Mid-Month Macro Update

Slowing Progress on Inflation

Someday, perhaps, we’ll get to stop talking about inflation. As long as prices remain the most important variable in the economic outlook, though, we’ll keep providing updates for our readers.

Last week, we received a fresh batch of inflation data with the August CPI and PPI reports. The Consumer Price Index revealed positive news for economic observers. Core inflation fell for the fifth straight month, and on a 3-month annualized basis, dropped to the lowest level since March 2021.

However, that good news came with a caveat. ‘Core’ measures of inflation strip out the price of food and energy – and energy prices are reaccelerating.

The reason economists regularly cite core inflation is not because food and energy prices don’t matter, but because food and energy prices tend to be volatile and not indicative of broader price pressures in the economy. In short, core inflation has traditionally been a better predictor of future inflation.

However, sustained increases in energy prices – not just volatile swings – can lead to broader price pressures. That was a major theme during 2021 and 2022, and one that was initially (and incorrectly) discounted by policy makers. When fuel prices rise, so do production and transportation costs, and over time, those costs can spill over to consumers.

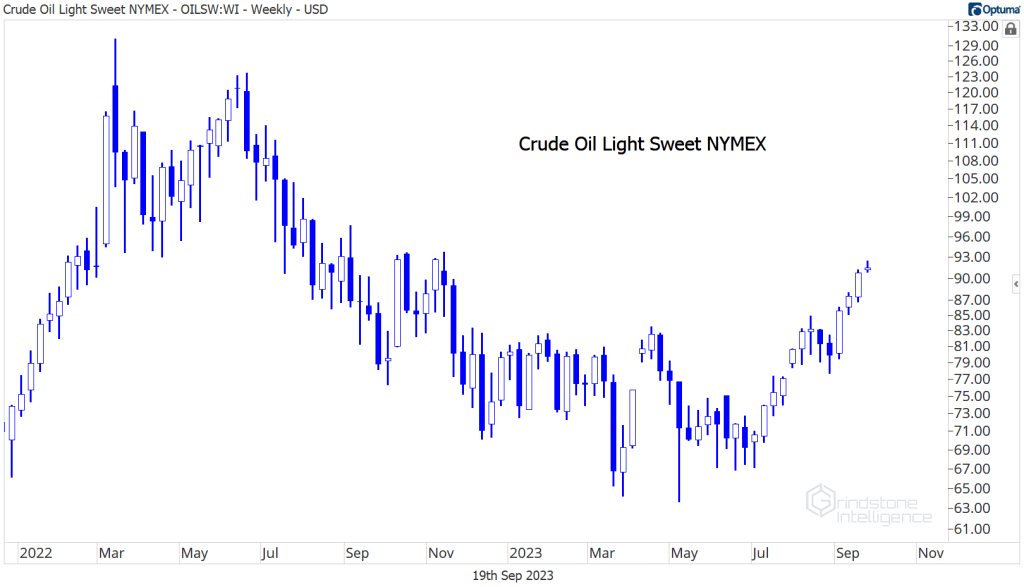

Crude oil prices have now risen for 10 of the last 12 weeks. They’re more than 40% above the lows set last May and knocking on the door of their highest level since last September.

The latest stage of the rally came after Saudi Arabia extended voluntary crude oil production cuts to the end of the year, a move they say will help bring the oil market into balance as global economic uncertainty abounds. The price reaction is a welcome development for OPEC and its allies, which have held less sway over the oil market in recent years given the proliferation of production elsewhere, especially in US shale regions.

As a result of oil’s rise, PPI for Consumer Energy Goods rose in August at the fastest monthly rate since 1990.

Meanwhile, concerns about labor costs continue to permeate the news flow. There’s a shortage of workers in the US. The number of jobs available for every unemployed person in the US has declined from last year’s peak level, but at 1.4, is still well above anything this country had experienced prior to the pandemic.

Labor unions are taking advantage of the shortage. The International Brotherhood of Teamsters reached an historic agreement with UPS earlier this summer, which included significant wage and working condition concessions from the package delivery company. According to the Teamsters, wage increases for full-timers will keep UPS Teamsters the highest paid delivery drivers in the nation, improving their average top rate to $49 per hour. And in another big win, UPS will equip in-cab A/C in all larger delivery vehicles, sprinter vans, and package cars purchased after Jan. 1, 2024. The Teamsters estimate the incremental costs for UPS to be near $30 billion.

Now, the United Auto Workers union is looking for a big win of its own. Contracts with the Big 3 US automakers expired this month, which gave new UAW President Shawn Fain a chance to set new industry standards. He opened negotiations with calls for a 40% pay increase, a 32-hour workweek, and improved retirement benefits, among other things. When he and auto industry executives failed to reach an agreement by last week’s deadline, the union began strikes at 3 plants – one for each Ford, GM, and Stellantis. If no progress is made, the UAW intends to ramp up strike activity in the coming weeks.

