(Premium) Consumer Discretionary Sector Deep Dive – September

From failed moves come fast moves in the opposite direction. That’s what’s happening right now in the Consumer Discretionary sector. Twice over the past 3 months, prices have briefly surpassed the August 2022 highs. Twice they’ve failed to sustain the move. This time, the sector got punished.

With momentum putting in a bearish momentum divergence on the latest breakout attempt, the most likely path forward is for more frustration – both for bulls and bears. This isn’t a downtrend, but it’s no longer a healthy uptrend either. We’re dealing with something in between.

The rapid selloff hasn’t done too much damage to the sector’s year-to-date return. It’s still more than doubled the performance of the benchmark S&P 500, and it’s one of only 3 sectors that have outperformed the index.

Much like we’re seeing in other areas of the market, though, we’re seeing increasing signs of internal weakness within Discretionary. The equally weighted sector just dropped below its 200-day average for the first time all year, and momentum is more oversold than it’s been at any point since the COVID lows. Oversold readings can often be followed by short-term rallies, but they’re certainly not signs of overwhelming demand from bulls. At the very least, we’re looking at a damaged uptrend that will take some time to repair. At worst, this is a trend reversal and we’re headed back to the October lows.

If we go even deeper and look at the small-cap sector, we can see that things have been going poorly for Discretionary for more than just the last month or two. The sector is in the Lagging quadrant of the weekly Relative Rotation Graph.

Part of that can be attributed to seasonal weakness. Consumer Discretionary stocks don’t do all that well after the first 4 months of the year. Check out the seasonal patterns for the sector relative to the S&P 500. Save a strong performance in November (when holiday shopping optimism is at its peak), Discretionary tends to lag from June to December.

Short-term trends within the space are among the worst of any sector.

Ninety percent of large cap Discretionary stocks are in short-term technical downtrends. Only breadth in Utilities and Real Estate is worse.

The long-term view is only moderately better. About 40% of sector members are in outright uptrends, but 46% are trending lower.

Digging Deeper

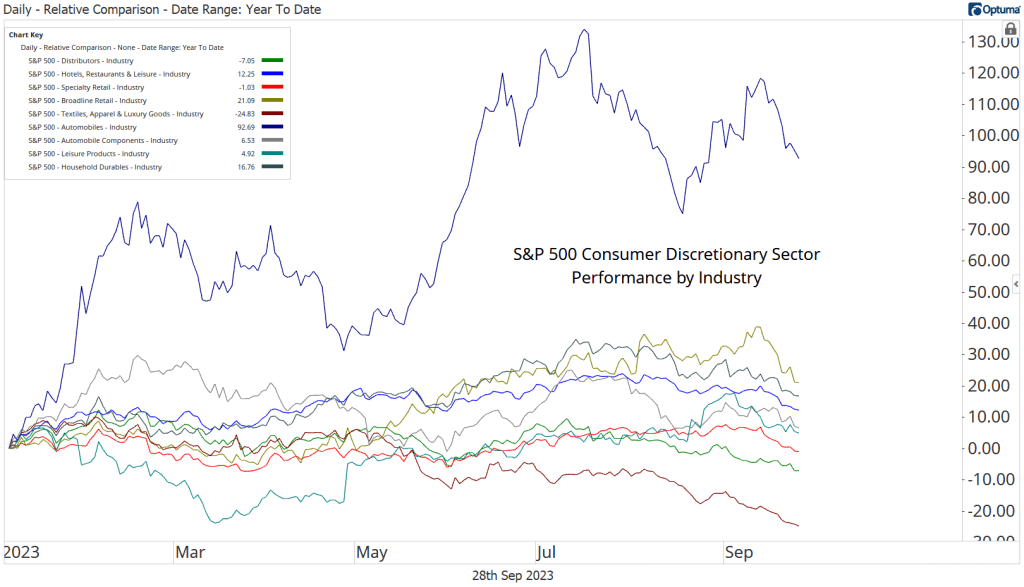

Why has Consumer Discretionary been near the top of the leaderboard in 2023? It’s most thanks to some stock called Tesla. It’s driven the Automobiles Industry to gains of 92% this year (down from as much as +130% over the summer.

