The Median Stock Trailed the Index in 2021. That’s Normal

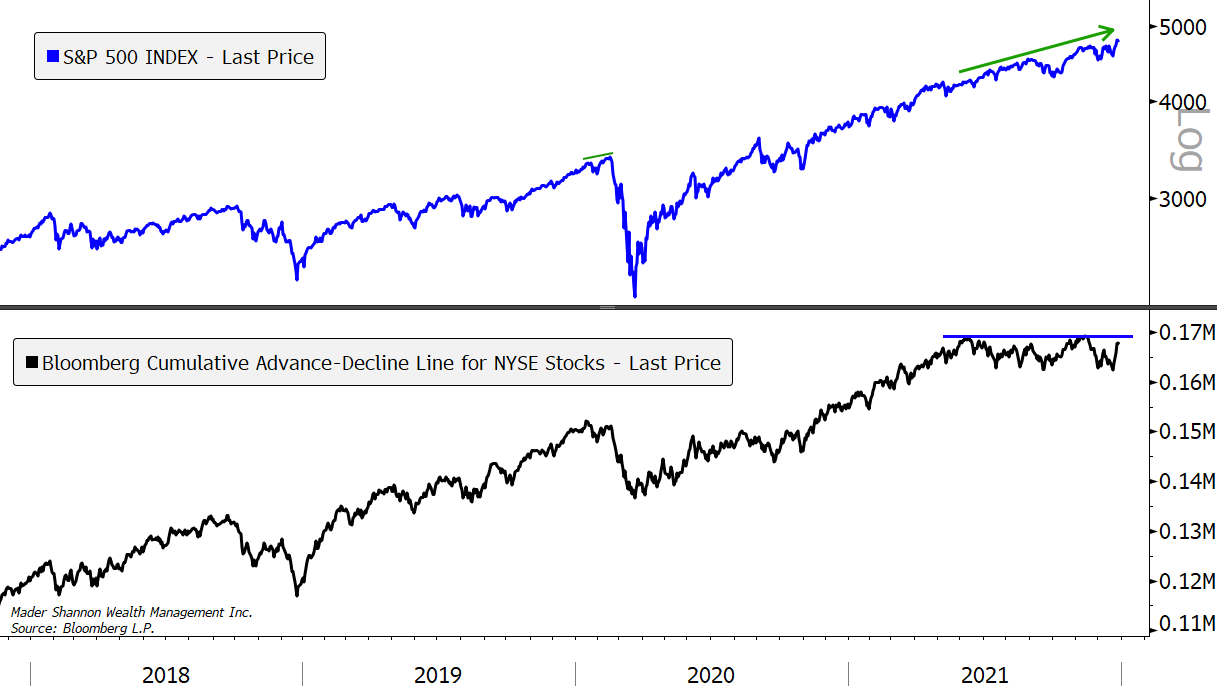

Market breadth wasn’t great this year. That’s not news to anyone that closely follows the markets. Large cap stock indexes have touched new highs in each of the last 14 months, but the cumulative advance/decline line for NYSE stocks stopped going up in June.

It’s been common to hear about how the markets are being dominated by ‘Big Tech’ or ‘FAANG’ or ‘MAGMA’ or whatever we’re calling them these days. It’s true that mega cap stocks have helped push markets higher this year, and it’s true that the average stock is lagging benchmark indices. But the average stock lagging the index is a pretty normal occurrence. Here’s how U.S. stocks have done over the last 25 years.

In 2021, 42% of issues in the Russell 3000 trailed the index, roughly in-line with the average over the last 25 years. Moreover, that’s a significant improvement over 2020, when only 32% of members outperformed – the lowest participation since the internet bubble. Last year’s performance really was dominated by the mega caps.

This year the strength broadened from mega to large cap stocks. But as I’ve covered several times this year, mid and small cap stocks were largely left behind. Many of those companies, in fact, have been more than left behind. They’ve been crushed. And that’s what makes this year abnormal.

The distribution of returns is unusually wide for a year with so little index volatility. The winners are winning by more, and the losers are losing by more. Here’s how each decile has performed relative to the median this year compared to typical performance.

