(Premium) Consumer Discretionary Sector Update – July

Consumer Discretionary was the top-performing group in June, aided by broad strength across the sector. Each of sector’s 19 sub-industries were positive in June, helping to push the equally-weighted index to new 52-week highs.

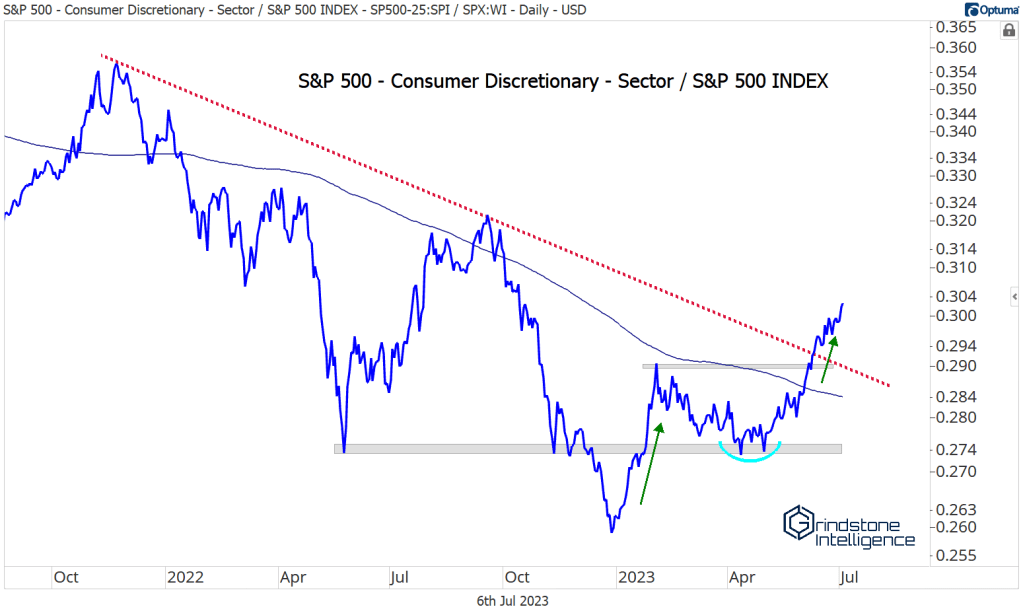

That strength is even more apparent on a relative basis. When Discretionary was lagging near the end of the year, we were struck by the underlying outperformance within the group. The sector overall was moving to new lows, but the average Discretionary stock had been outperforming the average S&P 500 stock since last May!

Now, Equal Weight Consumer Discretionary is at new 52-week highs when compared to the Equal Weight S&P 500 Index.

And we’re finally seeing the follow-through in the cap weighted indexes, too. Consumer Discretionary has broken the relative downtrend line from the 2021 highs, further solidifying a bearish-to-bullish trend reversal.

Homebuilders continue to pace the rally, along with Auto manufacturers. The Homies are showing a ton of strength on a relative basis. Here they are breaking out of a multi-year base relative to the S&P 500.