Performance is much less impressive elsewhere. Only two other industries – Household Durables and Broadline Retail – are outperforming the S&P 500 Index.

Leaders

The decline over the last month has been broad. Only Ford was able to stay in the green. Autos are a theme again here. Ford, Autozone, BorgWarner, CarMax, General Motors – they aren’t all auto manufacturers, but they all have direct exposure to that end market.

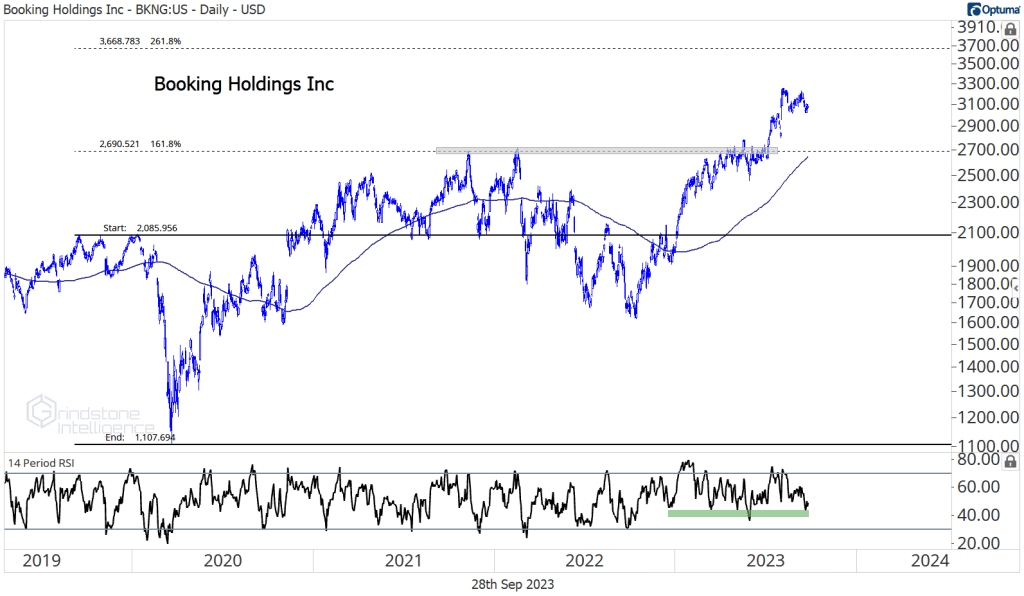

Travel has also done well. We’ve liked Booking for awhile, ever since it broke out above the 161.8% retracement from the 2020 selloff. We haven’t had much opportunity to buy on pullbacks (since there haven’t been any), but we still think it can go to $3660. Momentum has stayed well out of oversold territory for the year.

And on a relative basis, the strength is pretty clear. Compared to the rest of the sector, Booking is breaking out to multi-year highs.

Losers

The Leaders and Losers lists are a perfect example of why we prefer to stay with trends. Notice how closely the far right column correlates with the performance over the last. The winners tend to keep winning, and the losers tend to keep losing.

Mohawk is one we can short on any rallies back toward $90.

Growth Outlook

True to its identity as a growth sector, Consumer Discretionary is expected by analysts to be a growth leader over the next two years. The group is on pace for 25% EPS growth in 2023, and analysts think the bottom-line will annualize at 15% in 2024 and 2025.

Those aggressive growth targets depend on significant margin expansion. If expectations are to be believed, Consumer Discretionary profit margins will reach 9.4% in 2025. The highest mark from 2010-2022, meanwhile, was 7.7%. The difference is at least partially due to a growing share of earnings contributed by higher margin businesses like Tesla. But there’s certainly a healthy amount optimism baked into these projections.

One More to Watch

Everyone I know seems to have an opinion about housing. Lots of people got really worked up when I told them homebuilding stocks were at all-time highs earlier this year. How could that be when housing was in a recession?

Well, the bears may yet have their day in the sun. D.R. Horton is testing its breakout level. We’ve liked the homebuilders all year, and we see no reason to change that as long as DHI is above $105. This is an uptrend that’s innocent until proven guilty.

If we’re breaking below those former highs, though, it’ll be best to step aside.

The post (Premium) Consumer Discretionary Sector Deep Dive – September first appeared on Grindstone Intelligence.