Mid-Month Market Update: March 2023

Technical Trends

US large cap stocks erased their hot start to the year, declining more than 5% over the past month. The S&P 500 Index has dropped back below a falling 200-day average. The Dow Jones Industrial Average is down just 2.4% over the last year, but it’s been the laggard so far in 2023. The NASDAQ Composite, meanwhile, has been the best performing major index over the last month and quarter.

Bond prices continue have risen dramatically over the past week, after turbulence in the banking sector spooked investors. Still, the 10-Year Treasury note remains below a falling 200-day moving average – clear evidence that a downtrend still exists. While yields are down from their October peak, the threat of continued policy tightening by the Federal Reserve remains a risk for fixed income investors.

Crude oil prices are nearing their lowest level in over a year, as risks to the global economic growth outlook are weighed against the uncertain outlook for global production amid the ongoing war in Western Europe. Lower crude oil prices would be a welcome sight for both inflation watchers and all of us at the gas pump.

Banking’s Biggest Crisis Since 2008

In case you haven’t heard, there’s a bit of a banking problem.

Last Wednesday evening, Silicon Valley Bank, a California-based lender, surprised investors by announcing plans to raise capital. Facing a credit ratings downgrade from Moody’s, they’d chosen to offload a $21.4B bond portfolio at a $1.8B loss. To fill that hole, they hired Goldman Sachs to help them raise $2.25B.

Things didn’t go as planned. Instead of raising capital, the announcement triggered a run on the bank. By Friday morning, the bank was placed in FDIC receivership.

SVB’s customers, most of whom had deposits well in excess of the FDIC’s $250,000 insurance limit, withdrew their funds en-masse. On Thursday alone, they took $42B(!). For comparison, Washington Mutual’s failure in 2008 came after depositors withdrew a mere $16.7B over ten days.

Unlike the financial crisis of 2008, this crisis wasn’t caused by poor lending practices. Instead, it was facilitated by seemingly safe investments in Treasurys, agency debt, and mortgage-backed securities that turned sour as interest rates spiked. You may remember the unprecedented level of monetary and fiscal stimulus in 2020 and 2021. The economy was flooded with cash from stimulus payments, and the Federal Reserve pushed rates to nearly unprecedented lows with an expansive QE program.

Banks needed something to do with the inflow of deposits, so many of them plowed that money into intermediate and long-term Treasurys. It seemed a low risk choice, given that Fed officials themselves anticipated no rate hikes until at least 2024. But when inflation pressures proved not-so-transitory, the Fed was forced into action. They’ve since raised rates at the fastest pace in decades.

As the prices of bonds dropped, banks found themselves sitting on piles of unrealized losses. Those aren’t a problem if the bank can hold them until maturity, but if they’re forced to sell any to shore up capital or fund deposits, it results in major problems.

SVB was obviously the worst offender, but that didn’t stop investors and depositors across the country from re-thinking their banking relationships. The contagion spread, and on Sunday night, another S&P 500 company was shuttered: Signature Bank.

Banking authorities had seen enough. By not taking action, they risked a widespread banking panic that could send the economy and monetary system into a tailspin. Capital position aside, few banks can be expected to withstand losing 25% of deposits in less than 24 hours.

By Sunday evening, the FDIC announced plans to fully insure all deposits at both SVB and Signature Bank – even the ones above $250,000. They’ll then replenish their Deposit Insurance Fund (DIF) by assessing higher fees to bank members. In addition, the Federal Reserve announced lending facilities that would help provide liquidity to other banks in need.

Whether that will be enough to restore confidence and ring-fence the collapse remains to be seen.

Focusing on the Fed

The banking crisis that has gripped markets in recent days has caused a dramatic shift in expectations regarding the future path of Federal Reserve interest rate policy.

Just one week ago, Fed Chair Jerome Powell wrapped up two days of testimony before Congress, where he defended the Fed’s recent policy actions and reinforced their commitment to bringing price inflation under control.

In testimony before the Senate Banking Panel, he said that recent economic data would likely require a higher terminal Federal Funds Rate and could force the committee to reaccelerate the pace of interest rate hikes. Powell attempted to walk back those remarks somewhat on Wednesday when he appeared before the House, saying no decisions had been made about the upcoming FOMC meeting. But the damage to market confidence was already done.

