(Premium) Can the Rally in Communication Services Broaden Out?

It’s been a good run.

But now it’s time to take a break.

Along with Information Technology and Consumer Discretionary stocks, the Communication Services sector has dominated equity market returns this year. Even before AI dominated the headlines and pushed semiconductor stocks through the roof, it was names like Netflix, Meta, and Alphabet that were leading us higher.

Alas, all good things must come to an end. Or at least, they can’t continue on as they were. We think the outperformance by Communications is set for a pause.

Relative to its benchmark, the S&P 500 index, the sector has made it all the way back up to its mid-2018 lows. That’s also where its underperformance accelerated last spring and where it was rejected on a summer rally. We don’t believe prices will just ignore this historically important level.

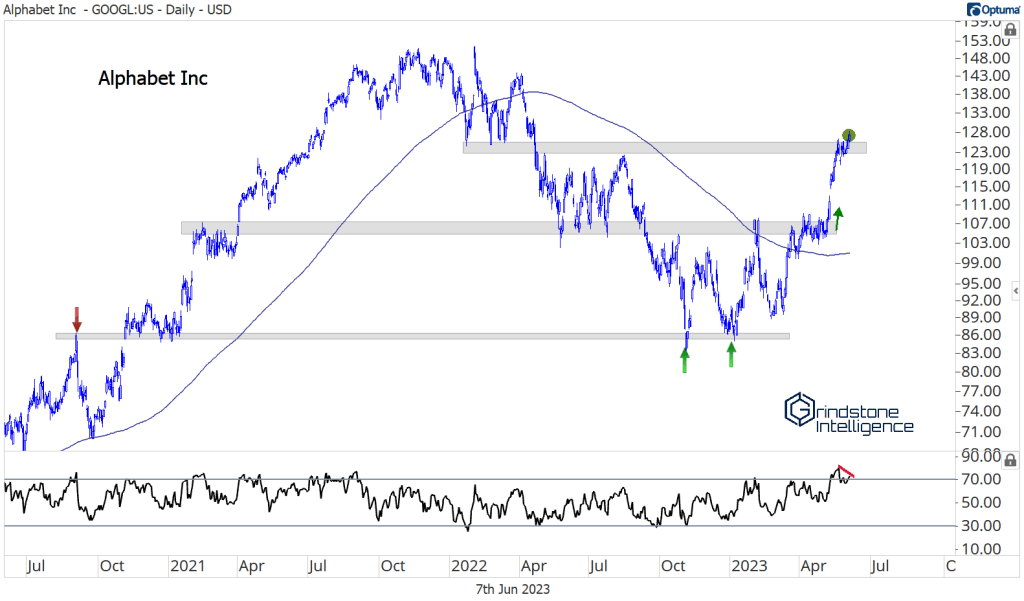

We’re hitting this potential resistance at the same time as several of the biggest stocks in group are running into key levels of their own. Alphabet had quite the run in May, but now it must surpass the early 2022 lows, an area that was stiff resistance last summer. Additionally, momentum has weakened over the past few days, setting the stage for further consolidation or a mean reversion back toward last month’s breakout level. Either scenario would still be consistent with the early stages of a new, long-term uptrend.

Meta finds itself in no-man’s land, nearing the site of the huge breakdown in early 2022. It may still close the gap from that initial collapse, but we don’t expect Meta to continue at this torrid pace.

Those two behemoths running out of steam would be trouble, considering they make up such a huge portion of the sector. Together, they represent half of the SPDR Communication Services ETF (XLC). But there could be a silver lining: The rest of the sector is trying to turn things around.

The equally-weighted Communications sector relative to the equally-weighted S&P 500 index has been trending higher all year, and the ratio is now farther above its 200-day average than it’s been in almost 2 years.

If the ratio breaks above the October and February highs, we’ll start to believe that the sector’s recent relative strength has real staying power.