Increased labor costs drive inflation higher, which could cause more problems in the future. Labor strikes have negative economic repercussions today. According to Goldman Sachs, a prolonged UAW strike would weigh significantly on Q4 GDP growth – as much as 0.6% if the strike lasts as long as the one in 1998.

That’s just one of the headwinds facing the economy in the months ahead. Student loan payments are set to resume in October, which will undoubtedly crimp consumer spending. Political gridlock in Washington puts a government shutdown on the table next month, too. Each of those could add another 0.5% drag to economic growth in Q4.

At this week’s FOMC meeting, Fed officials will have to weigh the potential for an energy-driven reacceleration in inflation against the growing risks to the economy. Almost no one expects they’ll raise rates tomorrow. Instead, we’ll be focused on the Summary of Economic Projections, where participants will detail their latest estimates for growth, inflation, and interest rates over the coming months and years. At his post-meeting press conference, expect Powell to leave his options for November open.

Meanwhile, the European Central Bank last week decided to raise interest rates for the 10th consecutive meeting. It could be their last. From the statement: Based on its current assessment, the Governing Council considers that the key ECB interest rates have reached levels that, maintained for a sufficiently long duration, will make a substantial contribution to the timely return of inflation to the target.

Two other major central banks are also scheduled to meet this week. The Bank of England will likely raise rates for the 15th time in 2 years, bringing their policy rate to the highest level since 2008. It could be their last hike as well, according to economist surveys, but recent wage inflation data make a pause at Thursday’s meeting unlikely.

The Bank of Japan, under the relatively new leadership of Governor Ueda, is unlikely to change short-term interest rate targets as they monitor an increasingly fragile economy. However, Ueda may give further clarity on future plans to end negative interest rate policy. He’s already taken steps toward that end, including raising the cap on long-term interest rates in July, which the BOJ hoped would improve liquidity in that market.

Third Quarter Earnings Preview

We haven’t slowed our talk about inflation, but management teams have. Transcript data from earnings conference calls show that mentions of the word ‘inflation’ have steadily declined in recent quarters.

The talk about rising costs and price increases has been replaced by the latest hot topic – one that tends to get investors much more excited: Artificial Intelligence. AI mentions have skyrocketed this year:

Perhaps one reason everyone is so excited about Artificial Intelligence is because AI can be a solution to inflation.

By harnessing the power of AI-driven automation, businesses can streamline their operations, reduce costs, and improve efficiency. AI systems can optimize supply chain management, forecast demand with greater accuracy, and enhance inventory control, all of which can lead to reduced production expenses and more stable prices for consumers. Additionally, AI-driven data analytics can help policymakers make more informed decisions about monetary policy and fiscal measures, ensuring a more balanced and stable economic environment. Furthermore, AI can empower financial institutions to better detect and prevent fraudulent activities, thus safeguarding the integrity of the financial system. In essence, AI’s ability to enhance productivity across various sectors can contribute to curbing inflationary pressures and fostering economic stability.

For example, ChatGPT wrote that last paragraph in less than 10 seconds after being given a a very simple prompt: Write a paragraph about how AI can help solve inflation by increasing economic productivity.

