Not a Risk-Off Rotation

Can Health Care be a leader?

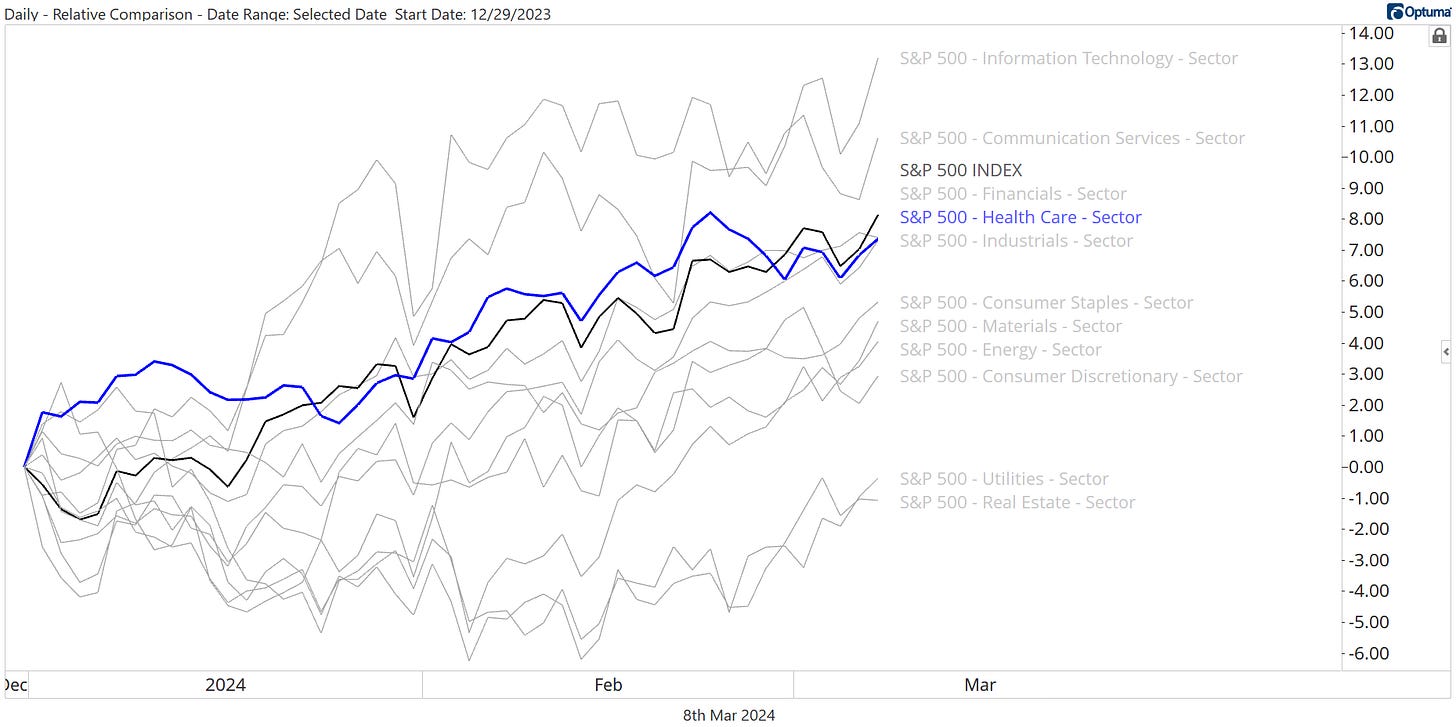

We’re a little more than 2 months into the new year, but if you look at sector leadership, you might think we’re still stuck in 2023. Information Technology and Communication Services are each up double digits for the year, pacing the 8% year-to-date gain for the S&P 500 index.

We’ve spent most of this year watching and waiting for a rotation out of those big growth sectors and into the value-oriented laggards of 2023. While a full-on rotation hasn’t materialized - at least not yet - those other sectors haven’t done too bad. The Industrials and Health Care sectors have both broken out to new all-time highs, and the Financials are knocking on the door. All three are keeping up with the benchmark S&P 500, too.

The big laggards in 2024 are the risk-off, yield sensitive areas of the market. Utilities and Real Estate are both negative for the year.

That’s not such a bad thing. The risk-off areas should lag during bull markets. That’s evidence of risk appetite, and risk appetite is what drives prices higher.

Hold on though, Health Care is risk-off, too, right? We hear that all the time, and it passes the fundamental smell test. The revenues and earnings of Health Care companies tend to be less cyclical, making them a preferred area for investors to hide during economic uncertainty. But that doesn’t tell the whole story.

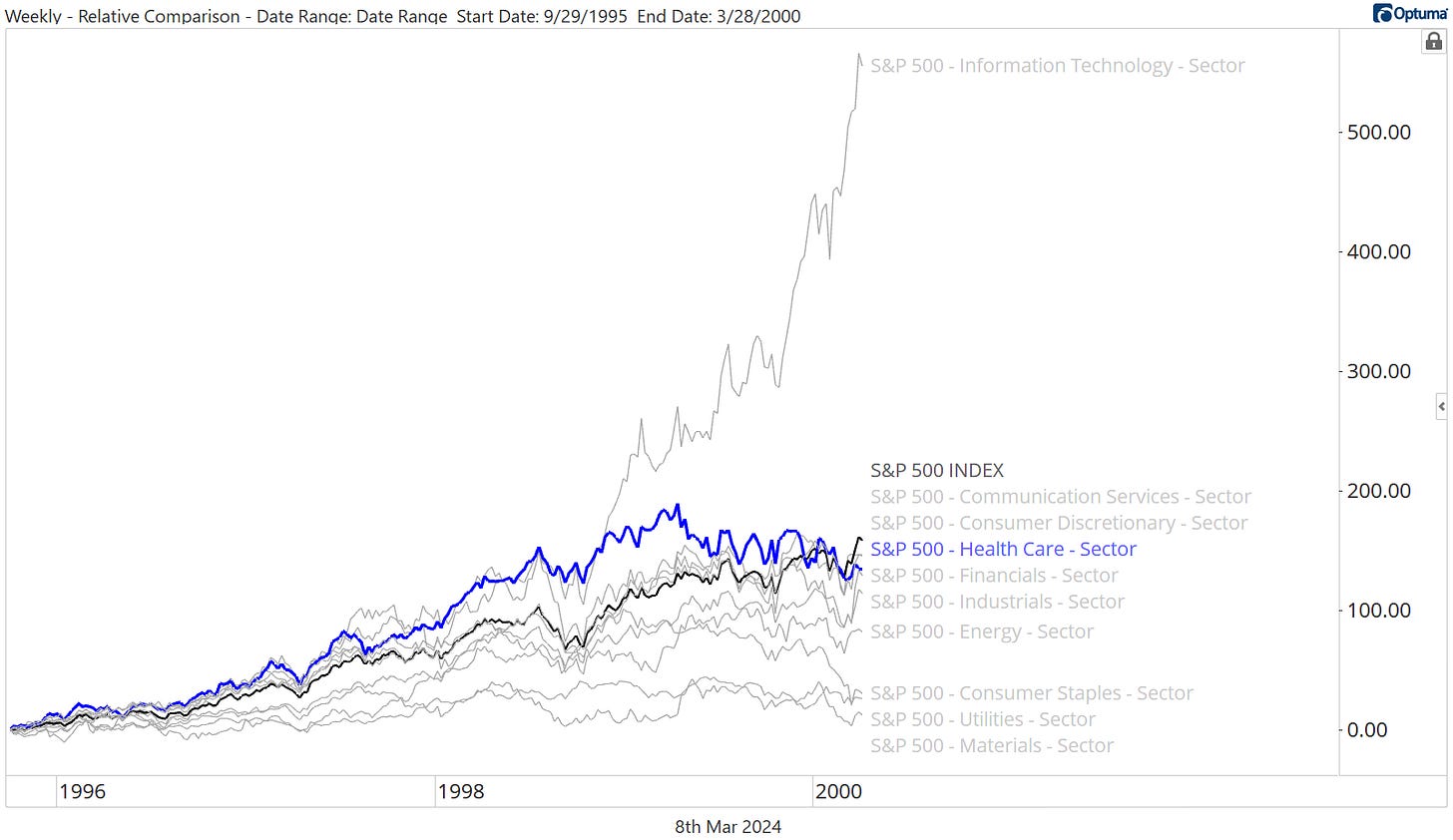

Take a look back at the 1990s and the dotcom era. Sure, by the time everything came unwound in the spring of 2000, Tech was the only thing that mattered. But up until the start of 1999, Health Care was tracking the Tech sector step-for-step.

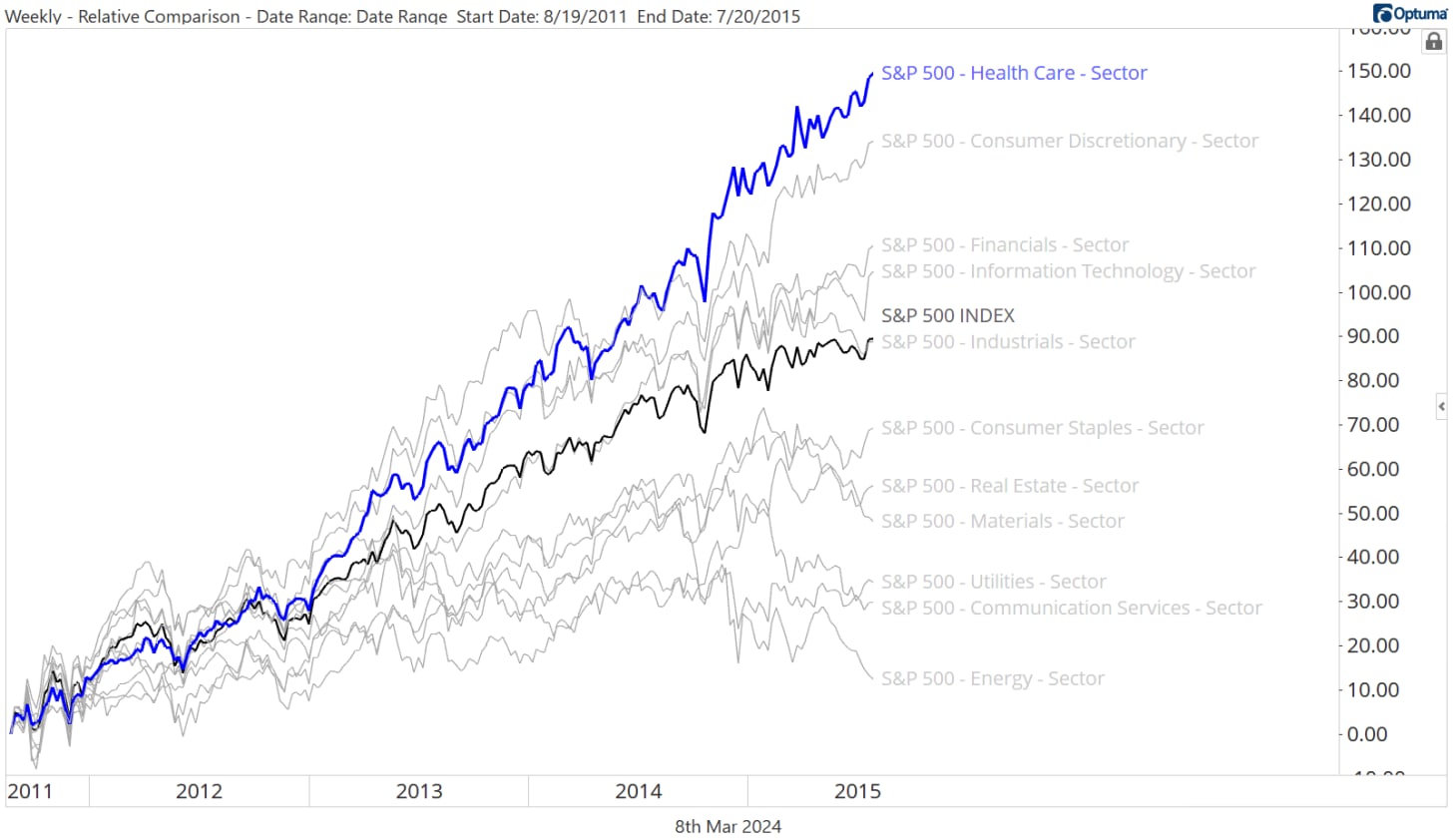

And for the bull market that raged from the 2011 lows until the summer 2015 highs, Health Care was the outright leader.

