(Premium) Communication Services Sector Deep Dive – September

Sitting atop the sector leaderboard in 2023 is Communication Services. Just like most of the equity market during September, Communication stocks have faltered. But they’ve dropped somewhat less than most of the market over that period, putting their year-to-date gain at 36.9%. That’s more than triple the benchmark’s 11.8% rise for the year.

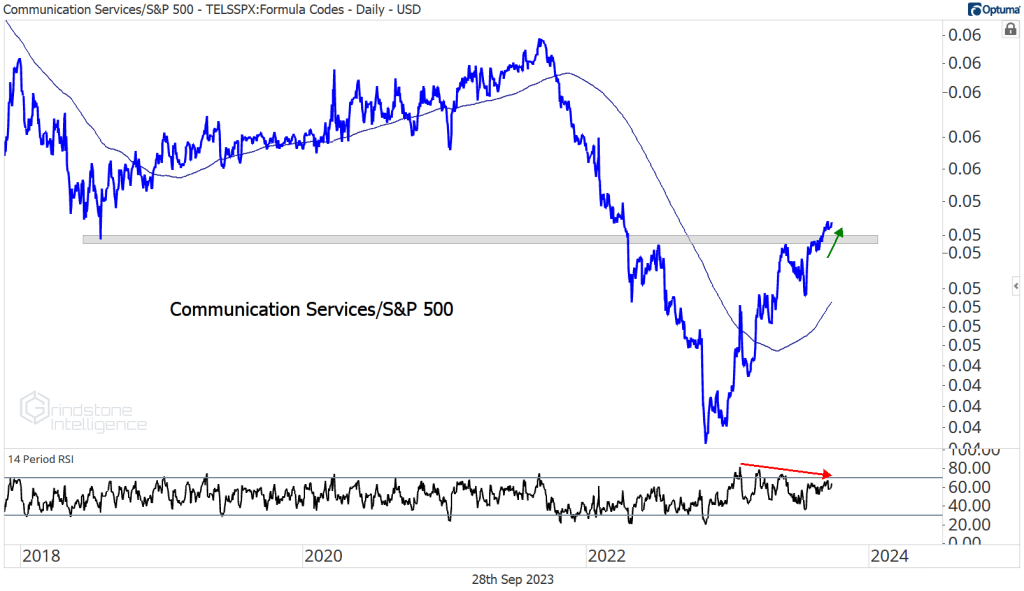

The road ahead is a tough one. Prices failed to move past the highs set at the end of July, and momentum put in a bearish divergence on the attempt. Momentum divergences can be worked off through price or through time – neither is attractive for sector bulls.

We’re seeing a similar bearish momentum divergence for the group on a relative basis. With momentum weakening as the ratio of Communications vs. SPX challenged resistance created by the 2018 lows, we believed the lower probability outcome was a swift breakout. We lowered our opinion on Communications to Underweight in August. So far, that rating hasn’t worked out, and we’ll be forced to evaluate that position if price fails to confirm what we’re seeing in RSI.

The sector has been supported by strong September seasonality. Since 1990, Communications has outperformed the S&P 500 more in September than in any other month. We’re seeing that same seasonal pattern play out today.

Beneath the surface, however, things are weaker than they appear at first glance. The equally weighted sector peaked back in February, and it just broke the uptrend line from the October lows.

And if we look at the equally weighted sector compared to the equally weighted S&P 500, we see a ratio that’s near a flat 200-day average and is still below last summer’s swing highs.

And the equally weighted sector is in the Lagging quadrant of the weekly Relative Rotation Graph.

In other words, this year’s relative strength in Communications has been driven entirely by a handful of names.

On a long-term basis, roughly the same number of stocks are in technical downtrends as in technical uptrends. The sector is almost perfectly split between stocks that are doing just fine, and stocks that aren’t doing fine at all.

There’s not much in between.

Shorter-term, almost 70% of the group is trending lower. If those trends don’t start improving soon, the structural health of the sector will deteriorate quickly.

Digging Deeper

Interactive Media has been the best performing sub-industry this year, turning in a gain of 66%. The next best area has been Cable & Satellite, which is still up a respectable 24%. Charter Communications is one to watch in that space. Charter recently completed a bearish to bullish reversal. It set higher lows, broke the downtrend line, and then got above the 200-day. It followed that performance up in August by breaking through former resistance from the January highs. We want to buy pullbacks toward $430 with a target of $500, but only if we’re still above that key level.