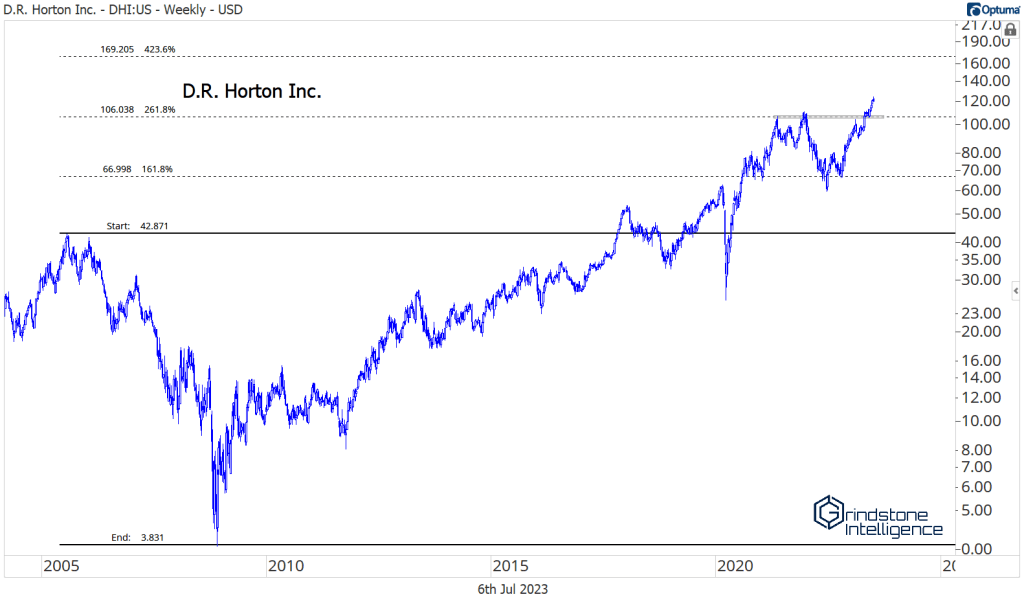

D.R. Horton has been a leader ever since it successfully back-tested its pre-COVID highs last summer.

We think it continues a lot higher. DHI’s 2021 peak coincided with the 261.8% retracement from the entire 2005-2008 decline. The stock then bottomed last June at the 161.8% retracement. Ever wonder why we use these Fibonacci levels? This is why. The market respects them. It doesn’t really matter whether we believe in the merits of ancient math. The market does. Longer-term, that puts our target for D.R. at $170, with the $106 breakout level acting as support on any further pullbacks.

We’ve got a similar setup in Lennar, another homebuilder. Its 2021 peak also occurred at a key Fib retracement level, and the ensuing selloff bottomed at those 2005 highs.

Just like DHI, LEN set a year-to-date peak on February 2, then spent a few months gearing up for a breakout above the 2021 highs. We want to own it above those highs at $110 with a target of $170, which is the 261.8% retracement from the 2005-2008 decline.

Lowe’s is trying to join in after the home improvement stocks had been largely left behind all year. LOW just broke out to new 52-week highs and can challenge last year’s highs up near $265. We only want to be long if it’s above $220.

On the Autos side, Tesla has been the big winner, more than doubling off its year-end lows.

It’s nearing a potential level of resistance, though, which limits the upside on any new positions. We don’t want to be buying TSLA below $310.

The same goes for Ford, which jumped more than 20% after breaking the downtrend line from last summer. We still think it can test those summer highs, but the setup today isn’t great from a risk-reward perspective. We want to see how it responds to overhead supply.