Does any of that mean Health Care must be a leader? Of course not. There are plenty of bull markets where it’s lagged. But Health Care can be a leader in a bull market, despite the popular narrative that it’s a risk-off sector.

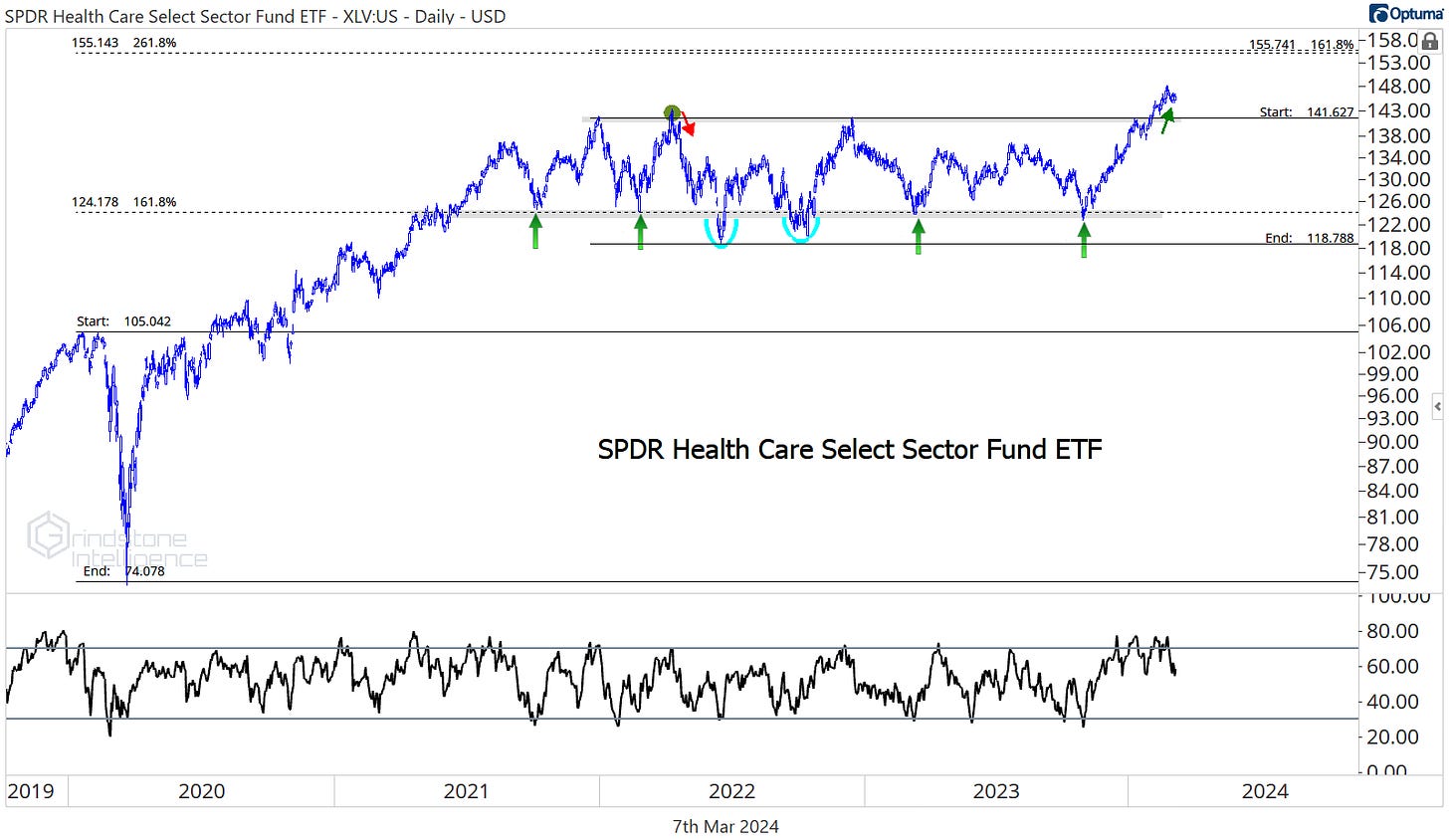

We think they’re positioned to be a leader for the remainder of 2024. This is an area that was completely out of favor for most of the last year. During 2023, the Health Care sector underperformed the rest of the market by 20%, falling from 7-year relative highs to near 10-year relative lows. This is exactly where Health Care bottomed in 2021, so why can’t it do so again?

What we really like is the bullish momentum divergence at these lows. After getting severely oversold on the initial test of those lows last November, RSI hasn’t dropped below 30 on subsequent declines. We saw the same types of momentum divergences at the 2020 and 2023 peaks and the 2021 bottom.

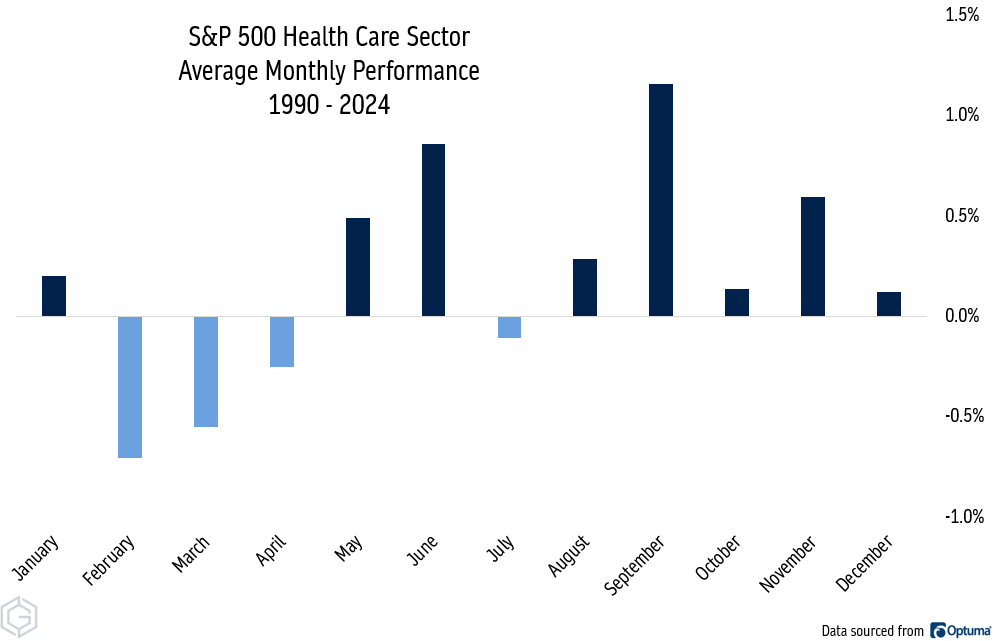

It’s not all good news. We’re in the midst of a weak seasonal period for Health Care stocks. They’ve lagged the rest of the S&P 500 by 0.55% on average in the month of March since 1990 and tend to lag again in April.

But remember that seasonality is a general guideline, not a prescription. Even in March, where the sector has underperformed the S&P 500 most consistently, Health Care has still won out a third of the time. This year could easily be the ‘one’ in the one-in-three.

The small cap sector will offer a good clue on whether our thesis of Health Care outperformance is correct. While the large cap sector has been hitting new all-time highs, the small cap space has been trying to reverse a downtrend.

PSCH has broken the downtrend line from the highs and is above its 200-day, both important steps in the reversal process, but we need to see it move past this resistance area from the 2022 lows. If we’re breaking down below this area, we need to rethink our bullish Health Care thesis.

For the large cap sector, we continue to target $155 for XLV, which is both the 261.8% retracement from the 2020 decline and the 161.8% retracement from the 2021-2023 range.