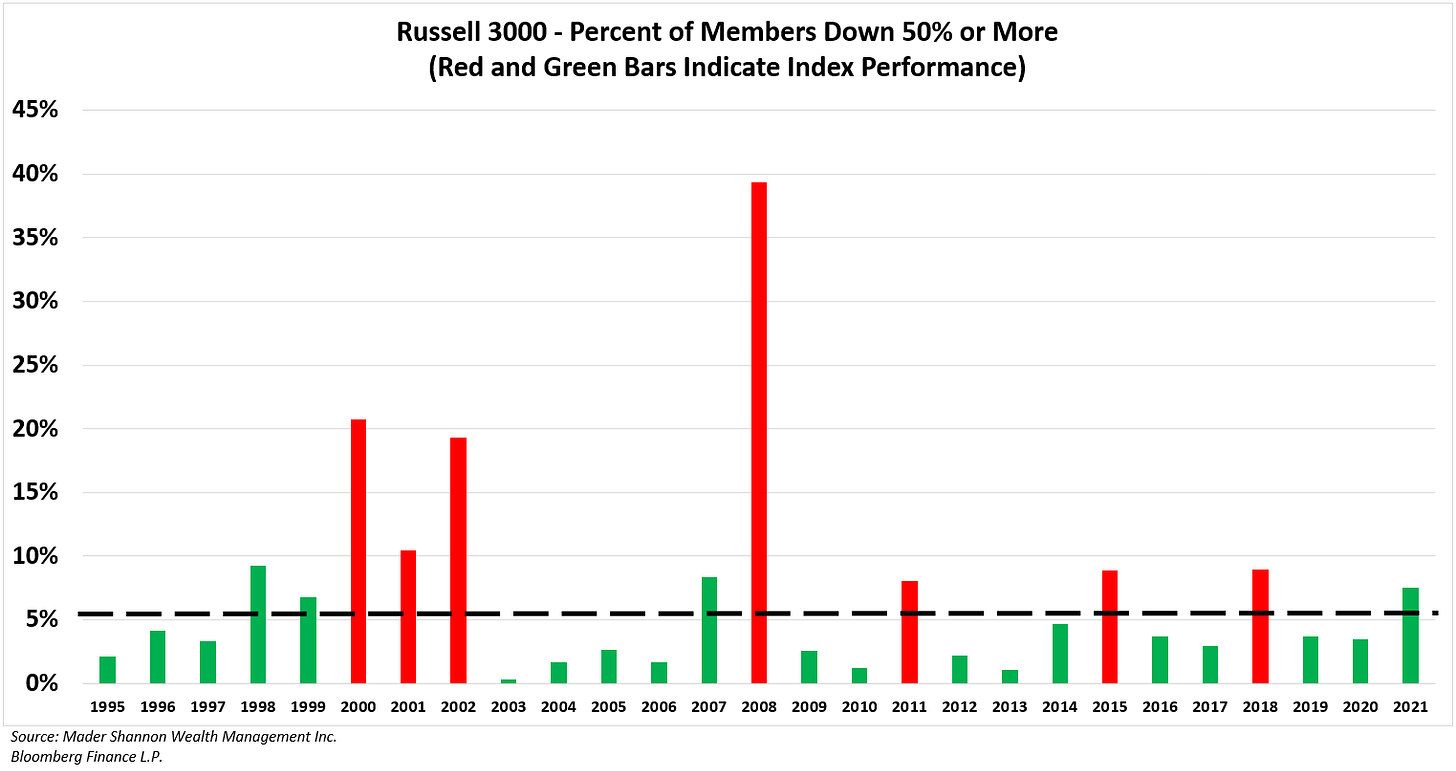

In a year where the Russell 3000 is set to finish nearly 25% higher (10% more than the median since 1995), the number of stocks set to finish the year 50% lower than where they started is twice as high as an average year.

Of the last 10 times that 5% or more of equity issues lost half their value during the year, the index has finished positive only 3 times: 1998 (+22%), 1999 (+19%), and 2007 (+3%). We now get to add 2021 to the list.

Each of those prior instances occurred shortly before a bear market began, so does that mean we’re headed for trouble? Perhaps. But don’t forget U.S. stocks rose 30% from the end of 1998 to the 2000 peak. Breadth alone is not a great timing tool.

Nothing in this post or on this site is intended as a recommendation or an offer to buy or sell securities. Posts on Means to a Trend are meant for informational and entertainment purposes only. I or my affiliates may hold positions in securities mentioned in posts. Please see my Disclosure page for more information.

The post The Median Stock Trailed the Index in 2021. That’s Normal first appeared on Grindstone Intelligence.