(Premium) Consumer Discretionary Moving to the Front of the Pack

The return of risk-appetite.

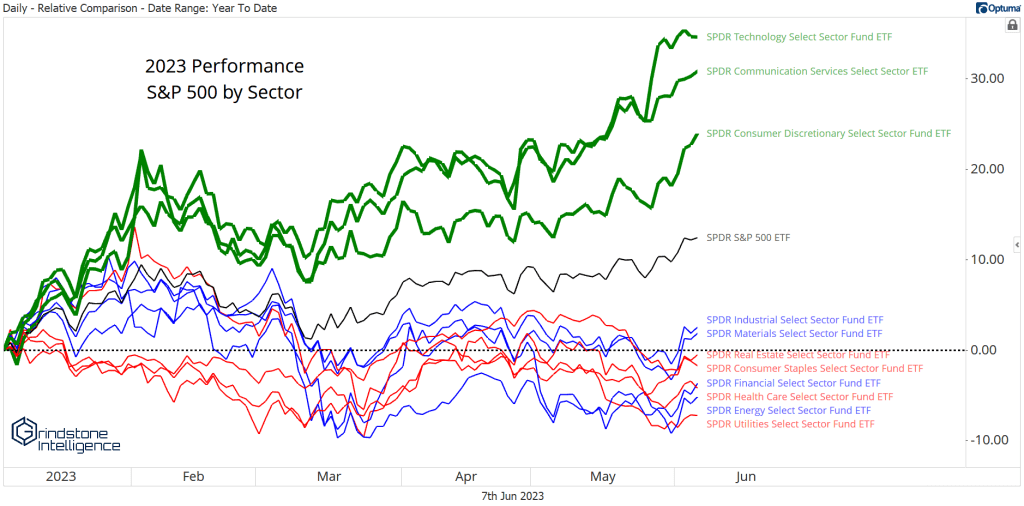

If risk-appetite is back, why shouldn’t we like the risk-on sectors? Consumer Discretionary has lagged Tech and Communications so far in 2023, but it’s working hard to close the gap. May’s rally pushed the sector to new 8-month highs.

This is just another example of a failed move sparking a trend reversal. At year-end, things weren’t looking so great, as Consumer Discretionary dropped below support from its pre-COVID highs and to multi-year lows. But just as quickly as the sector broke down, it rallied back.

During the year-end weakness, we were struck by the underlying strength within the group. While the sector overall was moving to new lows, the average Discretionary stock had been outperforming the average S&P 500 stock since May! We still see that ratio acting constructively.

Now the question is whether the cap-weighted sector can follow through with relative strength of its own. Compared to the cap-weighted S&P 500, Discretionary surpassed its 200-day moving average for the first time since last fall – but the ratio still needs to move past its February highs to confirm the move.

Fortunately, it’s not just the mega caps that have been working.

