New Highs Aren't Bearish

Top Charts and Trade Ideas from the Financials Sector

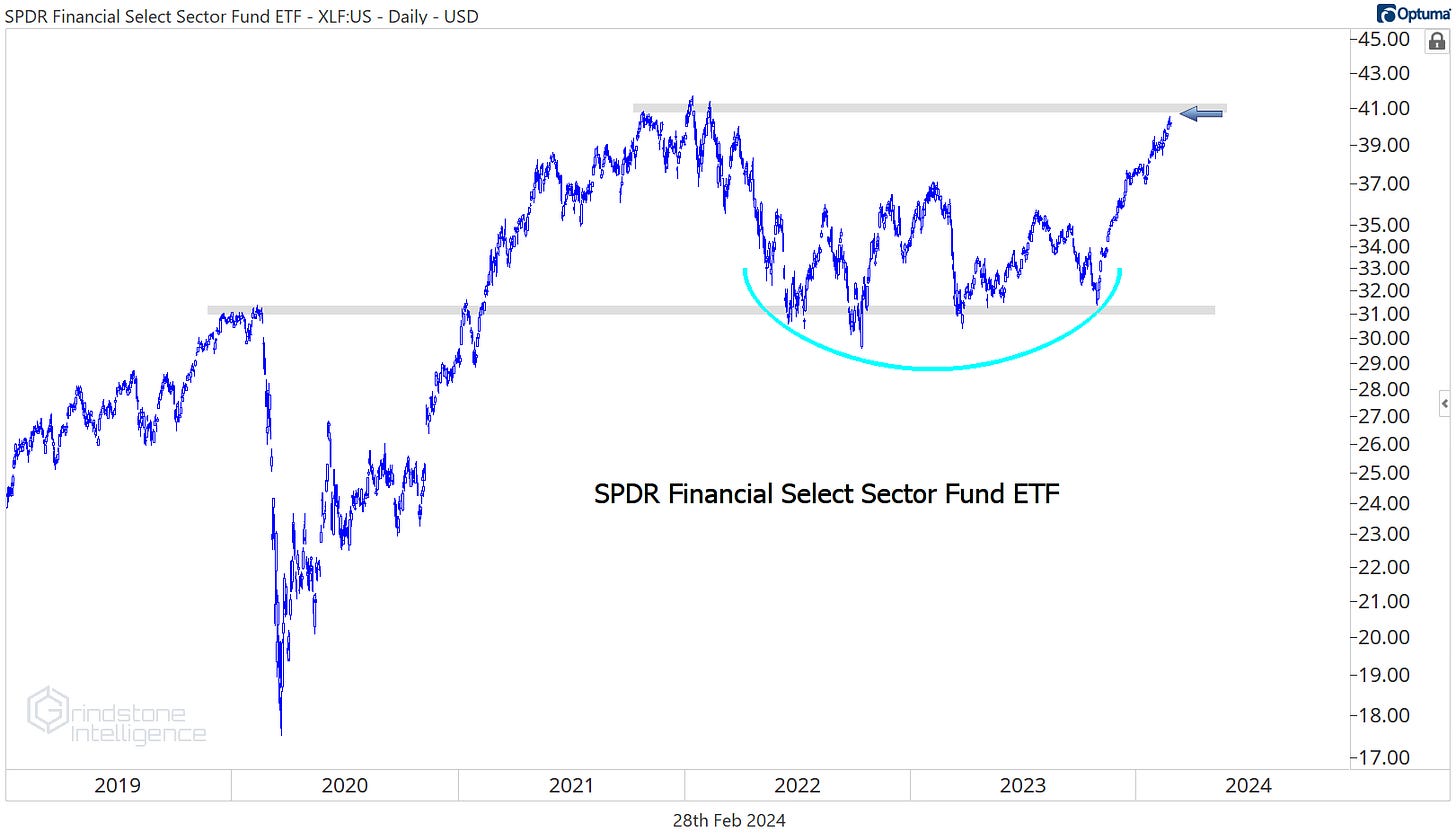

The Financials sector is knocking on the door of new all-time highs.

It’s been more than two years since US equities began their bear market and nearly 1 year since the collapse of Silicon Valley Bank sparked a panic that nearly upended the entire banking industry. Last March, everyone was scrambling to become experts on the accounting intricacies of held-to-maturity securities and the extent of unrealized losses on bank balance sheets. Even now, there are widespread concerns about the lasting impacts of the ongoing collapse in commercial real estate values.