Digging Deeper

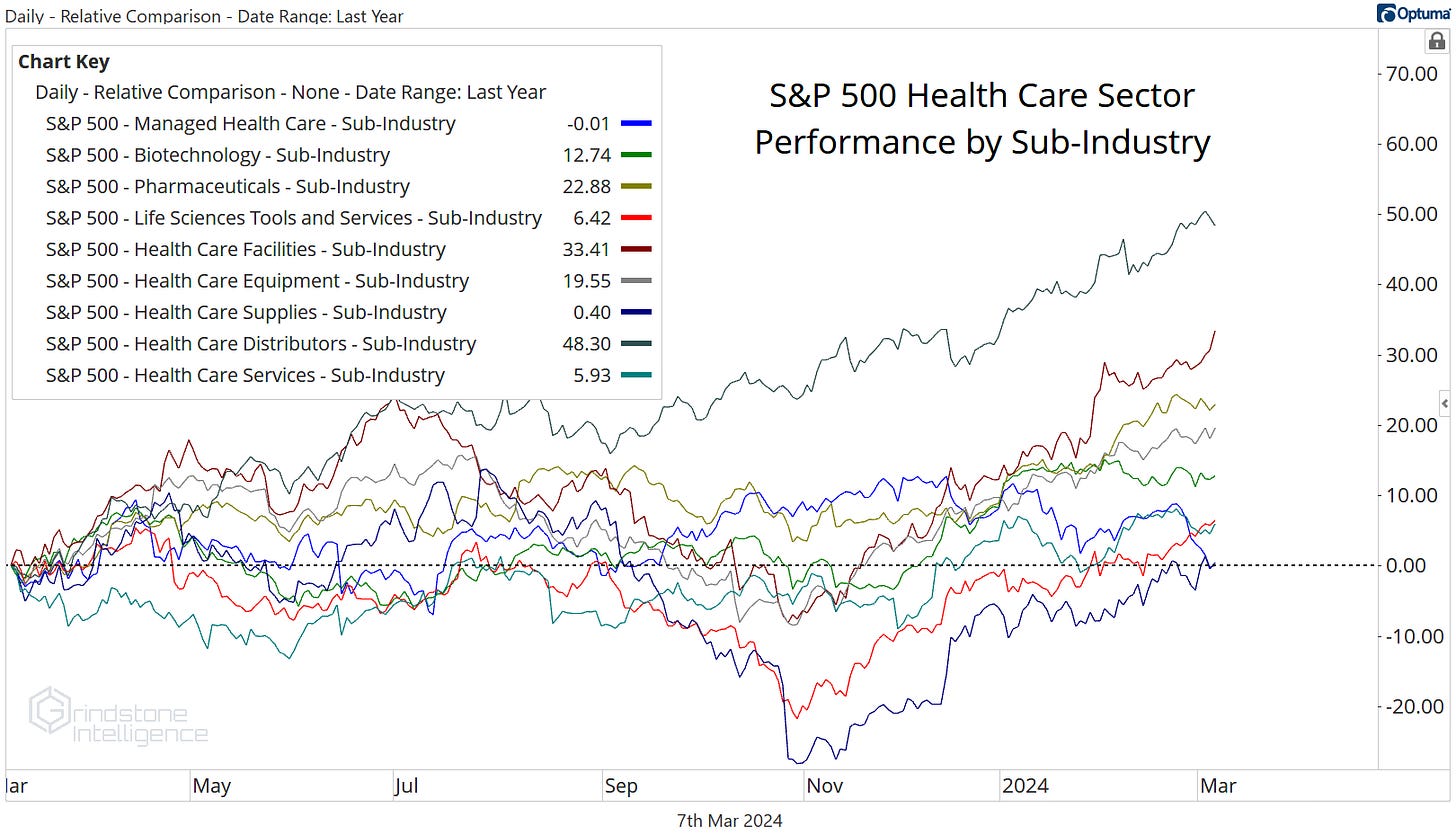

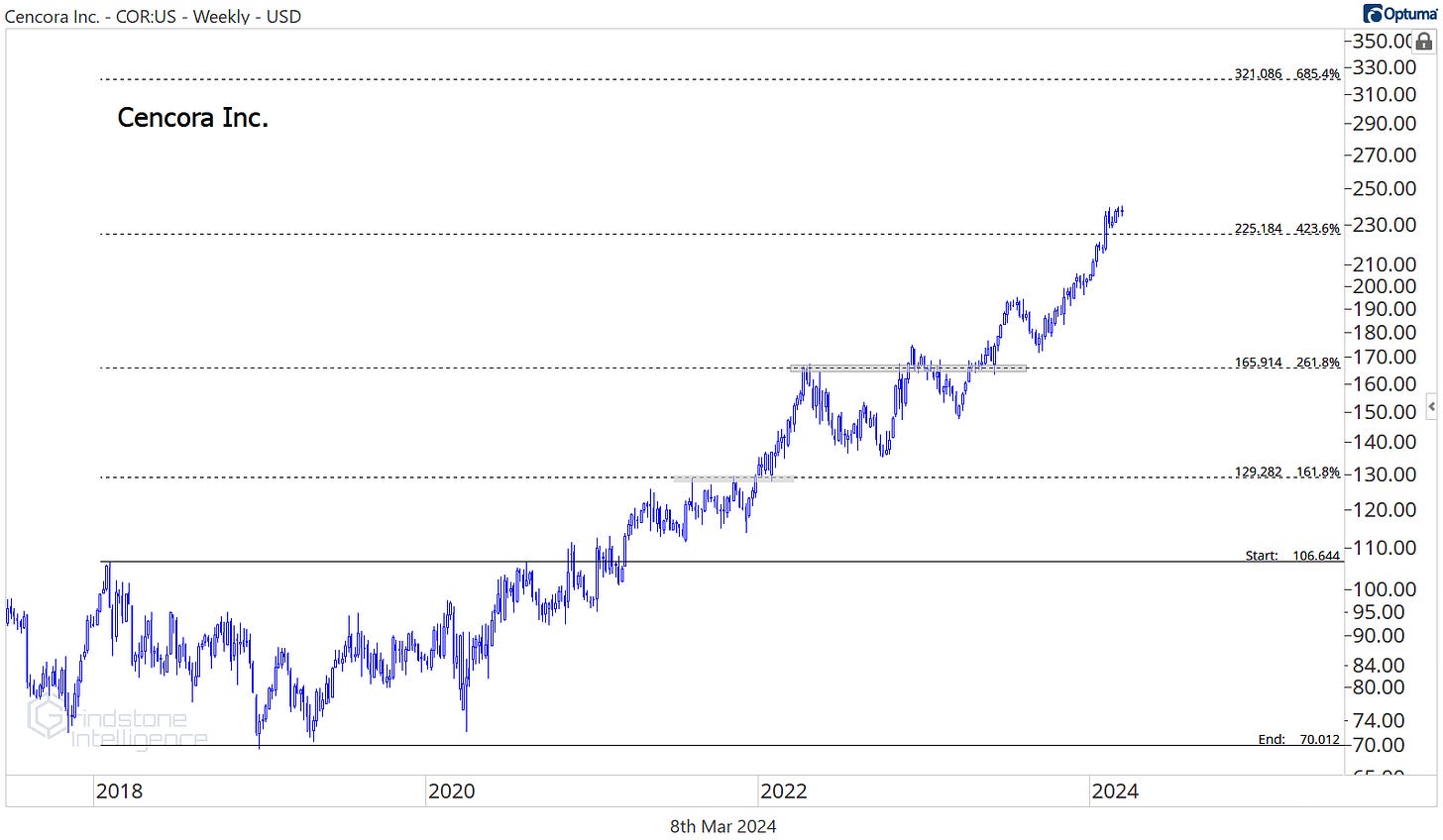

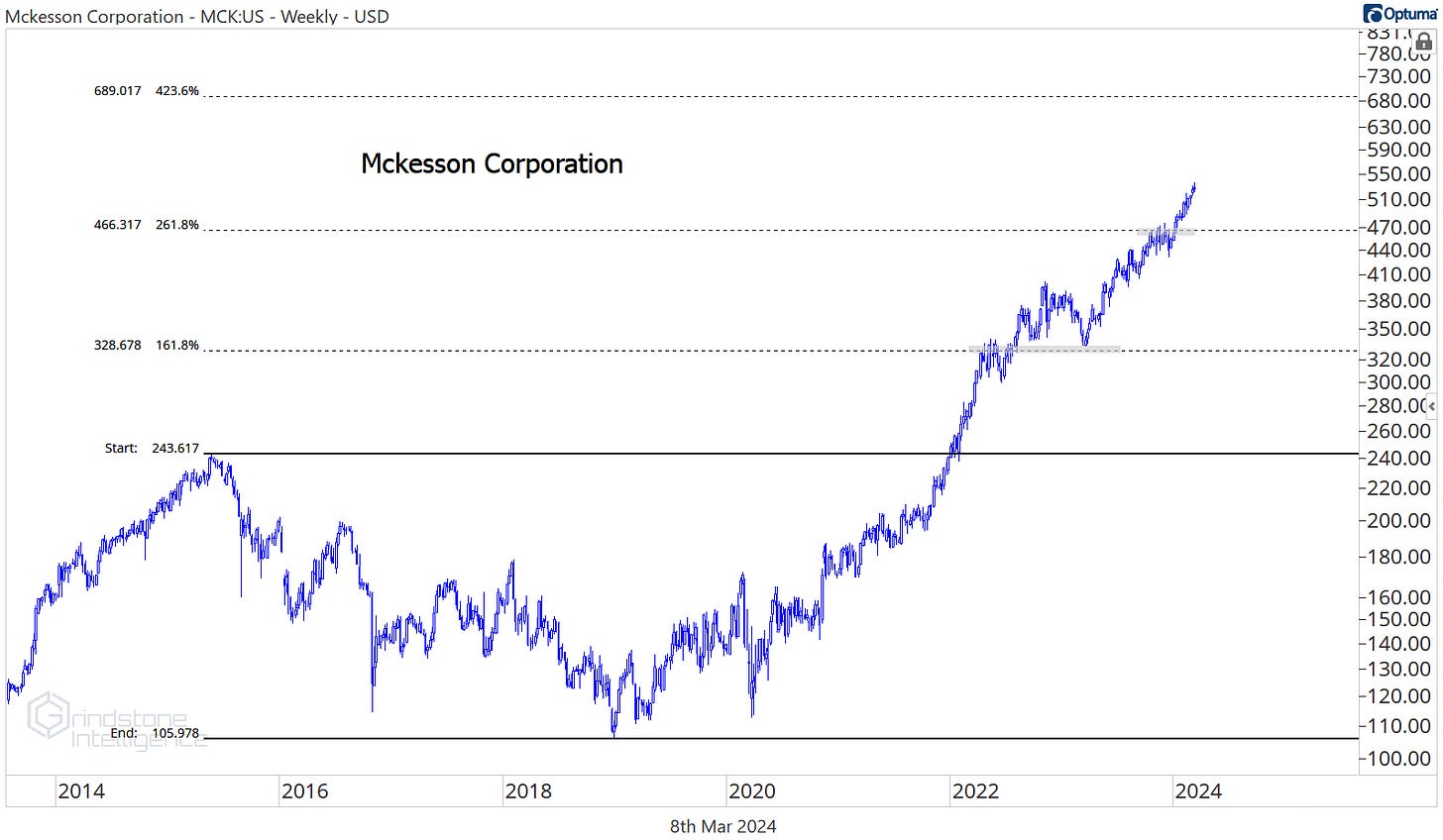

The Health Care Distributors continue to be a leader. We’ve been pointing out the relative strength in that space for months, and there’s really nothing new to talk about.

As long as COR is above $225, we can be long with a new target of $320, which is the 685.4% retracement from the 2018-2020 range.

We’re still targeting $690 on MCK, with $470 as our risk management level.

