(Premium) Communication Services Sector Deep Dive – August

If you want to outperform the market, you need to own the things that are outperforming the market.

It’s not enough to just make money during a bull market. You could own Treasurys and “make money”, but there’s a huge opportunity cost of owning Treasurys when you could own stocks that are rising in value much faster.

That’s why we spend so much time looking at relative charts. We want to know which sectors and stocks are leading and lagging so we have a chance of finding the ones that will beat the benchmark.

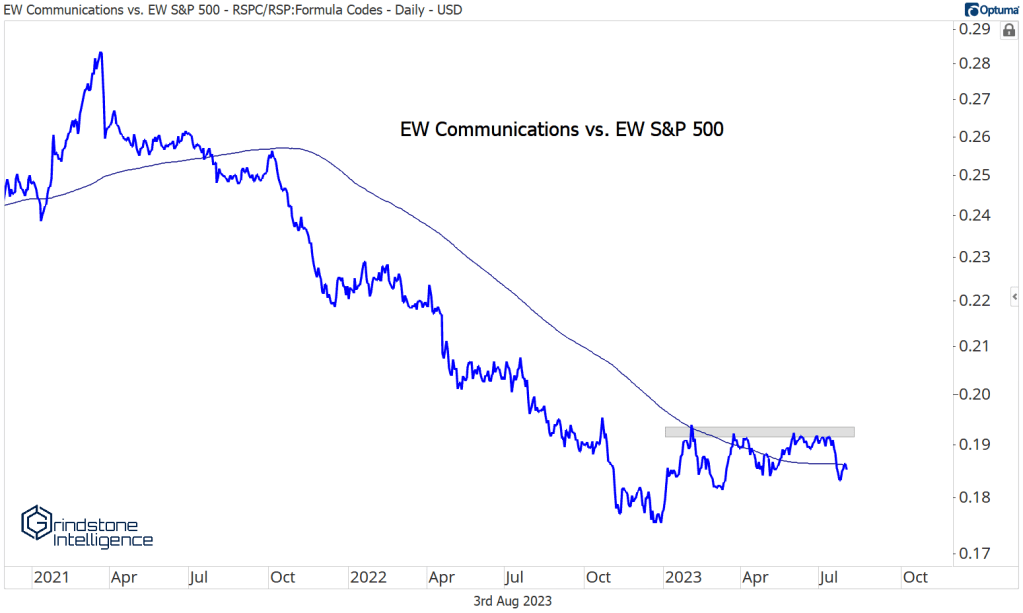

And on a relative basis, the Communication Services sector has a problem with overhead supply.

Relative to its benchmark, the S&P 500 index, the sector made it all the way back up to its mid-2018 lows. That’s also where its underperformance accelerated last spring and where it was rejected on a summer rally. That area is acting as resistance once again.

On an absolute basis, investors are still “making money”. Prices have kept rising. But the sector hasn’t gotten overbought since the middle of June. That’s a bit concerning as we near a potential area of resistance in the 61.8% retracement from the 2021-2022 selloff.

More concerning is how weak breadth has been for the group. The mega caps like Alphabet and Meta have been driving the gains, but when we strip out their oversized impact and compare the equally weighted Communications sector to the equally weighted S&P 500, we see a ratio that’s just 5% above last year’s bear market lows. (For comparison, the market cap weighted equivalent at the top of this post is 25% off its lows.) In short, the average stock in the sector isn’t doing so hot. That weakness – along with the potential for a stalling out in the mega caps – led us to downgrade Communication Services to underweight yesterday.

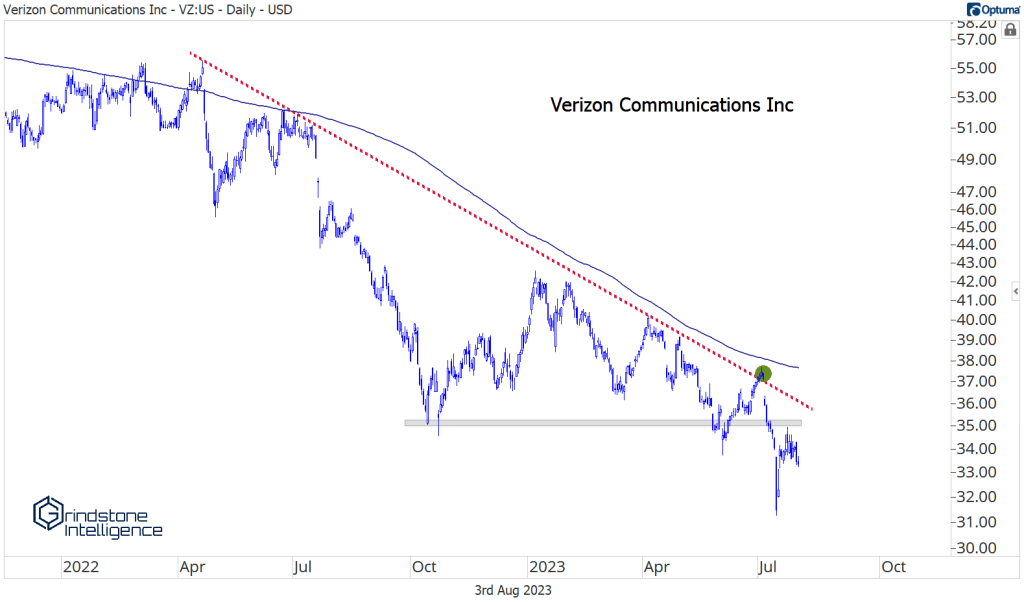

The big integrated telecom companies are among the worst offenders. Verizon tried to break it’s downtrend line early last month, but it never managed to get above a falling 200-day moving average. It followed that up with new decade-plus lows.