Despite all that, the ‘crisis’ was over almost as soon as it began. From March 17th, 2023 to today, the Financials have tracked the rest of the stock market step-for-step.

Bank failures were no doubt concerning, but it was remarkable how well the sector held up even during the worst of the crisis. The Financials never even broke below their pre-COVID highs - a level that has a bit of historical significance.

Today, the Financials aren’t just hanging above support. They’re threatening to break out to new highs. And they’re doing it with better breadth than any other area of the market. 93% of Financials sector stocks are above a rising 200-day moving average.

In bull markets like this, most stocks go up - that’s just how bull markets work. But that doesn’t mean we shouldn’t be selective. We want to focus not just on the stocks that are rising, but on the ones that are outperforming. And compared directly to the S&P 500, we’re seeing more constructive action for the Financials than we’ve seen in quite some time. The Financials/SPX ratio is above its 200-day and just found support at a key, one-year rotational level. That sets the stage for outperformance in the weeks and months ahead.

With nearly every single Financials sector stock in a long-term uptrend, it won’t surprise you to learn that there are a lot of great individual setups. But we still want to be focusing on the areas that show relative strength - the ones that aren’t just going to rise, but are most likely to outperform the rest of the sector as well.

We discuss our favorite names below

Digging Deeper

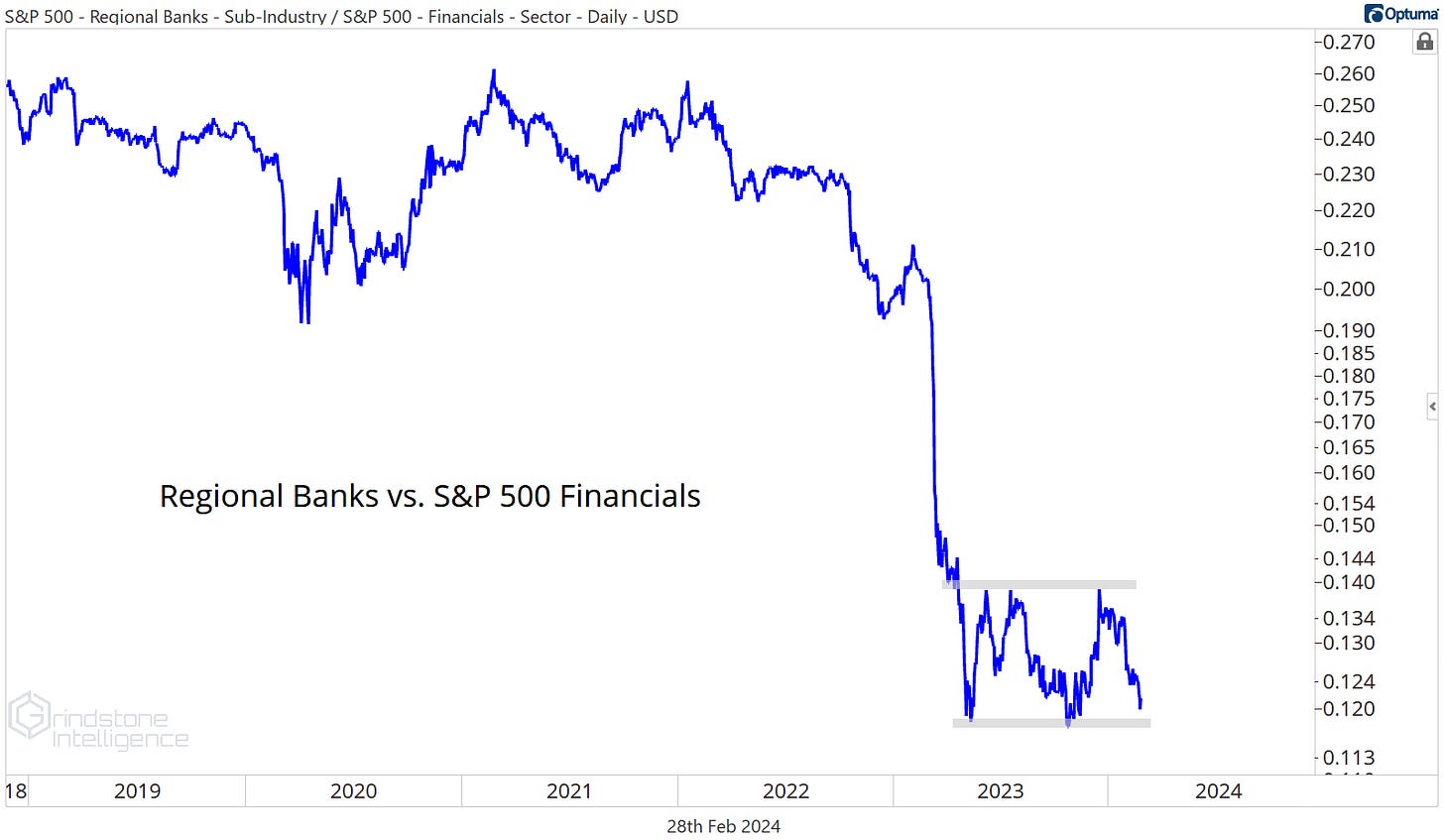

Unsurprisingly, the banks have been the worst performing industry within the sector over the past year. All of that underperformance came last spring - since setting a bottom vs. the overall Financials sector last May, the regional banks have kept pace:

But they’re threatening to break out of this 9 month consolidation. Consolidations tend to resolve in the direction of the existing trend, which is clearly down in this case. There’s no reason to be involved in the regionals until we see otherwise.