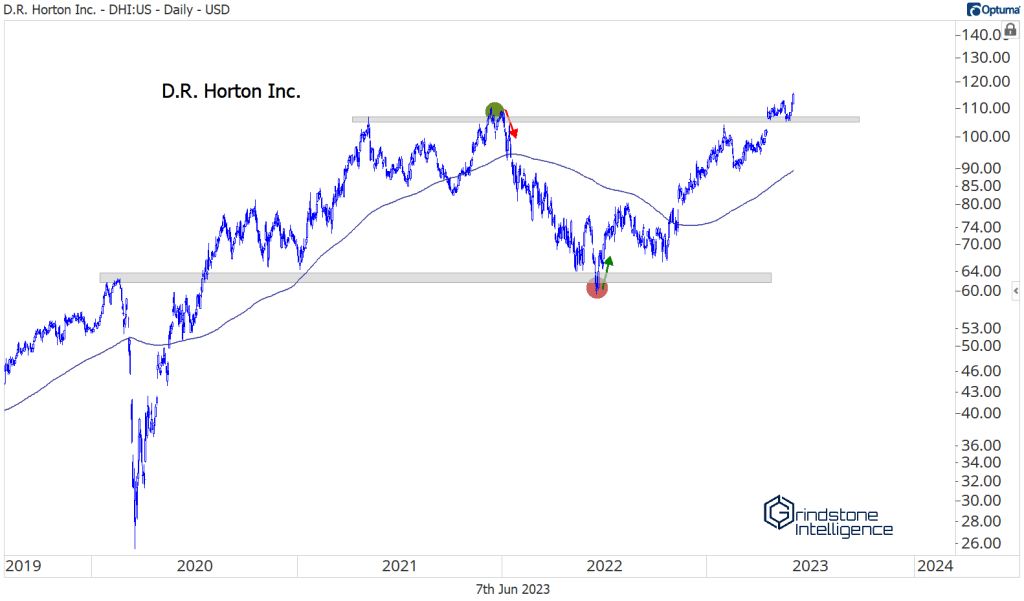

Homebuilders are at all-time highs following successful breakouts from multi-year consolidations. D.R. Horton has been a leader ever since it successfully back-tested its pre-COVID highs last summer.

We think DHI continues much higher. Its 2021 peak coincided with the 261.8% retracement from the entire 2005-2008 decline. The stock then bottomed last June at the 161.8% retracement. Ever wonder why we use these Fibonacci levels? This is why. The market respects them. It doesn’t really matter whether we believe in the merits of ancient math. The market does.

Longer-term, that puts our target for D.R. at $170, with the $106 breakout level acting as support on any further pullbacks.

We’ve got a similar setup in Lennar, another homebuilder. Its 2021 peak also occurred at a key Fib retracement level, and the ensuing selloff bottomed at those 2005 highs.

Just like DHI, LEN set a year-to-date peak on February 2, then spent a few months gearing up for a breakout above the 2021 highs. We want to own it above those highs at $110 with a target of $170, which is the 261.8% retracement from the 2005-2008 decline.

Not liking the ‘stay-at-home’ story? No problem. Travel is working just fine, too.

Booking Holdings is challenging resistance at the 2021-2022 highs. That level is also the 161.8% retracement from the COVID selloff. On a breakout above 2700, we want to be buying BKNG with a target of 3660, which is the 261.8% retracement level from that decline.

Cruise lines are getting some love, too. Carnival is at its highest level in a year. We like this chart because it’s a good reminder to not give up on names too early. That was a textbook inverse head-and-shoulders reversal in the back half of 2022, and a textbook breakout above the neckline. Then it failed.

But that didn’t mean we needed to give up completely on CCL. Failed moves lead to mean reversions more often than they do trend reversals. We need to be ready to jump back on the ship – pun intended – when that trend resumes course. We don’t love the lack of clear technical targets in CCL, but a move back to $20 or even $30 wouldn’t surprise us. This stock was trading above $70 not that long ago.

We’ve got a nearly identical setup in Caesars Entertainment, except this one hasn’t broken out yet. We want to be buying CZR on a move above $55, with a target of $70.

Auto parts retailers were dragged down by the absolute bloodbath in Advance Auto Parts over the last two weeks. Structurally, the setup in O’Reilly hasn’t changed any – except perhaps by giving us a cleaner risk level to work with over the near-term. We’re targeting a move to $1,066 in ORLY. If the stock falls below $860, we’ll be forced to take a second look at our bullish stance.

Starbucks continues to give us opportunities. It’s pulled all the way back to the 2019 highs, which offer a fantastic level to manage risk against. If we’re above $100, we like SBUX with a target back at the 2021 peak of $126. Below that, we want to leave it alone.

Garmin is another with a risk-reward setup that’s hard to ignore. It just broke out above its 2020 peak, which had been resistance all year. This has the potential to be a big bearish to bullish reversal in one of the biggest post-COVID winners, so we’re paying close attention. We want to own it above $105 with an initial target above $130.

Speaking of bearish to bullish reversals, we might be getting one in Tesla. Yes, the stock has already doubled off its lows. Perhaps it’s unfair to just now be calling it a bullish reversal. But throughout the entire rally, Tesla never challenged its 200-day average (which has been falling). That changed last month. We’re above the long-term moving average and setting new year-to-date highs. And we don’t think it’s too late to jump on board if this is a new uptrend. We like TSLA with a target of $300 as long as it’s above $210. If we pass that first target, it could go quite a bit higher.

Tesla isn’t the only automaker with bullish action. Ford is trying to break a multi-month downtrend line after spending the last year bouncing along support.

The risk level couldn’t be more clear: we can’t own F below $11. If it’s above that, though, there’s no reason we can’t challenge last summer’s highs at $17.

The post (Premium) Consumer Discretionary Moving to the Front of the Pack first appeared on Grindstone Intelligence.