Mid-Month Market Update: February 2023

Technical Trends

US large cap stocks have jumped more than 7% to start the year and continue to erase last year’s decline. The S&P 500 Index is further above its 200-day average than at any point in the last 12 months, as stocks attempt to enter a new bull market. The Dow Jones Industrial Average is down just 1.4% over the last year, while the NASDAQ Composite has been the best performing major index over the last month and quarter.

Bond prices continue to fall as interest rates rise. The 10-Year Treasury note is stuck below a falling 200-day moving average – clear evidence that a downtrend still exists. While yields are down from their October peak, continued policy tightening by the Federal Reserve poses a threat to fixed income investors over the coming months.

The US Dollar has rebounded in recent weeks, presenting a headwind to commodity prices. The impact has been most pronounced in precious metals, where both gold and silver have dropped. For silver, prices are back to November levels.

Focusing on the Fed

The Federal Reserve raised interest rates by 0.25% at their February meeting, bringing the Federal Funds target rate to a range of 4.25% to 4.50%. That’s the highest level since the Fed took rates to zero in response to the 2008 financial crisis.

At his post-meeting press conference, Fed Chair Jerome Powell reinforced previous guidance for continued hikes and a terminal rate above 5%. When confronted with the reality that markets were pricing in rate cuts in the latter half of the year, Powell repeated that rates will likely need to remain elevated for ‘some time’ in order to achieve the Fed’s mandate of price stability.

Market participants are beginning to believe him.

In the last two weeks, the gap between the implied Federal Funds rate for July (when rates are expected to reach their peak) and December has narrowed. In January, futures markets reflected a 0.4% rate cut by year-end. The difference is now less than 0.1%

The shift could be a reflection of growing consensus among FOMC participants – nearly every member has expressed a desire to keep rates elevated for an extended period in order to control inflation. Equally important, though, is economic data that’s shown few ill effects from tighter financial conditions. That could make price stability harder to achieve.

Don’t Bet Against the US Consumer

Interest rate hikes have done little to slow the labor market: unemployment dropped to a 50-year low in January. That was after the US added more than 500,000 jobs in the month, far exceeding all estimates from economic forecasters.

Strong employment is supporting continued consumer spending. Forecasters entered the year lamenting that excess savings from the pandemic would soon be depleted, causing a slowdown in consumption. This week’s retail sales report has placed that narrative on hold.

Sales grew 3.0% from December and accelerated to 6.4% on a year-over-year basis. We’re well past the growth fluctuations caused by shutdowns and stimulus payments, but annual growth is still better than at any point in the 7 years that preceded COVID.