We’d like Charter even more if it can complete the bearish to bullish reversal on a relative basis, too. Momentum is in a bullish range for the first time in years – that’s not something you typically see in downtrends. Here’s the stock compared to the S&P 500 challenging a key rotational level.

Leaders

Only 4 stocks in the sector have gained over the last 4 weeks, including the 2 most important ones.

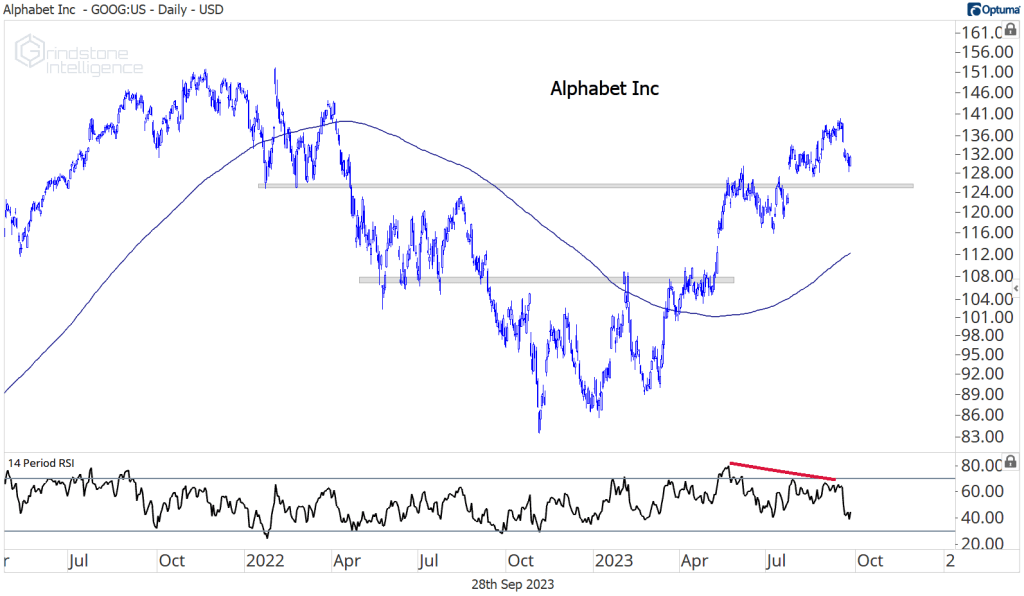

The everlasting strength of Alphabet continues to impress. It successfully held its breakout above $127 and set new one-year highs earlier this month. There’s not much stopping the stock from challenging its all-time highs up at $150 – except for that pesky bearish momentum divergence. Remember, though, momentum divergences don’t mean a thing without price confirmation. Don’t fight the tape.

Meta has been dealing with momentum problems of its own, as it continues to challenge the 2022 breakdown level near $300. Remember how we said momentum divergences can be worked off through price or through time? The more time that Meta spends up here, the more likely it is that it’ll break out.

Losers

The list of 1-month laggards is littered with names that have also underperformed this year. If you scroll back up and check out the industry derby, you’ll see Broadcasting and Advertising at the bottom of the barrel. Those two are home to Warner Bros, Interpublic, Omnicom, and News Corp. Paramount, Netflix, and Fox are all members of the Movies & Entertainment sub-industry.

Growth Outlook

Following what’s expected to be a stellar earnings performance in 2023, analysts believe Communication Services will be a growth driver in 2024 and 2025, too. Annualized EPS over those years is projected to be 14% – that’s double the long-term earnings growth rate for the S&P 500 index.

Much of that increase will depend on the ability to grow profit margins – by a lot. Implied 2025 margins are at 19.3%. The 5-year sector average is just 15.9%.

One More to Watch

Perhaps this section would be more aptly named One to Avoid. Disney has been an outright stinker for a couple years now, and it’s tough to see what the catalyst could be for a new uptrend. You hate to bet against an industry legend like Bob Iger, but unless the stock climbs back above the COVID lows at $85, we’d much rather be short than long.

The post (Premium) Communication Services Sector Deep Dive – September first appeared on Grindstone Intelligence.