(Premium) April Information Technology Outlook

Tech is back in the driver’s seat in 2023. It’s the top-performing sector of the year, up 22% through the end of March. It closed the month at its highest point since last August.

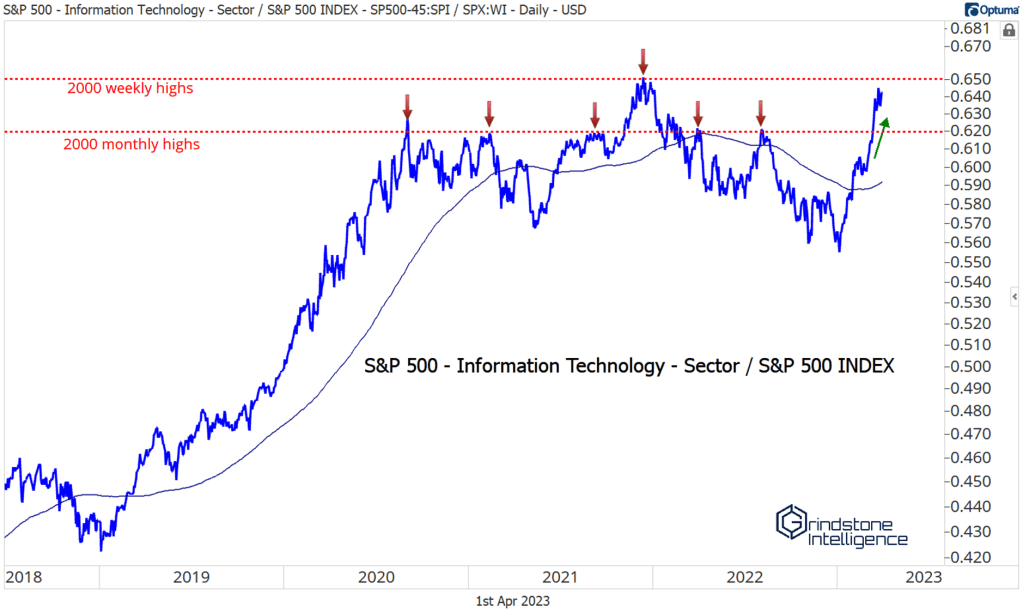

On a relative basis, the sector has surged back above the monthly highs from 2000. In the first week of January, Tech was breaking down to new multi-year relative lows. As so often is the case, that failed breakdown became the catalyst for a new relative uptrend.

The surge was led by large-cap tech. For all of 2022, it was big tech that was lagging, and the equally weighted index outperformed by a handsome margin. But that uptrend line was broken in the first week of March, and now the ratio is trying to find support at last year’s lows. A mean reversion rally for the ration in favor of the equally weighted index could be coming.

That wouldn’t necessarily spell the end of Tech’s outperformance, though, because tech’s dominance over the rest of the market wasn’t limited to just the biggest stocks. The EW Tech sector is near 52-week highs when compared to the S&P 500. The strength within Tech is broad.

Analog Devices just surged to new all-time highs after consolidating just below its 2021 peak. We want to be buying any pullbacks in the stock above 190, with a target of 216. That’s the 161.8% retracement from last year’s selloff.

Cadence Design Systems is steadily working toward our target of 240. Now may not be the best time to initiate a new position – the risk/reward isn’t skewed in our favor – but we can look to take advantage of any pullbacks toward 190.

Motorola Solutions just broke out to new highs as well, after spending a year trying to work through resistance at the 261.8% Fibonacci retracement from the 2019-2020 decline. If MSI is above 270, we want to be long with a long-term target of 366, which represents the 423.6% retracement from that selloff.

One of our favorite litmus tests for a bull market is to see what’s happening to underperforming stocks. If bears can’t keep down the worst stocks, what hope do they have of taking down the rest of the market? Now check out Intel.

One month ago, INTC was setting 8-year lows. But bears couldn’t keep it down. To the contrary, Intel is already setting new 7-month highs.

What’s that tell you about this market?

View the rest of our April outlook:

April Technical Market Outlook

(Premium) April FICC Outlook

(Premium) April Information Technology Outlook

(Premium) April Communication Services Outlook

(Premium) April Consumer Discretionary Outlook

(Premium) April Industrials Outlook

(Premium) April Financials Outlook

(Premium) April Energy Outlook

(Premium) April Materials Outlook

(Premium) April Health Care Outlook

(Premium) April Consumer Staples Outlook

(Premium) April Real Estate Outlook

(Premium) April Utilities Outlook

The post (Premium) April Information Technology Outlook first appeared on Grindstone Intelligence.