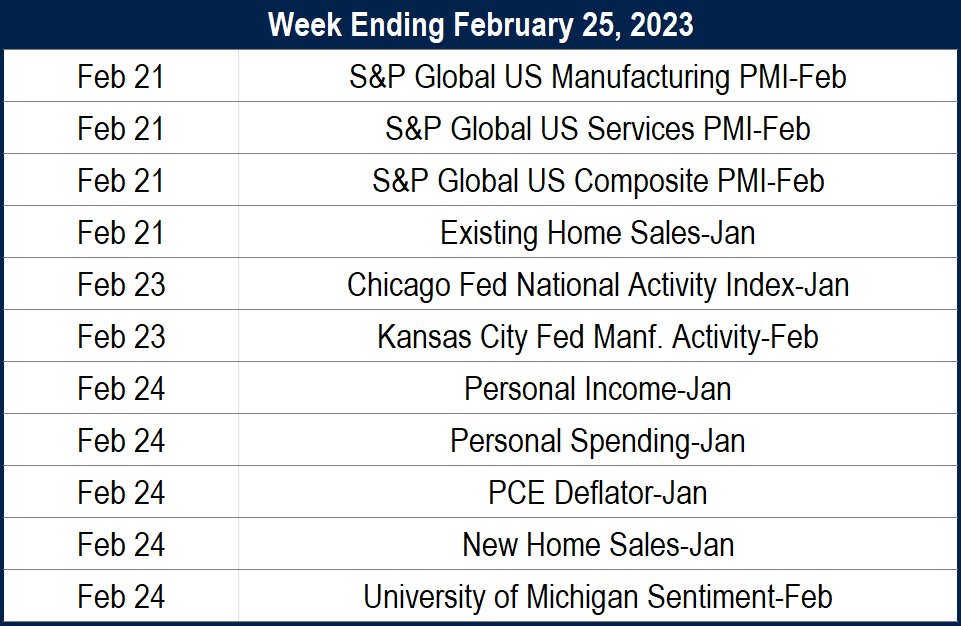

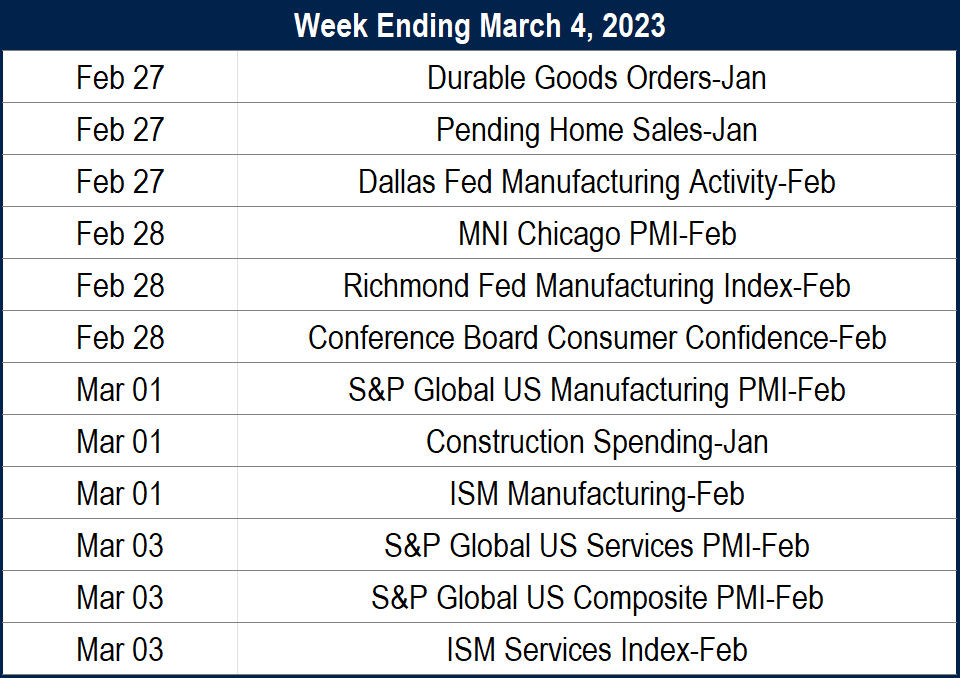

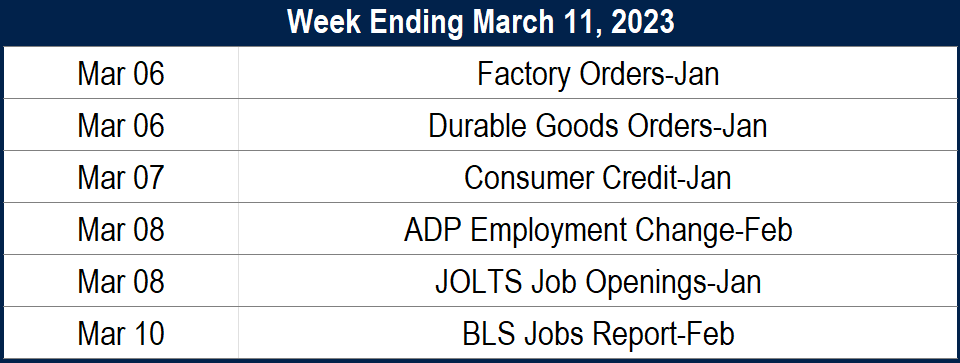

A Look at What’s Ahead

The content displayed here is for educational and informational purposes only and is not intended to constitute personalized investment advice. Contact a financial advisor if you have questions regarding your personal financial situation.

The post Mid-Month Market Update: February 2023 first appeared on Grindstone Intelligence.