(Premium) Communication Services Sector Deep Dive - October

The Communication Services sector was on a roll.

Most of the equity market peaked in late July and sold off throughout the months of August and September. Communications, meanwhile, continued to hover near its highs, up more than 40% for the year. October was more of the same, with the sector even managing to touch new 52-week highs on the 11th.

Then came earnings season.

Earlier this week, Alphabet reported results for its cloud business that disappointed the street. The stock dropped 9.5% on the news, its worst 1-day performance since the middle of the COVID collapse in March 2020. And since Alphabet is the largest component of the sector, its weakness drove a nearly 6% decline in the price of Communication Services overall.

The selloff acts as confirmation of a bearish momentum divergence that we've been eying for weeks. Although the sector has been trekking steadily higher all year, RSI peaked all the way back in June and hadn't even reached overbought territory since then. That divergence implied a lack of outright control for the bulls - and it was happening near the 61.8% retracement of the entire 2021-2022 decline. Still, with the sector continuing to rise and show relative strength, waiting for price action to confirm the momentum weakness was the best move. Now that it has, Communications is best left alone as it digests the year-to-date gains.

Structurally, the group is still in a relative uptrend versus the rest of the index. The 2018 lows are the line in the sand. We wouldn't be surprised to see the ratio backtest its breakout above that key rotational level, but we definitely don't want to see break back below. If we do, it'll be best to approach this sector from the underweight side, rather than the neutral side.

We'd be more bullishly inclined if we see the strength beneath the surface. Most of this year's sector outperformance has been driven by the mega caps (GOOGL, META, NFLX). Meanwhile, the equally weighted sector peaked against the equally weighted S&P 500 back in February. A breakout would catch our eye.

From a breadth perspective, it seems that relative breakout could come sooner rather than later. 45% of stocks in the Communication Services sector are above rising 200-day moving average, a share second only to Energy.

Half the sector, though, is stuck in a technical downtrend. So a relative breakout may come even as stocks are falling. Check out the absolute weakness in the equal weight Communications ETF (RSPC). It's broken the uptrend line from the October lows and just hit its lowest level since May.

That's worrisome considering the strong seasonal tailwinds that are in place. The fourth quarter is supposed to be the best time of the year for the sector, but that hasn't played out yet in 2023. When Often, the best lessons from seasonality are when stocks don't follow their seasonal patterns. If we can't rally during the best times, what do you think will happen during the worst?

Digging Deeper

The Interactive Media & Services sub-industry, home to both Alphabet and Meta, has driven a bulk of the sector's 35% gain for the year. Each of the other 7 sectors is up less than 20%.

Alphabet is at make or break levels. If it can hold onto this area of potential support near $125, then we can continue to approach the stock from a bullish perspective.

A look at GOOGL compared to its benchmarks, however, tells us there are better places to be for the time being. Check out this nasty failed breakout for the stock when compared to the S&P 500. From failed moves come fast moves in the opposite direction, and we don't want to be on the other side of this reversion. Even in a bullish outcome, it will likely take some time to repair this damage.

The same goes for GOOGL vs. the rest of the Communications sector. This consolidation should resolve in the direction of the underlying trend. But it could very well take some time. Until then, there are better places to look.