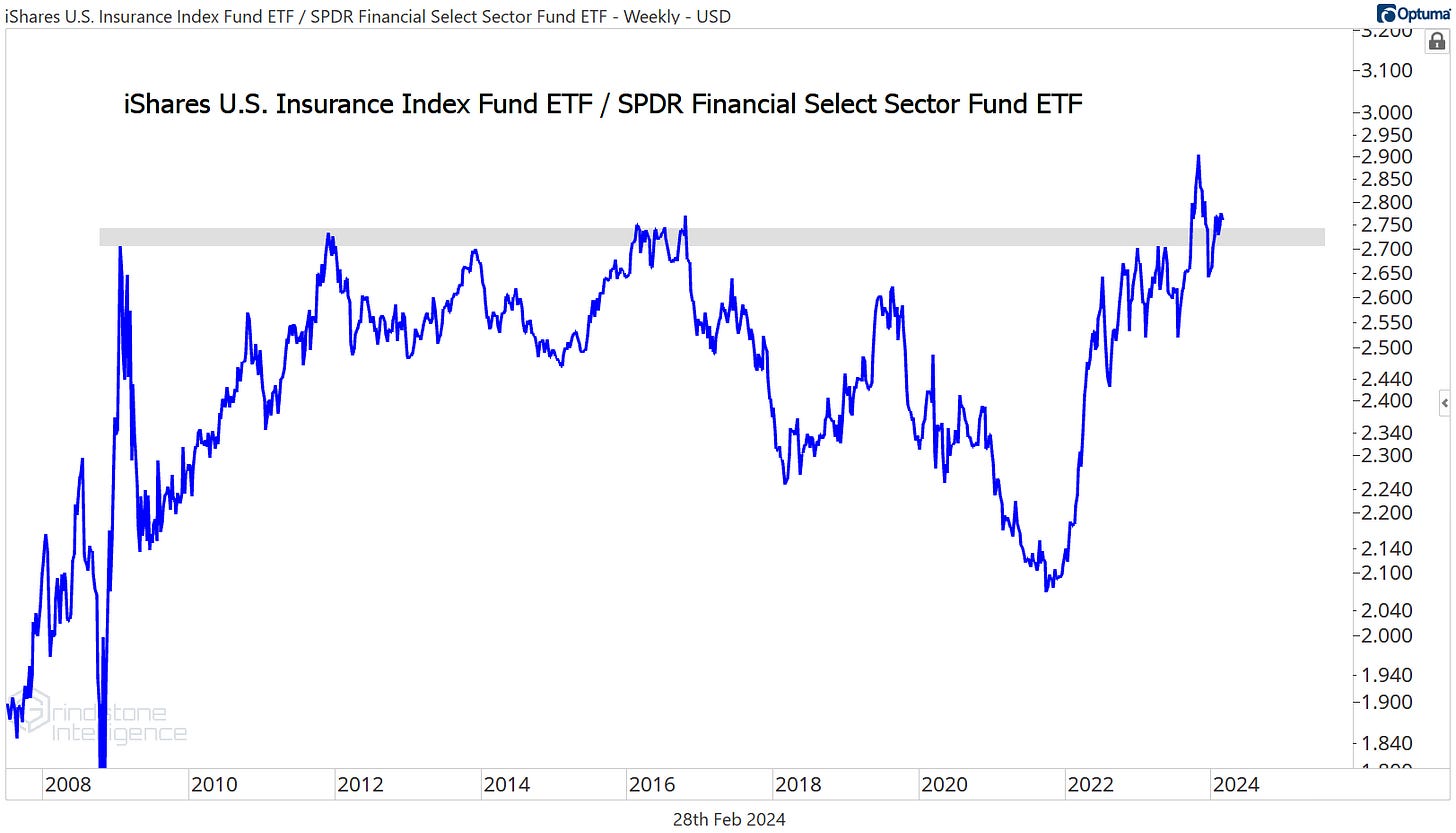

We like the insurance space a lot better. Check out IAK. It’s halfway to our target of $130, which is the 261.8% retracement from the 2020 decline.

More impressive than that is this massive 15-year base for IAK relative to the rest of the sector. If insurance stocks are above their 2009 highs vs. the XLF, how can we not be buying them?

Progressive has been a monster. The risk/reward here isn’t great with PGR midway between our risk level of $170 and our target of $205, but we want to keep an eye out for any pullbacks.

Especially with all this relative strength. Check out this bullish resolution out of an inverse head and shoulders continuation pattern for Progressive relative to the rest of the insurance space. Whatever Flo is doing, she needs to keep doing it.

Leaders

Speaking of bases, how about this decade-long base for American Express compared to the rest of the Financials sector? There’s nothing bearish about new all-time relative highs.

We want to buy any pullbacks in AXP towards $185 with a target of $250.

Brown & Brown is nearing or target of $86, so we want to see how it responds to potential resistance at that level.

Longer-term, though, we think BRO heads to $106, which is the 261.8% retracement from the 2022-2023 decline. We only want to be initiating new positions if the stock is above $87. Supporting that view, as you may have guessed, is the relative strength we’re seeing. BRO just successfully backtested the neckline of a 3-year base relative to the rest of Financials, which positions them well to continue outperforming.

Losers

In bull markets we want to be buying relative strength and avoiding relative weakness. Losers tend to keep on losing. And MarketAxess is a loser.

If this turns into a failed breakdown relative to the rest of the Financials, then maybe we can start talking about a trend reversal in MKTX. Until then, though, we need to avoid it like the plague.

