(Premium) Consumer Discretionary Coiling Up

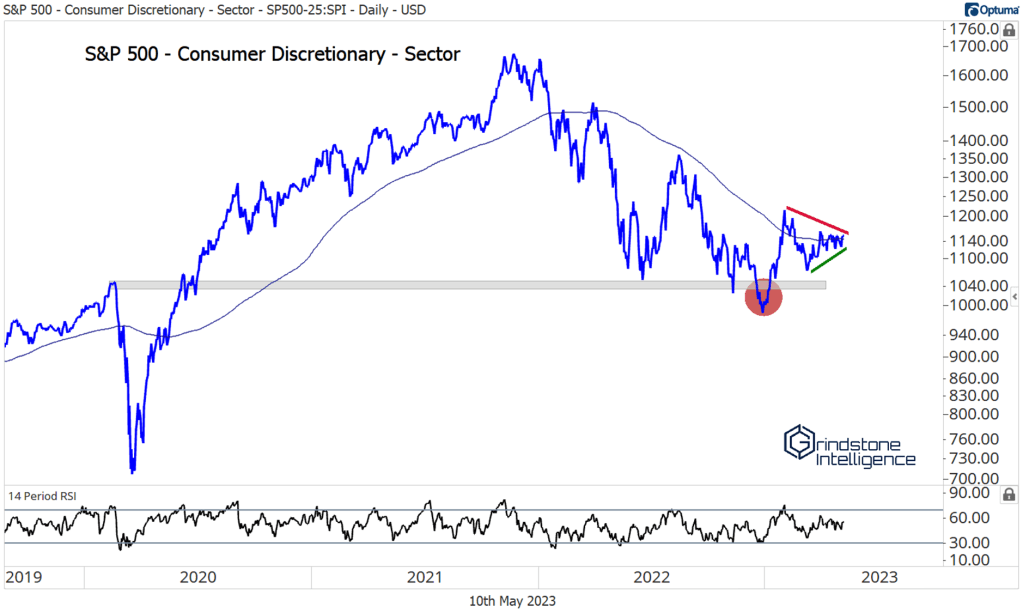

Consumer Discretionary is ready to make a move.

We just don’t know in which direction.

The sector is a leader year-to-date, but it’s gone nowhere since January. Instead, Discretionary’s been coiling up on top of a flat 200-day moving average. A price near a flat 200-day is a price without a trend, and trading things that have no trend is a good way to find lots of heartache and frustration.

Beneath the surface, though, things are a bit more rosy. The average Discretionary stock is outperforming the average S&P 500 stock. The ratio of EW Consumer Discretionary to EW SPX spent the last few months digesting the 2022 run-up, and after some quality basing action, we’re knocking on the door of new 52-week highs.

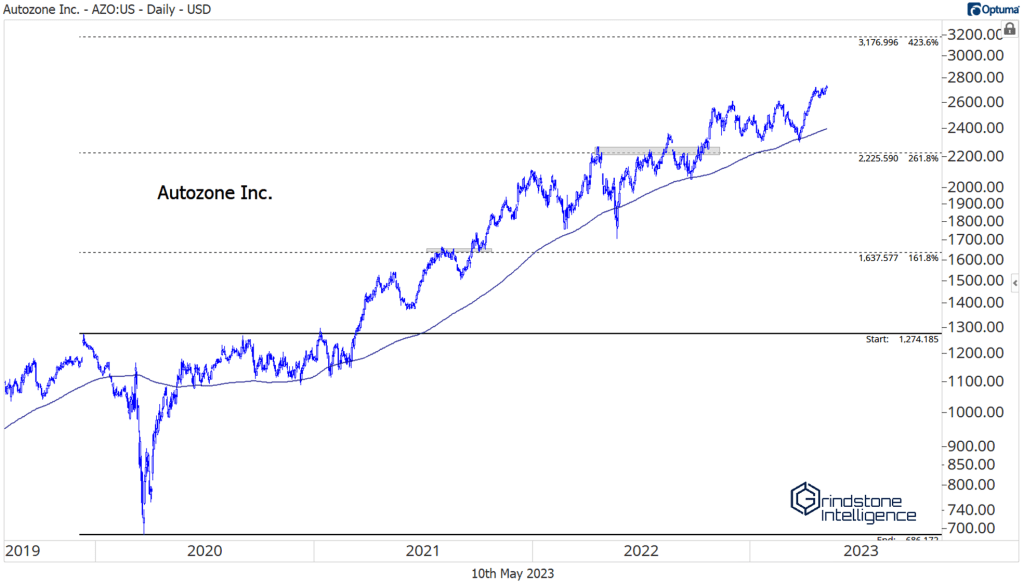

We still like a lot of the same stocks in the sector. At this point, we probably sound like a broken record talking about the auto parts stores. Why recreate the wheel? This is what we said last month.

