(Premium) April Energy Outlook

The Energy sector faces significant headwinds, which skews the risk/reward in favor of bears. For months, we’ve been pointing at tough resistance and waning momentum on both an absolute and relative basis. The sector has been unable to surpass its 2014 highs, and weekly momentum failed to get overbought on the most recent rally. At the very least, we think it takes some time to work off that bearish momentum divergence. At the very worst, prices revert back to the 200-week mean.

After being the top performing sector in both 2021 and 2022, Energy has been one of the worst places to be in 2023. Our underweight view remains appropriate, given the continued relative weakness. Compared to the S&P 500, the sector is now below a 200-day moving average and below an eight-month rotational level that will act as tough overhead resistance on any rally.

Devon Energy is one that offers a favorable setup from the short side. It just set new 52-week lows, and momentum fell meaningfully into oversold territory for the first time since 2020. If DVN falls back below 49, we think it can drop all the way to 33. If it’s above 49, there’s no reason to be involved.

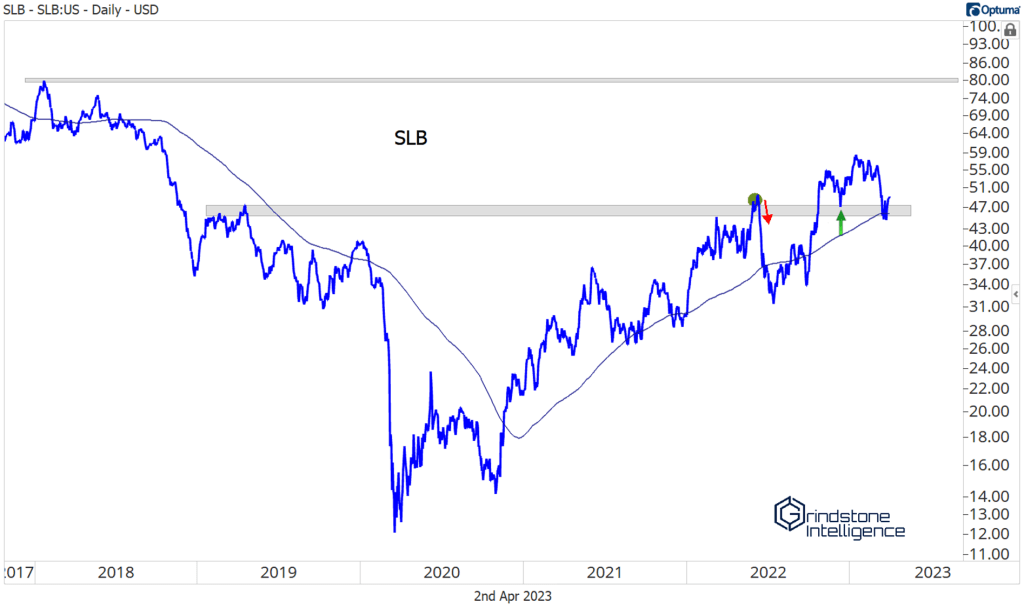

Just because we’re negative on the sector, though, doesn’t mean you can’t find opportunities on the long side. SLB is holding on to support from the 2019 and 2022 highs. If it’s above 47, we think it goes to 80. Of course, it’ll have an easier time getting there if Energy as a whole isn’t falling apart.

View the rest of our April outlook:

April Technical Market Outlook

(Premium) April FICC Outlook

(Premium) April Information Technology Outlook

(Premium) April Communication Services Outlook

(Premium) April Consumer Discretionary Outlook

(Premium) April Industrials Outlook

(Premium) April Financials Outlook

(Premium) April Energy Outlook

(Premium) April Materials Outlook

(Premium) April Health Care Outlook

(Premium) April Consumer Staples Outlook

(Premium) April Real Estate Outlook

(Premium) April Utilities Outlook

The post (Premium) April Energy Outlook first appeared on Grindstone Intelligence.