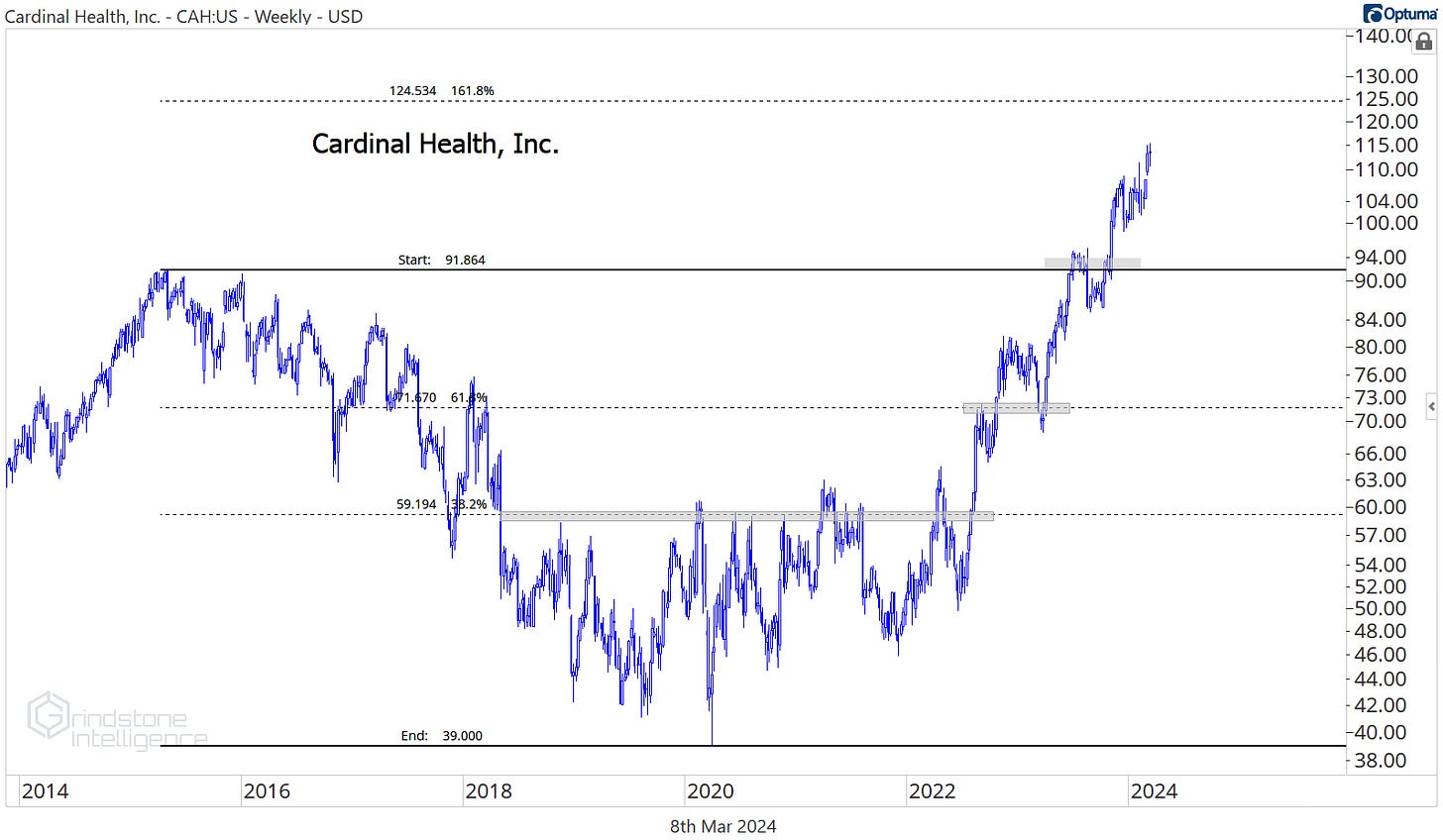

And for Cardinal Health, we’re still looking at $125.

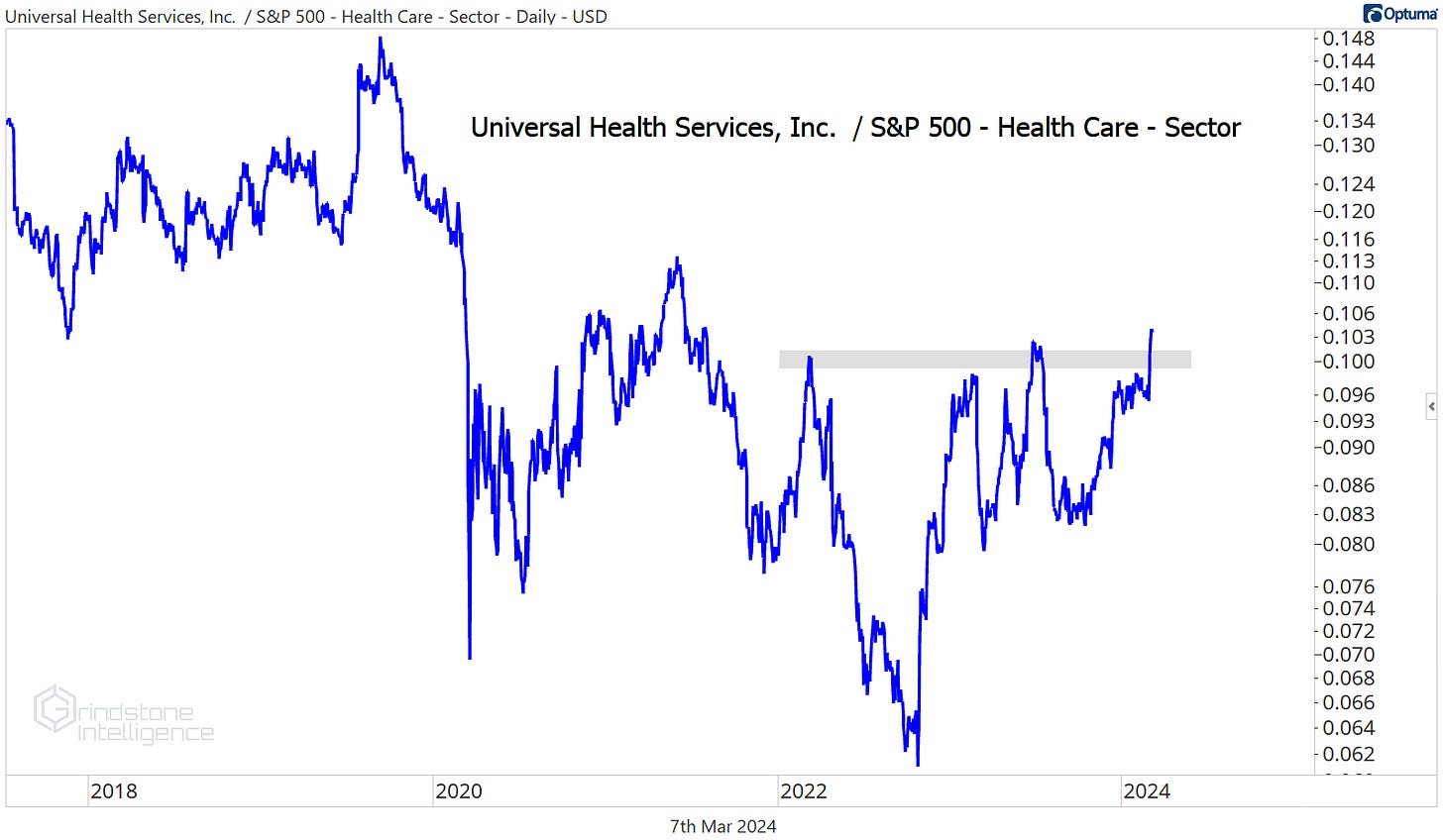

The recent strength in the Health Care Facilities space is really impressive, though. United Health Services is hitting new multi-year highs relative to the rest of the sector.

The risk/reward setup is pretty clean, too. Universal Health Services just went nowhere for nearly a decade. From big bases come big resolutions. We continue to like UHS from the long side as long as it stays above $160, with a target of $225.

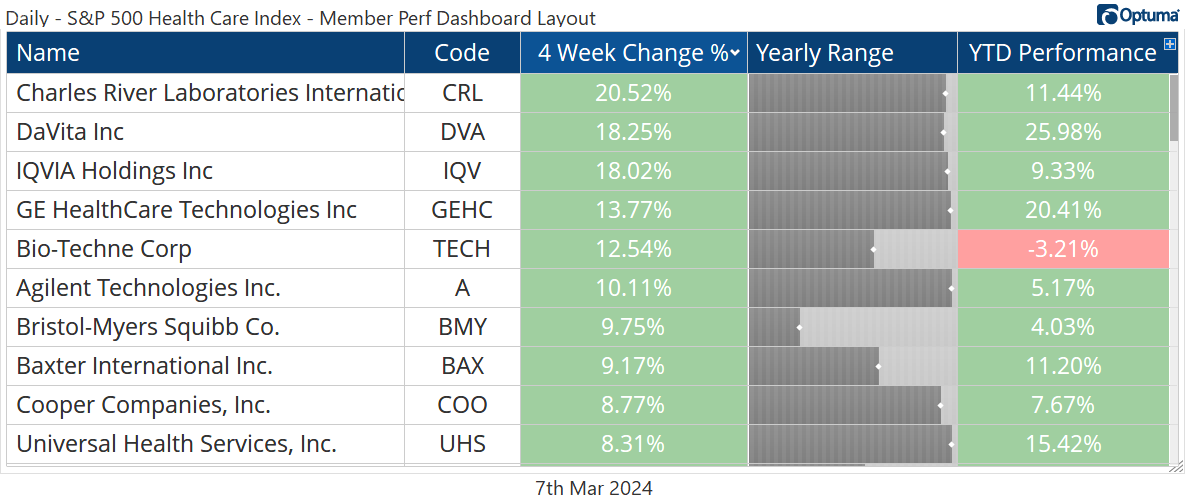

Leaders

Looking at stocks setting new all-time highs like the Distributors and Facilities stocks is a great way to find relative strength, but we need to keep an eye out for stocks putting in major reversals, too.

