(Premium) April FICC Outlook

The relationship between the US Dollar and stocks was the only thing that mattered in 2022. Each time the Dollar rose, stocks fell. And each time the Dollar retreated, equities got a reprieve. That relationship is back in force in 2023.

The Dollar weakened throughout March, offering a tailwind that’s brought the S&P 500 back near multi-month highs. Whether stocks can push ahead may very well depend on how the DXY responds to its 2017-2021 highs.

With European Central Bank still in the early stages of a rate hike cycle and the Federal Reserve likely nearing the end of its own, international interest rate dynamics favor further weakness in the DXY. If it falls back into its pre-2022 range, that’ll be a tailwind for equity prices.

Fixed Income

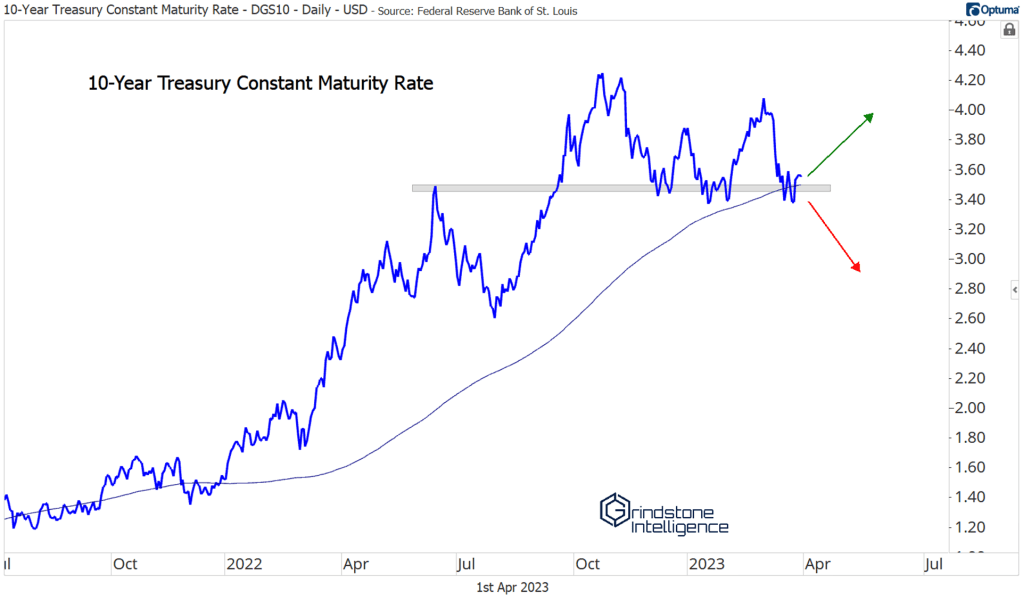

Speaking of interest rates, long-term Treasurys are looking for direction. Ten year yields have been dancing around 3.5% since last summer.

Like the Dollar, yields have shown a significant negative correlation with stock prices over the last year, so this resolution has big implications for more than just bond prices. If last year’s relationship holds, a breakdown in yields would be a boon for stocks. The only question is, why would yields break down? If it’s because markets are pricing in a deep recession in the back of the year (instead of simply a moderation in inflation pressures) and investors are dumping stocks for the safety of Treasurys, last year’s correlations won’t matter.

