Mid-Month Market Update: January 2023

Technical Trends

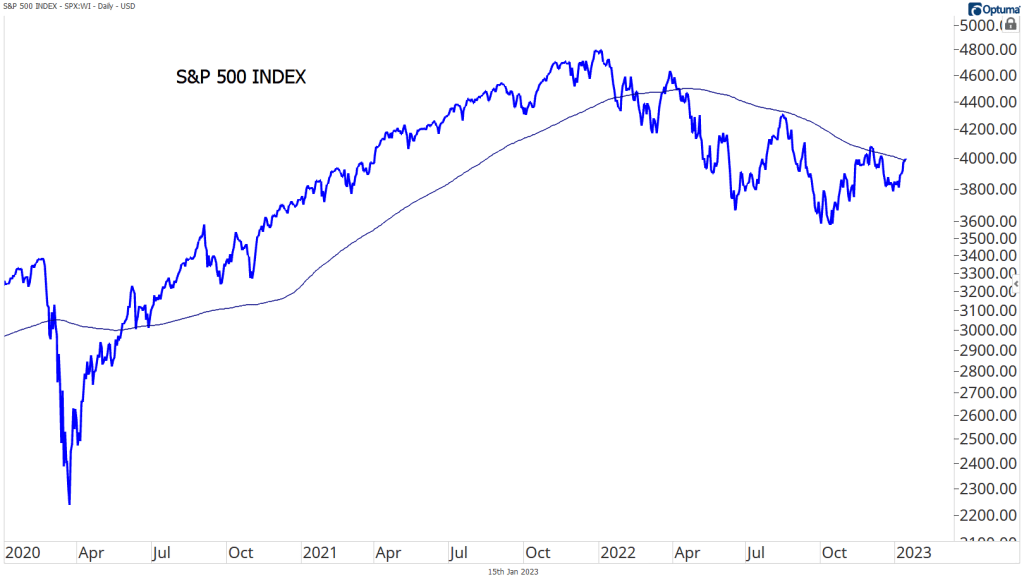

US stocks have rallied over the last several months, a welcome reprieve from the persistent downward pressure that punished investors for most of 2022. The S&P 500 has returned to its 200-day moving average for just the second time since last spring, threatening to put an end to its technical downtrend. The Dow Jones Industrial Average continues to be the outperformer among the major US indices, rising more than 15% over the last quarter. It’s now down only 5% over the last year. The NASDAQ Composite, meanwhile, would need to rally more than 40% to return to all-time highs.

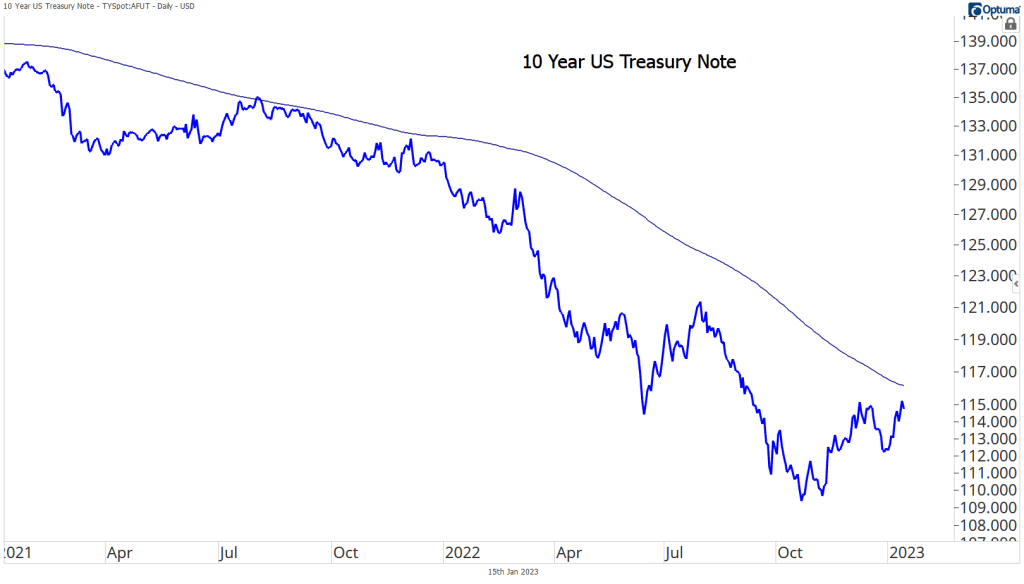

Bond prices are still in a clear technical downtrend, as the 10-Year Treasury note is stuck below a falling 200-day moving average. Still, the benchmark yield has fallen to 3.5%, well below the 15-year highs seen in October.

