(Premium) Checking in on Commodities

What do we want to own?

That’s the question we ask ourselves every day. Stocks? Bonds? Commodities? Crypto? Cash? The answer doesn’t have to be like flipping a light switch. It’s not like we want to be all in on stocks on Monday, then all in on Treasurys by Tuesday afternoon. Instead, the answer to “What do we want to own?” evolves slowly over time. Our minds gradually change as new evidence comes in, and our decisions follow those slowly-formed opinions.

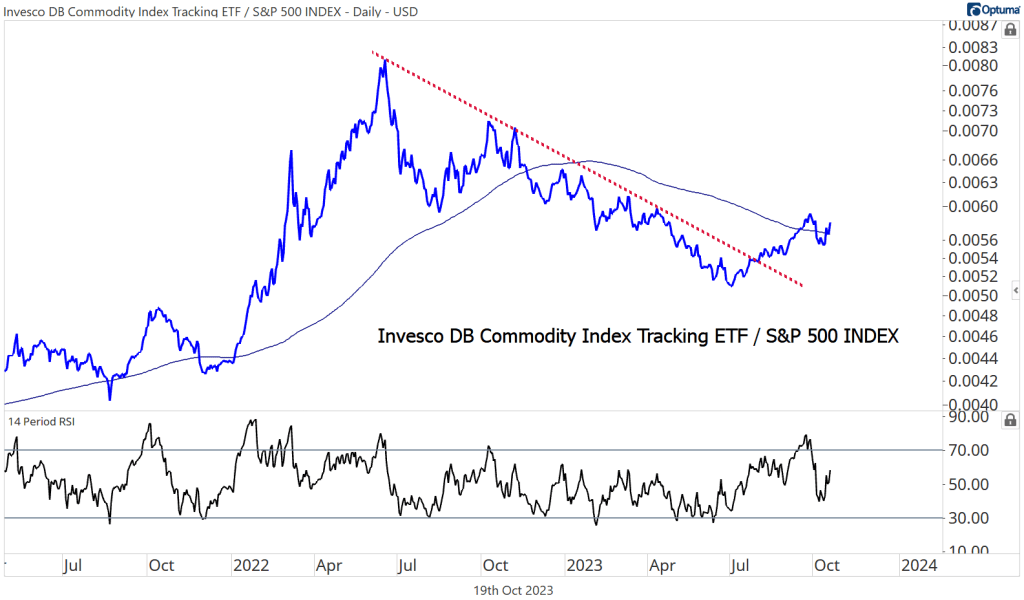

Stocks have been the place to be since last fall. There’s not much argument about that. Since equity prices peaked at the end of July, though, commodities have been leading the way. Check out the ratio of the Invesco DB Commodity Fund (DBC) vs. the S&P 500 below. We first broke the downtrend line, then momentum hit overbought territory for the first time all year. It’s too early to definitively call this the start of a new uptrend, but at the very least, this year-long downtrend has weakened considerably.