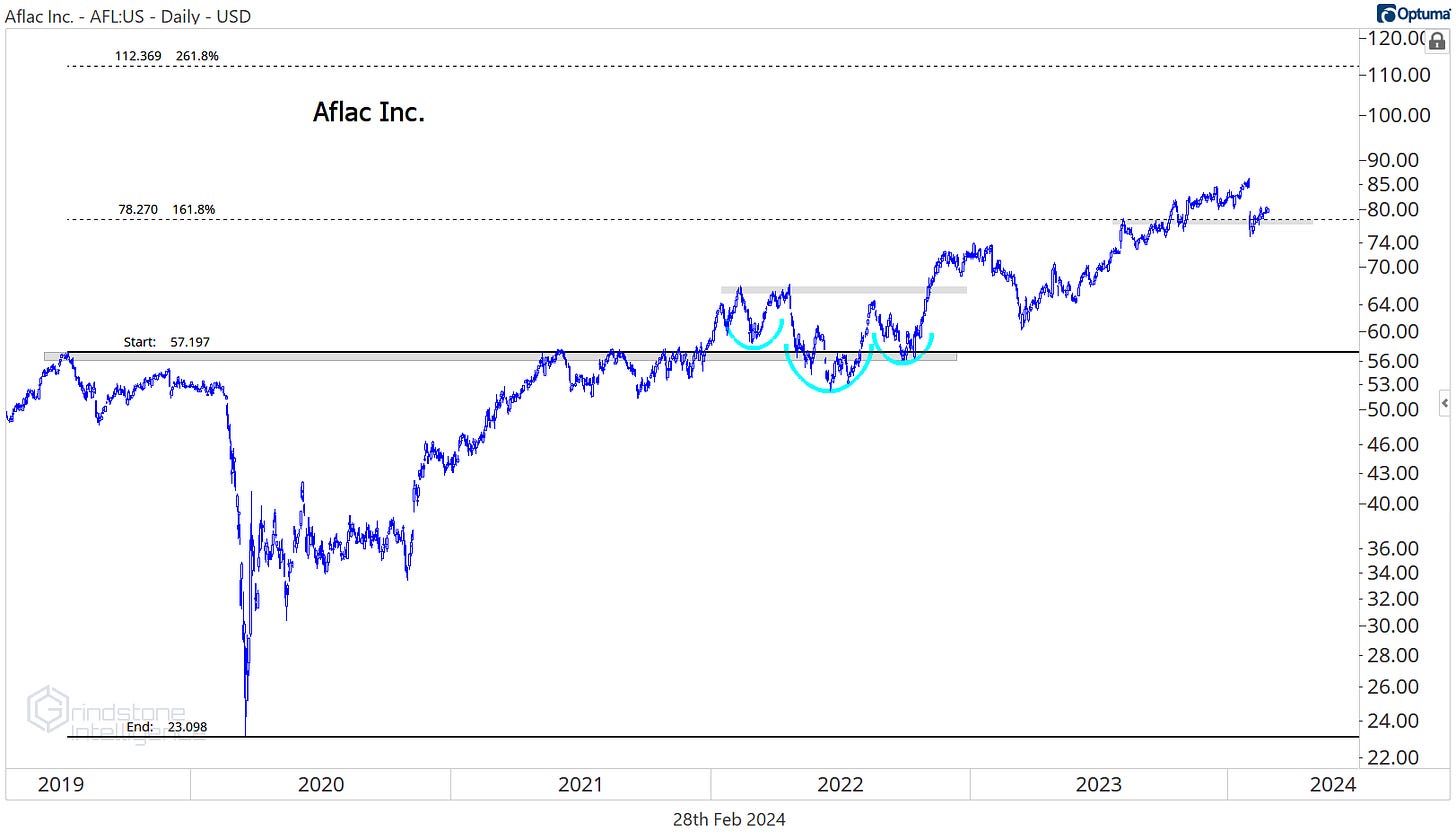

Another thing we want to be doing during bull markets is buying pullbacks in the strongest names. Aflac is consolidating above the 161.8% retracement from the 2019-2020 decline, which gives us a great risk/reward setup from the long side. We like this insurance name above $78 with a target up at $112.

More Charts to Watch

Trends are always more likely to persist than reverse. That’s why we spend most of our time focusing on stocks in uptrends and avoiding the ones in downtrends. But that doesn’t mean trends never reverse. We’re eying a potential downtrend reversal in Fidelity National.

It’s been one of the worst stocks in the world over the past few years, but compared to the S&P 500, FIS stopped going down last fall. And the FIS/SPX ratio is further above its 200-day right now than at any point since March 2020.

On an absolute basis, the downtrend reversal is even further underway. FIS just hit new 52-week highs. We continue to like FIS above $63 with a target of $90, which is the 38.2% retracement from the entire 3 year decline.

