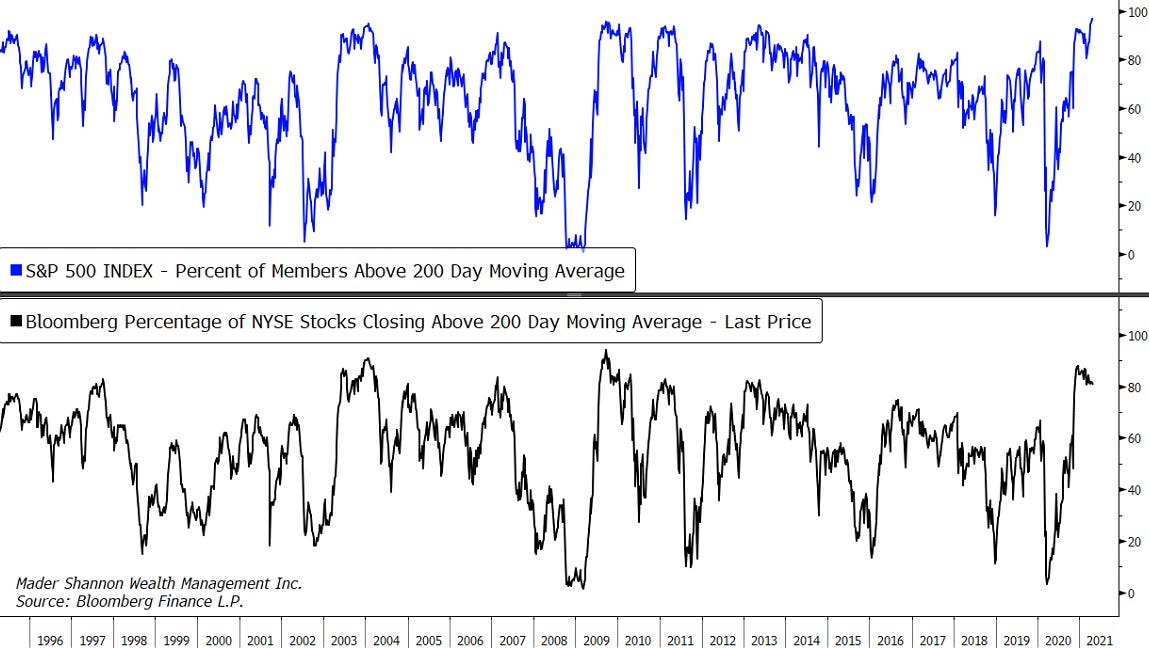

The vast majority of stocks are in uptrends, too. The 200-day moving average is a simple (though not infallible) tool to gauge the trend of prices – if the current price is above the 200DMA, a stock is generally considered to be in a long-term uptrend. At the very least, it’s hard to argue that a stock trading above its moving average is in a downtrend. With that as our backdrop, few stocks today are in downtrends. In fact, more stocks in the S&P 500 are above their 200DMA than at any time in the last 30 years (the extent of my available data).

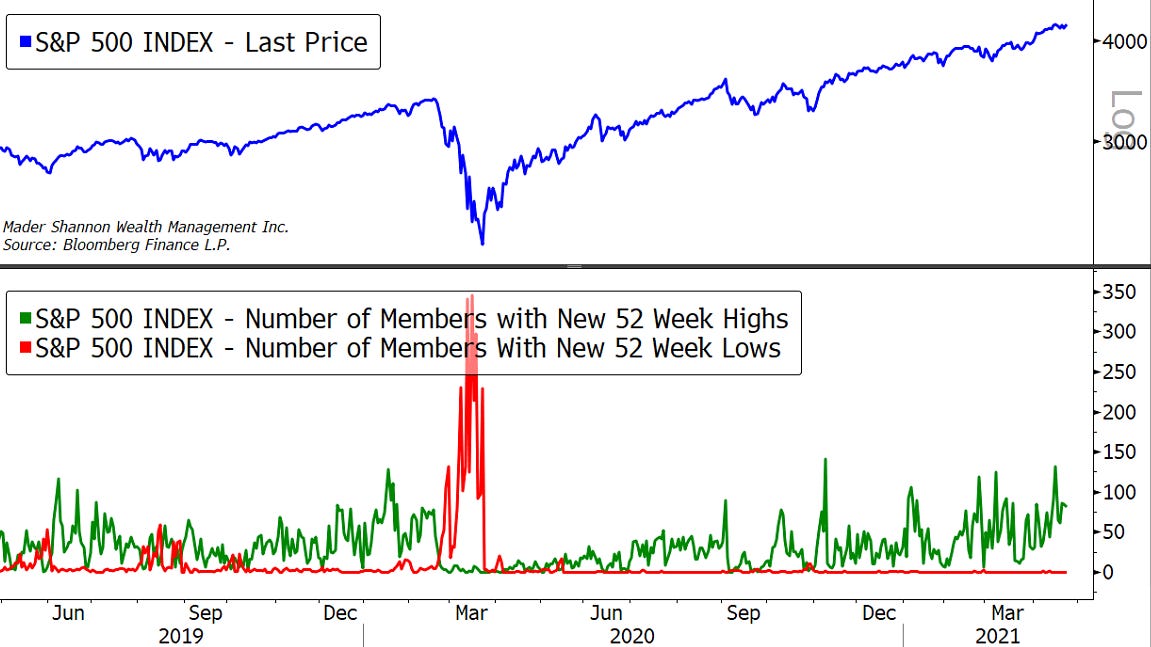

With so many stocks in uptrends, it should come as no surprise that many are setting new 52 week highs as well. And almost none are setting new lows. If trends were weakening, we might see the number of new highs diverge from prices like they did in February 2020 before the selloff began. But that’s not what we’re seeing today.

Stock prices are moving higher. That trend could stay intact for another year or it could change tomorrow. Who knows? No matter the market environment, if you look hard enough for signs of trouble, you can find a reason to be concerned. Right now, market breadth isn’t one of them.

Nothing in this post or on this site is intended as a recommendation or an offer to buy or sell securities. Posts on Means to a Trend are meant for informational and entertainment purposes only. I or my affiliates may hold positions in securities mentioned in posts. Please see my Disclosure page for more information.

The post Looking for Internal Weakness in Stocks? Don’t Hold Your Breadth first appeared on Grindstone Intelligence.