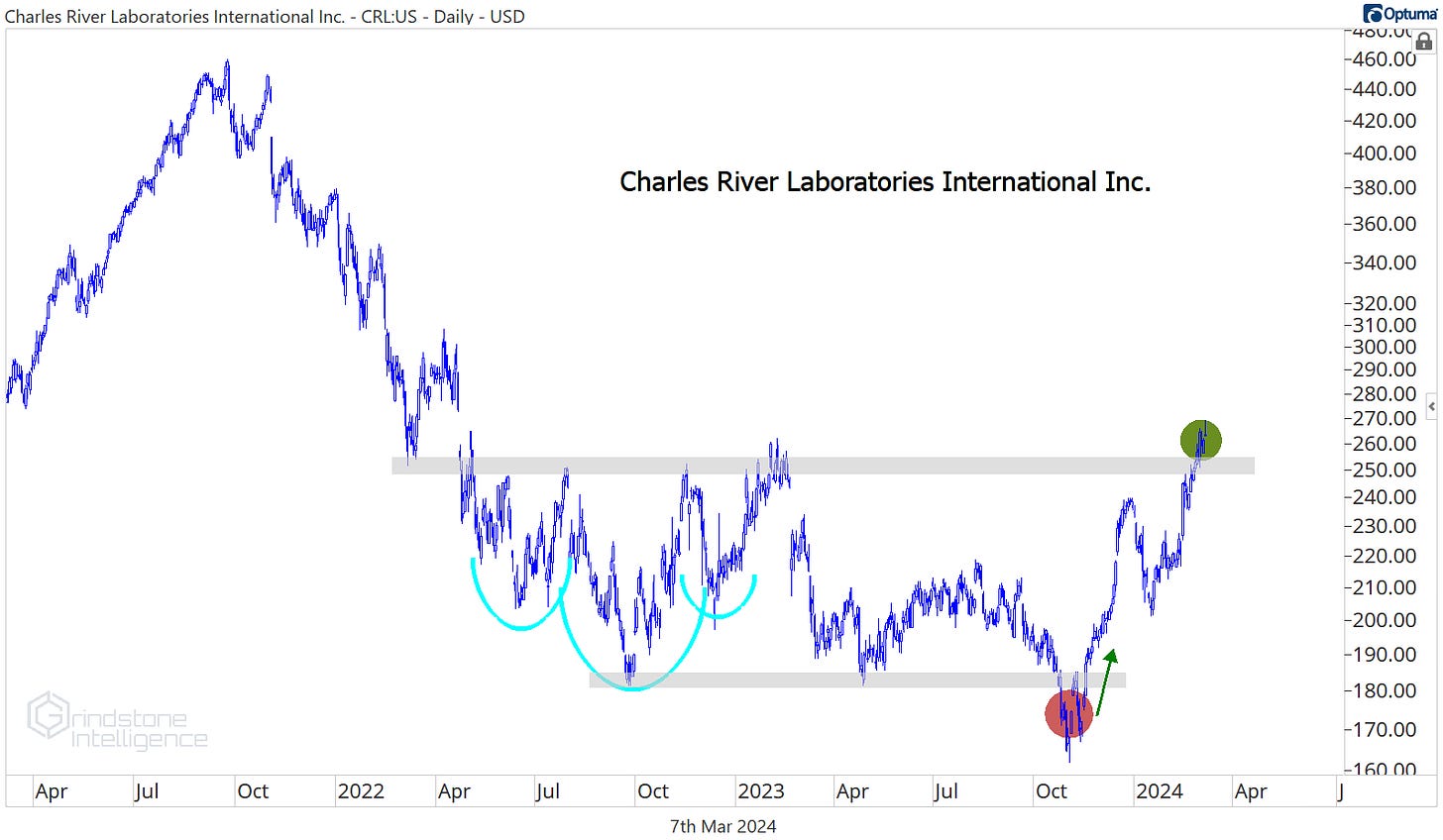

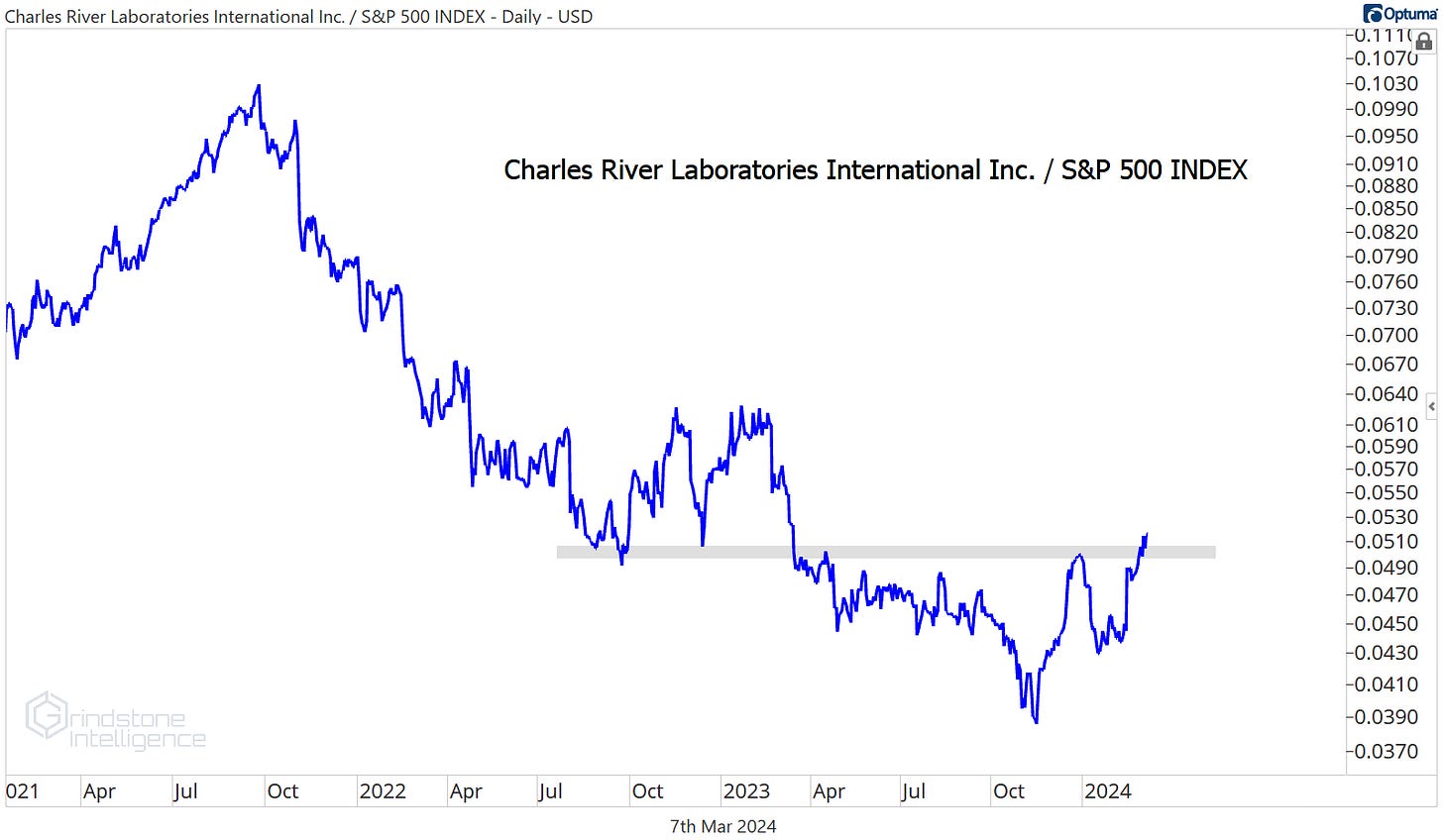

Charles River Labs is trying to complete the bottoming process right now.

Bottoms are a process. CRL formed a textbook inverse head and shoulders reversal pattern back in 2022, then reminded us all that the market doesn’t care about the lines we draw on a chart. The reversal failed. The real shift happened when bears couldn’t capitalize on a breakdown to new lows last October. From failed moves come fast moves in the opposite direction, and now CRL is at multi-year highs.

What we like even more than the multi-year absolute highs is this breakout for CRL relative to the rest of the market.

We want to be buying Charles River above $250 with a long-term target back at the former highs of $460.

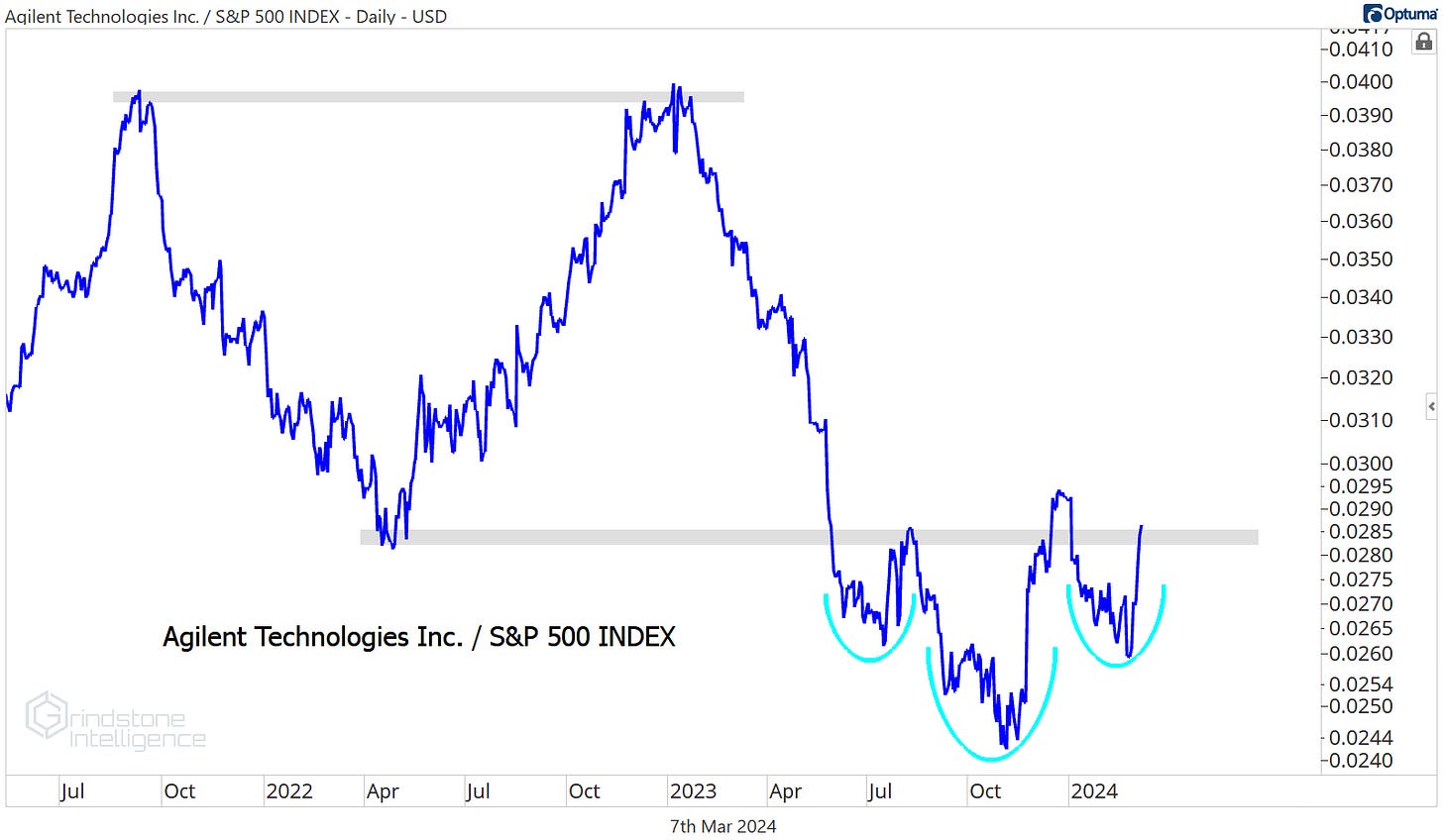

Agilent is another one that’s working on a bottom relative to the rest of the market. We just saw how inverse head and shoulders patterns don’t always work out, but if the Agilent/S&P 500 is back above the 2022 lows, we don’t know how we can be anything but bullish.

We want to be buying Agilent above $137 with a target of $180.

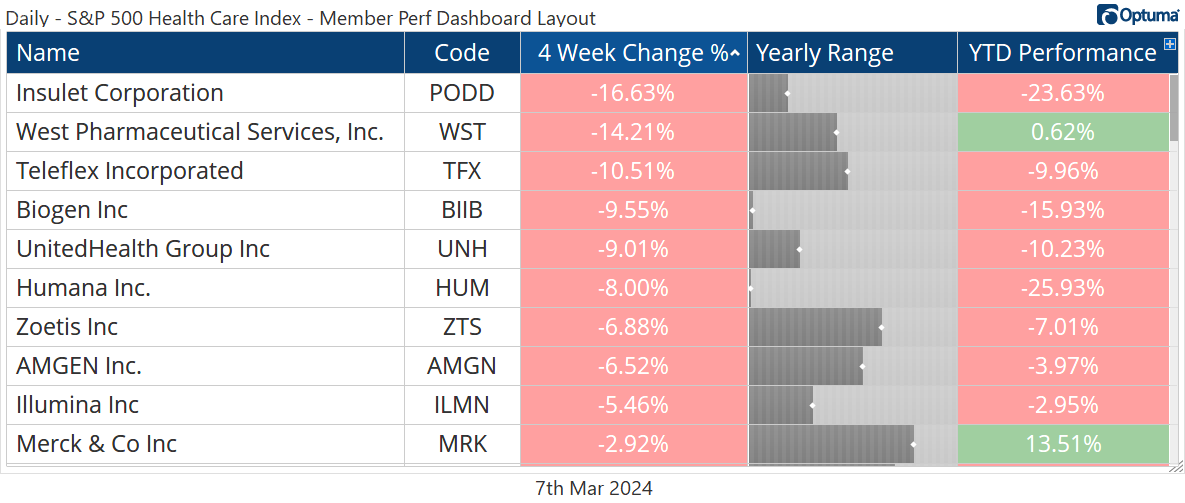

Losers

In bull markets we want to be buying relative strength and avoiding relative weakness. The managed care space is where we’re seeing the relative weakness right now.