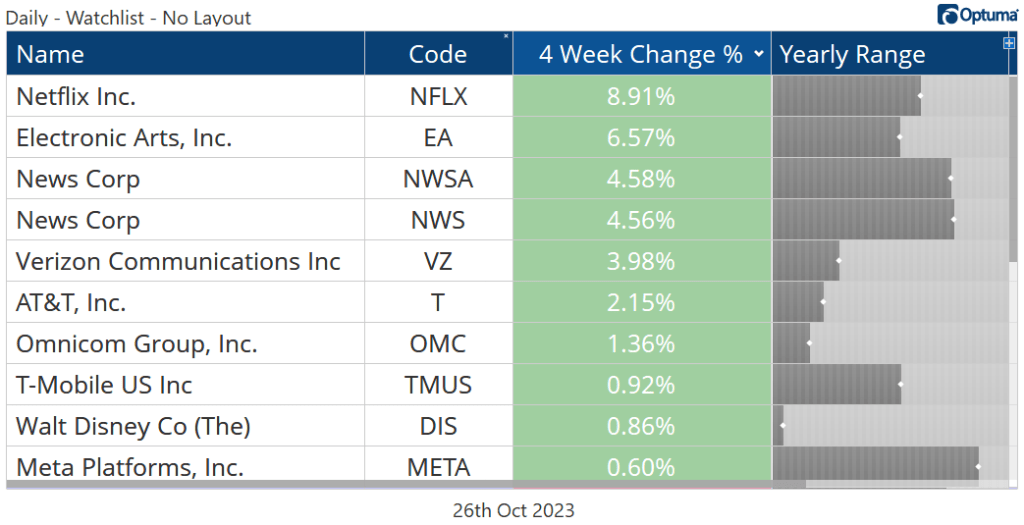

Leaders

The leaderboard has some unfamiliar names on it this time around. The Integrated Telecoms have been a great way to lose money over the last 5 or 6 years, but they're working on a potential reversal. Here's the sub-industry challenging a key rotational level.

What really caught our eye, though, is how AT&T and Verizon are working on relative bottoms. Here's T versus the rest of the sector finding support at the December 2021 lows. Yesterday, the ratio broke out to multi-month highs.

T-Mobile found support at a logical level, too - its 2020 relative highs. This looks like classic bottoming action.

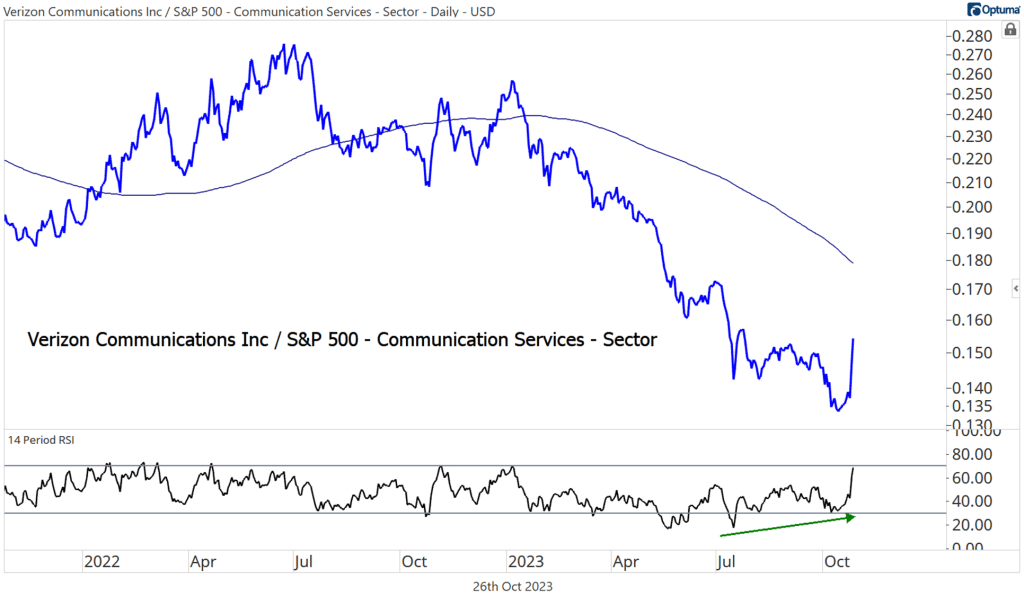

Even Verizon, which has been the worst of the three, just confirmed a massive bullish momentum divergence vs. the rest of the sector.

Losers

Comcast has dropped 4% over the last 4 weeks, but we don't want to overreact to that decline. CMCSA has been steadily outperforming the S&P 500 index since last fall, and we're not seeing evidence of a reversal just yet.

On an absolute basis, the stock has stayed out of oversold territory all year and is still above a rising 200-day moving average. We want to be buying this pullback with a target back near the former highs of $61.

Growth Outlook

Following 17% of expected earnings growth in 2023 (the second-best of any S&P 500 sector), analysts believe Communication Services will be a growth driver in 2024 and 2025, too. Annualized EPS over those years is projected to be nearly 15% – that’s double the long-term earnings growth rate for the S&P 500 index.

Much of that increase will depend on the ability to grow profit margins – by a lot. Implied 2025 margins are at 19.2%, but the 5-year sector average is just 15.9%.