Mid-Month Macro Musings - 11/14/2023

A Labor Led Recession?

Widespread recession predictions began more well over a year ago, but so far, the US has avoided widespread economic downturn. Why? Thank the consumer.

Harry S Truman once quipped, “It's a recession when your neighbor loses his job; it's a depression when you lose your own.” For most of the last two years, though, it’s been neither. Everyone has had a job. The unemployment rate in January was 3.4%, a level last seen in the late 1960s.

While unemployment is near record lows, job openings have remained near record highs. As of the latest report, roughly 1.5 job openings were listed for every unemployed worker in the United States. How meaningful is that? Prior to 2018, the ratio of job openings to jobless had never even reached 1.0. Right now, the labor market is 50% tighter than that.

With a tight labor market came increased negotiating power for workers. Labor unions are experiencing a renaissance like they haven’t had since the 1970s, including big wins in the past few months against employers like UPS, Ford, General Motors, and Stellantis. Total employee compensation has risen 4.4% over the last 4 quarters - down from the peak rate of 5.1%, but still double the average growth rate from the 2010s.

I learned back in Economics 101 what should happen when the price for labor increases, but I’ve learned that reality is distorted by complex nuances and rarely follows simple textbook explanations. This time, though, Professor Coronado’s teachings paid off. Labor supply has increased in response to the tight labor market, pushing the prime age labor force participation to its highest level in 20 years! Driving the increase are female workers, who now are working at a higher rate than ever before.

There’s a limit to everything, though. Unemployment rates can’t go to zero, as it takes time for new entrants to find work and for job switchers to find positions that match their skillset. And eventually, no more workers can be drawn into the labor force.

We’re finally seeing those signs of normalization. The unemployment rate is still quite low compared to historical averages, yet has ticked up to 3.9%. Continuing claims are on the rise.

The question is, at what point does ‘normalization’ become ‘slowdown’?

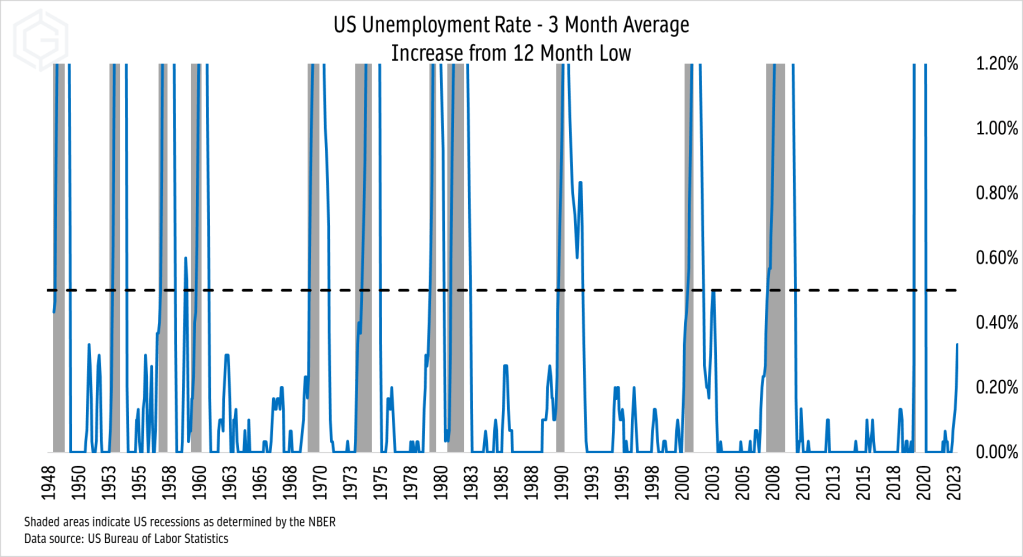

Claudia Sahm, a former economist at the Federal Reserve, created a metric that can help us answer that question. Known as the Sahm Rule, her research shows that every time the 3-month average unemployment rate has risen more than 0.5% from its 12-month low, the US has entered recession. We haven’t crossed that threshold yet.

Similar to the Sahm’s work, our research shows that the increase in continuing jobless claims haven’t been sustained long enough to trigger a recession warning, either. When claims don’t set a new 6 month low for more than 40 weeks, the US has always entered a recession. Jobless claims, reported every Thursday morning, were on a concerning trajectory for the first part of the year, but then peaked in April.

In short, the labor market is turning, but the data doesn’t quite say a recession is at hand.

That said, we can’t ever rule out a downturn. No one indicator is perfect, and even the best-trained economists (who are much smarter than we are) are notoriously bad at predicting recessions. We’re keeping an open mind and thinking about how bad things could get.

The Economic Bear Case: Cracks in Consumer Credit

Last week, the New York Fed Consumer Credit Panel published its quarterly report on Household Debt and Credit. Unsurprisingly, it showed that US consumers are continuing to support their spending with borrowing. Total debt balances rose to $17.29 trillion.

The level of debt tends to grab the most headlines, but the level matters far less than consumers’ ability to service that debt. (If you disagree, just ask today’s homebuyers. A $400,000 mortgage in 2021 is considerably more affordable than a $250,000 mortgage today.) On balance, households are still making ends meet. The percent of credit balances in delinquency is well below where it was in 2019.

However, delinquencies ticked up meaningfully over the most recent quarter, and there are some concerning trends beneath the surface. For one, total delinquencies are being held down by the absence of student loan delinquencies. From early-2020 until last month, borrowers weren’t forced to make payments on student loans. That pushed the delinquent percentage of student loan balances from more than 10% to about 1%.

Looking past the data that’s distorted by student loans, it’s clear that consumers are starting to have issues - especially those aged 18-39. For that age bracket, a higher percentage of credit card balances are in serious delinquency than at any point in the last decade.

It’s the same thing for auto loans. The youngest borrowers are more behind on payments than they’ve been since the tail end of the financial crisis.

Further weakening in the labor market would be gasoline on a consumer credit dumpster fire. Already, lenders have become more reluctant to make consumer loans. According to the Fed’s Senior Loan Officer Opinion Survey, the appetite for making consumer loans is at levels seen only 2 other times in the last 30 years. Both were during sharp economic downturns.

A surge in late payments would only increase their resolve… and credit crunches almost always cause recessions. In our opinion, that’s where the biggest risk to the economy lies.

Until next time.