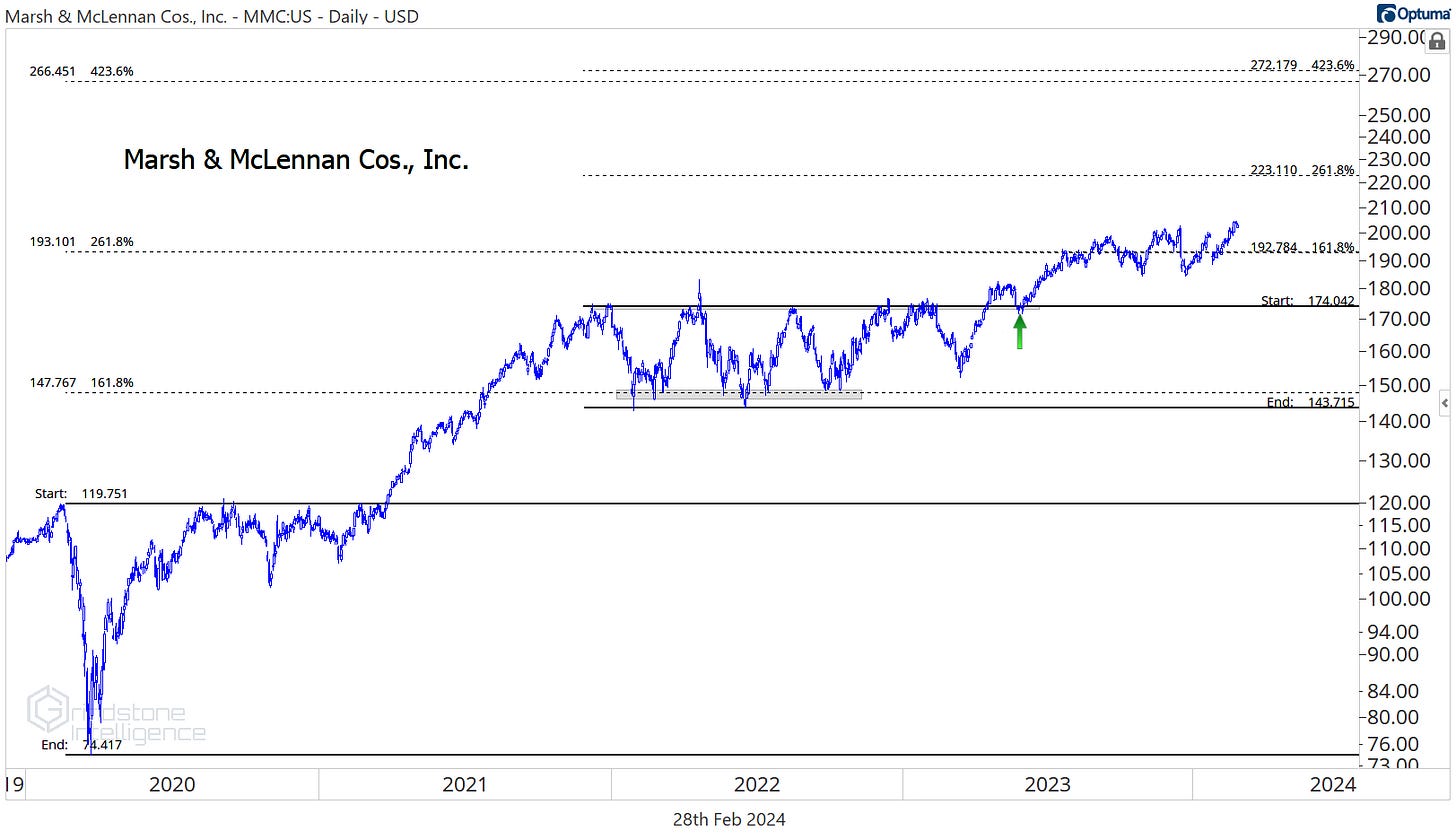

We’re also eying a reversal in this short-term downtrend for MMC relative to the rest of the Financials. This looks like a textbook retest of the 2020-2022 highs, with a bullish momentum divergence to boot.

It helps that on an absolute basis, there’s no downtrend to reverse. Marsh & McLennan has been consolidating near its highs for the last 6 months. We want to be buying it above $195 with a long-term target of $270.

Fiserv has hit our target above $150, so we’re now in wait-and-see mode.

If it can get above $155 and hold it, though, we can be initiating new long positions with that new level to manage risk against. Our next target is $205.

As you might have guessed, FI has been on our radar because it’s showing relative strength versus the rest of the market. Compared to the S&P 500, it’s at multi-year highs.

Is there any Financials stock more important than JPMorgan? We don’t think so. If JPM is setting new highs, you’ll have a hard time convincing us that we’re in the midst of anything other than a healthy bull market. It was stuck below the 423.6% retracement from the 2007-2009 decline for the last few years, but it just broke out above that key resistance level. We want to be buying JPM above $180 with a target of $275.

JPM also is breaking out relative to the rest of the Financials - that’s not bearish.

We stepped aside on CBOE in November after it hit our target of $175, as we wanted to see how it responded to potential resistance at the 161.8% retracement from the 2018-2020 decline. The response was a good one, and last month, we set a new target of $235. There’s no need to change that now.