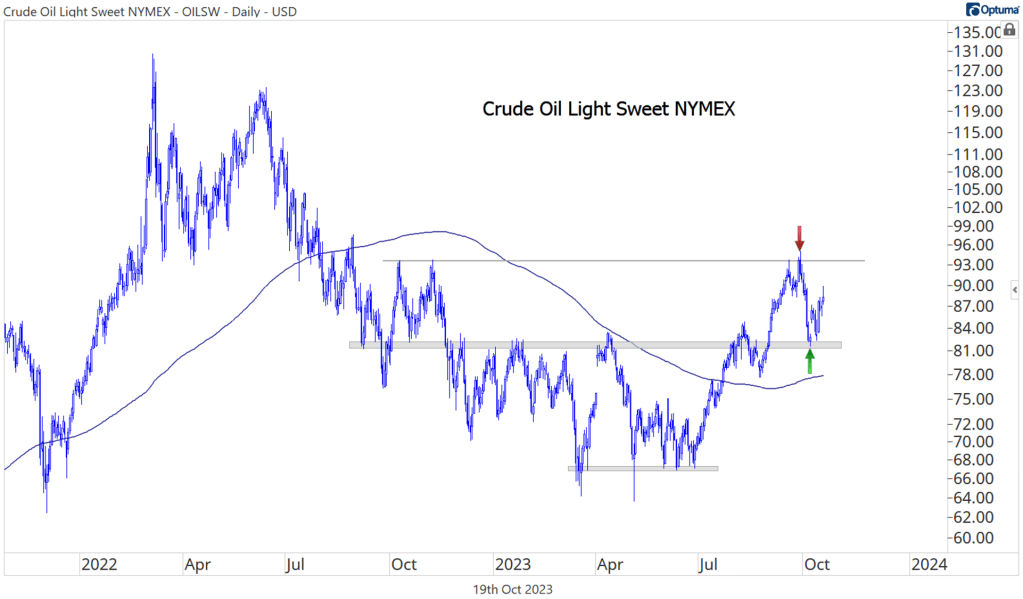

A sharp reversal in the price of crude oil is responsible for the shifting trend. After the bears failed to capitalize on breakdowns over the summer, the bulls took control and rallied prices from their lows in the mid-60s, past significant resistance at $82, and all the way above $90. For now, crude is stuck in the middle of a trading range between the spring highs of $82 and last fall’s swing highs near $95.

With crude rangebound, other commodities are trying to step up. The Invesco DB Energy Fund is still in the leading quadrant of the commodities Relative Rotation Graph, but base metals have climbed out of the lagging quadrant, and both agriculture and precious metals have turned higher.

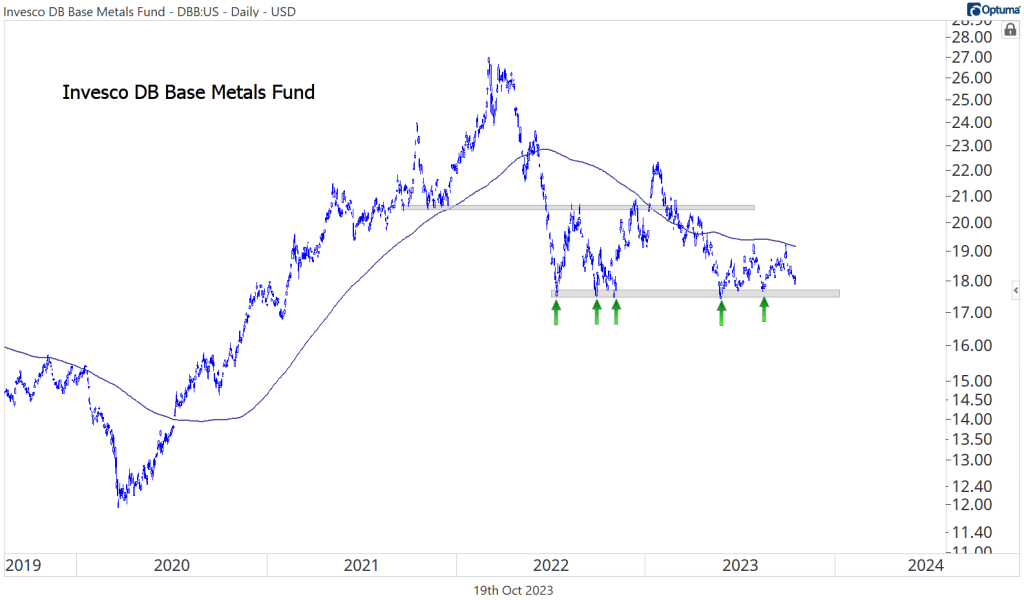

Relative strength in the base metals has more to do with their lack of outright weakness during crude’s early-October selloff. The Invesco DB Base Metals Fund (DBB) is still hanging above key support at $17.50 – a level it’s tested nearly half a dozen times since last summer. There’s really not much to get excited about here unless we see a breakdown and you want to get involved from the short side.

We’d like the base metals more if copper had been able to maintain its uptrend line from last summer’s lows. But it didn’t.

