Mid-Month Market Update: December 2022

Technical Trends

Equity prices have been steady over the last month and continue to be led by the Dow Jones Industrial Average and its tilt towards value stocks. The Dow is down only 4% over the past year, while the growth-oriented Nasdaq Composite is down a whopping 27%. The S&P 500 remains in a technical downtrend, with a current price below a falling long-term moving average. However, even when the index was at its lows for the year, prices never fell beneath their pre-COVID highs.

The 10-year Treasury yield has fallen below 3.5% after touching a 15-year high of 4.3% in October. The decline follows a shift in Fed policy expectations over the coming months. The year has still been a disappointment for bond investors, with the Aggregate US Bond index tracking for its worst annual performance on record.

The US Dollar Index has fallen 8% from its October highs, partially reversing a 25% rally over the prior 18 months. A weaker Dollar lessens a headwind for S&P 500 earnings. The decline reflects the recent moderation in Federal Reserve interest rate increases, as well as a shift toward tighter monetary policy in other developed countries.

Focusing on the Fed

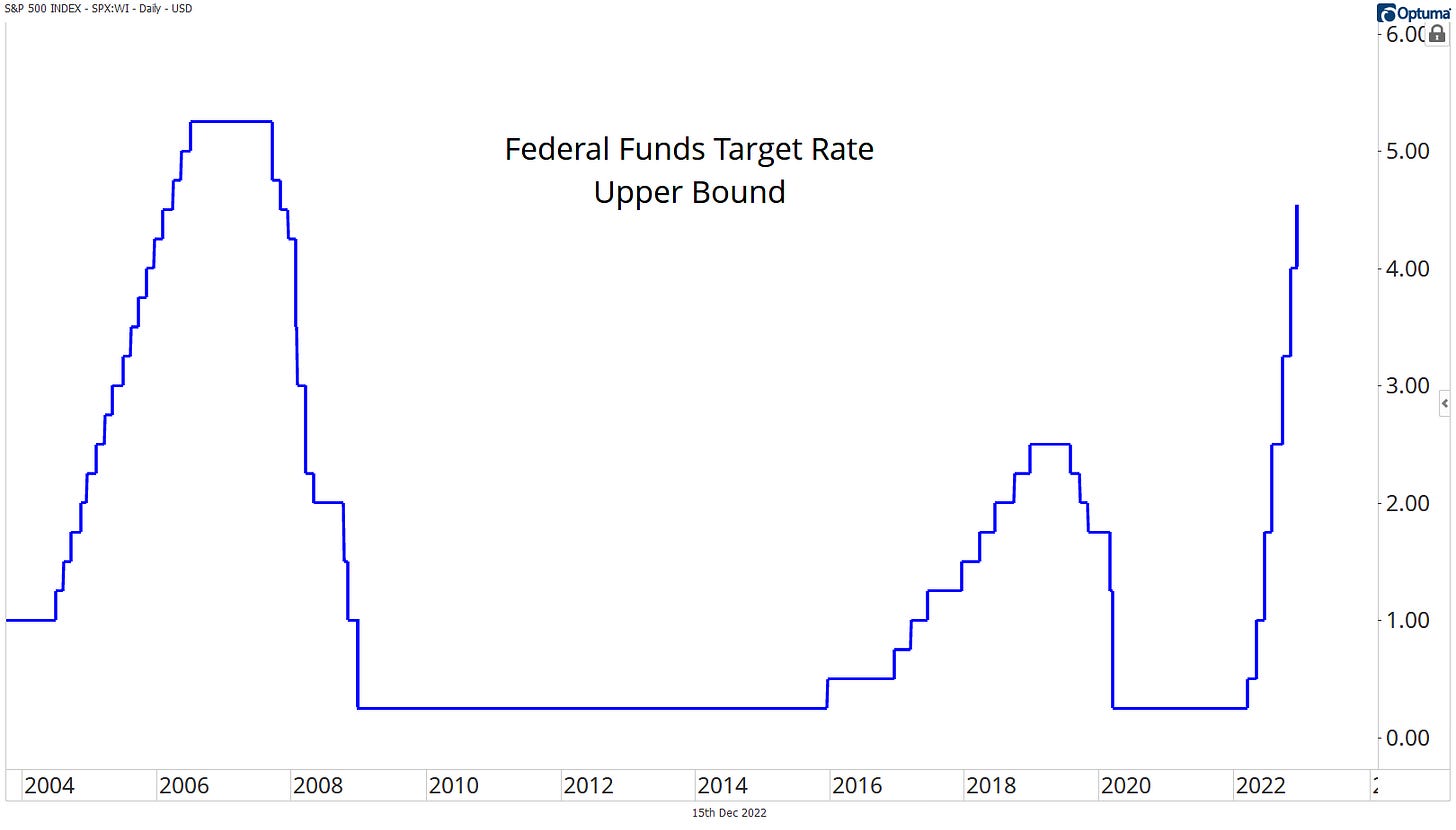

After four consecutive interest rate hikes of 0.75%, the Federal Reserve slowed the pace of tightening by raising rates by only 0.50% at their most recent meeting. It’s the first sign of a dovish pivot since the Fed began applying the economic brakes in early 2022. Since that time, they’ve raised overnight borrowing costs to the highest they’ve been in nearly 15 years.