Last month we pointed out this really important rotational area for UnitedHealth relative to the rest of the market. Instead of finding support here, UNH broke to new 52-week relative lows.

Longer term, this uptrend in UNH is still very much intact. The ongoing multi-year consolidation will most likely resolve to the upside. While we’re waiting for that, though, there’s opportunity cost in not owning the areas of the market that are ripping higher.

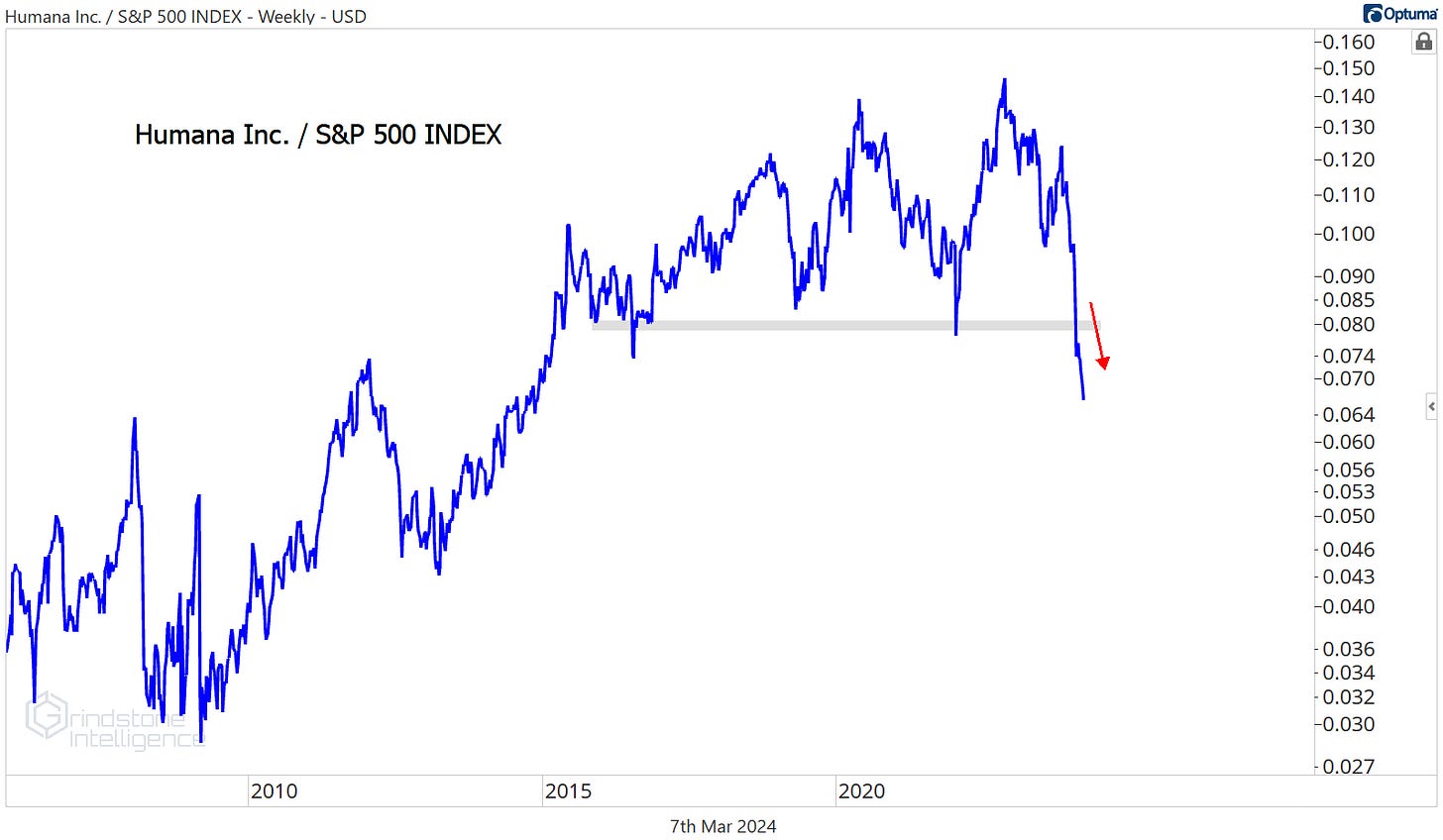

Humana is even worse than UnitedHealth. It just broke to new decade lows relative to the rest of the market.

If this were a bear market, we’d be looking for opportunities to short the relative weakness in HUM. Right now, though, we’d prefer to just ignore it and spend our time looking elsewhere.

More charts to watch

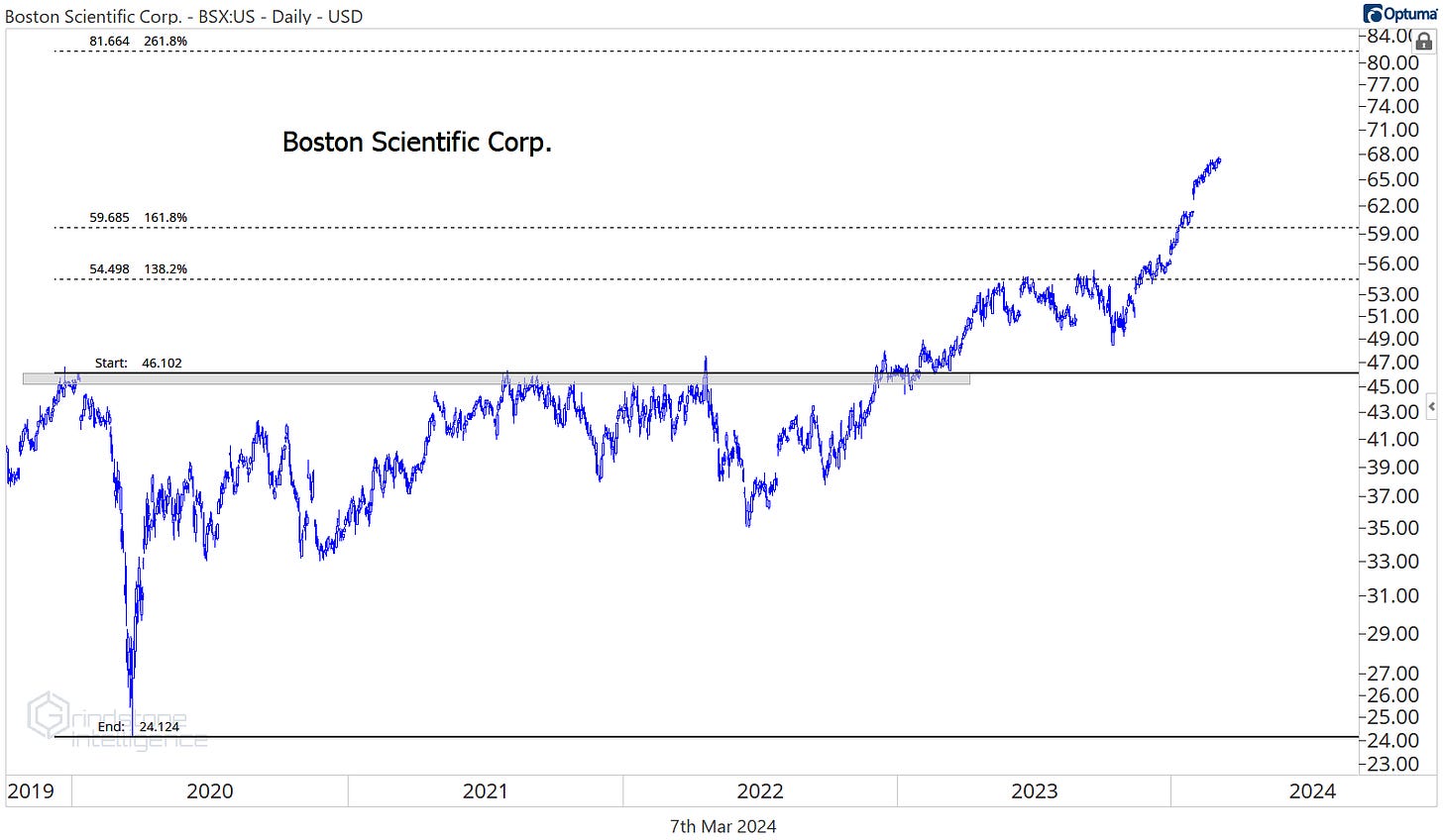

Boston Scientific continues to be among our favorites. After breaking out relative to the rest of the market last month, it’s been consolidating above the former highs. That’s not bearish.

The risk-reward here isn’t great today, but if we see a pullback in the broader market that keeps the relative strength profile intact, we want to be buying BSX above $60 with a target of $81.