Precious Metals

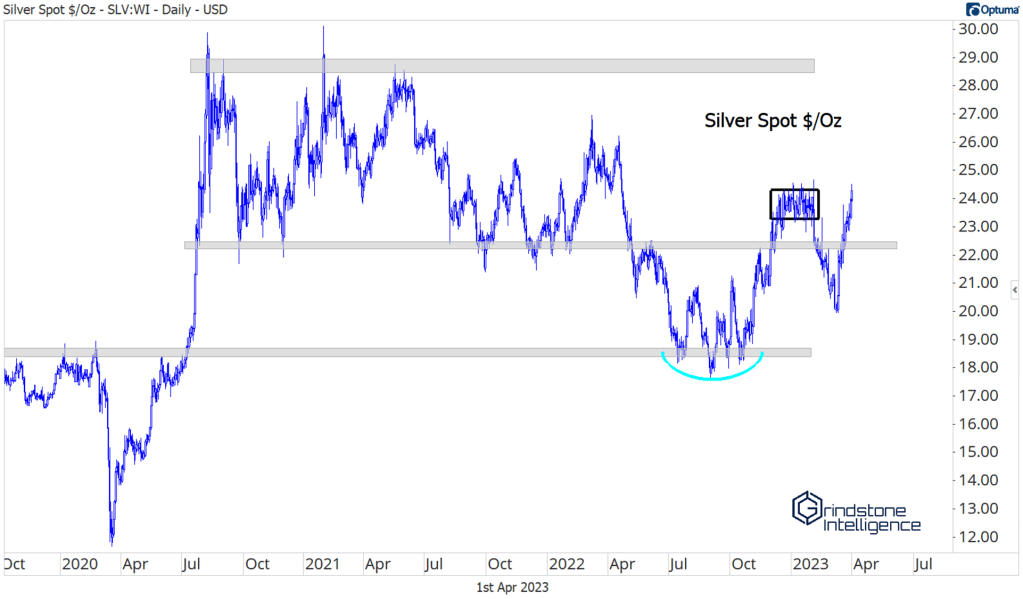

Last month, we were encouraged by relative strength in Gold, as it managed to bounce off of support at 1800, a level we’d been watching since December. We noted that a further bounce was likely, but upside would be limited unless silver’s performance showed meaningful improvement.

We got both.

Silver surged back above 22.50, a key support level from 2021-2022, and it’s approaching new year-to-date highs. Back in December and January, we grew concerned about silver’s sideways trajectory while gold was rallying. Silver’s lack of participation caused us to turn cautious on precious metals ahead of the February selloff. We’ll see whether silver has the momentum to push through that congestion area this time around.

If it does, that could easily support gold prices moving above 2000 and to all-time highs. The failed breakdown last fall has proved the perfect catalyst to get gold moving higher.

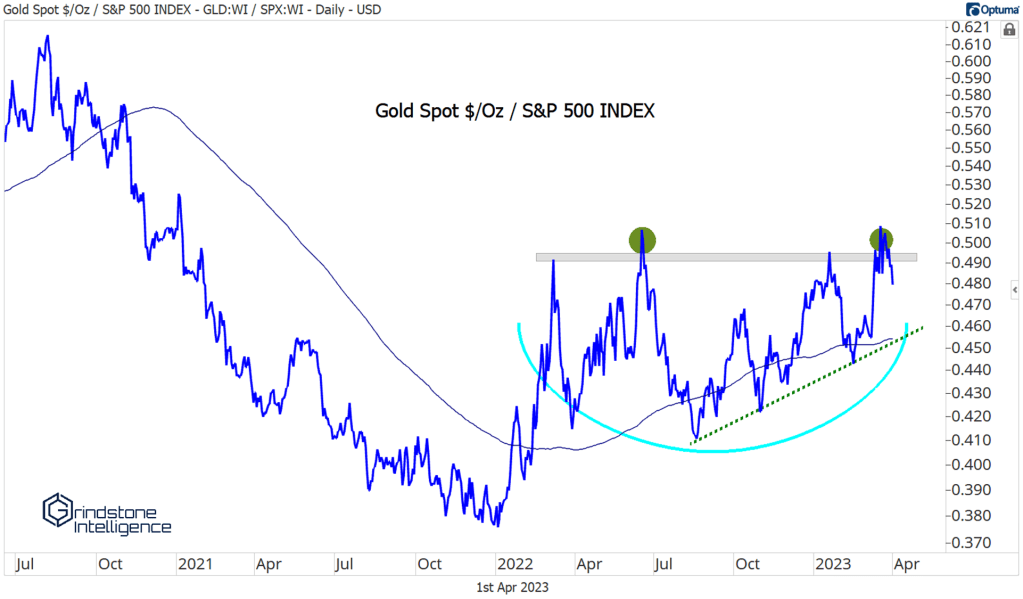

Relative to stocks, gold is working on a 12-month base that could set it up for an extended period of outperformance. The ratio has had a few false starts along the way, but its been all higher highs and higher lows since August. We’re on breakout watch.

Bitcoin

Cryptocurrencies are at the forefront of investor returns this year. That follows a horrendous 2022, in which Bitcoin dropped by more than 60% and crypto volatility fueled the meltdowns of Terra and FTX.

Our outlook for Bitcoin remains unchanged from last month: until prices are either above 30000 or below 20000, the trend is sideways and a neutral position is appropriate. Based on the action over the last few weeks, though, a more positive opinion could soon be warranted.

View the rest of our April outlook:

April Technical Market Outlook

(Premium) April FICC Outlook

(Premium) April Information Technology Outlook

(Premium) April Communication Services Outlook

(Premium) April Consumer Discretionary Outlook

(Premium) April Industrials Outlook

(Premium) April Financials Outlook

(Premium) April Energy Outlook

(Premium) April Materials Outlook

(Premium) April Health Care Outlook

(Premium) April Consumer Staples Outlook

(Premium) April Real Estate Outlook

(Premium) April Utilities Outlook

The post (Premium) April FICC Outlook first appeared on Grindstone Intelligence.