The central monetary authority of the United States is still far from loosening policy, at least according to Chairman Jerome Powell. At his post-meeting press conference, Powell highlighted the risks of letting inflation expectations become unanchored, pointing to Federal Reserve missteps during the 1970s, when premature rate cuts allowed price pressures to spin out of control.

Futures markets pricing are priced for a sub-5% terminal Fed Funds rate and interest rate cuts in the latter half of 2023, but Powell believes rates will need to remain elevated for an extended period to crush inflation. He also cautioned against putting too much weight on a single data point, namely the most recent CPI report. He and his colleagues will need to see substantially more evidence that inflation is on a sustained downward path before they’ll consider loosening their grip.

Their views were made clear in the Summary of Economic Projections released after the meeting. On average, FOMC participants see the upper-end of their policy rate rising to 5.25% by the end of next year and inflation not returning to their 2% target until at least 2025. To get there, members believe GDP growth will need to be below trend in 2023 and 2024, and unemployment will have to rise to 4.6% in the coming months.

Still, Powell believes it’s possible to avoid a recession while bringing inflation under control.

A Tight Labor Market

The labor market remains exceedingly tight. That’s led to rapid wage growth and sparked concerns about a wage-price spiral that will force the Fed to tighten even further. On an absolute basis, it looks like it’ll take substantially more policy action to bring the labor market into balance. But at the margins, there are signs of normalization.

The unemployment rate is near 50-year lows and a fraction of the 14.7% peak reached during the height of the pandemic. It’s risen modestly in recent months, though, from 3.5% to 3.7%.

The number of job openings per unemployed worker is still significantly higher than anything seen prior to the pandemic. But job openings have declined by 1.5 million since the March peak, bringing the number of openings per unemployed down to 1.7 from 2.

Surveys from S&P Global, the Institute for Supply Management, and the National Federation of Independent Business also suggest that employers are pulling back on hiring as uncertainty mounts. In the tech sector, job cut announcements are piling up.

Those are all signs of a softening labor market – just what the Fed is hoping to see.

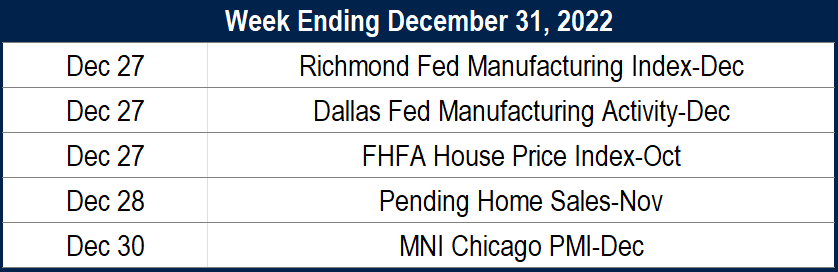

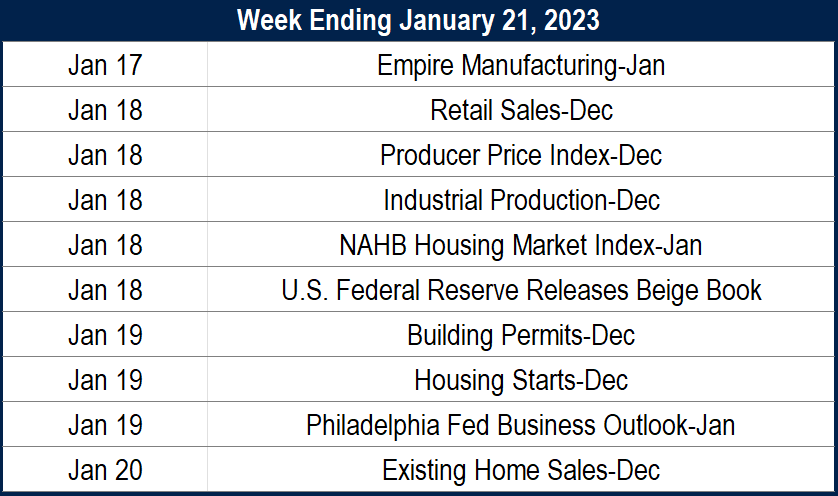

A Look at What’s Ahead

The content displayed here is for educational and informational purposes only and is not intended to constitute personalized investment advice. Contact a financial advisor if you have questions regarding your personal financial situation.

The post Mid-Month Market Update: December 2022 first appeared on Grindstone Intelligence.