And last week, copper set new lows relative to stocks.

Could that turn out to be a failed breakdown for copper? Sure. And if it does, perhaps we’ll change our tune. But for now, this area is guilty until proven innocent. The base metals are best left alone.

There are much better trends to be found in the agriculture space.

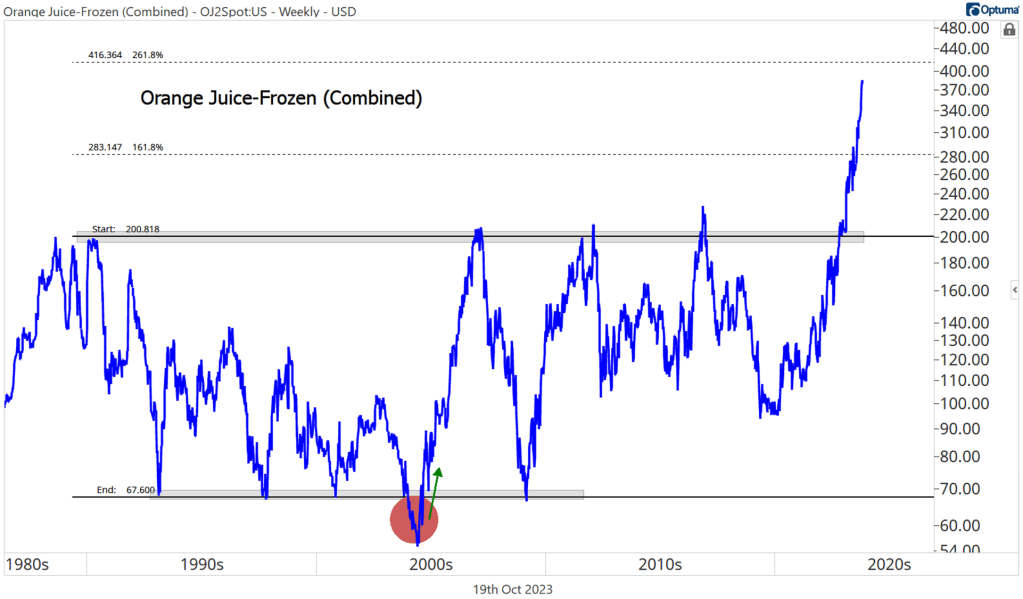

We acknowledged in July how crazy it was to be talking about a $400 target for OJ, but all it does is keep going up. That $400 target is the 261.8% retracement from the entire 1990-2020 range, and at this pace, we’ll be there by the end of the month.