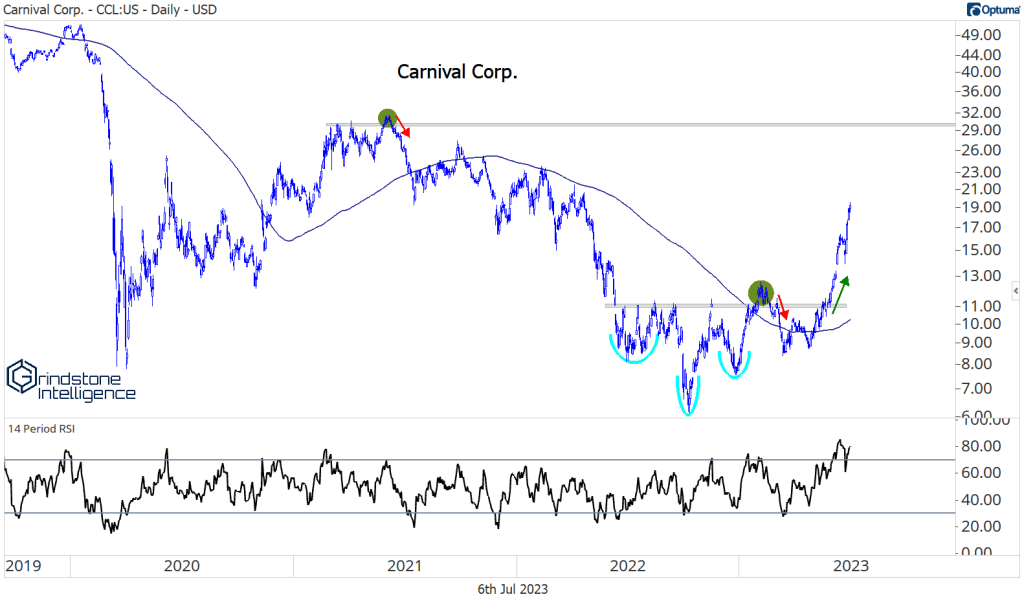

There’s still plenty of upside potential in Carnival Cruise, though, even after a triple off the lows. We love stocks that are showing strength on both an absolute and a relative basis, and that’s exactly what CCL is doing. Here it is compared to the S&P 500, setting new 52-week highs after a big, rounded bottom.

And on an absolute basis, the stock just got more overbought than it’d been since 2004! In the mid-point of the multi-year range, this isn’t a great setup right now, but we want to be buying pullbacks toward $14 with a target back at the 2021 peak near $30.

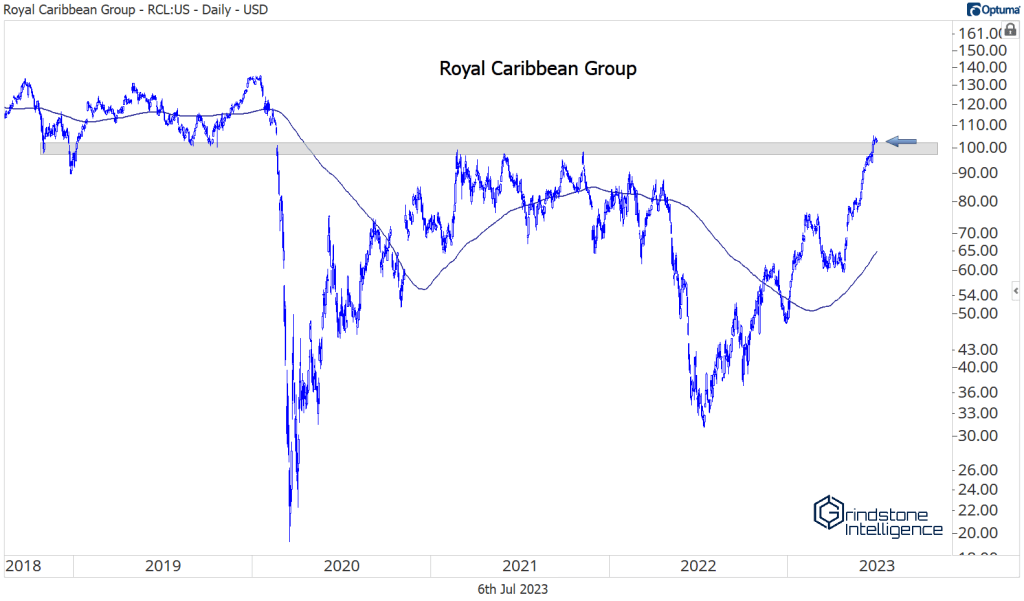

Royal Caribbean offers a much better risk level to work with in the near-term. We can be buying RCL above $100, with a target of $130, which is the January 2020 high.

In other travel-related names, Booking Holdings is challenging resistance at the 2021-2022 highs. Notice how momentum has stayed away from oversold territory during these last few months of consolidation, showing us the underlying strength in the stock. The key level is the 161.8% retracement from the COVID selloff. On a breakout above $2700, we want to be buying BKNG with a target of 3660, which is the 261.8% retracement level from that decline.

We need to be patient with Booking, though, because it could very well take a few more months of consolidation before it makes a move. And there’s opportunity cost in holding things that are going nowhere while other stocks are rising. Las Vegas Sands is a good example. Taken on its own, LVS has been consolidating since January after a strong rally to close 2022. It’s not moving higher, but it hasn’t given back any gains, either.

On a relative basis, though, things are different. We don’t want to own LVS (or any other stock doing the same thing) if it’s breaking down vs. the S&P 500.

The post (Premium) Consumer Discretionary Sector Update – July first appeared on Grindstone Intelligence.