Mid-Month Macro Update

Progress on Inflation Continues

Inflation data continued to show positive developments in last week’s report. Even though CPI rose modestly from the prior month’s 3.0% year-over-year print, the 3.2% reading was still better than most analysts had forecast. The biggest improvement came from so-called “core” inflation, which strips out volatile food and energy components of the CPI and is a better indication of the underlying inflation trend according to economists at the Fed. Core CPI dropped to 4.7% year-over-year, still more than double the target of central bank policy makers. Over the last 3 months, though, the reading has dropped to an annualized level of just 3%. That’s the lowest in almost two years.

The continued moderation is little surprise to us. We’ve been pointing out that inflation has been rather subdued for more of the last year. In September 2022, CPI ex-shelter dropped to 0% on a 3-month annualized basis, and it’s remained near the Fed’s target ever since. The year-over-year number is a paltry 1.2%.

“Is it really fair to strip out shelter? People have to pay for housing, too.”

True. Housing costs are important, which is why they comprise roughly one-third of the Consumer Price Index. But the BLS inflation tracker is notoriously poor when it comes measuring the changes in shelter costs: Home prices at the national level are actually lower than they were a year ago, and according to Zillow data, rent price inflation peaked 18 months ago.

CPI for shelter tends to follow those two data sets, but with a considerable lag. And we’re starting to see the turn. We expect shelter to exert significantly less upward pressure on headline and core inflation readings for the balance of the year.

Does that mean the Federal Reserve will call it quits on interest rate hikes? We think so. Last month, the Fed hiked rates by 0.25%, bringing the Federal Funds Target rate to the highest level in more than 20 years.

Though Jerome Powell declined to declare victory over inflation at his post-meeting press conference and was non-committal about what the next move might be, we believe July’s inflation report was good enough to warrant a pause at the September FOMC meeting. And if our beliefs about the trajectory of inflation over the back half of the year hold true, the Fed should be comfortable holding rates steady through year-end.

What are Fed officials saying about it? Well, Powell hasn’t said much of anything, and likely won’t until the Kansas City Federal Reserve hosts its annual retreat in Jackson Hole later this month. Governor Bowman made headlines last week when she voiced support for “additional rate increases” (note the plural: increases), but Philadelphia Fed President Patrick Harker spoke later that day and claimed that rates were already at a sufficiently restrictive level. Meanwhile, noted hawk Raphael Bostic from Atlanta has been in the ‘pause’ camp for awhile and even Minneapolis President Neel Kashkari has softened his tone.

In fact, Kashkari even went so far as to talk about the timeline for lowering interest rates earlier today. His opinion mirrored that of New York President John Williams, who in a recent interview with the New York Times spoke to the importance of targeting a real level of interest rates, rather than nominal. That means the Fed may need to cut nominal interest rates sometime next year as inflation falls, in order to keep real interest rates from rising.

For some reason, Williams’ comments got quite a bit of press, as if this is some new order of thinking at the Fed. It must be because people weren’t paying attention to Federal Reserve Chair Jerome Powell two months ago, when he said the same thing. Here’s an excerpt from our brief recap of the post-FOMC press conference back in June.

“Notably, the SEP showed expectations for a rate cut sometime next year, even while inflation remained above the 2% target rate in those forecasts. Fed Chair Jerome Powell justified this by saying that he’s targeting a level of real interest rates, so he anticipates rates will need to fall with inflation after they’ve reached a sufficiently restrictive level.”

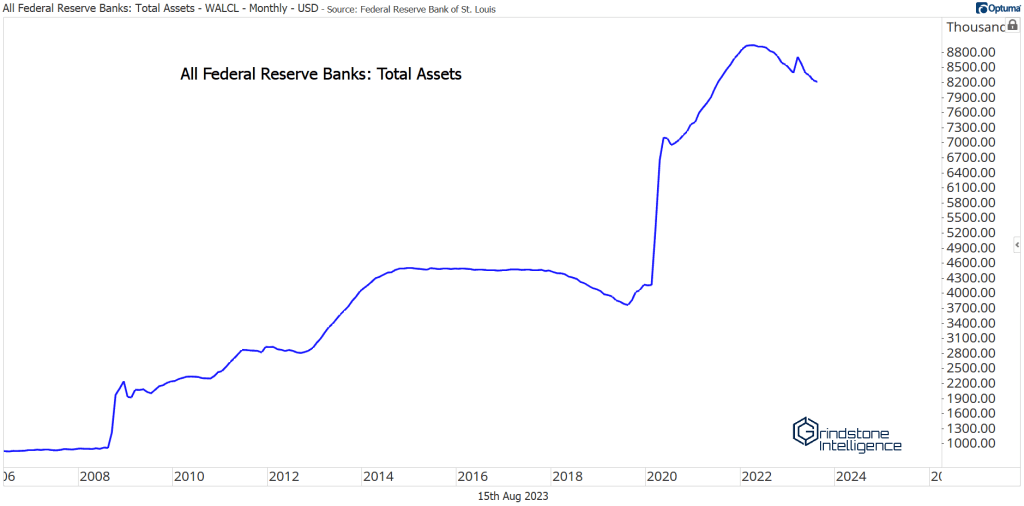

So barring an unforeseen reacceleration in inflation, it looks as though interest rate hikes have reached an end – or are nearing an end, at the very least. The Fed still has one important tightening tool at their disposal, though, and it’s still quietly exerting downward pressure on market liquidity: The balance sheet.

