(Premium) Consumer Discretionary Sector Deep Dive

From failed moves come fast moves in the opposite direction. Sometimes, those failures can spark outright trend reversals, marking a significant turning point for prices. More often, though, those fast moves are simply reversions to the mean – a pause of sorts – that eventually work themselves out before the trend continues as before.

We think the latter is most likely what’s happening with the Consumer Discretionary sector. A failed breakout earlier this summer was followed by an 8% decline, the largest pullback since mid-March. Momentum, however, remains in a bullish range, and prices are already trying to re-challenge last summer’s highs.

At the same time, the sector has shown resilience compared to the S&P 500. Since bottoming in December, Discretionary has stair-stepped high relative to the index, and momentum is in a bullish regime. There’s no reason to be bearish Consumer Discretionary right now.

It’s tough to be too bullish, either, unfortunately, since the sector’s largest component has been unable to move past a key level of resistance, even after a blowout earnings report. Momentum has trailed off since May, and those swing lows from last spring at $140 are Amazon’s ceiling for now.

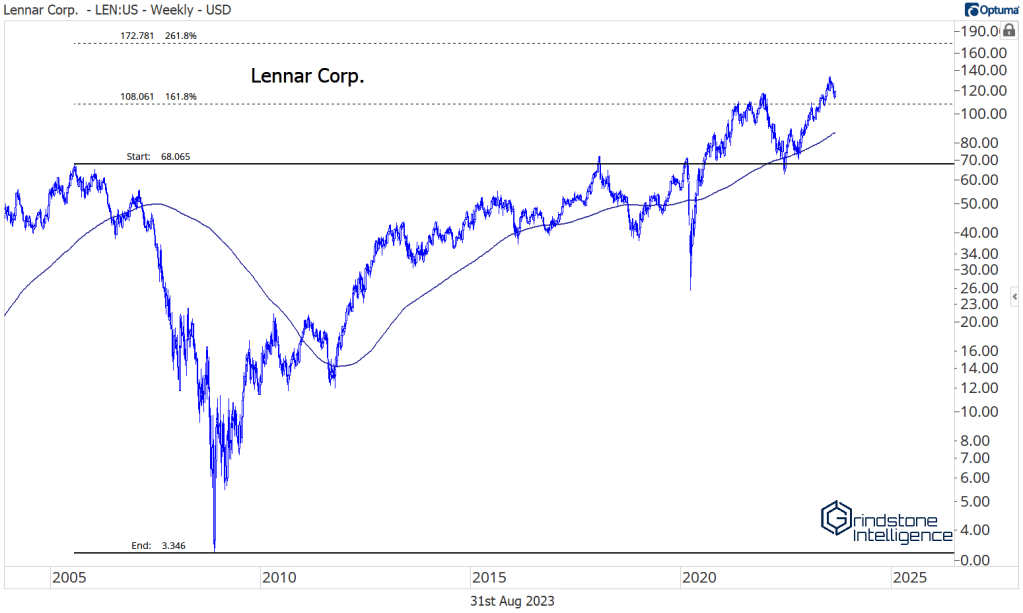

Meanwhile, the homebuilders have consolidated above former resistance, and offer an improved risk/reward opportunity since we last checked in. Lennar found support at its former highs, and we like it long with an initial target of $150, which is the 161.8% retracement from the 2022 decline.

Longer-term, we think LEN can go all the way to $170, which is the 261.8% retracement from the 2005-2008 decline.

That only matters if the stock can continue to rise on a relative basis – there’s no point in owning a stock if it’s not outperforming our benchmark. Our risk in LEN is very well-defined here – we only want to be owning it if the ratio of LEN/SPX is above those 2021 highs.

The setup in D.R. Horton is similar. We like it long above $105 with a target of $170, which is both the 423.6% retracement from the COVID selloff and the 423.6% retracement from the housing collapse back in the mid-2000s.

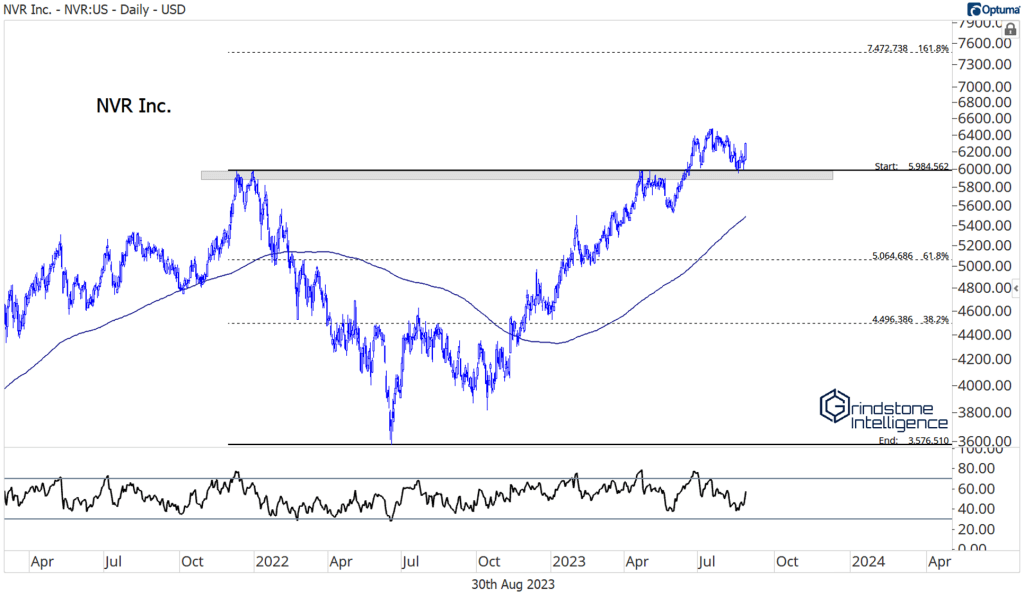

NVR is another homebuilder with a great setup. The level here is $6000 – we don’t want to be long below that. Otherwise, we’re setting a target near $7500.

Elsewhere in housing, but on the retail side, Lowe’s has pulled back to the summer breakout point after it touched 52-week highs. We believe it can challenge last year’s highs up near $265, but we only want to be long if it’s above $220.

Newly on our radar is Hasbro, which has completed a bearish-to-bullish reversal after dropping more than 50% from the 2022 highs. Now, the stock is further above its 200-day moving average than its been in more than 2 years, and momentum is in a bullish regime.

This stock has been a serial laggard since 2017, so we’re not ready to bet the farm by any means. But momentum for the ratio of Hasbro to the S&P 500 reached its highest level in several years back in May, and it’s now set both a higher low and a higher high.

It’s early, but this reversal could have legs and is worth keeping an eye on.

The post (Premium) Consumer Discretionary Sector Deep Dive first appeared on Grindstone Intelligence.