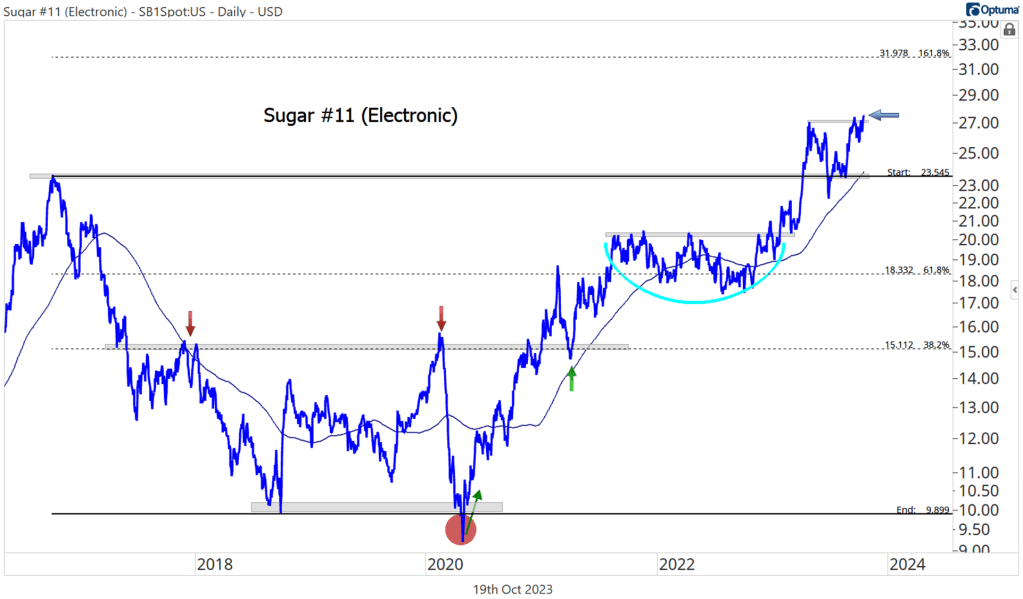

Orange juice is one that’s been tough to catch. It hasn’t had any meaningful pullbacks for buyers to step in, and we’re much closer to our target than we are to our risk level down at $280. Sugar offers a much cleaner setup. Sugar futures broke out of a huge base in the spring, but then stalled out near $27 before approaching our target $32. Prices have had 6 months to digest those gains, and they’ve been consolidating above their 2016 highs. Now, we’re getting a fresh breakout.

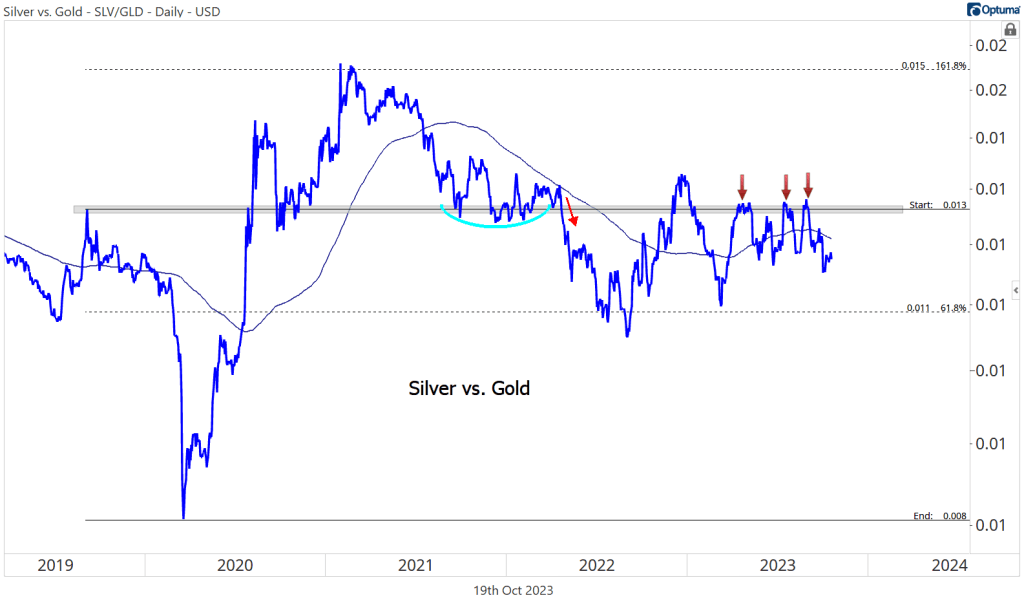

We’ve said it before about the precious metals space, and we’ll keep on saying it. We’re still waiting on silver to take a leadership role.

Prices for silver and gold tend to be highly correlated, but silver tends to move in greater magnitudes. As such, when precious metals are rising, we expect silver to outperform. That’s what we’ve typically seen during gold’s best runs. These days, silver refuses to lead. Until it does, we refuse to get too excited about the prospects for precious metals.

The 2019 high in the silver/gold ratio is what we’re watching.

