(Premium) Consumer Staples: Rejected Again

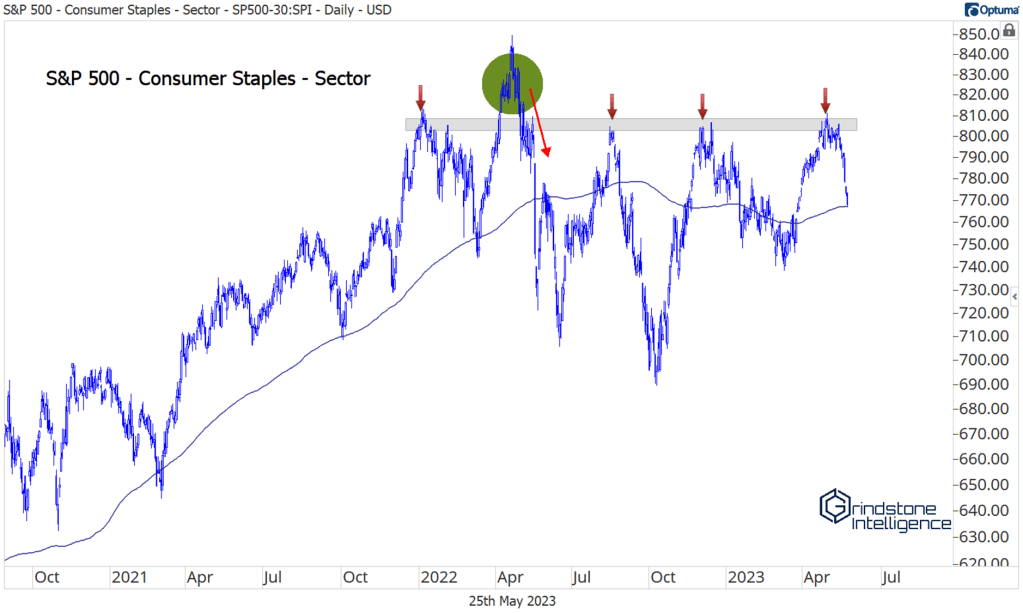

It looks like we’ll have to wait a bit longer for a breakout.

When we checked in on the Consumer Staples last month, we noted that the sector was closer than any other to a breakout. But instead of moving to new 52-week highs, Staples sold off again. Now, they’re back into the middle of this year-long trading range.

The weakness has been led (unsurprisingly) by stocks that were showing relative weakness on the breakout attempt. Keurig Dr. Pepper broke down to multi-year lows. It’s now challenging the 2019-2020 highs at 31.30. This area should offer some support, so any break below here would signal an abdication of duty by the bulls.

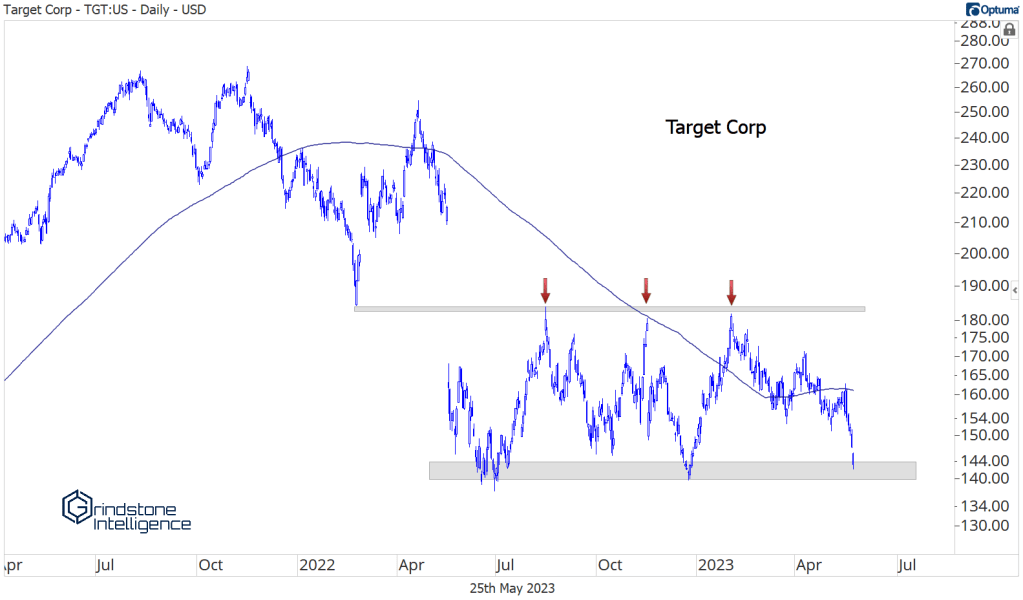

Target has drifted lower since February’s failed breakout attempt, and is a whisker from breaking to multi-year lows. This is where buyers need to step in and make a stand.