When the week began, the S&P 500 stood near 4050, 2-year Treasury yields were at 4.85%, and markets were pricing in a modest 0.25% hike at the March meeting. By the time Powell finished on Wednesday afternoon, though, stock prices were 2% below their Monday highs, that same 2-year Treasury yield was above 5% for the first time in more than 15 years, and a 50bps hike was fully baked in.

Just hours later, SVB announced their plans to raise capital, and in the aftermath, investors have cast doubt on Powell’s remarks.

As of this writing, markets are pricing in more than 100 basis points of interest rate cuts by year end, rather than the 100 basis points of hikes that seemed likely last week. Two-year Treasury yields, which tend to be a reliable predictor of future Fed policy, dropped from 15 year highs of more than 5% last week, to less 4%.

Volatility across the bond market has exploded. The MOVE Index, which measures Treasury rate volatility through options pricing , ripped to its highest level since 2009.

Investors and economists alike are scrambling to prepare for potential surprises at next week’s FOMC meeting. Federal Reserve officials entered a blackout period on Monday (they aren’t allowed to publicly address monetary policy until after the meeting), so it’s hard to know for sure whether SVB’s failure will dissuade Powell & Co. from hiking rates as previously planned.

You can understand their dilemma. On the one hand, banking turmoil is clear evidence that financial conditions are tight. And the failure will likely cause other banks to pull back on lending, cooling the economy even more.

On the other hand, the crisis has been contained (for now) by the joint efforts of the FDIC, the Treasury, and the Fed. So backing away from a hike could be interpreted as a lack of confidence in the rest of the banking system.

In addition, the economy has shown few signs of slowing, and Powell has often expressed concern about allowing inflation to fester and become entrenched, lest we return to the environment of the 1970s.

Job creation has averaged more than 400,000 per month to start the year. That’s faster than the pace of creation in 2022 and roughly double what most economists estimate is needed to keep pace with employment growth. And unemployment was already at 50-year lows. Job openings have remained stubbornly high, too.

That means there are still nearly 2 jobs available for every unemployed person.

Inflation data has improved, but prices are still rising much faster than the Fed’s 2% target. What’s worse, the disinflationary tailwind from goods prices is fading, while prices for services continue to accelerate, led by housing.

But all of that may not matter if financial instability gets out of control. The Fed will have to find a way to balance the risks of stoking further turmoil in the world’s banking institutions vs. the risks of inflation becoming entrenched.

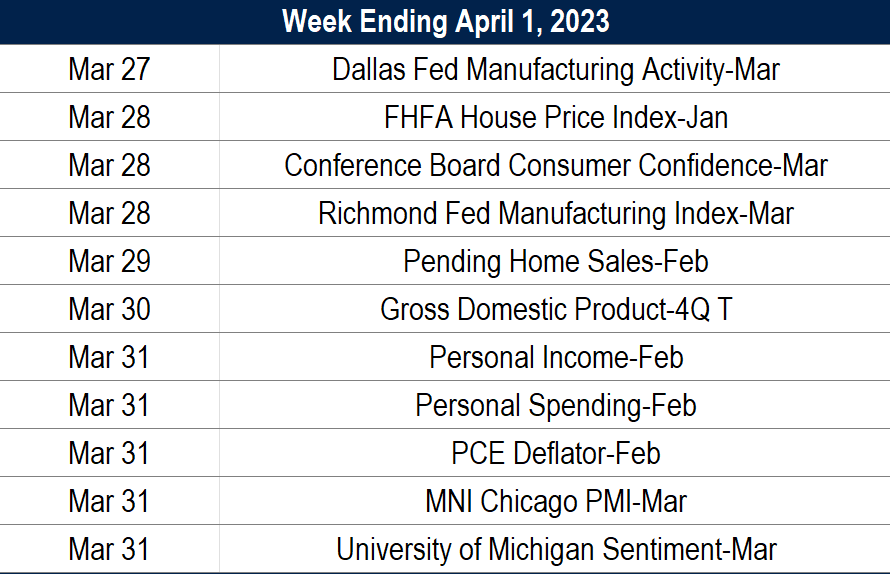

A Look at What’s Ahead

The content displayed here is for educational and informational purposes only and is not intended to constitute personalized investment advice. Contact a financial advisor if you have questions regarding your personal financial situation.

The post Mid-Month Market Update: March 2023 first appeared on Grindstone Intelligence.