Mid-Month Market Update: October 2022

Technical Trends

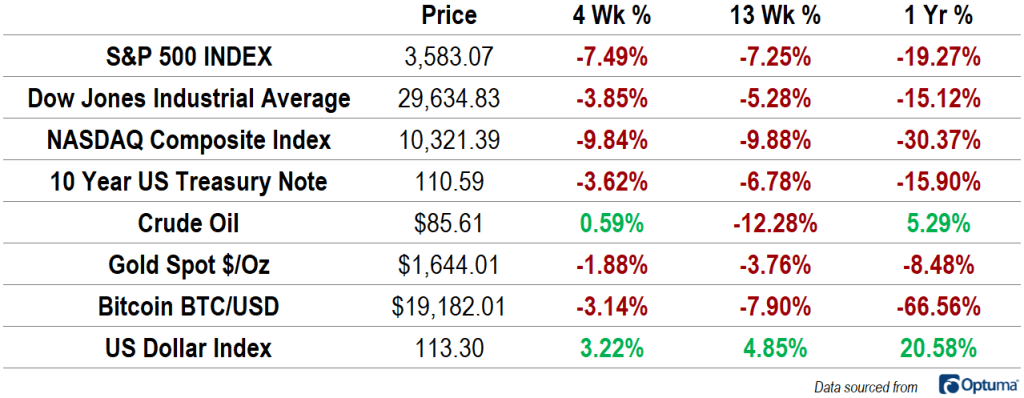

Stocks broke their June lows earlier this month after reversing an encouraging 2-month rally that lasted through July and August. The S&P 500 has now fallen more than 20% from its January peak and sits 19% lower than a year ago. Stocks are in a clear technical downtrend, setting distinctive lower highs and lower lows. An additional drop of 6% would push the index all the way back to its pre-COVID peak.

Bonds yields have continued to surge, with the rate on 10-year US Treasuries rising above 4% to its highest level since 2008. The impact on fixed income returns has been disastrous, and the US Aggregate Bond Index is having by far its worst year in memory. With both stocks and bonds under pressure, the traditional 60/40 investment portfolio has been a disappointment to those who’ve set expectations based on long-term historical returns.

Commodity prices rose throughout the early months of the year, but they’ve since joined other asset classes in their declines. Gold prices fell to their lowest level since April 2020, roughly 20% below the March highs. That’s coincided with a relentless appreciation by the US Dollar Index, which has jumped by more than 25% over the last 18 months. The Euro/US Dollar exchange rate dropped below parity for the first time since the year Euro notes and coins began circulation, 20 years ago.

Focusing on the Fed

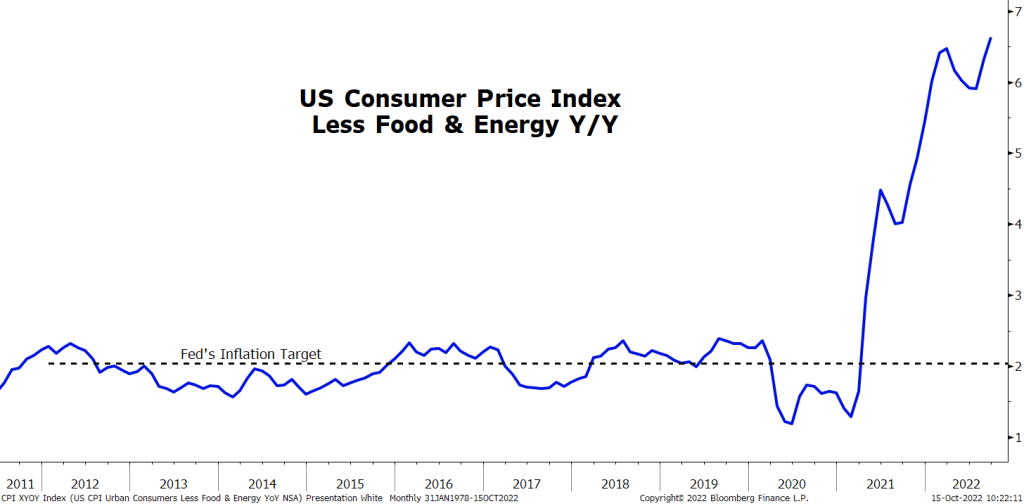

Markets are focused on the Federal Reserve, and the Federal Reserve is focused on inflation. Jerome Powell and Co. have spent the last two months warning about prematurely putting an end to tight monetary policy. As evidence, they point toward several failed attempts to control inflation during the 1970s, and laud former Fed Chair Paul Volcker for his success in ending the wage-price spiral during the tumultuous 1980s.

