Mid-Month Macro Update: May 2023

Inflation on the Right Track

Slowly but surely, prices are starting to normalize.

Consumer prices in the month of April rose at an annual rate of less than 5% for the first time in 2 years. Even more encouraging, the annualized 3-month change has been below 5% since September. That’s still above the Fed’s 2% annual target, but it’s not far above the levels we experienced in 2017 and 2018. The deceleration has been driven by energy prices, which have fallen 5.1% over the last 12 months.

Unfortunately, core inflation remains persistently elevated, and that measure tends to be a better indicator of future prices. Sticky services, a resurgence in the price of some durable goods, and housing costs are to blame – Core CPI rose at a 5.5% annual rate in April.

The good news is, housing costs are finally showing signs of stabilization. After more than two years of acceleration, the year-over-year change in the price of shelter ticked down in April. To be sure, it’s tough to get excited about 8% inflation in the single largest component of the CPI. But leading indicators of this index, including rent prices and national home prices, point towards continued normalization in the months ahead.

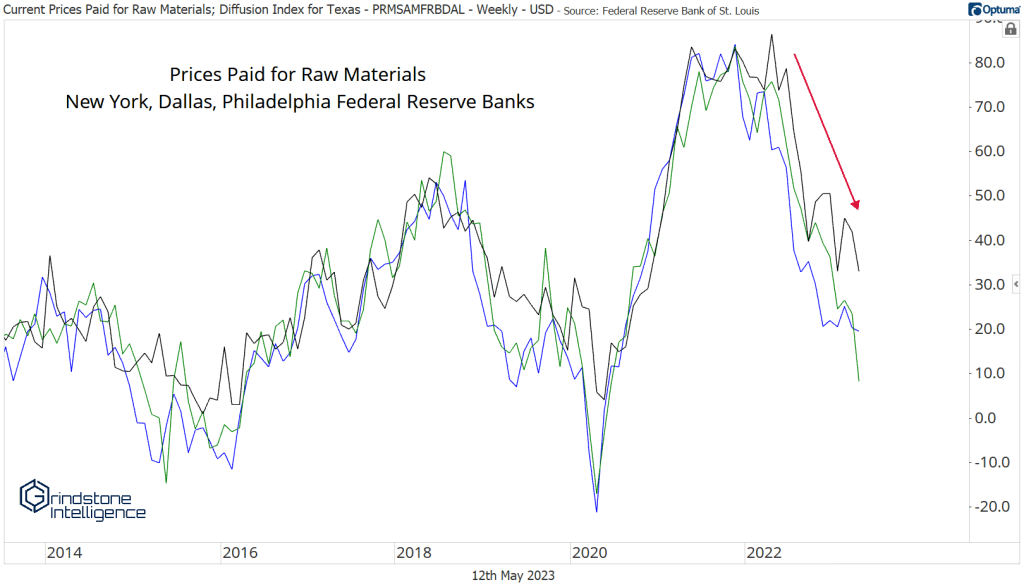

Business surveys indicate that price pressures are easing, too. The latest NFIB report showed that planned price increases from small businesses were back to pre-pandemic levels. Perhaps that’s because input costs are falling? Polls conducted by regional Federal Reserve banks show at prices paid for raw materials are returning to historical averages. In Philadelphia, the latest number was lower than any we’ve seen since 2016, pandemic extremes aside.

That’s a good sign for future inflation readings.

Focusing on the Fed

The Federal Reserve raised rates for a tenth consecutive meeting earlier this month. The hike came as no surprise, as most officials had voiced support for a more restrictive policy stance even in the aftermath of recent bank failures . Neither was it surprising, though, when Chair Jerome Powell laid the groundwork for a pause by removing language from the prior meeting’s press release that indicated additional policy firming would be necessary, and replacing it with more flexible language that highlights the Fed’s data dependence going forward. The latest hike brought rates in-line with the median year-end expectation of FOMC members, as indicated in the most recent Summary of Economic Projections. Incidentally, that’s also where the policy rate stood immediately before the Great Financial Crisis.

The Chair believes policy is near a level that is sufficiently restrictive to bring inflation down to the Fed’s 2% target. While recent meeting minutes showed that Fed staffers now project a mild recession later this year, Powell himself still believes a low-growth outcome is the most plausible. For that reason, he doesn’t believe the Fed will be forced to cut rates anytime soon. However, he voiced an openness revising his expectations should the data change.

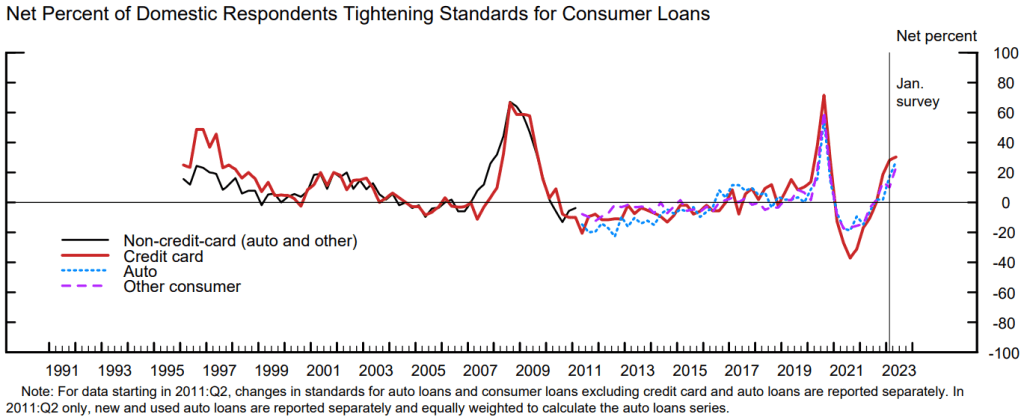

Ever the pragmatic pivoter, he indicated that he’ll be focusing a bit less on incoming inflation and employment data, and more on how cumulative tightening actions, ongoing QT, and recent bank failures will affect credit creation and stymie demand. To his point, the May release of the New York Fed’s Senior Loan Officer survey showed that credit standards for consumer loans are tightening at a pace we’ve rarely seen in the past 25 years.

Please leave this field empty

See which charts are catching our eye each week when you subscribe. It's FREE

Email Address *

Check your inbox or spam folder to confirm your subscription.

A Look at What’s Ahead

The content displayed here is for educational and informational purposes only and is not intended to constitute personalized investment advice. Contact a financial advisor if you have questions regarding your personal financial situation.

The post Mid-Month Macro Update: May 2023 first appeared on Grindstone Intelligence.