(Premium) A Wellness Check on Health Care Stocks

On the surface, not much has changed for the Health Care sector since we last checked in. Under the hood, we’re seeing some great opportunities.

The group has been a laggard in 2023, finishing near the low-end of the year-to-date sector derby. Despite that, it’s yet to show material weakness on an absolute basis, so there’s no reason for us to turn overly bearish. It’s well above last year’s lows, and it recently found support at the 161.8% retracement from the 2020 COVID collapse. Right now, we’re in the middle of a multi-year trading range and just above a flat 200-day moving average.

(click charts to enlarge)

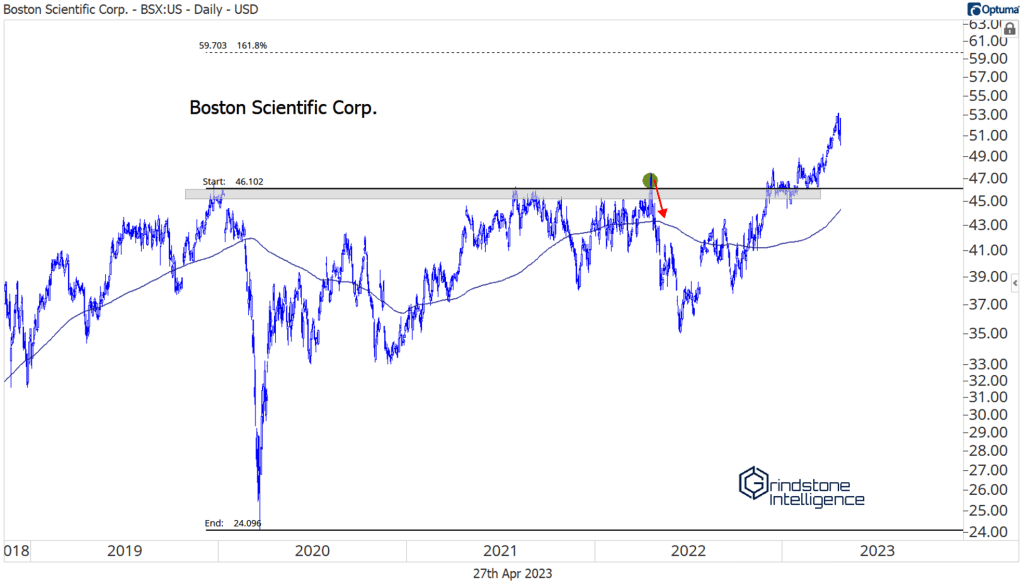

We’ve seen continued strength out of the Health Care Equipment space. The sub-industry had been stuck below stiff resistance for the better part of the last year, but finally broke through with some gusto earlier this month.

The breakout was led by Boston Scientific, which has been near the top of our list for several months. It’s now halfway to our $60 target.

We’ve seen good progress from Stryker, too. We said we wanted to be long SYK if it was above the 161.8% retracement from the COVID selloff. Now it is, so we’re targeting the 261.8% retracement, which is up near 380.

What’s impressed us even more, though, is the rallies we’ve seen from the weaker names within medical equipment.

Baxter International had been one of the worst stocks in the world for the last 3 years, but it recently found support at the former highs from 2014-2015. The stock is already up more than 20% from last month’s lows.

Medtronic, too, is working on a bottom. It just broke out to new 6-month highs, and it’s on track to close the month above its 200-day moving average for the first time since 2021. If you missed the breakouts in BSX and SYK, MDT offers a better risk-reward proposition right now. Near-term, we can target $99, which is the 38.2% retracement from the entire 2021-2022 decline. Our risk level is the February highs that we just broke past.

Moving away from equipment, HCA Healthcare is still one of our favorite charts out there. Call me crazy, but price action over the last 18-months looks identical to the price action from a couple years ago. Check it out: an earnings rally into consolidation, a failed breakout followed by a huge selloff, then stair steps higher to challenge the former highs. Last time, HCA rose another 70% after the breakout. Why can’t it do it again? We’re targeting 400 for now, which is only 40% higher from here. We only want to be long if the stock is above 260.

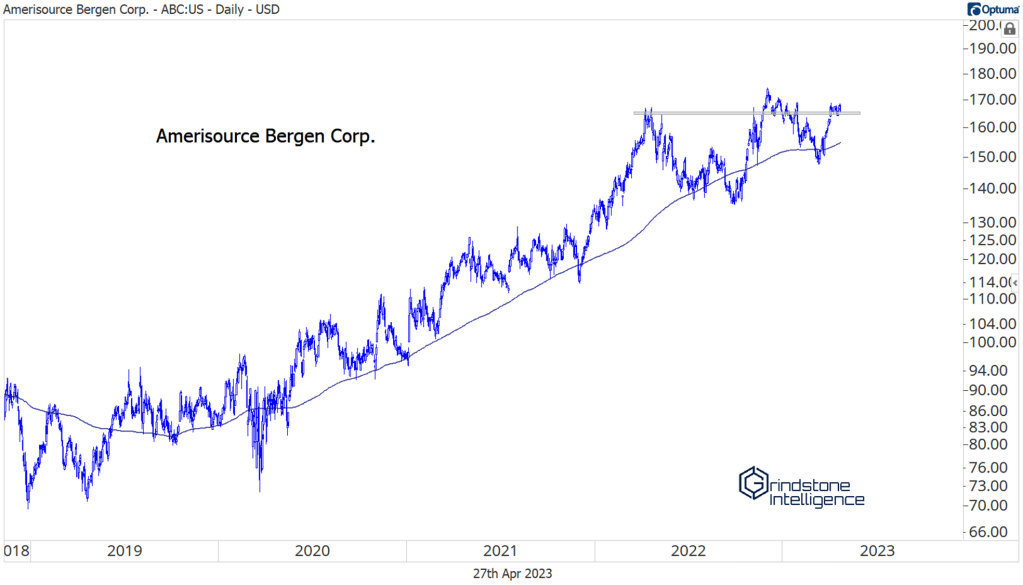

We’re also seeing renewed strength out of distributors. Amerisource Bergen Corp is back above its early-2022 highs after failing to hold its former breakout. This one has spent most of the last 3 years above a rising 200-day moving average – that’s not something you can say about too many stocks out there.

Where we’re not seeing participation is in the life sciences space. Danaher is a prime example. After a huge post-COVID rally, driven by a boom in testing and vaccine-related revenues, Danaher peaked at the 423.6% retracement from the initial 2020 decline. It fell back to the 261.% retracement, and spent the next year consolidating above it.

Earlier this week, though, Danaher reported that bioproduction was weaker than they’d expected, as funding for the space has dried up in the aftermath of SVB’s collapse. That pushed DHR to new multi-year lows, and dragged peers down with it.

With life sciences breaking down, it’s hard for us to get excited about Health Care at the sector level.

The post (Premium) A Wellness Check on Health Care Stocks first appeared on Grindstone Intelligence.