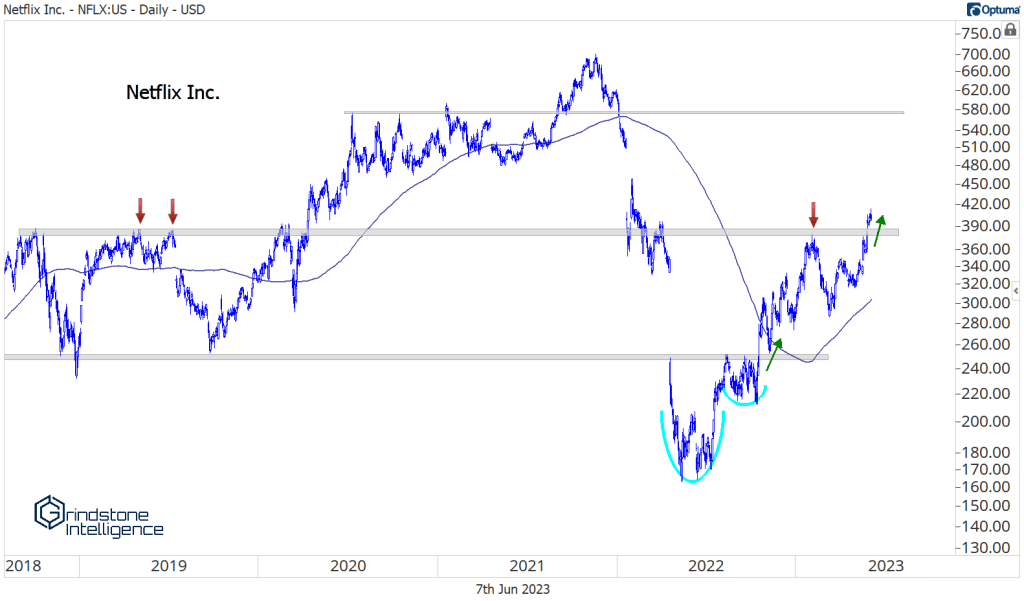

Netflix is one that could make a difference. It’s not as large as GOOGL or META, but it’s hanging above a key former resistance level after a few months of consolidation. We like the risk-reward setup here, and we can be long with a target of $580 as long as this one is above $400.

We’re seeing constructive action in advertisers, too. Omnicom was one of the first to break out earlier this year, and it’s been consolidating above major support for almost 6 months. We think it’s gearing up for a move toward the 161.8% retracement level from the COVID collapse, which is up at $108. But we need to step aside if it falls back below $85.

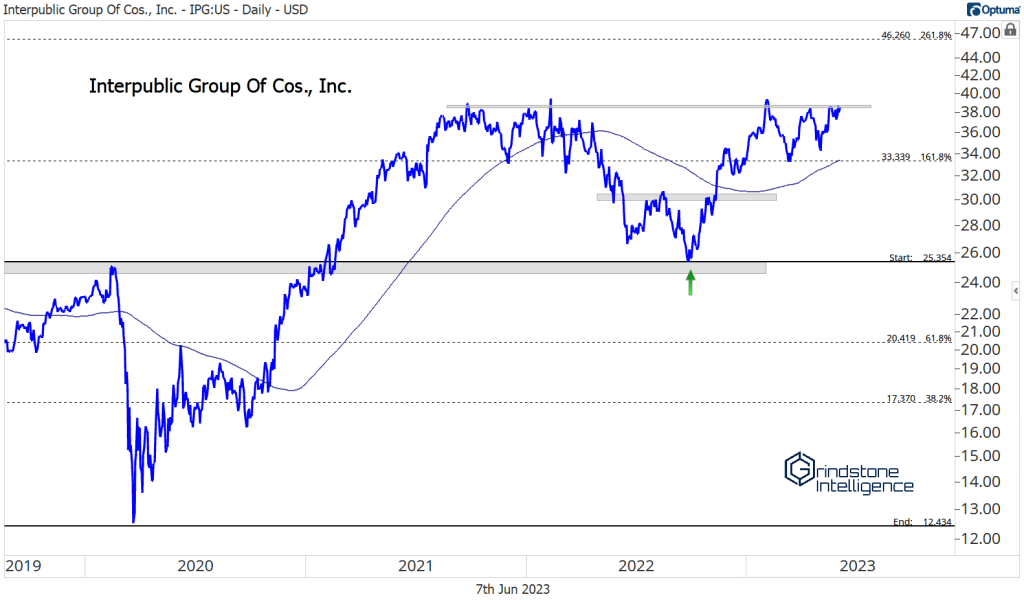

Interpublic Group could follow with a breakout of its own. This looks like a classic inverse head-and-shoulders continuation pattern, so we’re watching for a move above $39, with a near-term target of $46 if it does.

Those 3 can’t do it alone, though. We’ll have to see the weakest names hold the line if we expect the sector to outperform on a broad basis.

Telecoms and Cable and Satellite stocks have been in a downtrends for what seems like forever. Can they turn higher? Or at least stop going lower? We’ll see.

The Integrated Telecommunication Services Sub-industry has a chance to find support at last year’s lows.

Dish Network (which we’ve quite enjoyed making fun of) is trying once again to find a bottom. Will this one finally be the real deal?

And will this failed breakdown in Match Group spark a trend reversal? Or is this just a mean reversion that’s postponing further declines?

We’ve got more questions than answers. But we think other sectors offer better opportunities for now.

The post (Premium) Can the Rally in Communication Services Broaden Out? first appeared on Grindstone Intelligence.