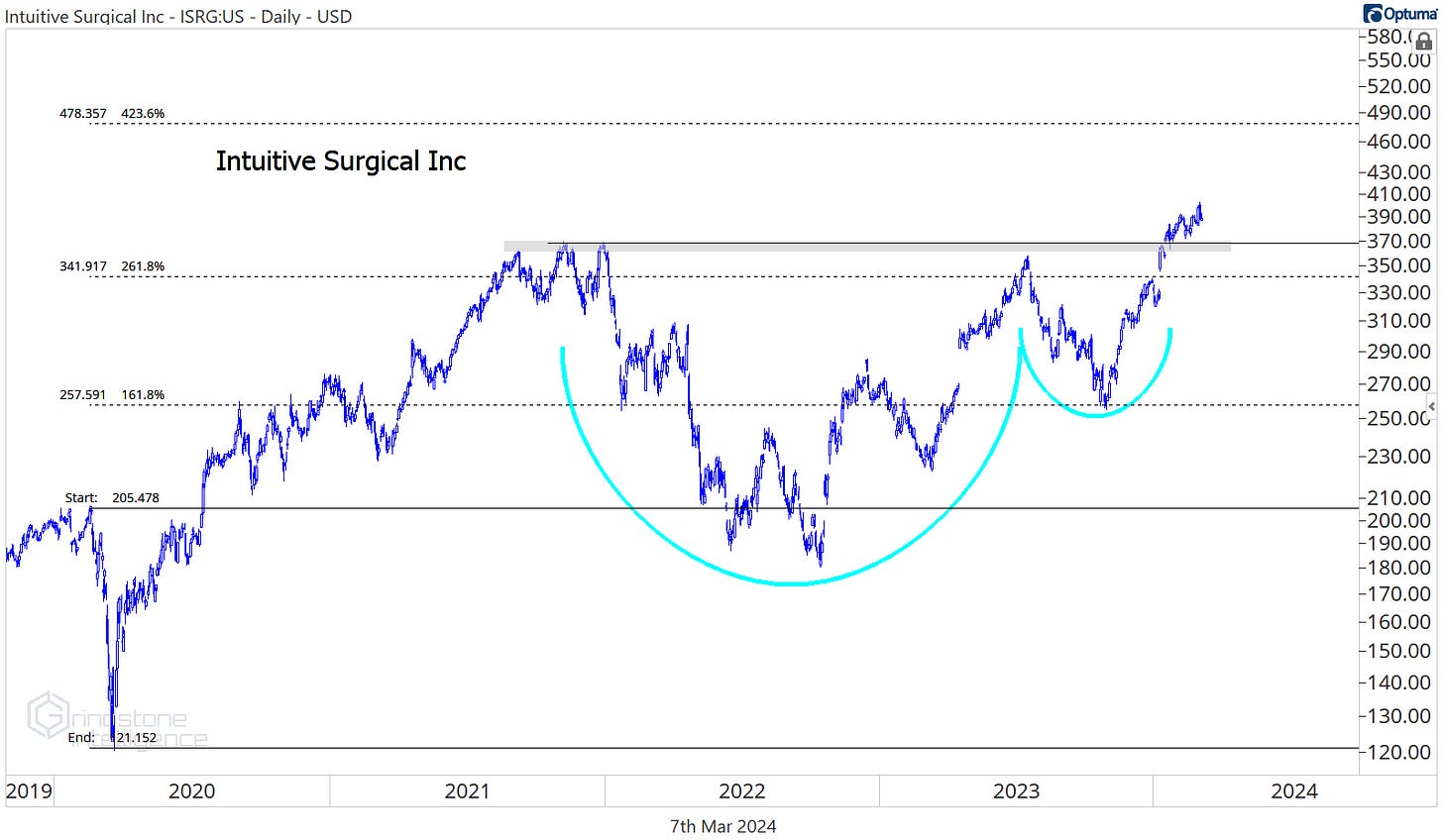

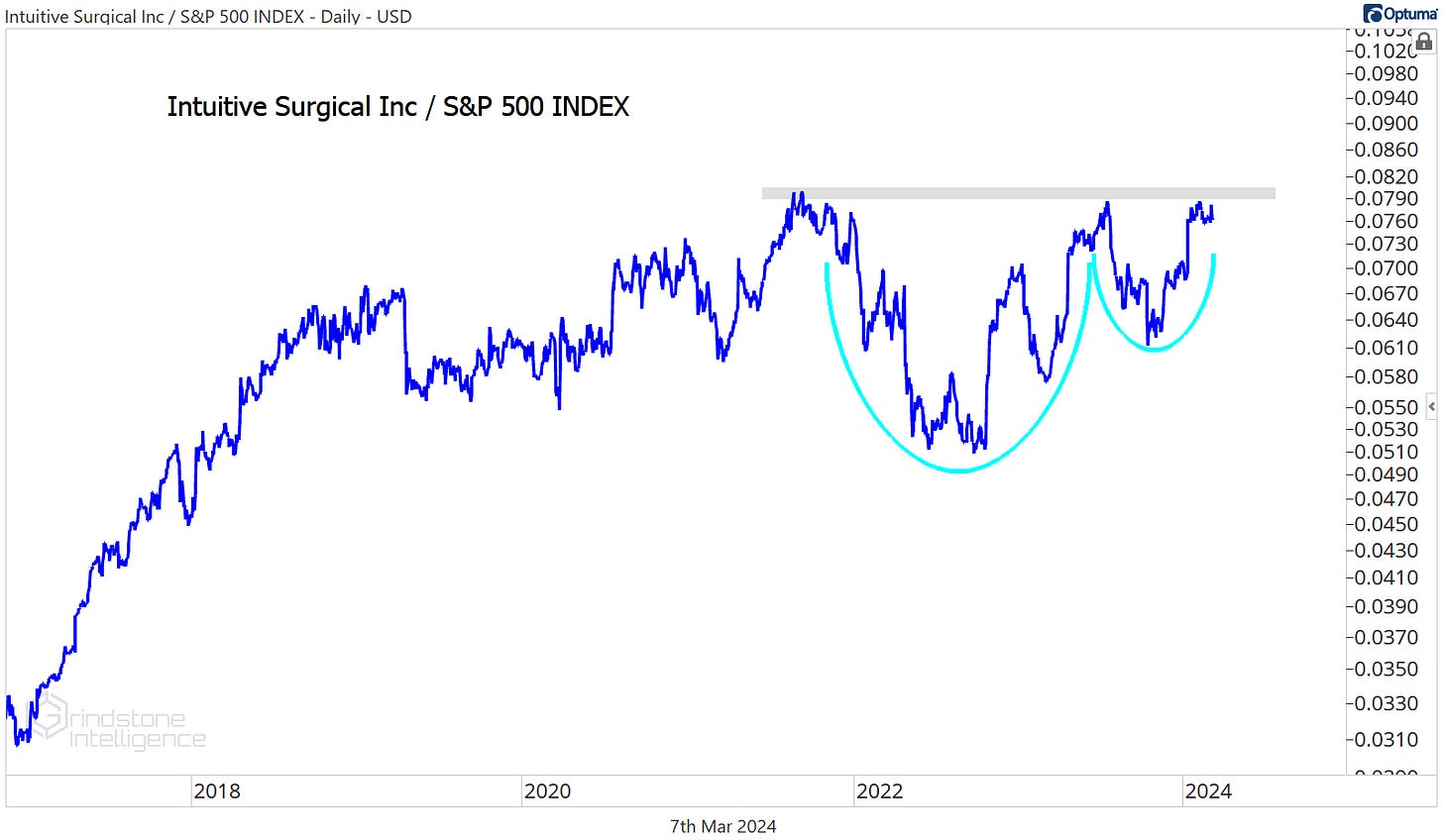

Intuitive Surgical just broke out of a 2-year cup and handle base.

We like ISRG above the former highs of $375 with a target of $480, which is the 423.6% retracement from the 2020 decline. Especially if it can complete the same cup and handle continuation pattern relative to the rest of the market.

