(Premium) November Energy Outlook

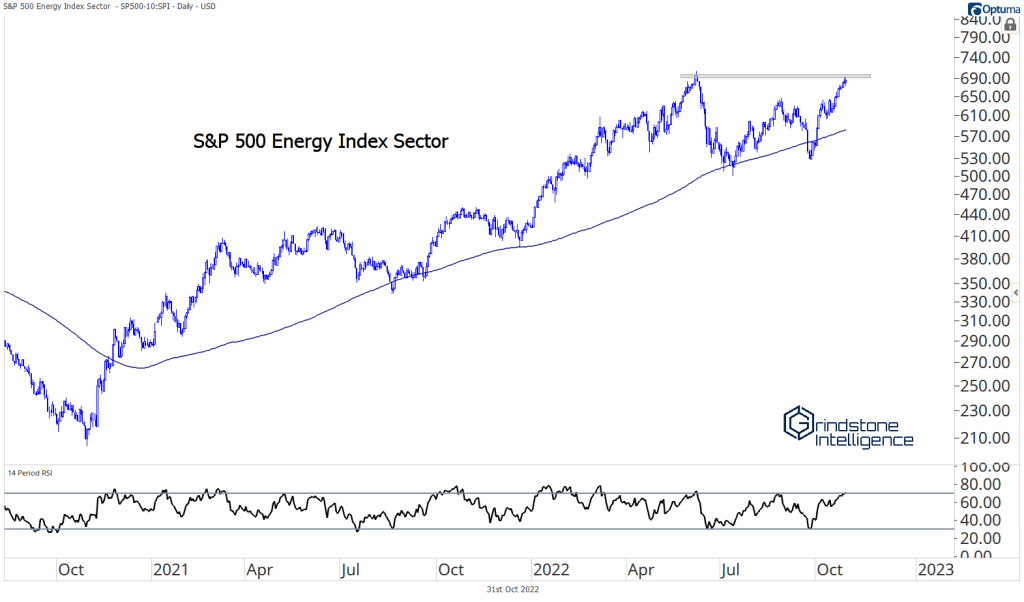

Energy solidified its position as the best performing sector on the year after a strong October. We absolutely do not want to be underweight this sector – it’s a freight train and we don’t want to stand in the way.

Here’s what would change my mind: There’s a potential bearish divergence setting up in weekly momentum. To be clear, we have zero price confirmation so far, so a reversal is still the lower probability outcome. But if Energy fails to hold this relative breakout, we should reassess how aggressively overweight we want to be and consider a neutral position instead.

Momentum divergences don’t have to lead to full trend reversals. More often than not, they’re just mean reversions that take some time to work themselves out, and then the long-term trend continues. But being on the wrong side can have ugly consequences. There was a similar divergence at the relative lows back in 2020, and that was the signal to reduce short positions in the space.

The potential momentum red flags coincide with Energy testing former highs on an absolute basis. If Energy gets rejected here, expect the relative chart to fail, too.

The biggest names in the sector are already breaking out above those former highs. Check out Exxon, Chevron, and Conoco Phillips. If these three fail to hold their new highs, Energy stocks have a big problem. But that’s not what’s happening right now.

The post (Premium) November Energy Outlook first appeared on Grindstone Intelligence.