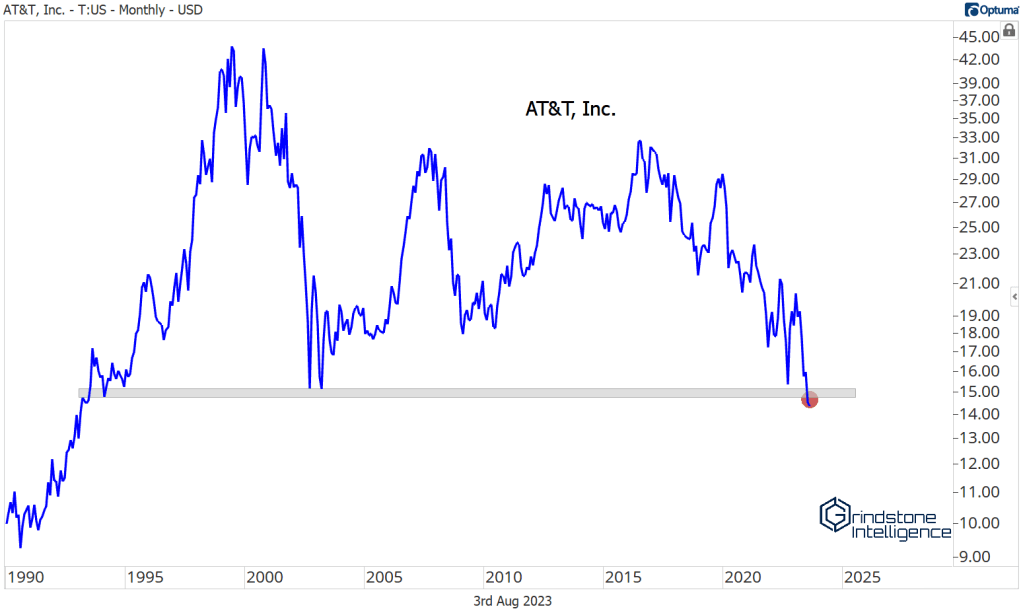

It was the same thing for AT&T, except for them, you have to go all the way back to the early 1990s to find prices this low.

Disney has been searching for a bottom for two years, and it’s testing support once again. “Testing support” isn’t something you typically say when you’re talking about things in uptrends.

Advertisers Interpublic Group and Omnicom were both on our watchlist after bullish resolutions out of big bases. But those breakouts turned out to be short-lived.

From failed moves come fast moves in the opposite direction. Both are now best left alone.

On the more positive side, Charter Communications is working on a bearish to bullish reversal. It’s set higher lows, broken the downtrend line, and is above the 200-day. The next step would be to break through this resistance area from the January highs.

Meanwhile, Alphabet and Meta are the two most important ones to watch. Alphabet gapped through resistance with a big earnings report last month, and it’s definitely not in a downtrend. Momentum, though, didn’t get overbought on the breakout. That raises some questions about the sustainability of the move.

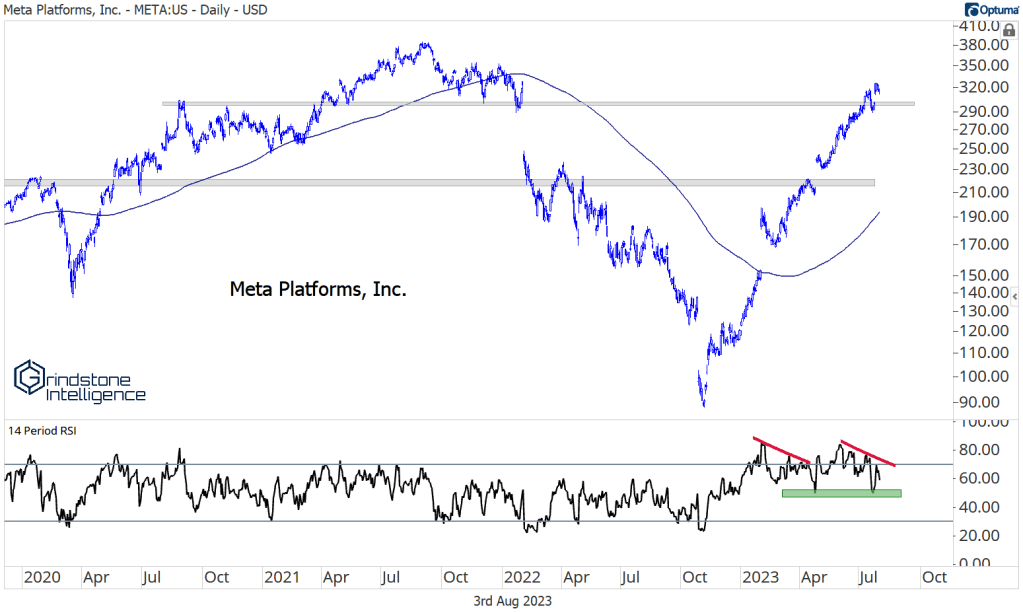

The same goes for Meta – this definitely isn’t a downtrend. But momentum failed to get overbought on the gap higher after earnings, which is a bit concerning, and we think consolidation near this key level is likely. Still, momentum divergences don’t mean anything without price confirmation (just look at the big divergence from earlier this year). We can’t be anything but constructive on Meta so long as prices are above $300.

With these two both trying to work past potential momentum divergences and so much weakness throughout the rest of the group, we think there are better sectors to focus our attention on over the coming weeks.

The post (Premium) Communication Services Sector Deep Dive – August first appeared on Grindstone Intelligence.