In the Fed’s first and only previous experience with quantitative tightening back in 2018-2019, they overshot the mark, forcing them to reverse course and restore stability to the overnight lending markets. The Fed’s asset level is still more than double where it was back then, which means we’ve likely got some room before reserve scarcity is a problem. But even monetary policy officials aren’t sure what the ‘right’ level for their balance sheet is, and it’s possible they won’t know until they’ve gone too far once again.

About that recession…

Remember when everyone was so sure that the US was headed for a recession? As Yogi Berra reminded us, “It is difficult to make predictions, especially about the future.”

The problem isn’t that economists are dumb. They’re well-educated, extensively trained and certainly a lot smarter than we are. The problem is that the economy is huge, there are tons of variables, and it’s downright hard, if not impossible, to accurately model its future. That’s why we generally refrain from making big economic forecasts here at Grindstone, and instead try to keep an open mind about possible future outcomes.

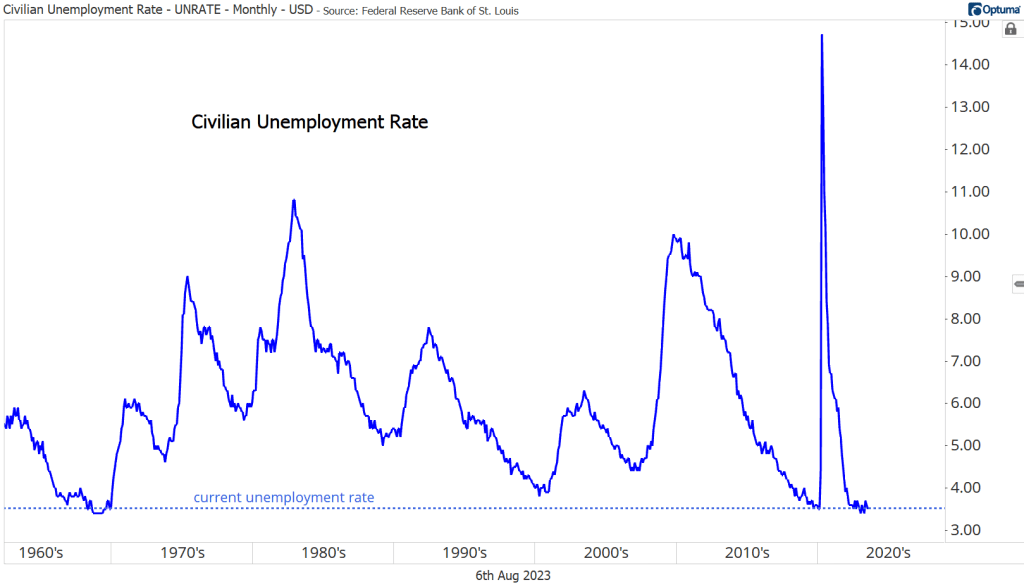

One thing seems certain, though. We aren’t in a recession right now. The U-3 unemployment rate is near its lowest levels in decades.

And the labor market remains extremely tight. There are 1.6 jobs available for every unemployed worker, something that was simply unimaginable 5 years ago.

People have jobs, and they’re spending money. Retail sales surprised to the upside in July, driven by both a successful Amazon Prime Day and broad increases in other spending categories. Real retail sales improved, too, although they’ve been flat for more than a year now.

The strong consumer report follows a surprise reacceleration in GDP in the second quarter, where real growth was 2.4%.

In short, this level of economic activity isn’t what you’d expect to see in a recession. Perhaps that will change over the next few months, as student loan payments resume, excess savings dwindle, revolving credit balances return to normal, and higher interest rates start to drag. Or perhaps nothing changes.

We won’t make any predictions, but we will be watching.

Debt Downgrades

Fitch downgraded long-term US government debt to a notch below AAA to kick off the month, citing recurring political battles over the debt ceiling and rising fiscal imbalances that will make it more difficult to service debt.

In our humble opinion, the downgrade itself isn’t a problem. After all, S&P Global downgraded US Debt to AA+ all the way back in 2011, and that didn’t mark the end of US Treasurys as a risk-free standard, or of the US Dollar as the world’s reserve currency.

Instead, the downgrade is a symptom of the problem, which is that government fiscal imbalances are unsustainable. The only thing which our two esteemed political parties seem to agree on is that more spending is better, and until that changes, the ability of the US Government to repay its debts will deteriorate.

It’s not just the US Government whose credibility is being called into question. Moody’s shook up its ratings on US banks last week, downgrading 10 names, putting another 6 under review for a downgrade, and placing negative outlooks on 11 more. An analyst at Fitch said the agency may soon have to downgrade its ratings on banks as well, after downgraded their view of the sector in June.

Downgrades or not, the market is largely shaking off concerns about debt repayments. Investment grade credit spreads have fully erased the post-SVB spike and recently dropped to new 52-week lows.

And even though the most recent Senior Loan Officer Opinion Survey showed that lenders continue to tighten up their standards, businesses aren’t reporting a significant deterioration in their ability to acquire credit. In the most recent NFIB Small Business Survey, the “Availability of Loans” was unchanged for the third consecutive month, and on par with the level reached last August.

At some point, rising interest rates and tightening lending standards may result in a credit crunch. We just aren’t seeing it today.

A Look at What’s Ahead

The post Mid-Month Macro Update first appeared on Grindstone Intelligence.