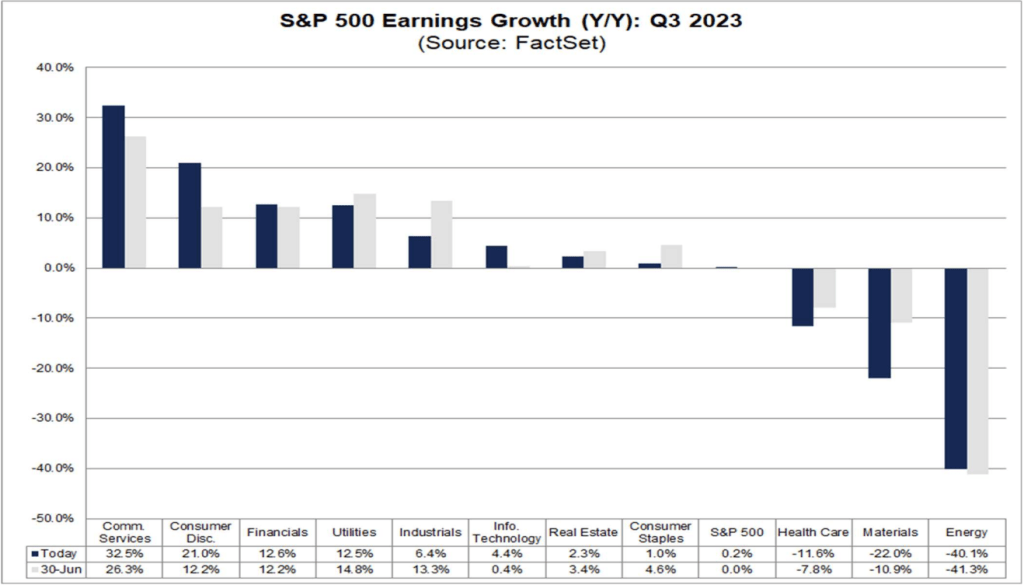

AI will have an important role to play for years to come. In the more immediate future, third quarter earnings reporting season kicks off in just a few weeks. S&P 500 earnings are expected to grow modestly, driven by a 32% increase in EPS for the Communication Services sector and 21% growth for Consumer Discretionary. Energy and Materials sector earnings are set to decline 40% and 22% respectively, according to estimates.

If actual S&P 500 earnings results confirm expectations, it will be the first time since Q3 2022 that index earnings have grown year-over-year. It will take more than that to change the story for 2023. Even though sales are expected to rise 2.3% this year, the bottom line is set to drop 2.3%.

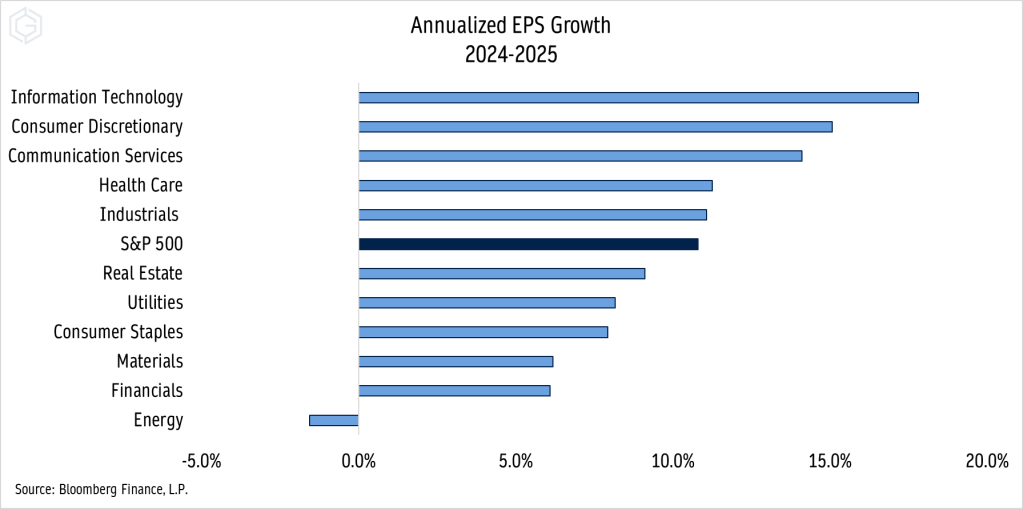

Fortunately, analysts forecast that index EPS will rebound with double digit gains over each of the next two years. The Information Technology, Consumer Discretionary, and Communication Services sectors are expected to lead the way.

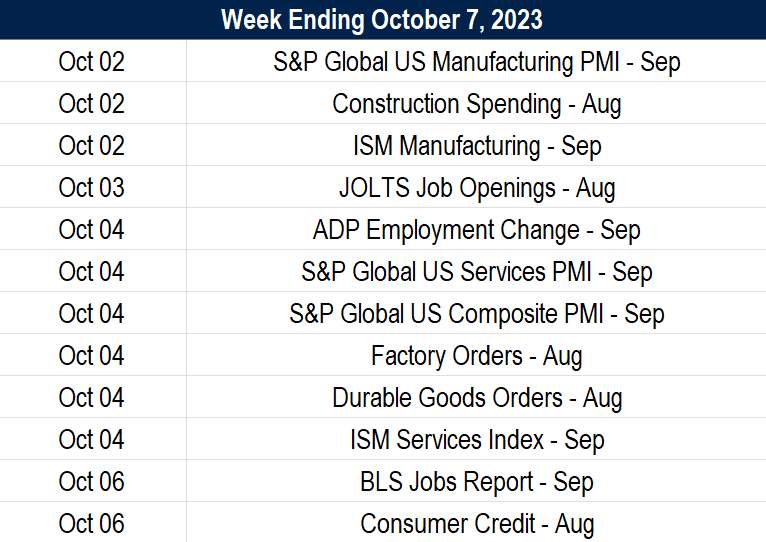

A Look at What’s Ahead

The post Mid-Month Macro Update first appeared on Grindstone Intelligence.