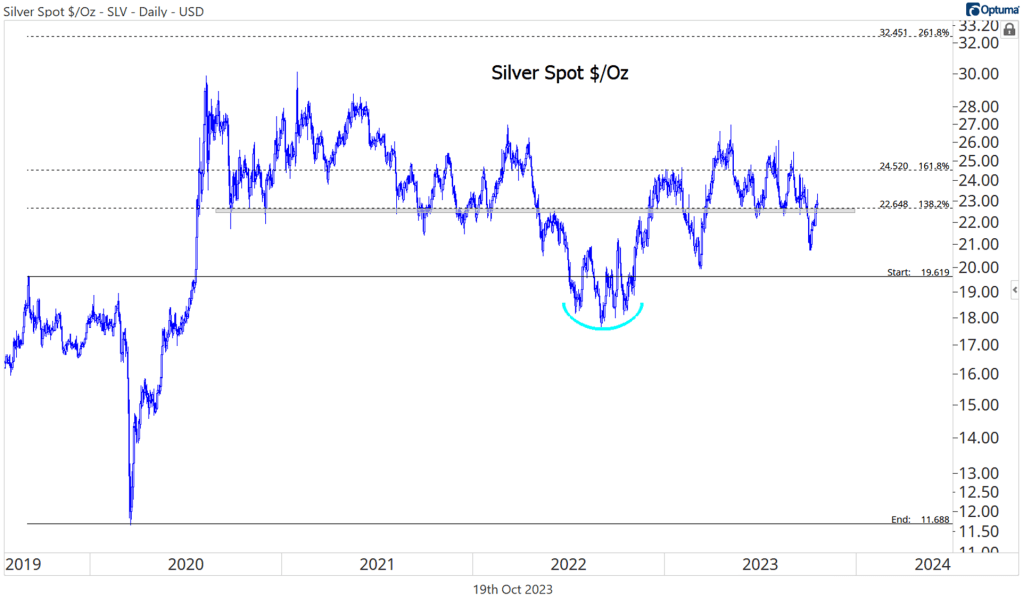

It’s not that precious metals are the worst place to be. In fact, they’ve held up rather well. Selling pressure at the end of September and in the first week of October pushed both gold and silver to their lowest levels since the spring, but buyers stepped in right when they needed to. Check out the Invesco DB Precious Metals Fund (DBP) finding support right where it needed to, at the 38.2% retracement from the entire 2011-2016 decline.

Here’s a closer look at the action.

Although there’s nothing actionable in the DBP, given that prices are in the middle of a big trading range and sit near a flat 200-day moving average, defending that key support level is a feather in the cap for the bulls.

Silver has already jumped 10% since then. More importantly, though, it’s back above $22.50, which is the 138.2% Fibonacci retracement from the 2019-2020 decline and has also been a key rotational level for the past 3 years. We’d be more optimistic about silver’s future prospects if it can surpass $24.50, which is the 161.8% retracement. From there, we’d be targeting a move to $32.

