Peak Inflation?

For most of the last year, rising prices have been everyone’s favorite topic. Or perhaps their least favorite. Whether you’re spending more at the grocery store, facing higher housing costs, or dropping $100 every time you fill up your truck, inflation affects us all. The most recent report from the Bureau of Labor Statistics showed consumer prices were 9.1% higher than a year ago, the highest rate since 1981.

Surging costs have spurred the Federal Reserve into action. Eighteen months ago, the FOMC’s summary of economic projections implied zero interest rate hikes until at least 2024. Officials started shifting their tone by the summer, and near the end of 2021, they retired the word ‘transitory’ as it became clear price pressures were more persistent than previously thought. By mid-January, no rate hikes until 2024 had turned into 3 quarter-point hikes in 2022. Tightening talk has only accelerated since, with Fed Funds futures pricing in a year-end target rate near 3.5%.

Markets tend to dislike tougher monetary policy. Equities fell into bear territory this year as the Fed tightened policy, pushing interest rates higher and helping create a strong US Dollar. With the Fed saying it’s firmly committed to a mandate of price stability, it can hardly take its foot off the economic brakes until prices slow. Until they do, it’ll be a headwind for equity returns.

Luckily, signs of peak inflation pressures are starting to appear.

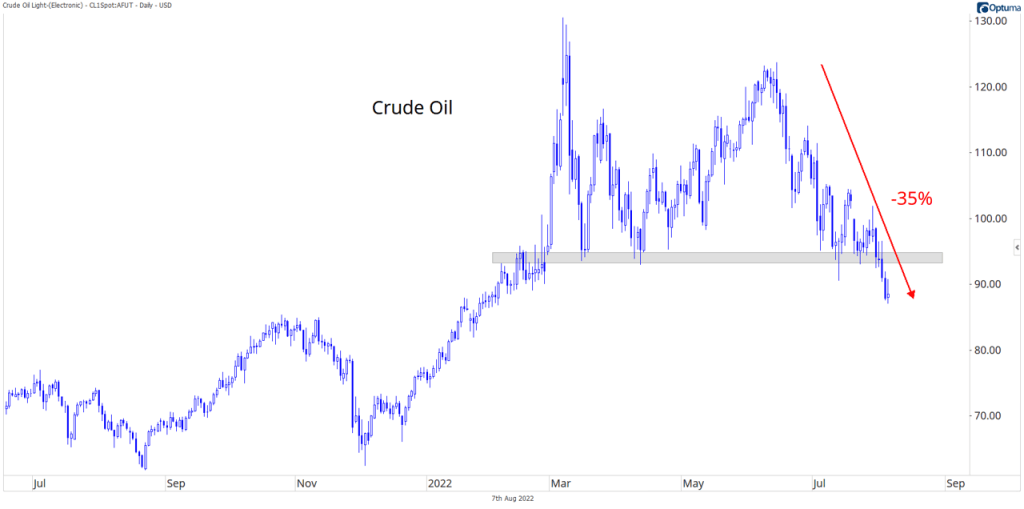

Energy costs comprise more than 8% of the CPI index, and they’re also a significant driver of production and transportation costs. Crude oil dropped below $90 on Thursday, closing the week at its lowest level since January. It’s still 30% higher than a year ago, but well below the March peak.

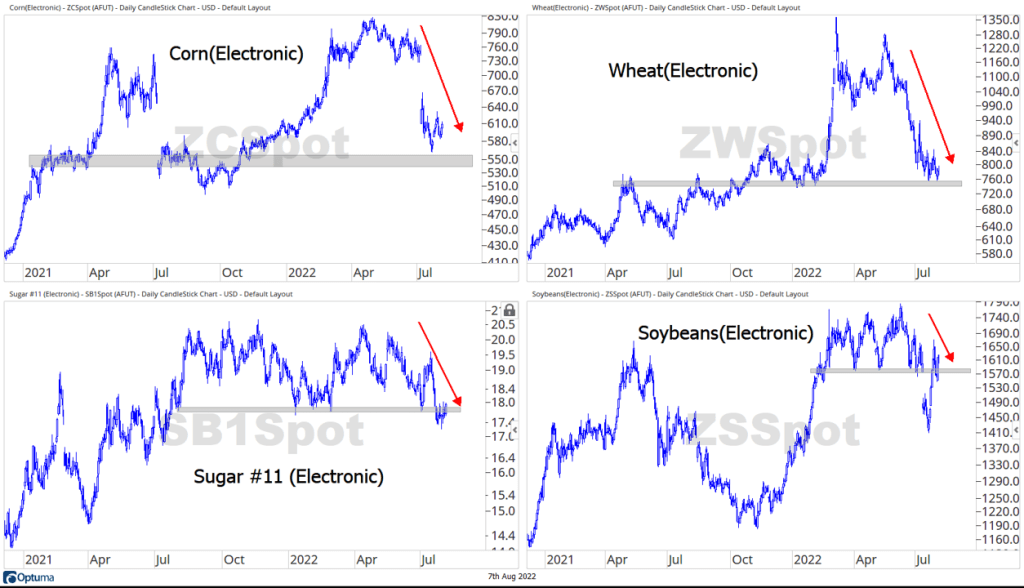

Other key input prices have come off their highs, too. Soybeans, Wheat, Corn, and Sugar futures have all retraced portions of their gains for the year. That should help put a lid on prices at the grocery store.

Copper started 2022 by surging to new highs, but then it fell 35% from those levels. It’s rebounded some in recent weeks, but prices are still significantly lower than they were a year ago.

And lumber, which deserves substantial blame for the increased cost of building a new home, is now back to normal, pre-pandemic levels. It’s nearly 70% below the March highs.

Data compiled by Federal Reserve districts confirms the drop in input costs. Diffusion indexes created from survey results indicates that inflation pressure coming from prices paid for raw materials has declined in recent months. Current readings are pretty comparable to what we saw in 2018. Back then inflation was in-line with the Fed’s 2% target.

It can take time for a drop in input costs to flow through to consumer prices, but it looks like we’re in the early stages of that now. The ‘prices received’ components of those same surveys have retreated from their highs. They’re still well above normal levels, but they are headed the right direction.

Of course, we can have all the ‘signs’ of peak inflation we want, but it doesn’t mean a thing if they don’t result in price pressures actually receding. We’ll know about that soon enough. On Wednesday, the BLS releases its CPI report for July.

Nothing in this post or on this site is intended as a recommendation or an offer to buy or sell securities. Posts on Means to a Trend are meant for informational and entertainment purposes only. I or my affiliates may hold positions in securities mentioned in posts. Please see my Disclosure page for more information.

The post Peak Inflation? first appeared on Grindstone Intelligence.