Mid-Month Market Update: April 2023

Poised for an Earnings Recession

Nearly half of S&P 500 constituents will report first quarter earnings over the next two weeks. If consensus expectations are correct, they’ll show that company profits are declining for a second straight quarter. Back-to-back EPS declines would signal the first ‘earnings recession’ since 2020, when COVID lockdowns brought the global economy to a grinding halt.

Since that time, corporate profits have risen at a pace that far exceeds the average annual EPS growth rate of 7%. Estimates for 12-month forward earnings are more than 60% higher than their 2020 lows.

Stimulus-fueled demand and record profit margins were largely to thank for that rise – but now those tailwinds have faded.

Revenues in the first quarter are expected to rise only 2% according to FactSet, substantially less than the annual rate of inflation. Profit margins are contracting, too, from last year’s elevated rate of 12.2%, to more modest 11.2%. Taken together, that points to an EPS decline of 6.5%. You rarely see that kind of drop outside of economic recessions.

Fortunately, actual earnings usually exceed expectations. In most years, consensus estimates trough in the weeks ahead of the reporting season, then hook higher as companies beat lowered expectations.

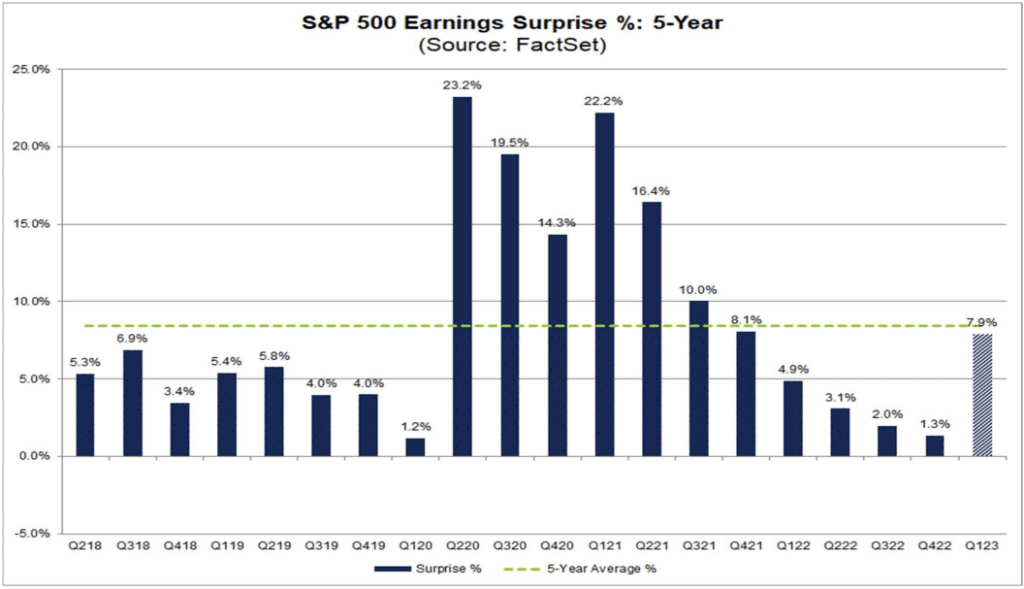

The average beat rate over the past 5 years? Over 8%. In other words, if corporate earnings exceed expectations at an average rate in Q1, we just might avoid that earnings recession. That’ll require the reversal of a 2 year trend, though.

Ever since earnings results outpaced expectations by 22% in Q1 2021, the beat rate has declined each quarter, reaching a low of 1.3% in the final quarter of 2022.

Early in the Q1 reporting season, profits are off to a strong start. We’ll see whether they can maintain the pace over the next two weeks, as more than 240 of the largest stocks announce operating results.

Focusing on the Fed

Since embarking on its latest monetary policy tightening cycle last March, the Federal Reserve has raised short-term interest rates by 4.75%. That’s pushed their target Federal Funds rate to its highest level since the onset of the Financial Crisis 15 years ago. More than that, the pace of hikes is faster than anything we’ve seen since the 1980s, when Paul Volcker pushed rates as high as 20% in his efforts to break the back of inflation.

Current chair Jerome Powell has channeled his inner Volcker during this era’s battle with inflation. He’s repeatedly warned against the risks of prematurely declaring victory, pointing at the Fed’s failures during the 1970s to restore price stability. Back then, policy was loosened each time the economy softened. That allowed smoldering price pressures to reignite, argues Powell. He’s reluctant to make the same mistakes.

That hasn’t kept market participants from pricing in rate cuts later this year, though, thanks to expectations of a looming economic downturn. Recession risks were already elevated as we entered 2022, and the failures of Silicon Valley Bank, Credit Suisse, and Signature Bank of New York served only to raise them further. If turmoil in the banking sector causes banks to reign in lending and credit creation, recession could come sooner and hit harder.

That’s the belief of the Fed’s staff economists, too. According to minutes from the March FOMC meeting, the staff projects a mild recession in the second half of this year. Previously, they’d anticipated low but continued growth.

Despite Powell’s protestations, the market believes he’ll cave to pressure and loosen policy if an economic downturn does arrive. Two year Treasury yields tend to reflect investors’ expectations of future interest rate policy. After SVB’s failure in mid-March, 2-year yields dropped more than 1%, and they remain more than three-quarters of a point below last month’s peak.

Fortunately for Powell, price pressures are receding, which could make it easier to support economic growth. In the month of March, growth in the Consumer Price Index dropped to a 5% annual rate, the lowest level since spring 2021. Goods inflation – primarily thanks to a drop in energy prices – has all but disappeared. Measures of housing costs could soon be headed lower, too. BLS estimates of shelter inflation notoriously lag real-world economic data, and those data imply housing inflation will taper off in early summer.

Still, inflation remains well above the Fed’s target, and the Fed’s own projection materials show they don’t expect to reach that target until 2025. A lot could happen before then.

For one, OPEC’s surprise decision to cut production a few weeks ago has oil prices back on the rise. That may be enough to keep Powell & Co. from lowering rates any time soon – even if a recession unfolds.

A Look at What’s Ahead

The content displayed here is for educational and informational purposes only and is not intended to constitute personalized investment advice. Contact a financial advisor if you have questions regarding your personal financial situation.

The post Mid-Month Market Update: April 2023 first appeared on Grindstone Intelligence.