The relative strength here is what we really like about the stock. CBOE just broke out of a 5-year base relative to the entire Financials sector, then successfully backtested the breakout level in December. Not only do we think CBOE goes higher, we think it will outperform. And if we want to outperform the market, we need to own the things that are outperforming the market.

The other key to outperforming the market is not owning the things that are underperforming. State Street just broke to all-time lows vs. the rest of the Financials.

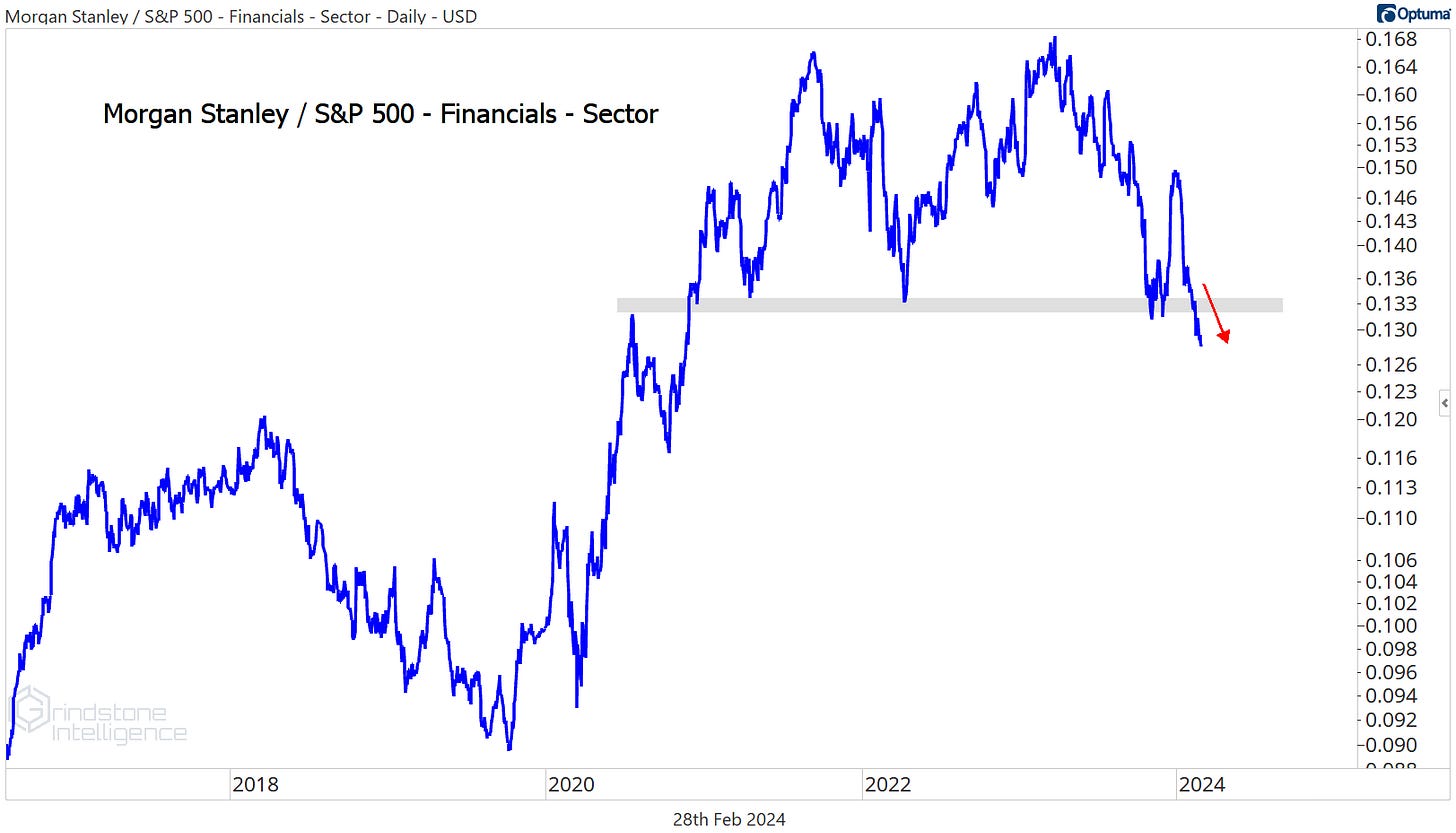

And Morgan Stanley is at multi-year relative lows.

There’s no reason to be involved with either from the long side.

Until next time.