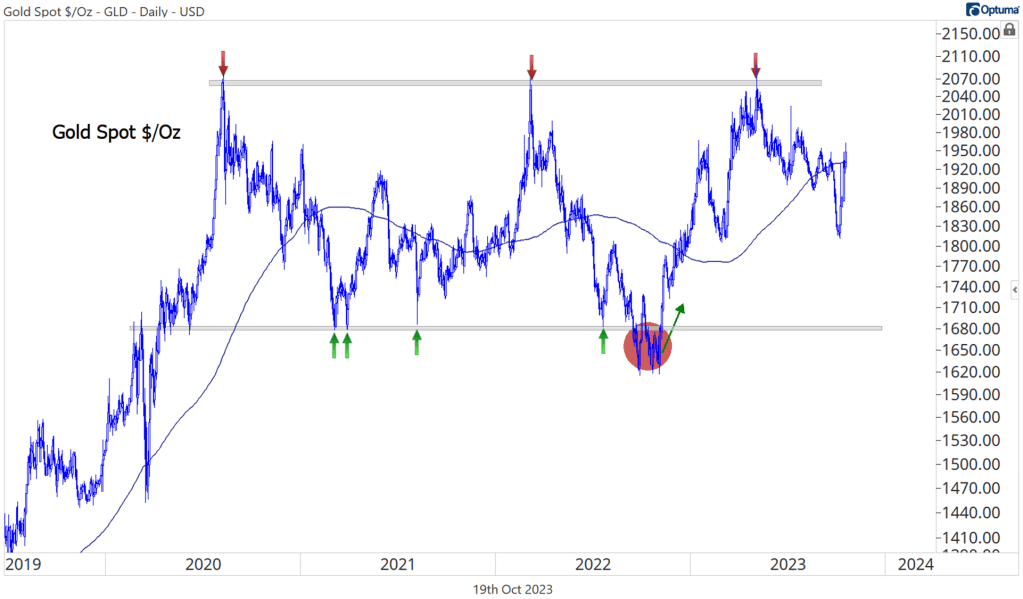

Perhaps if silver can get going, we’ll finally have the catalyst we need for gold to break out from this big, messy trading range. For now, gold prices are near a flat 200-day moving average and lacking an actionable trend.

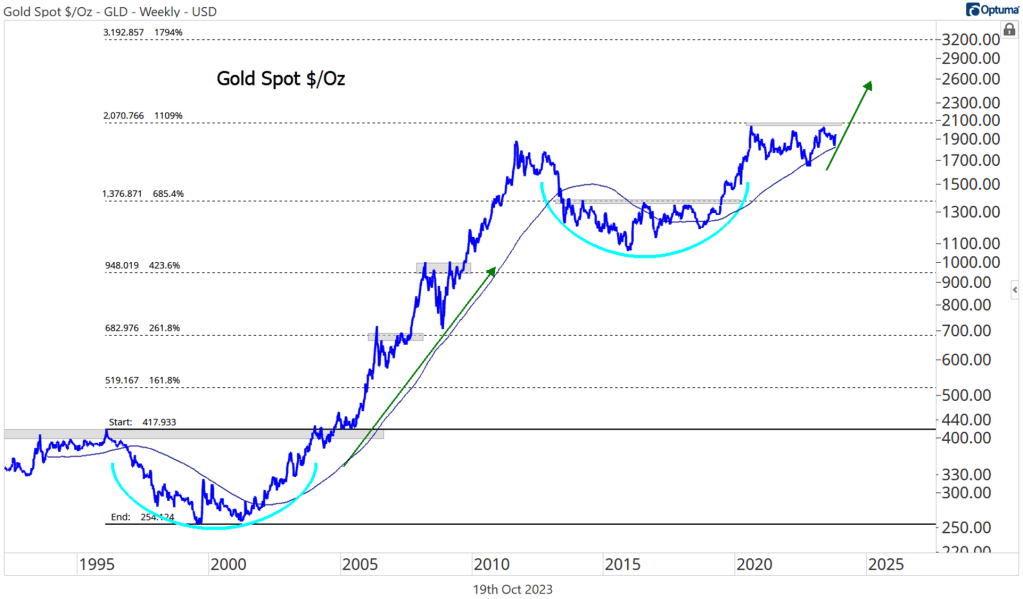

But if that bullish resolution does come? How high could gold go then? We’re eying $3200. That’s the 1794% Fibonacci retracement from the 1990s decline. Prices have respected these retracement levels all the way up: The hiccups in 2006 and 2008 occurred near Fib levels, the ceiling from 2013-2019 was the 684.4% retracement, and right now, were stuck below the 1109% retracement. It would make a lot of sense to go up and touch the next one. $3200 might even be a conservative expectation – prices rallied a lot more after the 2004 breakout.

If you’re holding on to gold because you’re not inclined to miss any of that potential rally, there are worse things you could have done. Stocks haven’t done any better over the past 2 years. And yesterday, gold reached its highest level against the S&P 500 since June.