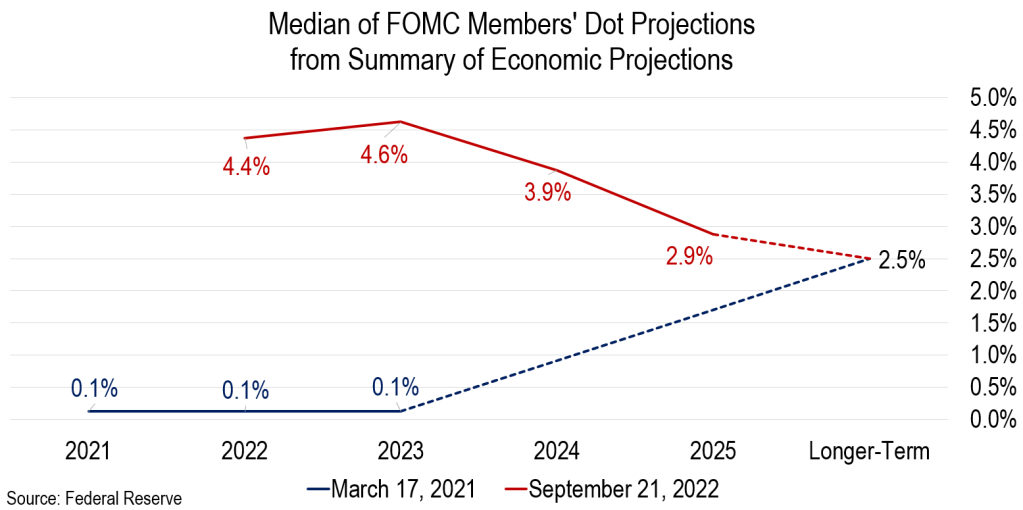

Just 18 months ago, the Fed was still clinging to hope that inflation would be transitory – that supply chain pressures would dissipate, energy costs would normalize, and labor shortages would self-correct. The Fed’s own forecasts indicated that interest rates would not rise from the zero lower bound until at least 2024, and they pegged the appropriate long-term level of the Federal Funds rate at 2.5%. The times have certainly changed. Since March, they’ve enacted the equivalent of twelve quarter-point interest rate hikes, and more are on the way. Market participants have priced in a year-end Federal Funds rate of 4.5%. That would be the highest rate since 2008 and a full 200 basis points higher than the Fed’s former long-term expectation.

A steady stream of speeches and TV appearances by FOMC members over the last few weeks have consistently reinforced Powell’s August Jackson Hole speech that rocked markets: monetary policy will tighten until inflation is under control, and that will likely require economic pain.

Despite their best efforts, though, economic activity has shown few signs of weakness and inflation pressures persist. Job openings declined by more than 1 million August, but the number of openings per unemployed worker is still at 1.6, well above any historical level seen prior to 2021. The economy continues to add jobs, unemployment claims are low, retail sales remain robust, and business surveys indicate continued expansion. The housing market has certainly cooled, but prices are still higher than a year ago, and weakness has not spread to other areas of the economy.

The most recent inflation data tells the same story: the Fed has more work to do. The Consumer Price Index rose 0.4% in September and 0.6% after stripping out food and Energy. While inflation indexes were driven mostly by higher commodity prices during 2020 and 2021, now they’re being dominated by services and housing costs. Monetary authorities are fearful that failing to break the cycle now only increase the future economic pain that must be inflicted to crush the inflationary spiral.

Of course, monetary policy works with a lag, a fact Fed officials are quick to acknowledge. It takes time for rate hikes to flow through to economic decision-making, and more time before that shows up in the data. The Fed has a track record of going too far and pushing the economy into a deep recession. Markets’ biggest fear is that they’ll repeat the mistakes of the past.

Earnings Preview

Third quarter earnings season is underway, and while aggregate earnings for the S&P 500 index are expected to show positive year-over-year growth for the eighth consecutive quarter (~2%), it’ll likely be at the slowest rate in 2 years. Revenues are set to slow, too, but will still grow at a healthy pace of more than 8%.

Wall Street will be watching and listening closely for indications of slowing demand, dwindling pricing power, and persistent cost pressures as they search for clues about the future of profit margins. They’ll also probe executives about how they’re preparing for a potential recession, and how their businesses will hold up should the economy experience a significant contraction.

Banks will be a significant drag on growth as they continue to lap year-ago earnings that were inflated by releases from loan loss reserves. This quarter, they’re set to return to more normal levels of loan loss provisions in advance of an expected economic slowdown.

The Energy sector will lead earnings growth as its constituents continue to benefit from elevated oil prices. According to FactSet, if Energy companies were excluded from the S&P 500, earnings for the index would fall 5% in the third quarter instead of rising 2%.

A Look at What’s Ahead

The content displayed here is for educational and informational purposes only and is not intended to constitute personalized investment advice. Contact a financial advisor if you have questions regarding your personal financial situation.

The post Mid-Month Market Update: October 2022 first appeared on Grindstone Intelligence.