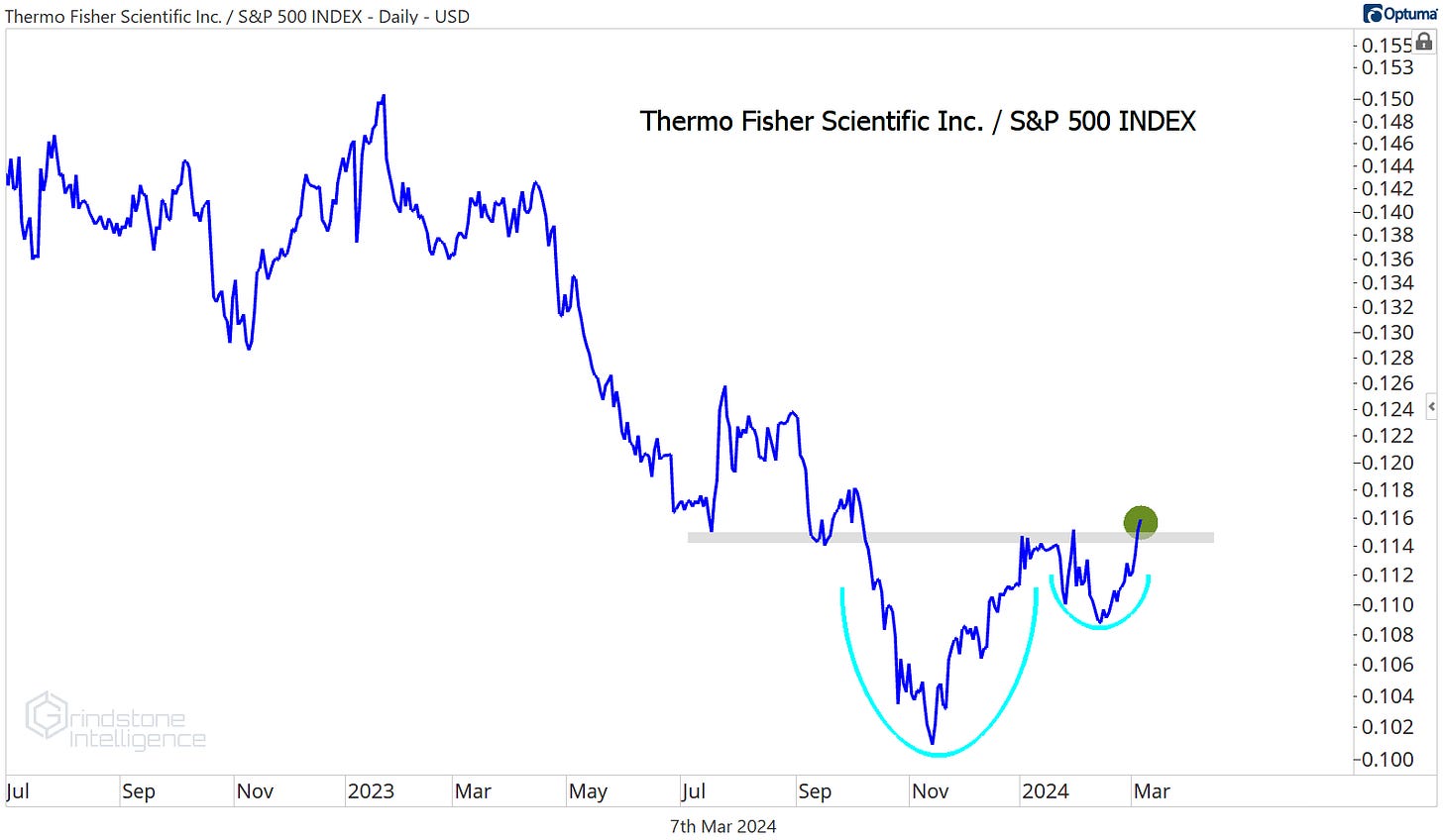

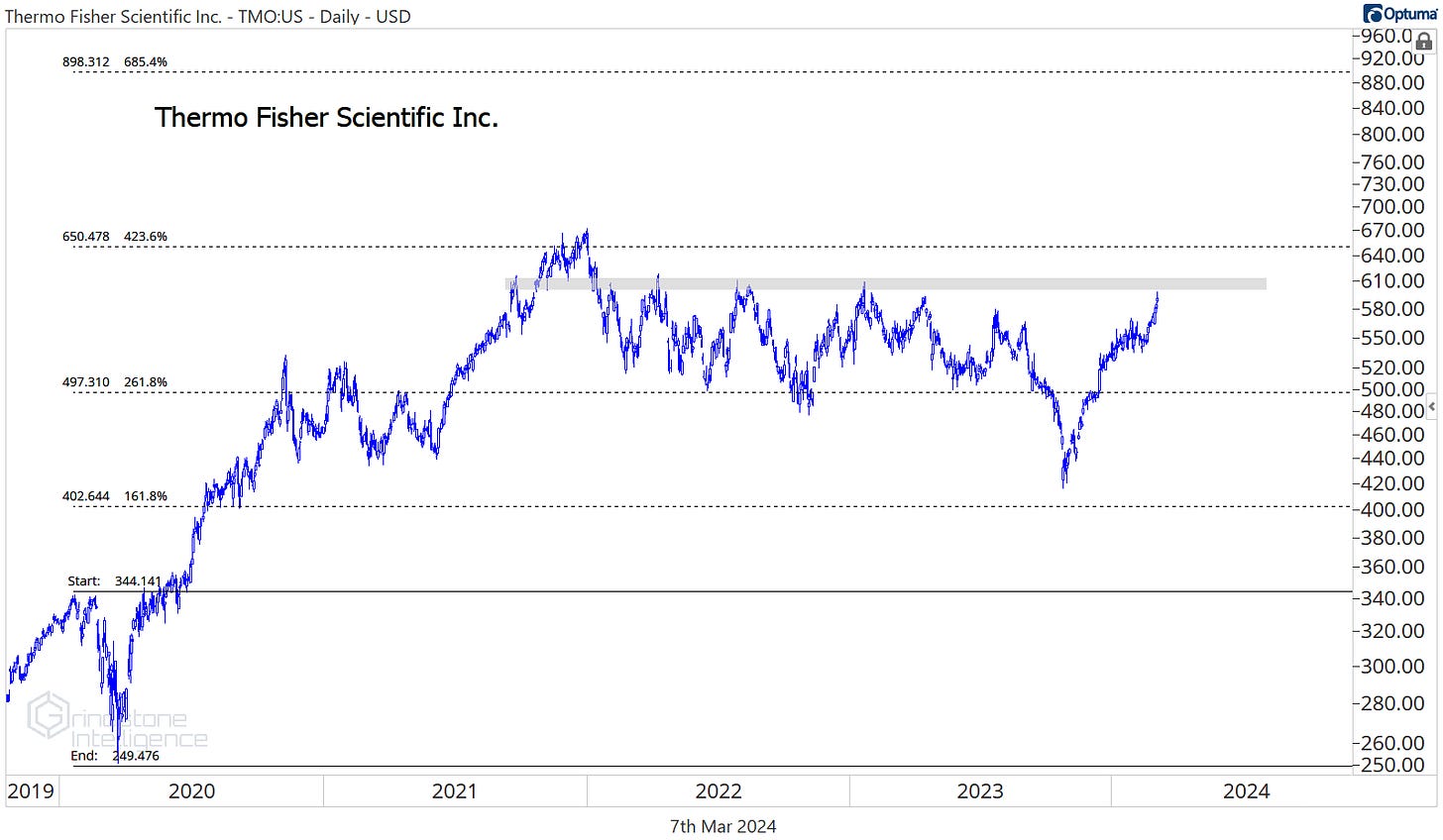

Here’s another cup and handle pattern to watch, except this time its a reversal of a downtrend, not a continuation of an uptrend. Thermo Fisher is setting new multi-month highs against the S&P 500.

TMO is still rangebound, but it’s knocking on the door of new multi-year highs. If that breakout comes, we want to be long with a target of $900.

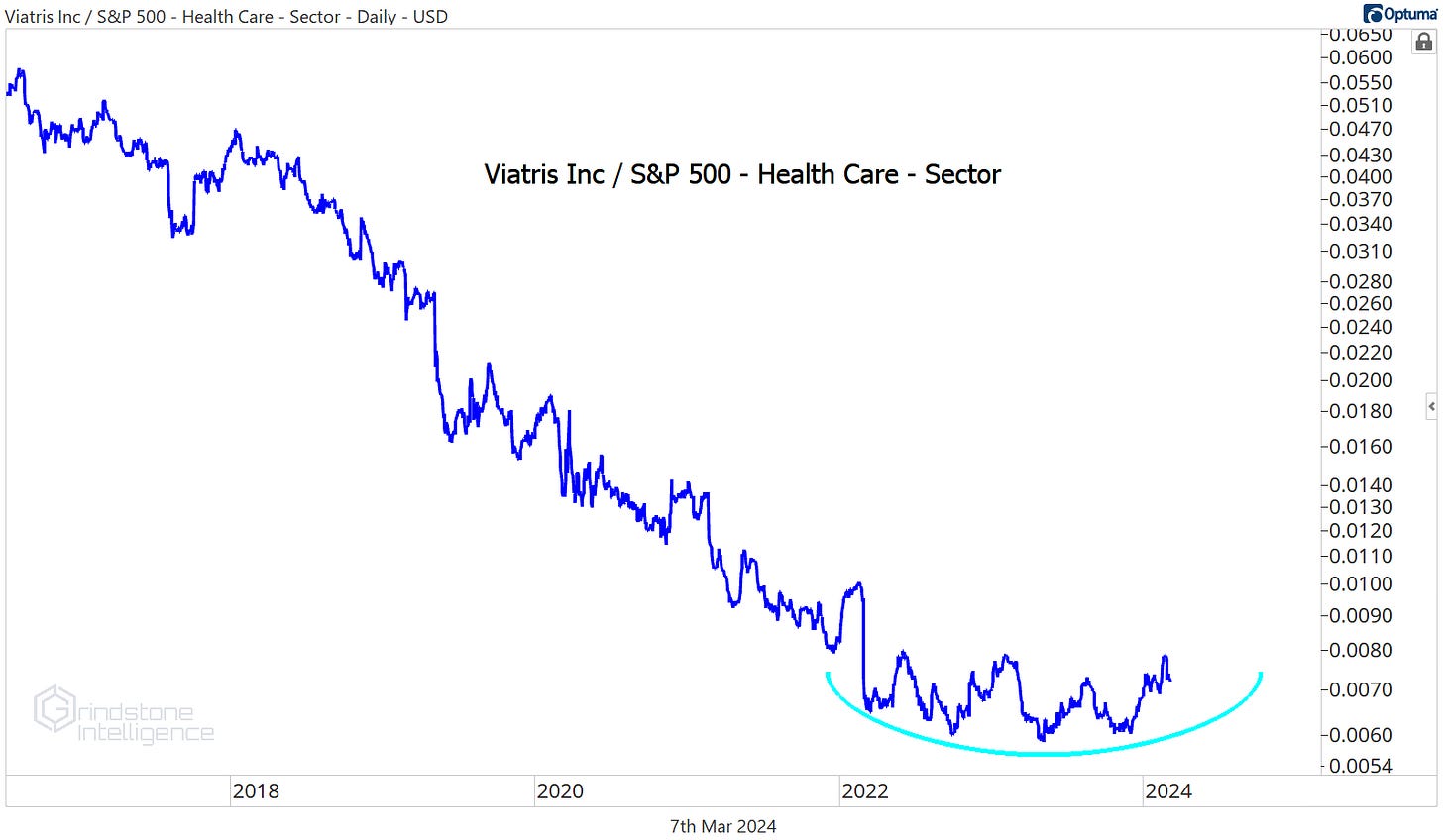

Ok, before we talk about this next one, we’d just like to say: It’s a downtrend. It’s a downtrend. It’s a downtrend.

But also… maybe?

Listen, VTRS is in a downtrend on both an absolute and a relative basis, and we don’t like betting on trend reversals because trend reversals are the lower probability outcome by nature. But that doesn’t mean reversals never happen. We don’t hate it long above $12.50 - and only above $12.50 - with an initial target up near the 2021 highs at $19.

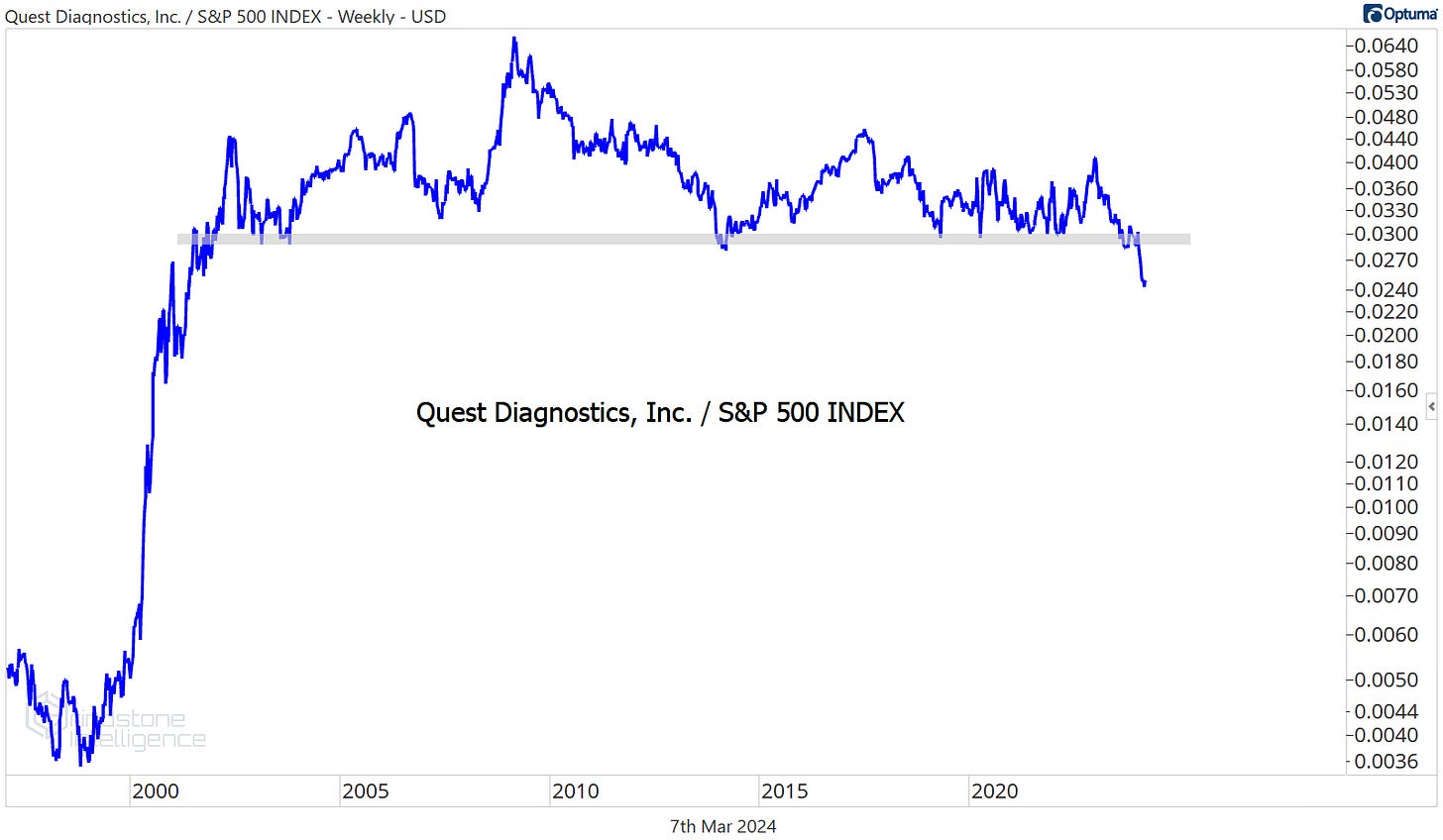

Oh and here’s Quest Diagnostics hitting new 20-year lows vs. the S&P 500. Gross.

Until next time.