Autozone and O’Reilly have been on our radar for awhile, given the overwhelming amount of relative strength they’ve shown. Both have spent most of the last 3 years above rising 200-day moving averages, and now both are nearing new highs again after a few months of healthy consolidation. For both, we’re using the 423.6% retracement from the COVID selloff as a longer-term target. For AZO, that level is $3,176. For O’Reilly, $1,066.

Nothing has changed.

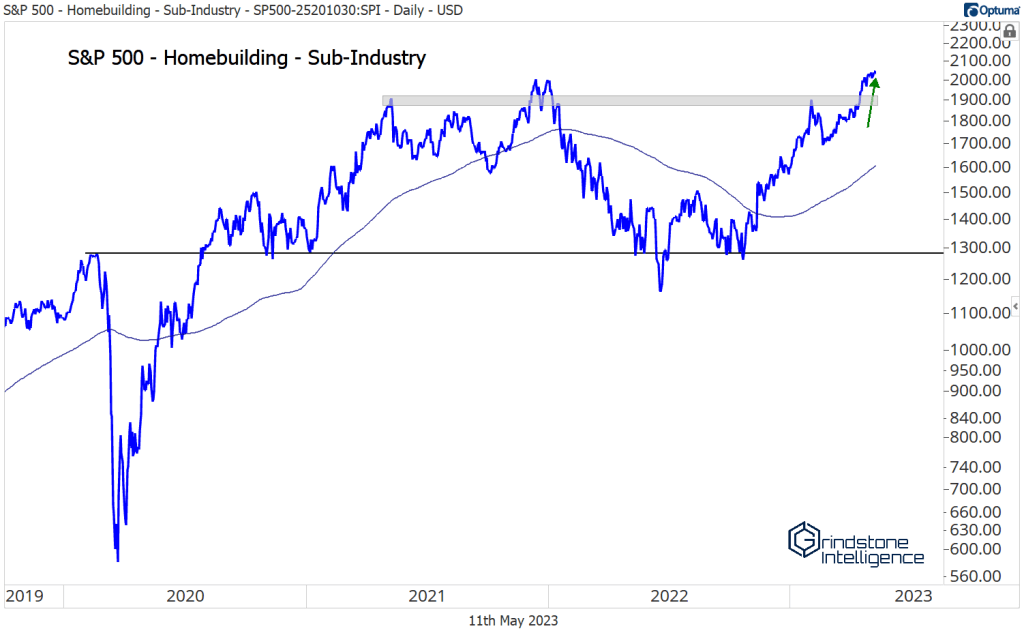

The homebuilders haven’t slowed down any, either. The industry is at new highs on both a relative and an absolute basis after a multi-year consolidation.

The multi-year consolidation in the homies started at a pretty logical level. For D.R. Horton, the nation’s largest homebuilder, the 2021 peak coincided with the 261.8% retracement from the entire 2005-2008 decline. The stock then bottomed last June at the 161.8% retracement. Ever wonder why we use these Fibonacci levels? This is why. The market respects them. It doesn’t really matter whether we believe in the merits of ancient math. The market does.

Longer-term, that puts our target for D.R. at $170 as long as the stock stays above $106. That target is the 423.6% retracement from the housing crisis selloff.

Here’s a shorter term look at the stock, which gapped above resistance this past month.

Lennar is in the same position. Its 2021 peak also occurred at a key Fib retracement level, and the ensuing selloff bottomed at those 2005 highs.

Just like DHI, LEN set a year-to-date peak on February 2, then spent a few months gearing up for a breakout above the 2021 highs. We want to own it above those highs at $110 with a target of $170, which is the 261.8% retracement from the 2005-2008 decline.

McDonald’s (along with the other restaurants that we pointed out last month) has continued to work, though it doesn’t offer the best risk-reward proposition at present. It’s setting new all-time highs, and we’ve liked it long above $270 with a target up near $356, which is the 261.8% retracement from the 2019-2020 selloff.

Here’s one that we haven’t talked about lately. Booking Holdings is challenging resistance at the 2021-2022 highs. That level is also the 161.8% retracement from the COVID selloff. On a breakout above 2700, we want to be buying BKNG with a target of 3660, which is the 261.8% retracement level from that decline.

The post (Premium) Consumer Discretionary Coiling Up first appeared on Grindstone Intelligence.