The US Dollar Index has fallen 11% from its October highs, reversing a substantial portion of the 25% rally over the prior 18 months. The decline reflects the recent moderation in Federal Reserve interest rate increases, as well as a shift toward tighter monetary policy in other developed countries. Since the Dollar was so negatively correlated with stock and bond prices last year, this weakness has aided the performance of both asset classes in recent weeks. It will also lessen a headwind to the overseas earnings of multinational corporations.

Focusing on the Fed

The Federal Reserve won’t meet again until the end of January, a month and a half after their December interest rate hike. Since then, inflation has continued to moderate. Consumer prices in December rose 6.5% year-over-year, down from 7.1% in November. Goods and commodities are to thank, and a slowdown in the cost of shelter is expected to further reduce price pressures by the middle of the year. Fed Chairman Jerome Powell used this chart to defend that assumption at an event late last year:

The combined weight of energy, goods, and housing (which alone accounts for nearly a third of the Consumer Price Index) will drag down inflation readings, but that won’t be enough to make the Fed declare victory. Instead, Powell is concerned about the persistence of higher prices in what he calls ‘core services’. To control those, most FOMC participants believe interest rates will need to climb above 5% and stay there for quite some time.

Interest rates aren’t the only tool for tightening monetary conditions. The Fed is also shrinking the level of assets on its balance sheet, effectively draining liquidity from the banking system. Prior to the 2008 financial crisis, quantitative easing was little more than a thought experiment. Since then, central banks around the world have embraced the tactic – few with as much vigor as our own Federal Reserve. During the financial crisis and the years afterward, it grew the balance sheet from roughly $800 billion to $4.5 trillion. In the 2 years following COVID, assets rose from $4 trillion to almost $9 trillion.

Now the Fed is tasked with shrinking the balance sheet to a normalized level – something they’ve only done once in the past, in 2018-2019. During that episode, they drained too much liquidity from the system, causing turmoil in short-term lending and forcing the Fed to reverse course through a program they termed ‘reserve management’. The correct level for the balance sheet is difficult for central bankers to estimate, but St. Louis Federal Reserve Bank President James Bullard expects the current runoff to last for at least the rest of 2023.

The more the Fed tightens financial conditions through rate hikes and balance sheet actions, the higher the risk that something breaks and a recession begins.

Earnings Season Begins

Earnings season is underway. Public companies will report their financial results for the fourth quarter of 2022 over the next several weeks, giving us key insights into how well they’re managing rising costs and labor shortages. We’ll also get indications on how consumer demand is holding up in the face of inflation.

Wall Street forecasters are currently anticipating a year-over-year earnings decline of about 3% for the S&P 500. That would be the first annual contraction since Q4 2020. However, earnings results tend to exceed expectations, and a positive surprise in-line with historical averages would mean an eighth consecutive quarter of earnings growth.

Over the long-term, stock prices track earnings, which is why earnings are important to watch. But the two can diverge for quarters or years at a time. That happened last year, when forward earnings continued to rise until the middle of the year, even after the S&P 500 Index peaked in the first week of January.

The question is, will earnings continue falling to reflect the selloff in the market? Or will stock prices rise to reflect the underlying strength in earnings? For now, Wall Street sees earnings growing an additional 4-5% in 2023.

In the coming weeks, most companies will detail their own internal estimates for the coming year. We’ll have to see how those stack up against consensus expectations.

A Look at What’s Ahead

The content displayed here is for educational and informational purposes only and is not intended to constitute personalized investment advice. Contact a financial advisor if you have questions regarding your personal financial situation.

The post Mid-Month Market Update: January 2023 first appeared on Grindstone Intelligence.