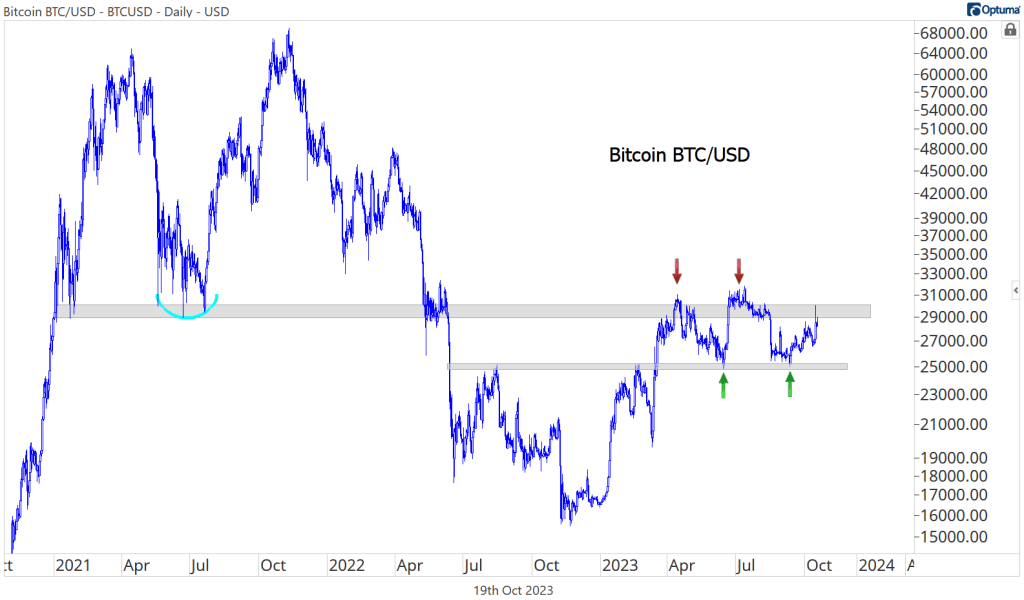

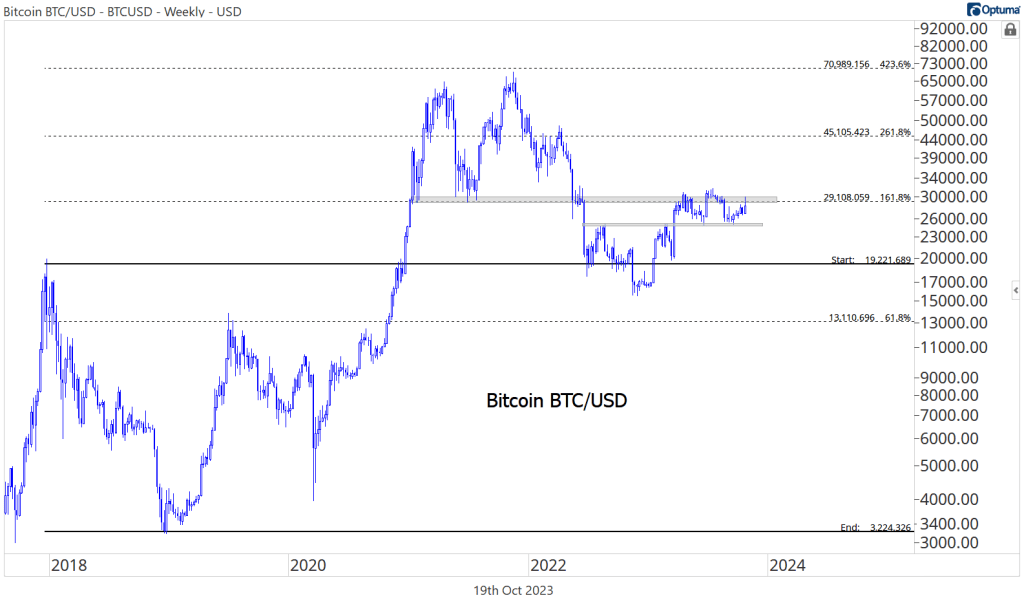

And we’ll end today’s note with Bitcoin, because it actually looks interesting for the first time in awhile. We’ve been consolidating above former resistance at 25,000 since March, and now we’re making another run at this still resistance level near 30,000. On a breakout, we want to be buying Bitcoin.

Our target is 45,000 which is the 261.8% retracement from the 2017-2018 decline.

The post (Premium) Checking in on Commodities first appeared on Grindstone Intelligence.