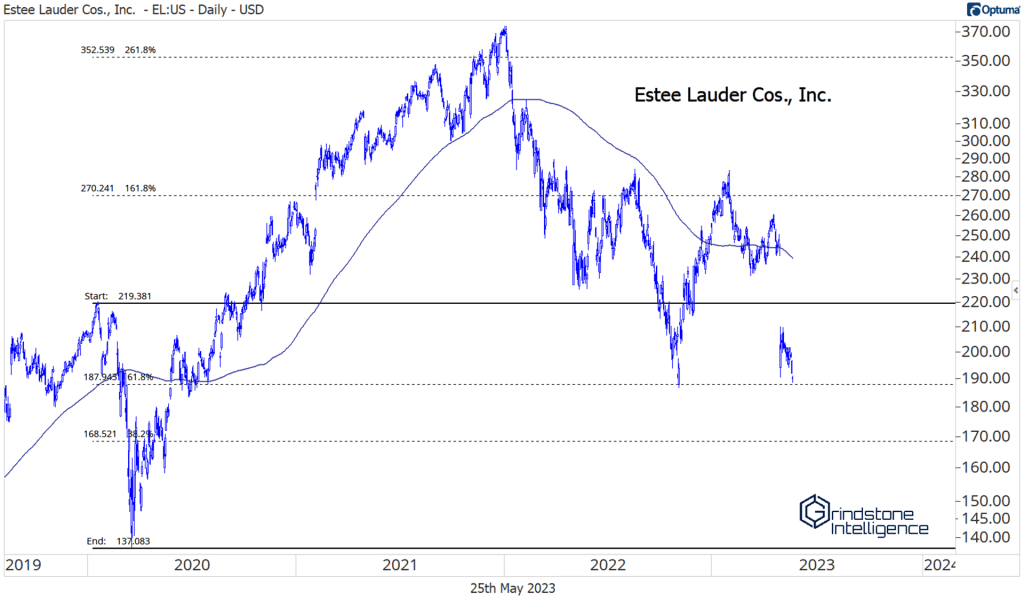

The same goes for Estee Lauder as it tries to hang above last year’s trough. That level is also the 61.8% retracement from the 2020 decline, so it’s a logical place for the stock to find support. A sustained breakdown would not bode well for the sector, though.

In names that we’ve favored over the last few months, structural uptrends are still intact. Lamb Weston and Hershey have both pulled back, but they’re still on track for the longer-term targets. For LW we’re still watching the 161.8% retracement from the COVID selloff, which is up near 127.

For Hershey, our target is the 423.6% retracement from that same decline. That’s all the way up at 325.

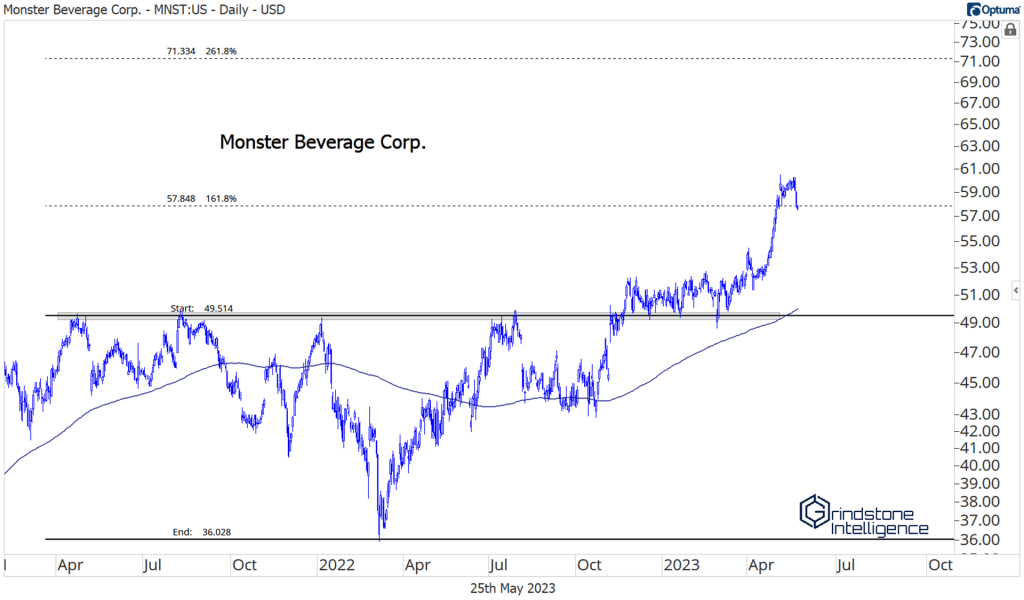

Monster Beverage reached our target of 58. If it continues to consolidate above that 161.8% retracement level, we’ll start looking at the next key Fibonacci level up near 71. For now, though, we want to see how MNST responds.

Walmart is still a no-touch below 155, as it continues to try and absorb supply from the top end of this three-year consolidation range. If and when Consumer Staples as a whole breaks higher, we expect WMT to do the same. We’ll be targeting 200 on a move above 155.

The post (Premium) Consumer Staples: Rejected Again first appeared on Grindstone Intelligence.